Market Thoughts

Bifurcated Rate Cut Sentiment

When Fed member John Williams suggested last Thursday that ‘r-star’ is .50%, markets took it as a sign that a 50 bps rate cut is in the cards. Bonds rallied, markets recovered their day’s losses and Gold and Silver skyrocketed. Although talked back that evening, clearly it shows the market is uber-sensitive to the yield curve and rates and all things priced in the USD. But opinion on whether to cut is also clearly divided.

Those who don’t think Fed should cut:

- “US Economy is doing fine so why waste the bullet?” and “If Fed is so bullish the economy, why cut?”

- “Lower yields are not stimulative this late in the cycle” inspires “Rate cuts incentivize malinvestment and asset bubbles”

- “We are Turning Japanese!”

Those who do think Fed should cut:

- “US Economy is fragile, as witness between Oct and Dec 2018, so must cut rates to sustain current market

exuberancestability.” - Only a Half-Point Rate Cut From the Fed Will Do “Anything less would fail to fix the imbalances in the global bond market, continuing to weigh on economic sentiment.”

Global Central Banks have their own ideas:

We expect 12 central banks to cut rates in the next couple of months. JPMorgan

At least they are talking their book!

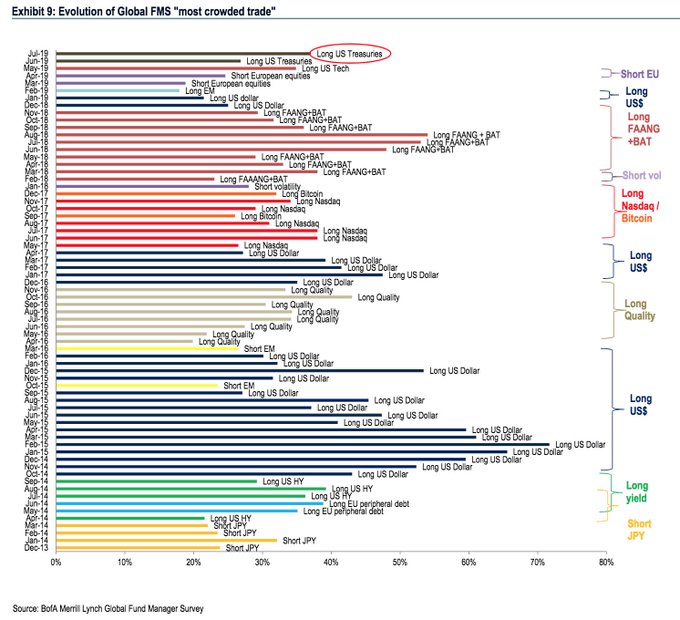

According to the July BofA fund manager survey:

Bond yield expectations are the lowest since 2008 and inflation expectations are at a 7-year low. Just 1% expect inflation to rise in the next 12 months vs 80% a year ago. @FerroTV

And might I add, they have had this book for awhile…

The Global Carry Trade Freight Train Rolls On

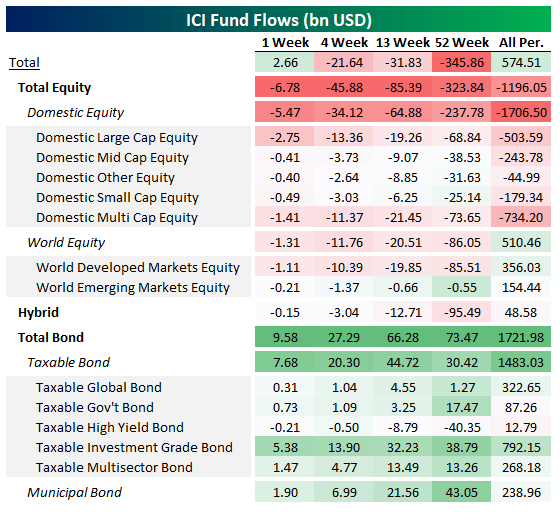

“On a cumulative basis, bond fund inflows total $1.7trn since the start of 2007, an interesting mirror image of the $1.7trn in domestic equity fund outflows since 2007”

My View:

- Powell’s position – there’s no going back to “normal”– only fuels more demand for the long end.

