We have several major Event Risk Dates coming up to keep on our radar. Some are election related and the others Covid. Two take place tomorrow.

Oct 22nd (Thursday/Tomorrow) – We have a Presidential debate at night and a US FDA Vaccine Advisory Committee meeting during the day. The last debate surely helped Biden, and, as a result the market. What about this time? For those playing along with vaccine trials, tomorrow is under-the-radar important. More on that below.

Stimulus, Election, and Covid Oh My

Next week is end of month, of course, and as such if feels very much as if these risk events – Stimulus talks (that never end), Election fears (that are justified) and rising Covid Cases (against failing Vaccine trials) – are holding markets hostage. And with good reason.

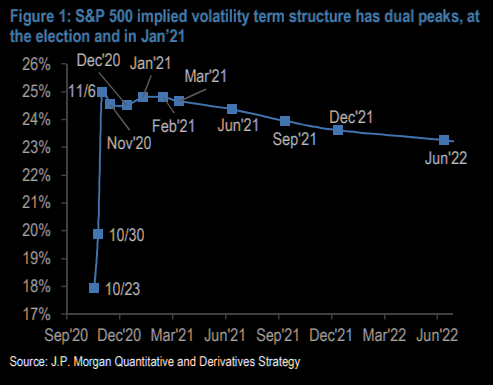

- November 3rd – IV will make a big move after 11/3. There are more than 2 million SPX puts sitting in December (election and year-end hedging). If we have an uncontested outcome (not my baseline assumption), then IV drops which should crush the IV in those expensive puts. This *should* fuel a market run. On the other hand, we can enter an election contested which *should* trigger higher IV, at which point (and here’s the kicker), the market drops and dealers need to chase the lows. This may be what I’m seeing in my Stock-Bond-Volatility analysis…

If my intermarket analysis is correct, we will have a tumultuous December with these dates to contemplate:

- December 1st – Deadline on Government Shutdown Debt Ceiling Raise. Remember 2018???

-

The United States federal government shutdown of 2018–2019 occurred from midnight EST on December 22, 2018, until January 25, 2019 (35 days). It was the longest U.S. government shutdown in history, and the second federal government shutdown involving furloughs during the presidency of Donald Trump. Wikipedia

-

- December 8th – Electoral College “Safe Harbor” Deadline, if needed, to resolve any controversies over elections.

- December 14th – Elector College casts ballots for president and vice president.

- December 18th – Monthly Options Expiration.

- December 23rd – Deadline for receipt of electoral college ballots.

Yeah, it looks a little too similar to Oct-Dec 2018 so be on guard.

Vaccine Disappointment

Vaccine Disappointment is apparent, not just in AZN reporting today of its failed trial or in JNJ a few weeks ago, but as indicated in price action across the ‘vaccine’ cohorts: $BNTX $PFE $MRNA $NVAX $AZN $JNJ $ABT $REGN $GILD … even my personal long-term fave of $MLLCF (antibody treatment).

