Market Thoughts

While there wasn’t a rate cut last week, and Fed Chair Jerome Powell continued to avoid mention of it today, in both press conferences he did everything possible to keep hope alive.

But herein lies the rub: unless Iran caves, unless China caves, unless North Korea caves, there is plenty of geopolitical strife to keep markets from roaring higher. And Fed is not a salve for tariffs – see my MarketWatch article on how this is Not 1995 – and how Dallas Fed President Rob Kaplan sees the Economic Conditions and the Stance of Monetary Policy:

“I am concerned that adding monetary stimulus…would contribute to build-up of excesses & imbalances in economy which may ultimately prove to be difficult & painful to manage”

All the while Gold and Treasuries are being bid like bond traders expect a market breakdown and painful global collapse.

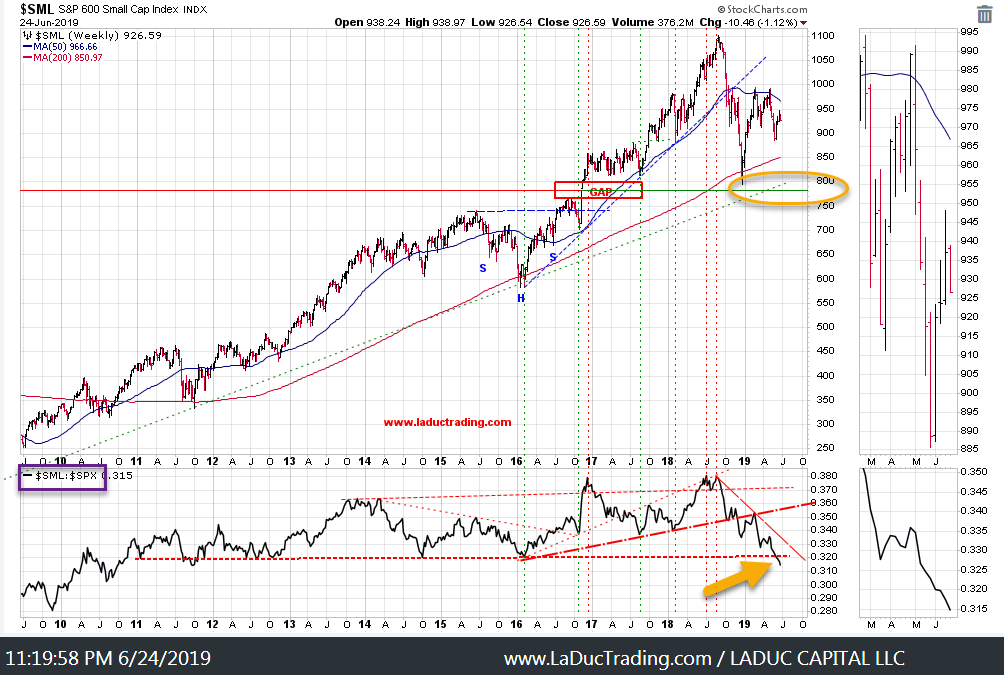

Of tactical significance, sectors with a reputation for economic warning are sending warning signals: Banks and Semis may be only weak, but Small Caps and Transportation stocks are reinforcing the signal from falling bond yields that all is not well with the economy. The mantra has been to avoid a Bull Trap when these sectors can’t lead.

Here’s my Intermarket Analysis on these two key sectors which similarly confirms relative weakness to SPX which I have been tracking and trading with members:

What I’m Worried About:

The G20 Meeting (June 28-30) is the obvious, pressing concern – with the extra 25% traunch of tariffs on China and China’s retaliation in reaction to Trump’s bully posturing.

But also a date I’ll be watching most closely – June 30th – for another reason, and not just because of Xi-Trump G20 meeting, but it’s the date for Reauthorization of TANF (temp assistance for needy families + child care entitlement). Why? It’s part of Fed Debt Ceiling that expires/needs bipartisan support to pass…

Most have forgotten the Federal Government Debt Limit is fast approaching and with it potential government shutdown.