- Inflation expectations reverse sharply: Just as they did of late – “1% expect inflation to rise in the next 12 months vs 80% a year ago”.

- Fed lowers short-term rates – to better sync with 2-year Treasury Note Yield: ~1.85 now on it way to where they were in Dec 2015 ~1%.

- Bull Steepener in yield curve results in the next 6-12 months.

- With “Fed-induced” inflation coming as short term rates fall, dollar weakness results but not likely until after Fed is done cutting 50 bps (estimated December 2019).

And with that, a Steepener is not bullish equities.

Are markets unstable? Look no further than the rates market.

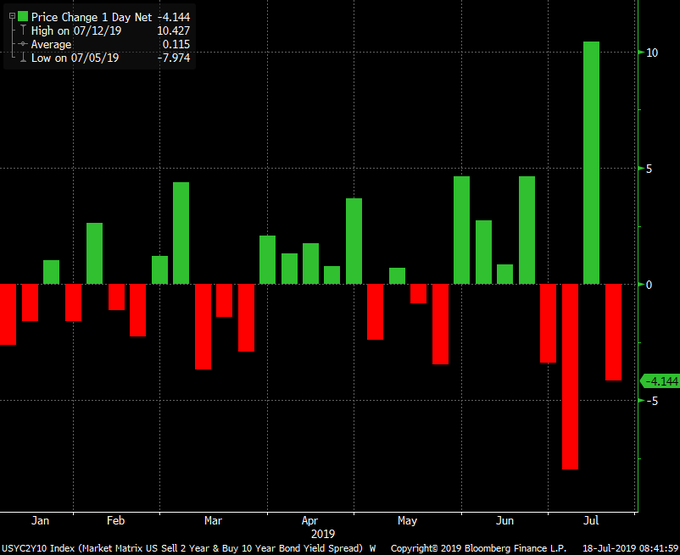

Curve conniptions: 2s10s on track for biggest weekly flattening of 2019 followed by biggest weekly steepening followed by second-biggest weekly flattening. @LJKawa

I mean, this is Crazy Ivan kinda stuff.

Russian Captains sometimes turn suddenly to see if anyone’s behind them.

We call it, Crazy Ivan.

Anything you can do is go dead, shut everything down, and make like a hole in the water.

Recently Published Research/Analysis for Clients of LaDucTrading:

BROKERAGE-TRIGGERED TRADE ALERTS!

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jul. 25th, 7:33 am Friendly Reminder we post a recap of My Daily Macro and Market Thoughts and WallStreetJane’s Journal on my Fishing Lessons page: https://laductrading.com/free-fishing-lessons/ (sign up cuz we don’t always post it here!) Today’s Title: The Race To The Bottom https://laductrading.com/2019/market-thoughts-the-race-to-the-bottom/

Trade Review

You know I analyze and write Macro but I trade Micro. If you aren’t my Trading Room or Trade Alert client (and if not, why not?), you can still check out my trade results (and then join)!

I make available my Closed Trades from my brokerage-triggered trade alerts that launched July 15th along with my total running account value!

Bookmark These Pages! We will be working on improving the design and usability but the data and results are there.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now trades full-time and actively shares her trading ideas, plan and process.

