Welcome to September…

Despite a strong week last week – after four weeks of sideways chop – markets opened down to start the new month with Russell the weakest. The stock and major macro moves today were pretty much over within the 1st 15 minutes:

- USD continues higher (on way to PT for trendline resistance: UUP to $27.30, DXY to $100)

- Silver, Gold and Miners screamed higher (despite USD strength).

- Interest Rates for 10-yr dropped hard but bonds (TLT) closed flat.

- Crude Oil opened down 3.5% despite threat of Hurricane Dorian

- ZIV sold off all day while Volatility moved higher but not dramatically

- Yuan deval continued (USD/CNH tagged $7.19)

- Yen threatened to break trendline support (USD/JPY needs to fail 105.44 and then 104.79 before resuming its downtrend)

Two Chart Tells Need Watching: HYG and TLT

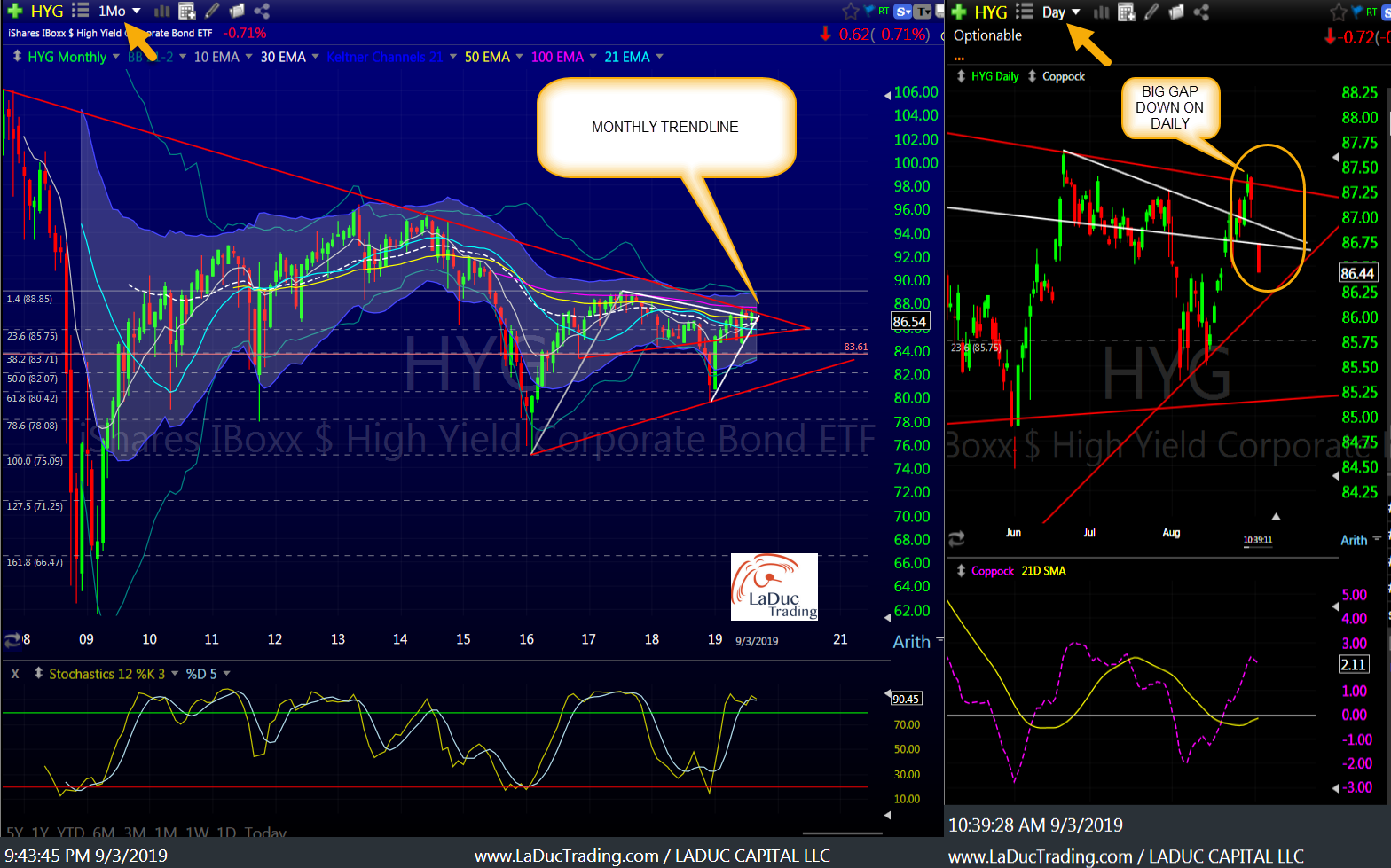

HYG tagged its monthly trendline last week (left chart in blue) and gapped down strongly this morning with oil (right chart in black) – below two daily trendlines I might add. There was an article I retweeted on Shale companies declaring bankruptcy that will help illuminate fears on the indebtedness of many in the oil patch and their risk to high yield investment grade bonds. A continued fall in HYG is very bearish SPY etc.

