Market Thoughts

Market is pricing in 3 rate cuts THIS YEAR – with January 2020 fed fund futures implying an effective average rate of 1.67% at the end of 2019 while it currently sits near 2.38%. This divergence in these rate expectations combined with a market tiring of the rhetoric of negotiated Trade Wars… but living the reality from the economic impact from Trade Wars unresolved …will test my $2718 gap-fill thesis this summer. @SamanthaLaDuc

Private Equity

Caution: Contents Are Hot!

Every week it seems another $2bn-$3bn leveraged buyout gets announced without much fanfare, according to Financial Times. Even the large deals, i.e. a $14.3bn takeover of a fibre optic cable operator or the $18.7bn purchase of US warehouses, don’t generate much newsprint. Private Equity activity in the first half of a year has eclipsed the pace seen in the boom year of 2006. The dealmaking is being fuelled by nearly $2.5tn of unspent capital that private equity groups have raised to finance their takeovers, money that has poured in from pension and sovereign wealth funds but not yet been spent. The value of leveraged buyouts climbed to $256bn in the first six months of 2019, the second-largest first-half on record, according to new figures from Refinitiv. The surge represents 13 per cent of global acquisition activity, the highest level since 2013

Looking Ahead – Risk Events

Stocks of Interest in the News

Boeing (BA): More concerns arise as: Pilots Flagged Software Problems on Boeing Jets Besides the Max

Pilots flying Boeing aircraft in recent years have reported flight-control problems they blamed on malfunctioning software — not on the company’s maligned 737 Max jets, but widely used earlier versions of the plane that are still in the air. Earlier this week, the Federal Aviation Administration disclosed that it had identified additional computer problems with the Max, aside from the anti-stall software known as MCAS that has been linked to two fatal nose-dive crashes in recent months. Fixing the newly discovered software glitch could take as long as three months, people familiar with the matter said Thursday.

Nike (NKE): Shares fell more than 3% in the extended session Thursday after the company missed consensus earnings estimates but beat revenue projections.

The company reported fourth-quarter net income of $989 million, or 62 cents a share, compared with $1.14 billion, or 69 cents a share, in the year-ago period. Revenue rose to $10.18 billion from $9.79 billion in the year-ago period. Analysts surveyed by FactSet had estimated 66 cents a share on revenue of $10.16 billion. For the first quarter, analysts expect adjusted earnings of 79 cents a share and sales of $10.64 billion. “Amid foreign exchange volatility, our double-digit currency-neutral revenue growth and expanding [return on invested capital] showcase Nike’s unrivaled ability to create extraordinary value for consumers and shareholders over the long term,” Chief Financial Officer Andy Campion and said in a statement.

Sector Inflection

Are Transports A Good Value Play?

Are Financials Now a Value Play?

Financials in S&P combrise 12% Market Cap but 20% of Earnings Weight.

“Lower short-term rates, higher longer rates, and a yield-curve steepening might just be the “macro” that helps the sector.”