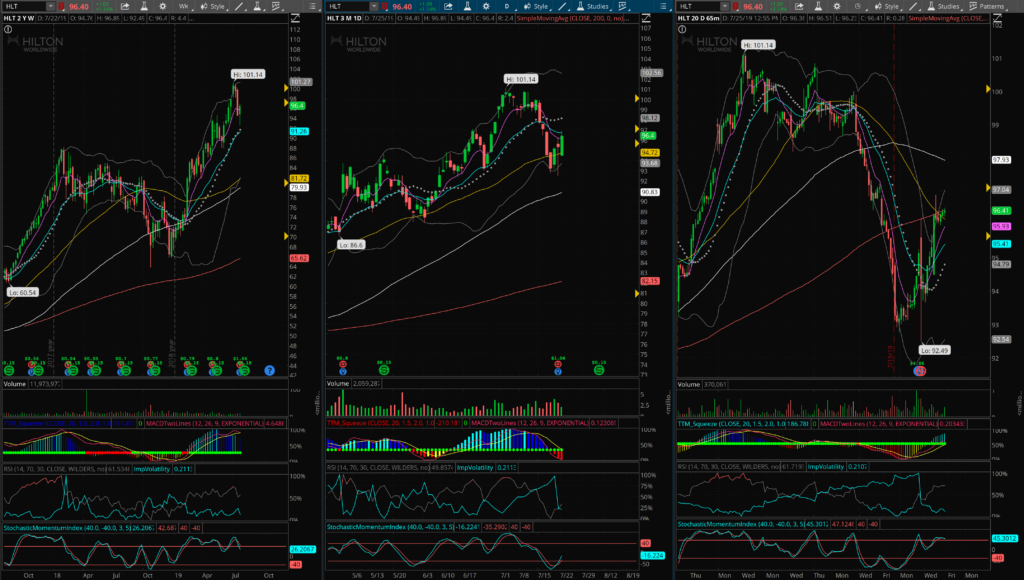

Trade Idea: $HLT

HLT had a nice pullback after a prolonged move higher. They reported earnings on July 24th, beating expectations. I like the test and retest bounce off the 50DMA and that it held gains in to the close. Room to move higher with the width of the bollinger bands and a midline intonating higher. Watching for entry at hold above 97.10. Price targets at 99 and then 100.50.

Macro Matters

After a long period of flattening, the yield curve tends to chop around 0% before decisively steepening. Tony Bombardia

Economic Data

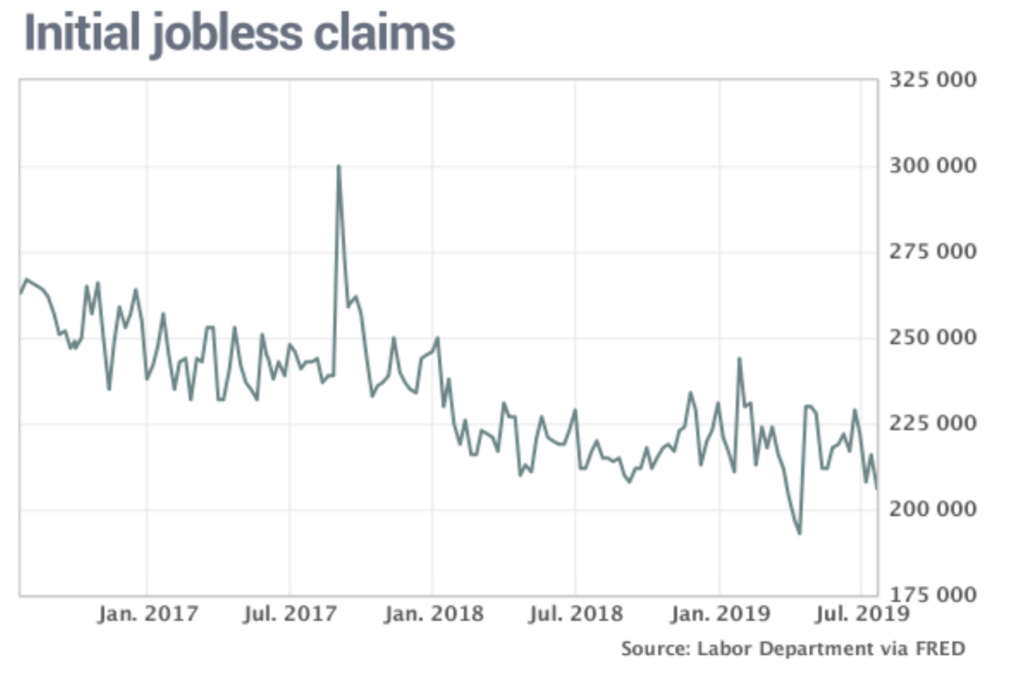

Weekly Jobless Claims: Initial jobless claims decline by 10,000 to 206,000 in late July