Oil and Gas Bankruptcies Grow as Investors Lose Appetite for Shale – WSJ

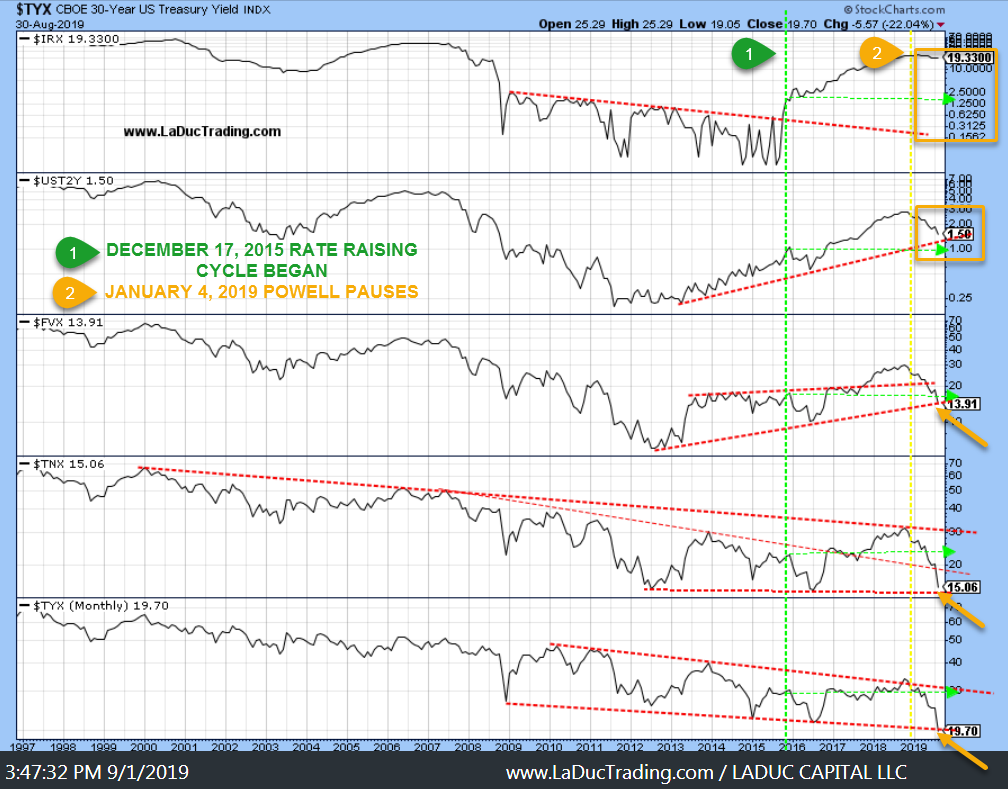

The other chart is of the Global Carry Trade run-away train: TLT but all bonds really. I call attention to this possible inflection point – of reversal – because it times so well with my other chart on rates (chart follows below) … and how TNX (10 -year) is coming into weekly channel support.

I would expect both of these instruments to tag/digest these major areas of resistance (TLT) and support (TNX) which should greatly influence the equities market. And unlike thinking that a pullback in bonds would be equities bullish, I can see a case where both bonds and equities sell off together (like they did in January 2018). Keep in mind, we have non-farm payroll Friday and FOMC next week so either could trigger a big risk off mode as discussed in last week’s newsletter: How the Market is Like Donkey Kong.

Brokerage-Triggered Trade Alerts!

Possible Macro Triggers for Bond Pullback

China Sells Treasuries

As part of retaliation. Not a high probability but I put it in here for consideration.