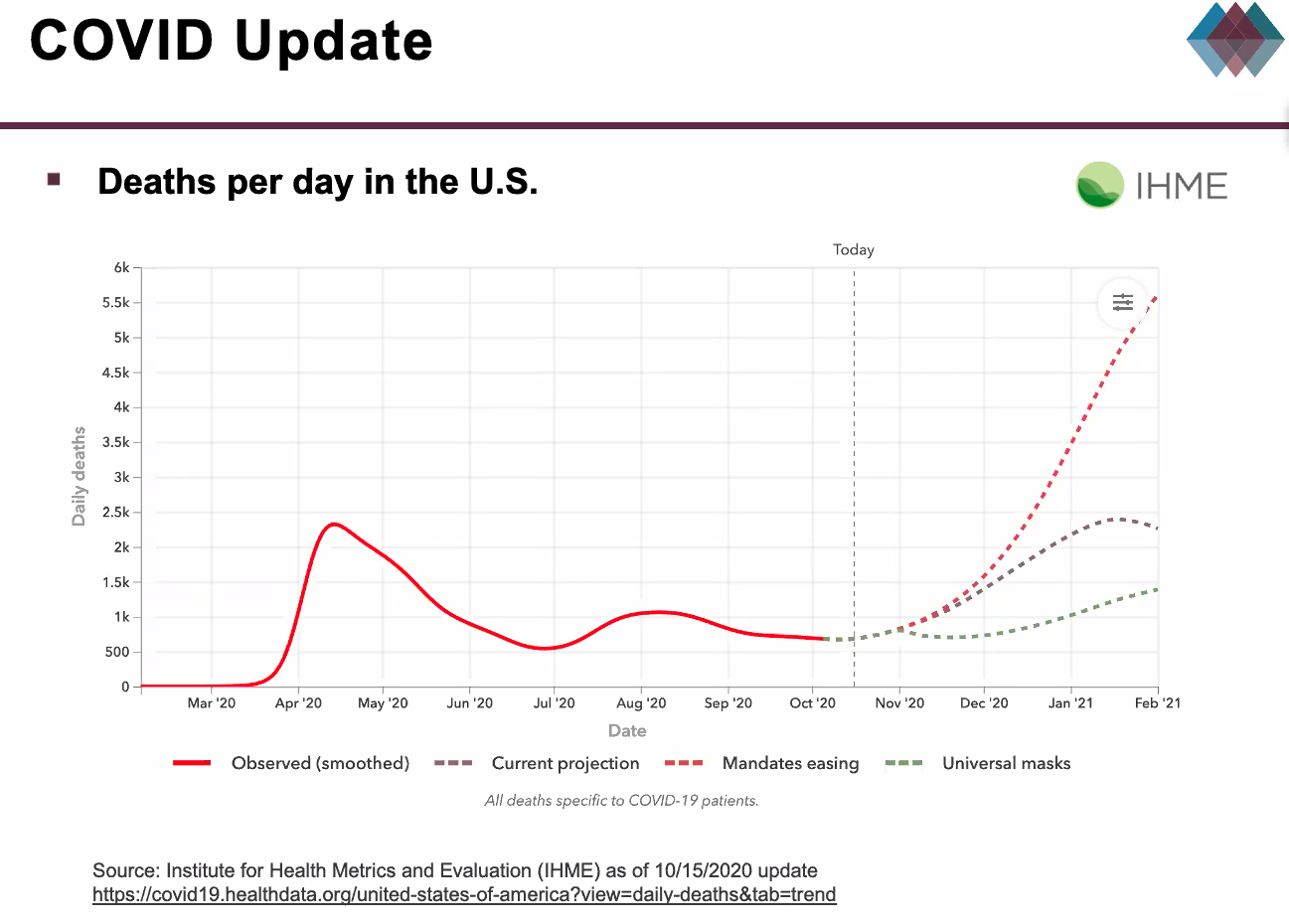

I smell trouble – not only in vaccine hopes becoming dashed, but as the Covid Cases Surge. As a result, many governments are triggering travel restrictions (Canadians to EU), NJ to NY, and so on. Countries and Cities are increasing restrictions around social gatherings and public venues, and schools are opting to go back to online learning. The 3rd wave is upon us, and it looks to be surging out-of-control with a Trump win and better controlled with a Biden win. Yes, I know how hyperbolic that statement sounds, but look at this graph and tell me how you interpret it!?

Biden has a policy for mandating face masks and supporting states in need (regardless of political leanings). Trump does not.

Bulls, Bears and Bitcoin

Now let’s go back to the future:

The most bullish pharma team (Credit Suisse) suggested 300m doses of a vaccine would be produced by year-end (and 80% from AstraZeneca). AZN just failed their trial…

Pfizer CEO announced this week they would not be reporting their trial results with BNTX until 3rd week in November. MRNA said the same. And yet, many are still expecting something totally-wicked-awesome to come out of the FDA Vaccine meeting tomorrow.

There are four major Phase 3 trials likely to report around year-end, but this could happen earlier depending on the outcome of the October 22nd US FDA Vaccine Advisory Committee meeting. @TheMarketEar

I’m curious, judging from price action on all the potential Covid19 vaccine candidates and trial results thus far, how is this October 22nd FDA advisory meeting market bullish?

I see a case for disappointment and with it, volatility.

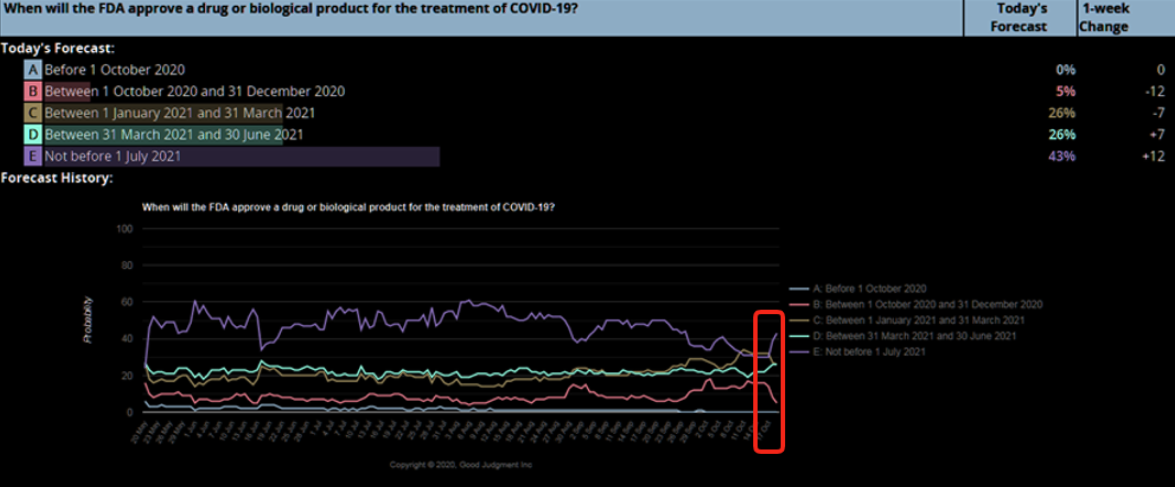

I’m not alone. Here’s the most recent ‘polling’ by experts (super forecaster odds) over the past few days: pushing Vaccine “not before 1 July 2021” to 43% from 31%. h/t @TheMarketEar

There is a reason implied volatility of the S&P is elevated. And another reason it is staying elevated.

These two client posts outline my working thesis. It doesn’t mean there aren’t some great value and momentum plays long, which we have spied in my trading room daily, but the risk is to the downside is growing:

Bitcoin is acting like a hedge more than VIX now since Gold/Silver/Miners are weak and markets are held hostage in essence pinning volatility until one of those event risks resolves itself. My bet:

Stimulus (next year), Covid vaccine (next year), and Election (…next year?).