Macro Matters

U.S. New-Home Sales Fall to Five-Month Low, Missing Estimates: Sales of new U.S. homes fell to a five-month low in May, adding to signs of weakness in the sector despite lower mortgage rates. Single-family home sales dropped 7.8% to a 626,000 annualized pace that missed all estimates in Bloomberg’s survey of economists, from an upwardly revised 679,000 rate in April, government data showed Tuesday. The median sales price decreased 2.7% from a year earlier to $308,000.

Consumer Confidence in U.S. Declines to Lowest Since 2017: U.S. consumer confidence fell in June to the lowest level since September 2017 as Americans became less upbeat about the economy and labor market amid trade tensions with China and Mexico. The Conference Board’s index declined to 121.5, lower than all forecasts in a Bloomberg survey, data from the New York-based group showed Tuesday. The median projection called for a reading of 131. A gauge of the present situation decreased to a one-year low of 162.6, while the measure of expectations fell to 94.1.

Case-Shiller Home prices flatlined in April: The S&P CoreLogic Case-Shiller 20-city index was unchanged in April compared to March on a seasonally adjusted basis, and was 2.5% higher compared to a year ago. That was the 13th straight month in which annual growth slowed, and the lowest pace of annual price gains since August 2012.Home prices continue to rise, but at a much slower pace. The cities with the strongest annual gains are still those in warm climates which were among the areas hardest-hit by the housing crisis: Las Vegas, Tampa, and Phoenix. But their rates of price growth are hardly the double-digit gains enjoyed by Seattle, San Francisco, and others not that long ago.

Trade Wars and More

Trump threatens “obliteration” as Iran slams sanctions on Khamenei: U.S. President Donald Trump threatened on Tuesday to obliterate parts of Iran if the Islamic Republic attacked “anything American”, as Iran said the latest U.S. sanctions had closed off any chance of diplomacy. “Any attack by Iran on anything American will be met with great and overwhelming force,” Trump tweeted just days the United States came within minutes of bombing Iranian targets. “In some areas, overwhelming will mean obliteration,” the U.S. president tweeted.

Stocks of Interest in the News

Biotech: M & A continues today with Drugmaker AbbVie Inc saying today it would buy Botox-maker Allergan Plc for about $63 billion, grabbing control of the biggest name in medical aesthetics to help reduce its reliance on blockbuster arthritis treatment Humira. AbbVie has been under pressure to diversify its portfolio as Humira, the world’s best-selling drug, is already in competition with cheaper versions in Europe and faces expiration of its patents in 2023 in the United States, its most important market.

FedEx (NYSE:FDX) is suing the U.S. Commerce Department, saying the Trump administration’s export restrictions would require the company to “police the contents of the millions of packages it ships daily even though doing so is a virtually impossible task” FedEx had previously ignited Chinese ire over its business practices when a package containing a Huawei phone sent to the U.S. was returned last week to its sender in Britain, in what it said was an “operational error.” Fears that China would blacklist the firm as a result sent FDX shares down 2.7% on Monday