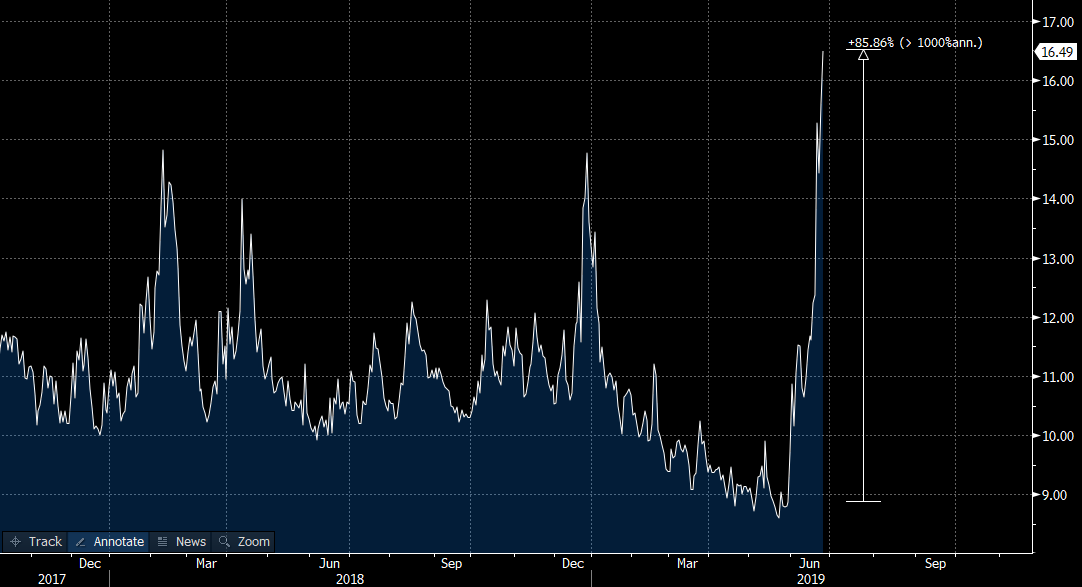

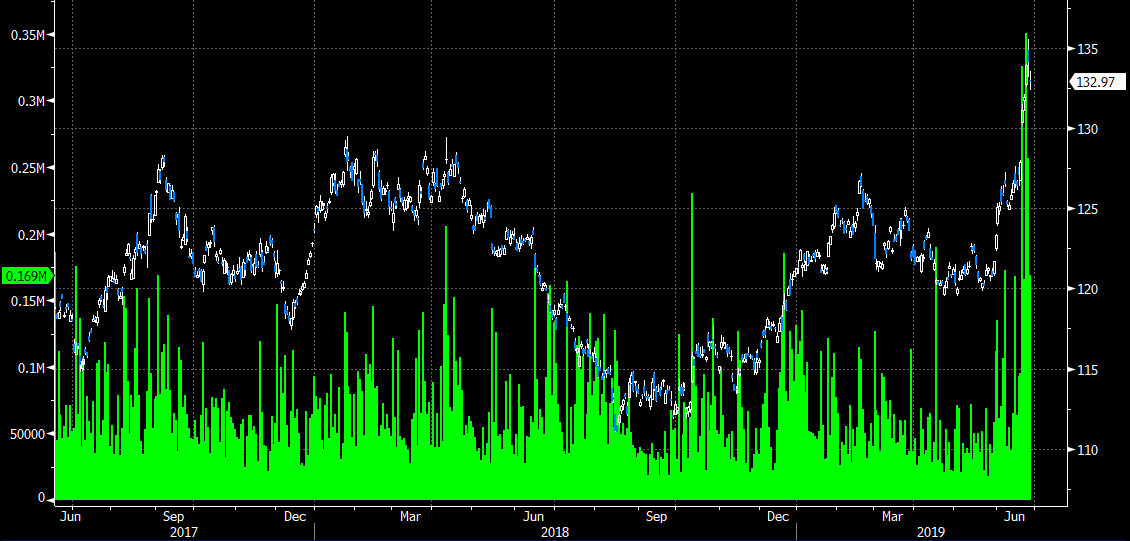

Gold volatility – the GVXX – couldn’t get enough!

Up close to 90% from early June. Charts courtesy https://themarketear.com/

Gold bull continues…at least in call volumes!