Pension Rebalancing

Thanks to @ROIChristie, I learned there is a structural capital flow that is little discussed or understood which can contribute to equities staying weak and bonds staying bid this September – due to accelerated funding from pension rebalancing that allows pensions to deduct contributions at the old tax rate (35%). I am inferring that the lack of large buying after this funding spree may signify a turning point for bonds. Not sure, but I will be curious how TLT handles that monthly trend-line as a Tell!

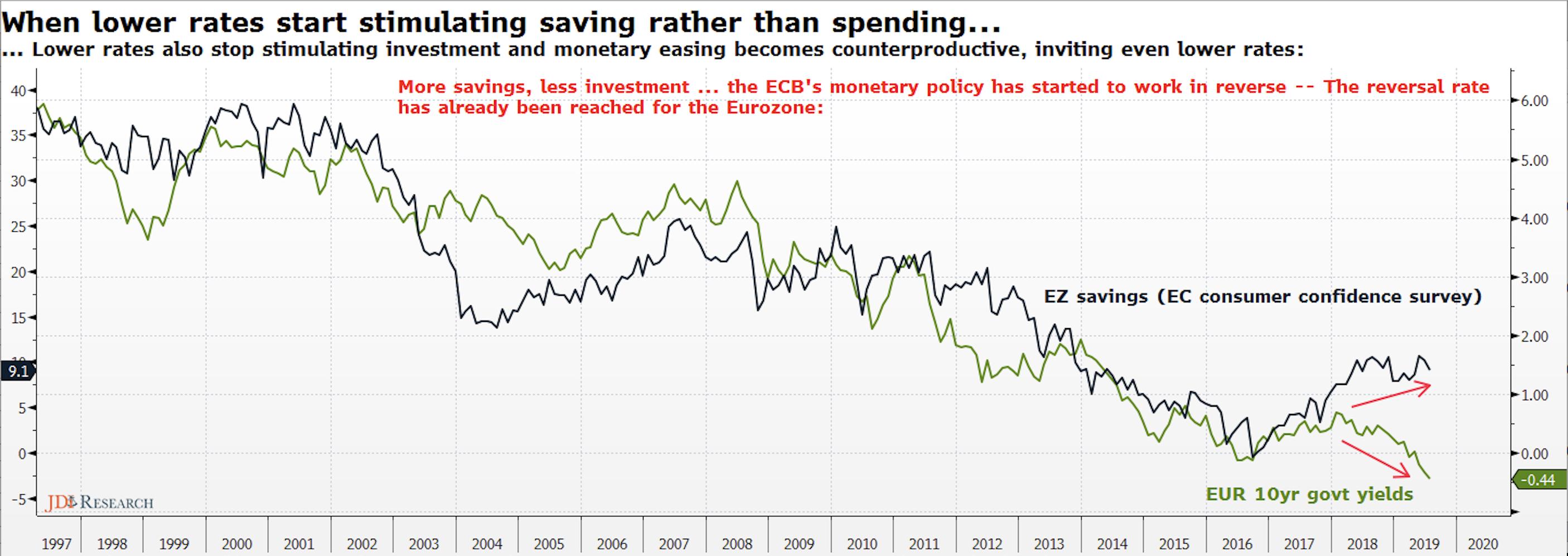

Low Interest Rates Don’t Incentivize Spending If Those Low Rates are to Prevent Armageddon

Negative rates have damaged banks and credit origination, says a study of 7,359 banks from 33 OECD countries. The bigger issue is how Low/Negative Rates incentivize Savings over Investment for companies and Savings over Consumption for individuals. Great Chart via @JulietteJDI

Gone Fishing Newsletter: New-Not-Normal

I Cover: Structural Capital Flows, Global Money Supply, Yield Differentials, Yield Curve Inversions, Trade War Impact, Earnings, Buybacks, Fed Rate Cuts, Unicorns, USD, Yen, Yuan, Global Carry Trade, China and Peak ‘Disposable Money’.

Other Recent Gone Fishing Newsletters for Clients

- Yen Nearing Escape Velocity

- Volatility Reprices Everything

- Market Thoughts: Out Of The Pool

- How The Market Is Like Donkey Kong

- Intermarket Chart Attack: Trading Trend Reversals

- Intermarket Chart Attack: Some Things are Really Broken

- Gold At An Inflection Point

- Intermarket Chart Attack: Something Is Broken