by Samantha LaDuc | Aug 18, 2020

I have a philosophy on trouble. Don’t feed it, and maybe it will go away. –Frank Sinatra Let’s face it, this market party is getting really wild and for those who don’t want trouble, it’s a good time to leave. I know not what will happen next, but I am envisioning some type of ‘distrubance’ […]

by Samantha LaDuc | Apr 10, 2020

Market Thoughts In follow up to my April 5th client post – Intermarket Chart Attack: Digestion, Indigestion – this one will be entitled Gluttony, because even if you don’t have the stomach for it, we are called on to feast again, whether we want to...

by Samantha LaDuc | Apr 1, 2020

USD Spike Risk “I contend the next phase of stock sell-off likely begins when the USD spikes hard and momentum stocks get sold.” Me, past few weeks. And why would the dollar spike if Fed is throwing everything it can at it to break it’s ascent? I...

by Samantha LaDuc | Mar 29, 2020

Worse Than 2008, More Like 1929 As I said repeatedly over the past few weeks to clients: This market is worse than 2008. My Interview with ForexAnalytix and my client posts and videos past month have demonstrated that I see this crisis as unlike any others. From March...

by Samantha LaDuc | Mar 28, 2020

Macro Matters Below I include a Guest Captain Commentary that dovetails perfectly with my Macro thesis. Practically every word of Steve’s missive I support (bolded emphasis/red highlights mine), as I have repeatedly called out in my market analysis for clients. Further, I believe the following five themes frame the backdrop of challenges to our economy and […]

by Samantha LaDuc | Mar 24, 2020

What we have witnessed in markets of late is a once-in-a-lifetime event: a 1% outlier event in risk-parity de-risking that slammed hedge funds Ronin, BlueCrest,Citadel, Millennium, and ExodusPoint to breaking points, caused some Fixed Income funds to restrict...

by Samantha LaDuc | Feb 19, 2020

Market Thoughts Investors are selling off the Yen on horrific economic data and the result is a SPY QQQ melt-up, risk-on market. It most likely stops when the Yen selling stops! This is a 3-standard deviation move so it’s a Big Deal that looks risk off but it’s actually JUST the opposite! Soon ? Higher […]

by Samantha LaDuc | Feb 10, 2020

Market Thoughts My market timing call Friday: Going into the weekend with headline and actual risk, we see bonds and gold getting bid up while miners and silver sell off. Tech is rallying but I contend we are approaching a point soon where this likely becomes a Sold...

by Samantha LaDuc | Dec 2, 2016

Much attention of late has been focused, with good reason, on rising yields, falling bond prices and the collapse in the Japanese Yen and Gold. So many assets are correlated that as a strategic technical analyst I look for macro themes to show themselves in...

