Market Thoughts

Samantha is traveling to NYC for meetings, presentation at the Benzinga conference and sourcing apartment for her daughter doing an internship at an architectural firm this summer. She will be busy and away from her trading desk for the remainder of the week.

Here’s Samantha’s MarketWatch article:

@WallStreetJane here filling in with some thoughts:

Big gains this week retreated slightly on this quad witching Friday. Surprisingly, at least to me, gold did not retreat and instead moved higher and held over the resistance from 2016.

With all of the middle east tensions and the Philadelphia refinery fire oil took another leg higher. Not good for summer driving season.

There’s a lot of chatter about the market, once again, getting ahead of itself. Next week will provide us with some answers.

Stocks of Interest in the News

PG&E is shopping a new plan that would allow it to emerge from bankruptcy in March. It includes a $14 billion fund established to address past wildfire claims, a $20 billion statewide fund for future fires, and possibly the refinancing of $11 billion in debt and interest. It’s the California utility’s first proposal and could be filed in August, according to a document reviewed by Bloomberg.

Prison stocks take a hit after 2020 presidential candidate Elizabeth Warren pledges to end private prisons:

Shares of private prisons GEO Group Inc. and CoreCivic Inc. took a hit Friday morning after presidential candidate Senator Elizabeth Warren tweeted about about her plan to terminate them. GEO slid as much as 5.8%, its biggest intraday loss since March, and CoreCivic retreated as much as 6%, the largest intraday decline this year.

Macro Matters

A mixed bag of economic reports today:

We had the flash manufacturing and services PMI this morning, both of which came in softer than expected, with manufacturing coming in at its lowest level since September 2009 and services the lowest since March of 2016.

Offsetting the negative PMI data was the stronger than expected existing home sales data at 5.34M versus the median forecast of 5.28M.

Sales of previously owned U.S. homes rebounded in May to a three-month high as all regions gained amid lower interest rates and a labor market that remains strong. Contract closings rose to 5.34 million annual rate, topping projections and climbing 2.5% from April’s upwardly revised pace, the National Association of Realtors said Friday. The median sales price rose 4.8% from a year earlier to $277,700.