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

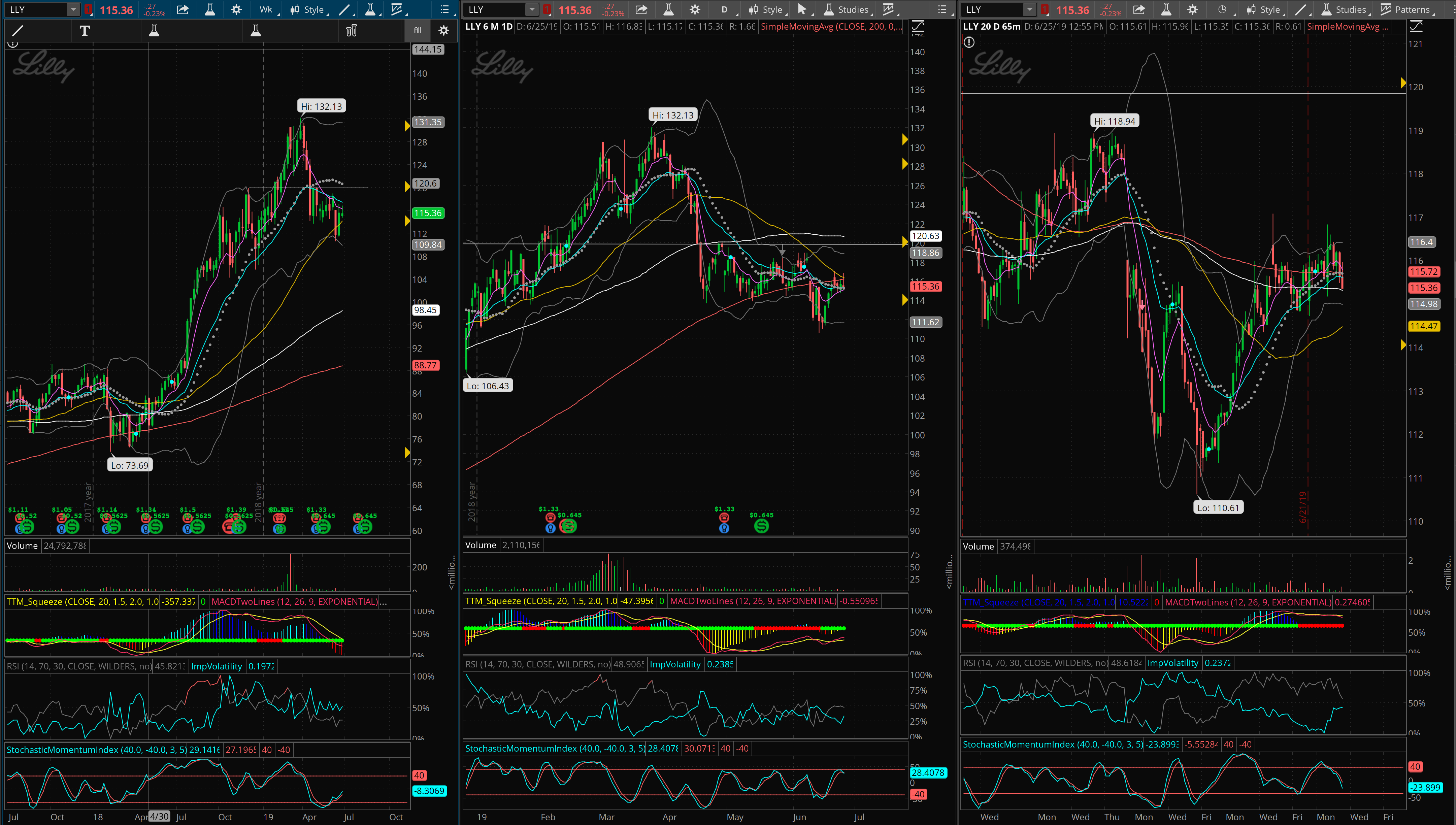

Trade Idea: LLY

LLY had been towing the line on the 200DMA and then when some bad drug data hit, it took the leg lower. It’s now been retesting that 200DMA all the while the 50DMA is going in for the kiss from above. I’ll be watching this name for a break below 114 for short entry. I would look to trade the August 16 (monthly) 115 strike. Price target 1: 111, price target 2: 108.

Great Reads

A leveraged-lending bust could hit economy quicker than subprime blowup, says ex-FDIC boss Sheila Bair:

“I do think that we are going to see distress in the corporate market, which can have a very strong and significant impact on the real economy,” she told MarketWatch in an interview.“With subprime, at least you had a bit of a flow-through,” she said. “It took a while. There was a market shock. But in terms of the real economic impact, it was more gradual.”