by Samantha LaDuc | Dec 1, 2016

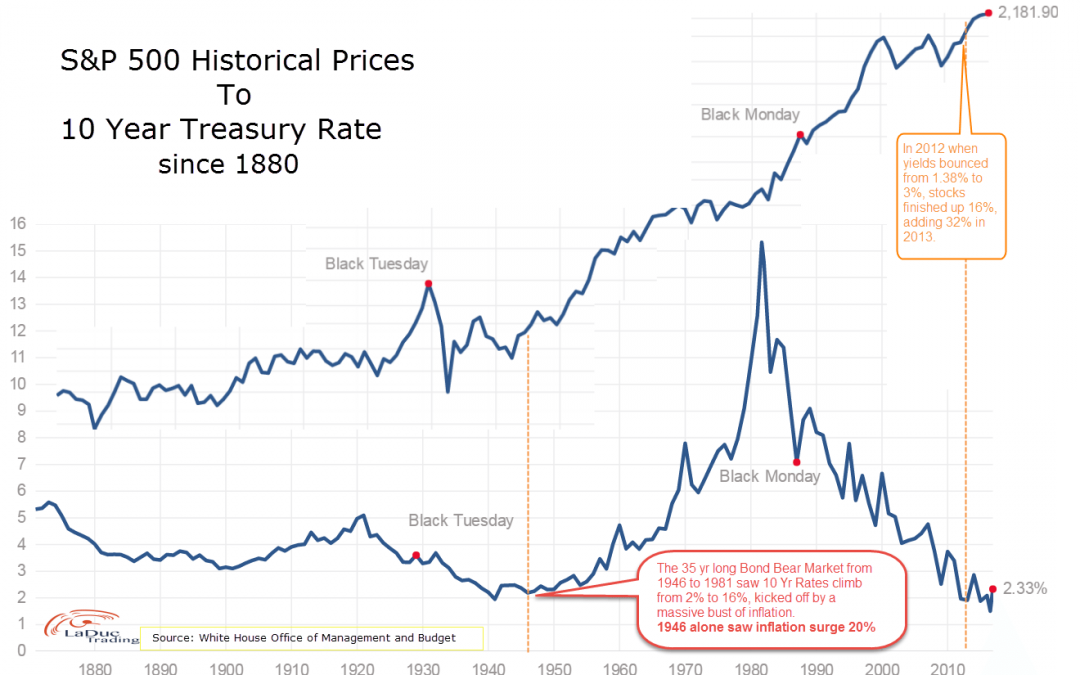

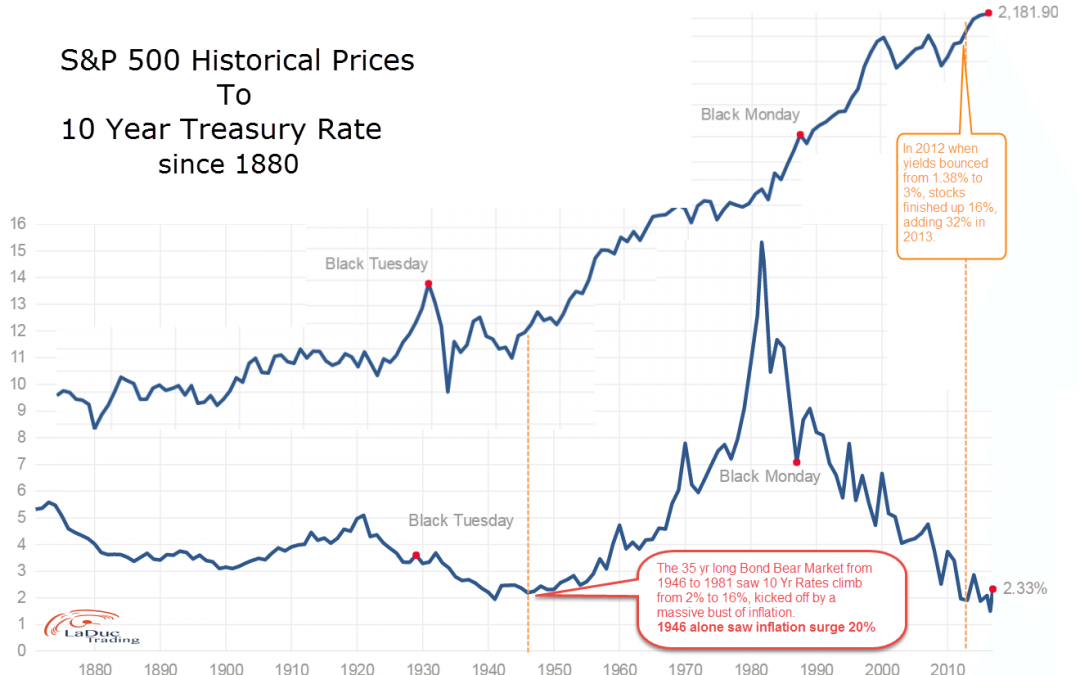

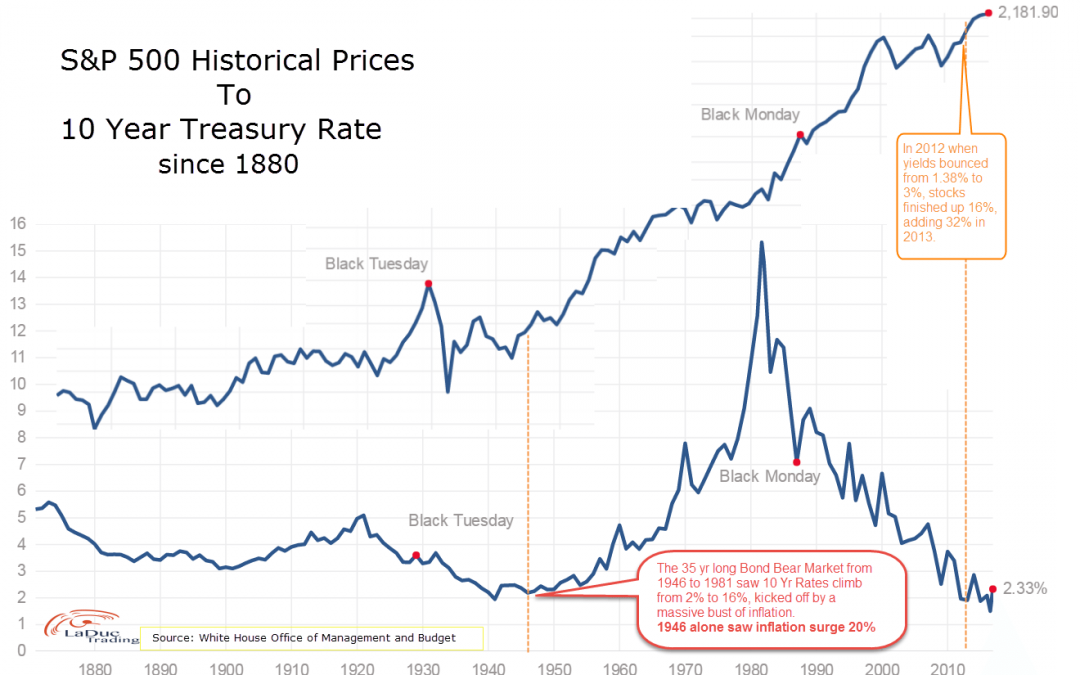

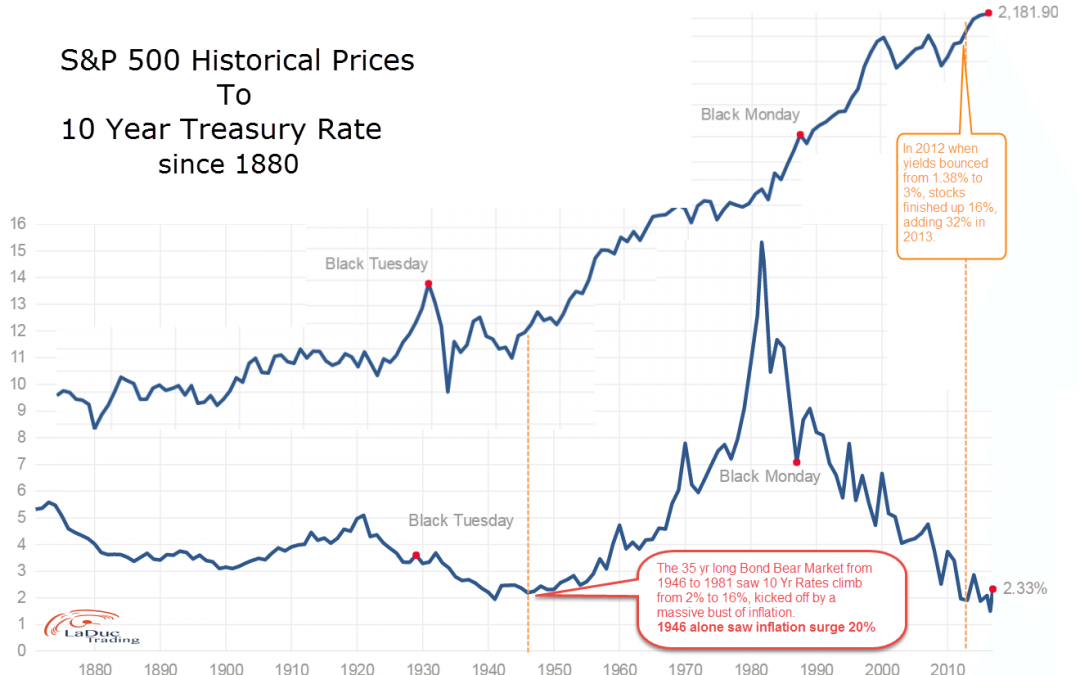

Higher Rates Can Be Bullish Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market, but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a blip on a chart). From a...

by Samantha LaDuc | Nov 28, 2016

S&P Bulls and Bond Bears Pin Hopes to 1946 Interest rates follow very long term cycles. Above highlights a 35 year (1946-1981) bond market–but unlike our most recent 35 year (1981-2016) bond market, they were in a rising rate environment (for more than a...

by Samantha LaDuc | Nov 22, 2016

Polls and predictive models failed to predict Trump’s strength let alone his win. That’s nothing. Wall street analysts and economists have been getting the rate thing wrong for years, and not by a little. Bloomberg reported hardly anyone on Wall Street saw the...

by Samantha LaDuc | Nov 22, 2016

There are lots of ideas out there on what to trade. The trick is synthesizing news-you-can use from the noise. Choosing ideas from veterans doesn’t make it a sure thing. But listening to ol’ timers…well, there is so much to be learned from...

by Samantha LaDuc | Nov 22, 2016

Every month I write a swing trading newsletter for those who can’t join me in my LIVE Fishing Daily Trading Room but want my macro take on the month ahead, or just my trade ideas they can set and forget. The daily room is for active traders where we mostly chase...

![Election Results? #BTD or #NotDoneYet]()

by Samantha LaDuc | Nov 6, 2016

An election–whether waiting on the results or dealing with the aftermath–can make anyone feel afloat in a paper boat on choppy water, small umbrella to protect from the swelling wave. A lot is at stake–both for our nation and for our market. I would...