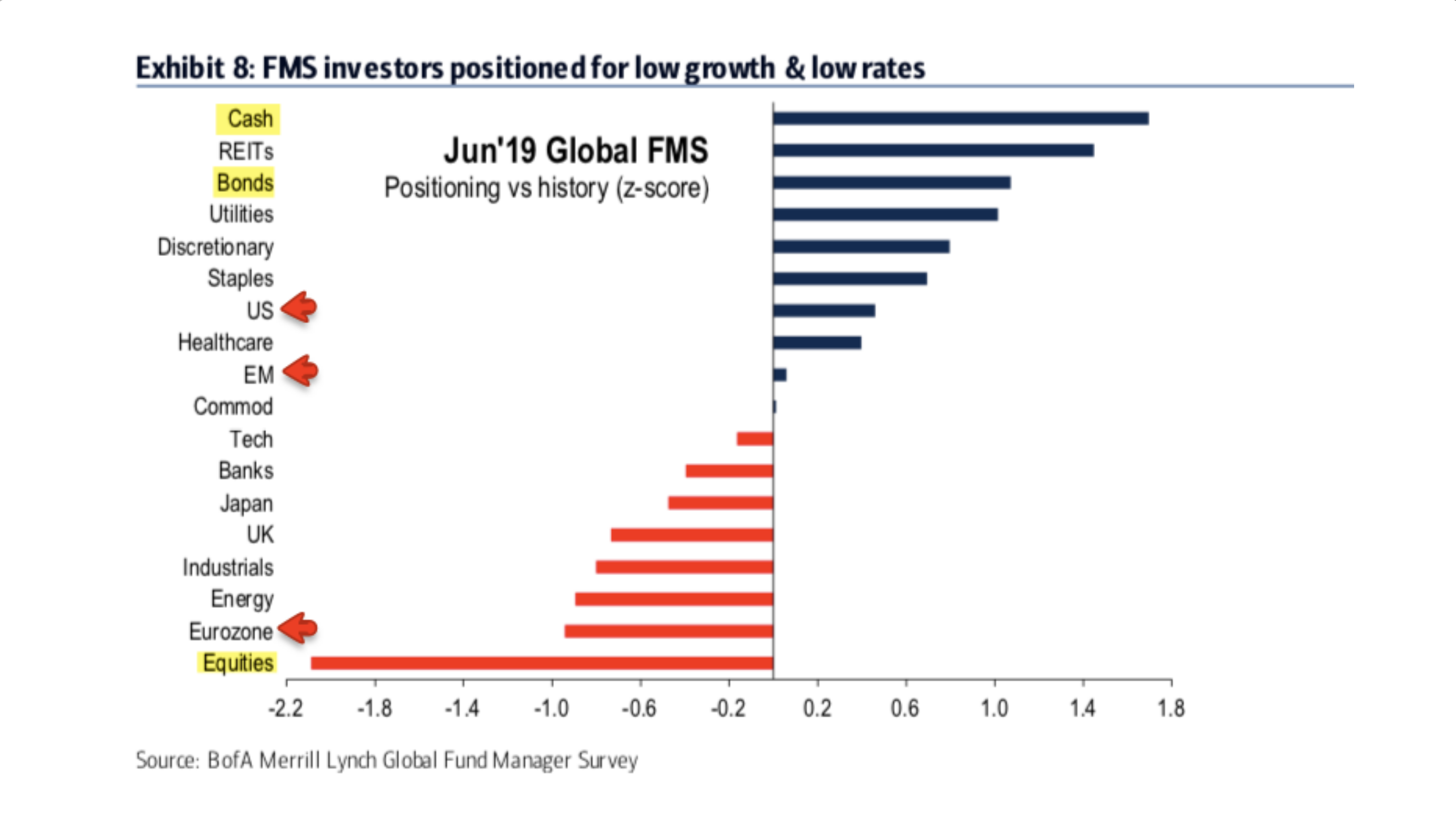

Global Fund Manager Positioning Survey:

