Back on July 3rd, I posted for clients my: Second Half Market Thoughts – Fave Trend Set-Ups. Here is an update on how all those stock picks did in Q3 2020.

Second Half Market Thoughts

By my estimation, and as I’ve warned in my live trading room past month+, Summer Trading will likely include wide swings – in both directions, between SPX $2950-$3250. More than likely, Treasury will keep cash handy to use to support the market and keep it from dropping into the Election. Still, I expect an election swoon, that is then followed by the invisible ‘hand of God (a.k.a. Fed/Treasury)’ that sends the dip-buyers into panic buying mode running SPX into $3500-3600. If we manage to push through $3250 this summer, then game on sooner! But either way, I doubt that negative COVID impact or earnings disappointment will derail the rabid speculation in stocks that has been enabled by US government liquidity, USD international cash swaps, and direct corporate bond buying by the Fed.

Wouldn’t you know, we tagged $3588 in SPX on September 2nd, right in that sweet zone I had called out beginning of July! And just prior to a 10% drop in SPY and 14% pullback in QQQ wherein just that one week, TSLA lost one-third of its value. Wouldn’t you know, I warned clients this pullback was coming:

- Aug 18th: Intermarket Chart Attack: Volatility Impulse Is Getting Closer

- Aug 28th: Intermarket Chart Attack: Let’s Talk About That Volatility Impulse

- Sept 1: Premium Fishing Video: More Momo, More Momo Volatility

I also called out my Favorite sector for ‘growth-at-all-cost’ play ideas and it was (is still) IPO:

Basically, this was my short list of momentum, continuation plays – with a smattering of Macro (precious metals, solar), some Covid/WFH beneficiaries, a few staples, retail and biotechs, but mostly hot, mid-tier, high-growth, tech-plays! (Red highlighted plays haven’t really worked, yet, but the rest of the 35 picks have!)

Note: The precious metal trade worked extremely well until I saw it tiring and called a Gold/Silver/Miner short August 8th for clients: Gold, Silver and Miners Due A Rest. Since then, GLD fell 10%, GDX 15% and SLV 20%.

3rd Quarter 2020 Review

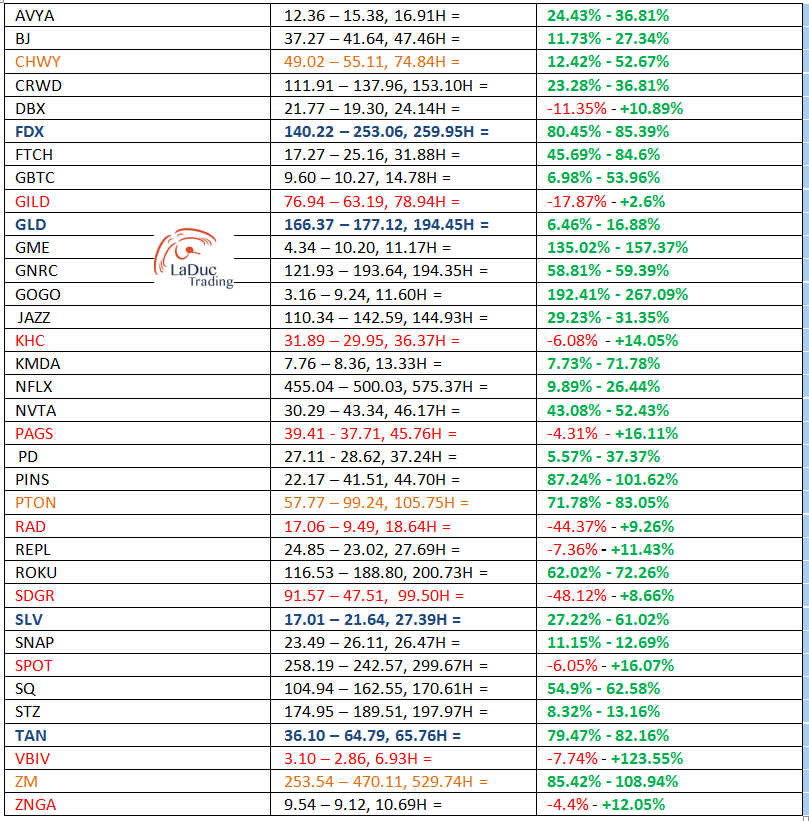

The following is the same list put in alphabetical order with prices taken from June 30 close – Sept 30 close with the high print (H) from the prior quarter. Please note: the stated rate of return for the three months is based on STOCK not option terms:

- *yellow = covid basket plays

- *blue = intermarket/macro theme

- *red = didn’t work on 3-month close but would have on high close price

As you can see, most were winners and some out-sized winners at that! If you were in my live trading room, you know I reviewed this list most every day for clients with the macro-to-micro rationale to support the trade – whether macro, fundamental, sentiment, technical, quant or intermarket. And as you can say, there are a lot of profits for those who stayed long and strong – whether using stock or options. And my timing of incoming volatility before the recent bout should/would have helped you preserve and protect profits.

What Does Q4 Have In Store

First, here are some over-arching comments on the list of 35 recommended trade ideas and where to from here:

- I am still excited about many of these stocks for Q4: ROKU, TWTR, SNAP, SQ, FTCH, CHWY, PINS, PTON, GOGO, GME, ZNGA ...

- I am not very interested in the “story” stocks like TSLA, NKLA for anything other than shorter-duration chases/swings.

- I am mostly only interested in a trading vehicle with very liquid optionality, so a stock-only pick is rare/high value – like my outsized returns in GOGO and GME past quarter.

- I also think the precious metal trade has further to fall before stabilizing and turning higher – possibly not before next year.

- I have not seen a viable trend reversal sign in the Growth-to-Value trade (or momentum to anti-momentum, covid-destroyed economically-sensitive companies), although I am expecting signs in Q4. I will update clients when I see The Turn.

- I have not been able to bring myself to trade/recommend most any of the SPAQ stocks as there isn’t enough historical price action for me to really even chart them. And then there is the whole euphoric speculation and valuation mania that needs to calm down before I can get seriously interested.

- I have no interest in position-trading Big Tech (FAANMG) as I suspect this bond proxy trade will come under pressure from a stronger US dollar, government anti-trust thrust, and economic slowdown that materializes during earnings season/Q4 to dampen the ‘growth-at-any-cost’ outlook.

With all of that said, I have a New List of Longs to Add for clients in my Q4 Outlook (CLIENTS ONLY)!

We’ll need this shopping list ready for after the next wave of volatility hits – which I’ve also timed for you.

Look for my Q4 market thoughts this weekend along with upcoming best set-ups on how to trade the Election Risk!

All the best,

Samantha