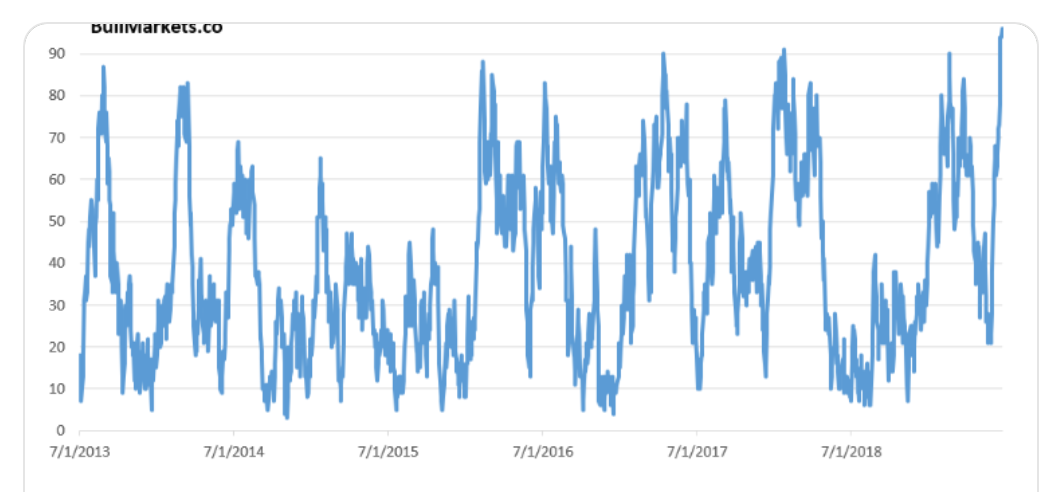

Gold sentiment – also at extremes

Gold’s Daily Sentiment Index was above 95. In the past, sentiment readings above 95 were bearish for gold 65% of the time 2 months later, with an average max drawdown of -5.66%

Macro Matters

The case for >3000 as per Adam Crisafulli, JPM

1) the recent deceleration in US growth momentum (seen in May and June data) begins to stabilize while int’l numbers (specifically Europe and China) improve

2) central banks proceed with easing actions (specifically the ECB and FOMC) despite the improved growth backdrop (as monetary policy aims to combat disinflationary pressures)

3) the US TSY curve continues to steepen (as Fed-sensitive 2yr yields are driven lower while nominal growth-sensitive 10yr yields hold flat or even rise)

4) the USD sees further downward pressure (providing a boost to SPX EPS estimates in the process)

5) Brent stays above $60 (and ideally above $65) but because of improved demand and ongoing OPEC+ discipline (not heightened US-Iran tensions in the Middle East)

6) US-China trade tensions quickly deescalate (specifically, some of the existing tariffs are rescinded and a compromise is negotiated to keep Huawei alive)

7) the 2020 SPX EPS consensus moves back up towards ~$183-185 (it currently stands at ~$178-179 and is creeping lower).

Not the base case though.

Economic Data

Weekly Jobless Claims: Came in slightly higher than expected at 227,000 vs. a consensus of 220,000

First-Quarter GDP Revision: The final Q1 GDP revision came in unchanged at 3.1%

The pace of growth in the U.S. economy in the first three months of 2019 was left at 3.1%, revised government figures show, as stronger business investment offset a weaker increase in consumer spending.

Most economists predict growth will taper off in the second quarter, however. The first quarter benefited from a surprisingly large increase in inventories of unsold goods as well as an improved trade balance, neither of which is expected to be repeated.

Pending Home Sales for May: Pending home sales jumped by a seasonally adjusted 1.1% in May but were 0.7% lower than a year ago, the National Association of Realtors said Thursday. The May increase beat the consensus forecast for a 0.6% rise.

Contract signings precede closings by about 45-60 days, so the index is a leading indicator for upcoming existing-home sales reports.

In May, pending sales in the Northeast were 3.5% higher, and in the Midwest, they were 3.6% higher. In the West, they dropped 1.8%. In the South, they edged up 0.1%, but were slightly higher than year-ago levels, the only region in which that was the case in May.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jun. 27th, 9:07 am AAOI – upgrade this morning. Above 10.50 looks good for gap fill to 11.60 and then 12.75

Jun. 27th, 9:55 am Pot stocks getting some interest. CRON, CGC, ACB; CRON if it can hold on a weekly above 16.70 could be good for a swing long.

Jun. 27th, 3:20 pm THAT WAS A RAD IDEA!! So this AM my top trade ideas: Long: OSTK, AAOI, RAD, WBA, X, AVGO – all working. Short: CAG, GIS, BA, TSLA, TSN, ROKU – only CAG triggered.

Jun. 27th, 3:26 pm With the announcement of RAD serving as “counter” to AMZN, this ‘circle the drain’ extremely oversold name just needed a trigger to bounce (post 1/20 stock split baahaahaa). Anyway, this AM I liked how the AMZN news reversed the 11% post EPS pre-mkt drop to ‘even’ at $7.43. I gave it an $8.50PT. It hit $9.69 before settling at $8.60. Pretty much the only time I trade Stocks over Options – when they are fast moving, low-priced puppies like this.