The number of people who applied for unemployment benefits last week fell to the lowest level in more than three months, reflecting the persistent strength of a U.S. labor in which layoffs have fallen to the lowest level in decades. The more stable monthly average of new claims declined by a smaller 5,750 to 213,000.

Durable Goods & Core Capex Orders

Durable-goods orders rose 2% last month, the government said Thursday. The increase was higher than 0.7% forecast of economists, but the decline in May also turned out to be deeper than initially reported. That took some shine off last month’s increase.

If cars and planes are stripped out, orders rose a smaller 1.2%. Transportation often exaggerates the ups and downs in orders because of lumpy demand from one month to the next. The only major category to suffer declines were defense. Orders for military aircraft dropped 32%.

A key measure of business investment, known as core orders, advanced 1.9% to mark the biggest gain in almost a year and a half.

Advanced Trade in Goods: Exports sank 2.7% in June, imports also decline

Exports fell 2.7% in June. The U.S. exported far less food and livestock feed in June and shipments of consumer goods also fell. At the same time imports dropped 2.2%, led by industrial supplies, mainly oil.

The trade gap widened to $55.5 billion in May, its highest level of the year.

ECB Signals Rate Cut, QE as Global Stimulus Push Picks Up

The European Central Bank sent its strongest signal yet that monetary support for the euro-area economy will be stepped up after the summer break, with lower interest rates and renewed asset purchases on the table.

President Mario Draghi and fellow policy makers said on Thursday they expect borrowing costs to stay at present levels “or lower” through at least the first half of 2020, opening room for a September reduction in the deposit rate from the record low of minus 0.4%. Officials also signaled they will restart their bond-buying program if needed.

Trade Wars and More

U.S. to pay farmers up to $16 billion for trade war losses, South to benefit

The U.S. government will pay American farmers hurt by the trade war with China between $15 and $150 per acre in an aid package totaling $16 billion, officials said on Thursday, with farmers in the South poised to see higher rates than in the Midwest.

The assistance, starting in mid-to-late August, follows Republican President Donald Trump’s $12 billion package last year that was aimed at making up for lower farm good prices and lost sales.

U.S. farmers, a key Trump constituency, have been among the hardest hit in the year-long trade war between the world’s two largest economies. Shipments of soybeans, the most valuable U.S. farm export, to top buyer China sank to a 16-year low in 2018.

No-Deal Brexit Risk Grows After EU Rejects Boris Johnson’s Demands

Boris Johnson pledged to “turbo-charge” preparations for a no-deal Brexit and hinted he’s mulling an election, as Britain’s new leader gambled on taking the hardest line he can with the European Union.

Making his first appearance in Parliament as prime minister, Johnson said he was happy to talk to the EU and would prefer an orderly divorce with a deal. But he warned that any chance of reaching an agreement hinges on the bloc abandoning its guarantee for the Irish border, something Brussels immediately rejected.

If neither side backs down, Britain will be on course to drop out of the EU on the exit day deadline of Oct. 31 with no deal in place to cushion the blow to the economy from disrupted trade.

Great Reads

We can only hope her conclusions are shared with all FED officials. Seems crazy they had nothing like this in place prior to 2008. The New York Fed Has a Black Swan Hunter

House passes bill to stop coming ‘tidal wave’ of failing pensions, “As of 2015, multiemployer plans had a total of $560B in unfunded liabilities”…