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

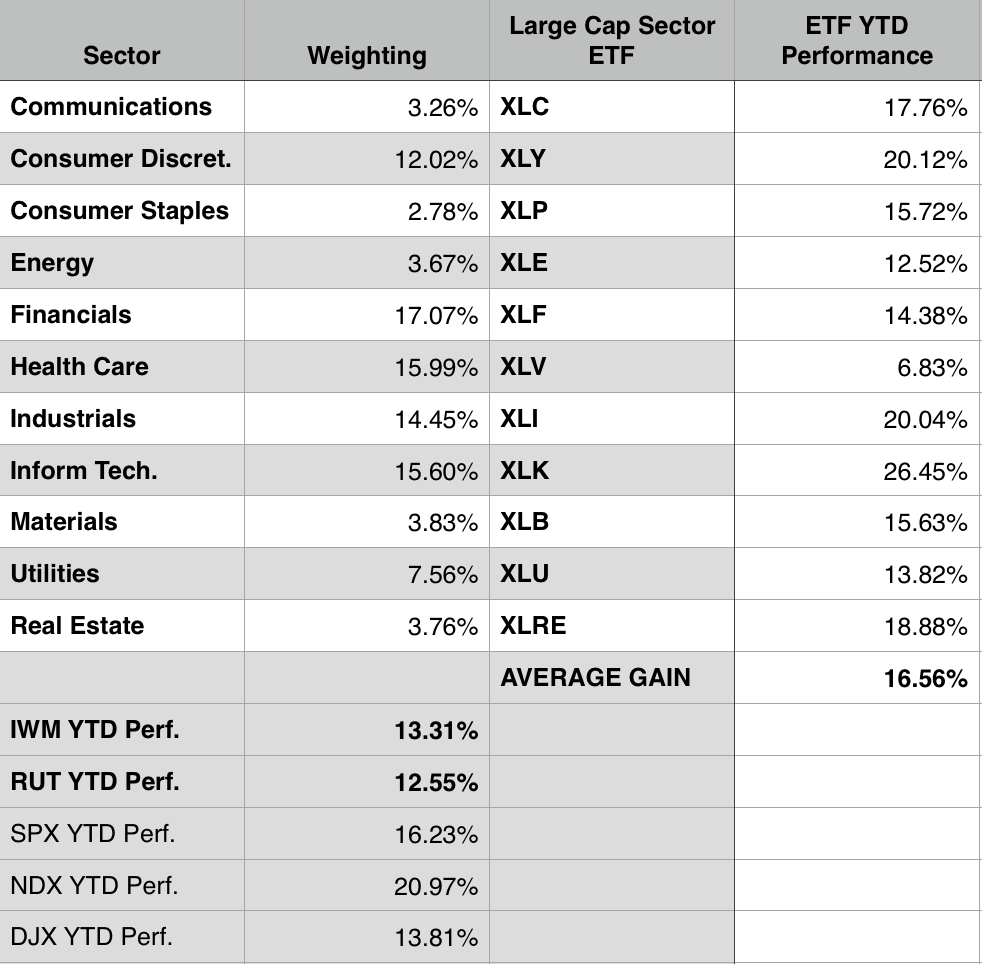

This morning in Samantha’s trading room she mentioned that healthcare was a significant percentage of the sector mix in the Russell 2000. Given the small caps laggard performance this year, I thought I’d take a look at how the large cap sector ETF’s have performed YTD in relation to RUT and IWM. Before looking up the data I thought we’d be talking about outperformance of the large cap ETF’s in the range of 5-10%, but it wasn’t that wide at an ETF/RUT outperformance of 4.01%. With this information in hand I’ll be curious to watch performance for the second half of the year. Do the small caps remain out of favor, or do they start to get some love and RUT plays catch up?

Great Reads

HPV vaccine has major impact on reducing infections, cancer, study finds

Vaccination against the virus that causes almost all cervical cancer is having a major impact on stopping infections and should significantly reduce cases of the disease within a decade, researchers said on Wednesday.