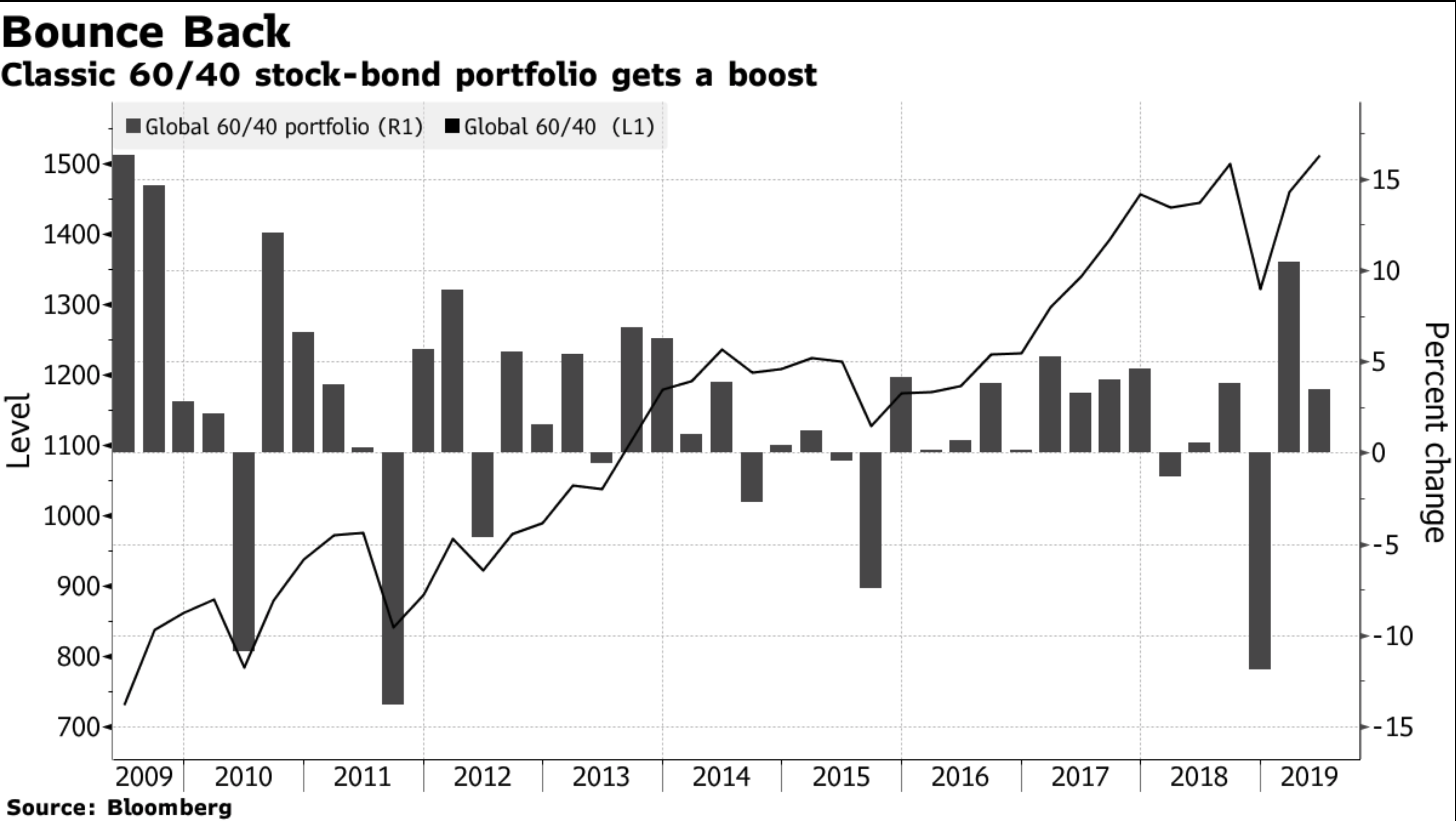

Bloomberg’s Sarah Ponczek provides us with a great article: Fed Loses Its Patience and Almost Everything You Can Trade Goes Nuts

She notes that with the exception of the dollar, this broad based rally and how a classic 60/40 stock bond portfolio is benefiting

The article further notes: In the 12 months following days when pretty much every asset class rose in unison, the S&P 500 has been higher nearly 70% of the time, with a median gain of roughly 8%, according to data from Sundial Capital Research Inc. When compared to the returns of fixed income, currencies and commodities, stocks almost always outperformed over the same period.

We’ll see….

Trade Wars and More

As Iran tensions mount, Trump said he aborted a retaliatory strike that would have killed 150 people and instead signaling he was open to talks with Tehran. Per Reuters:

Worries about a confrontation between Iran and the United States have mounted despite Trump saying that he has no appetite to go to war with Iran. Tehran has also said it is not seeking a war but has warned of a “crushing” response if attacked. “Any mistake by Iran’s enemies, in particular America and its regional allies, would be like firing at a powder keg that will burn America, its interests and its allies to the ground,” the senior spokesman of Iran’s Armed Forces, Abolfazl Shekarchi, told Tasnim on Saturday. A senior commander of the elite Revolutionary Guards struck a similarly defiant note, in comments quoted by the Islamic Republic News Agency (IRNA).

Chinese media is coming out swinging over the weekend: China Would Fight Trade War “to the End”

China has the strength and patience to withstand the trade war, and will fight to the end if the U.S. administration persists with it, China’s state-run People’s Daily said in an editorial Saturday. The U.S. must drop all tariffs imposed on China if it wants to negotiate on trade, and only an equal dialogue can resolve the issue and lead to a win-win, the newspaper said.

We’ll find out if Xi takes a similar tone when he and Trump meet next week at the G-20.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Samantha has been in NYC for her Benzinga presentation, but will be back in full swing Monday.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

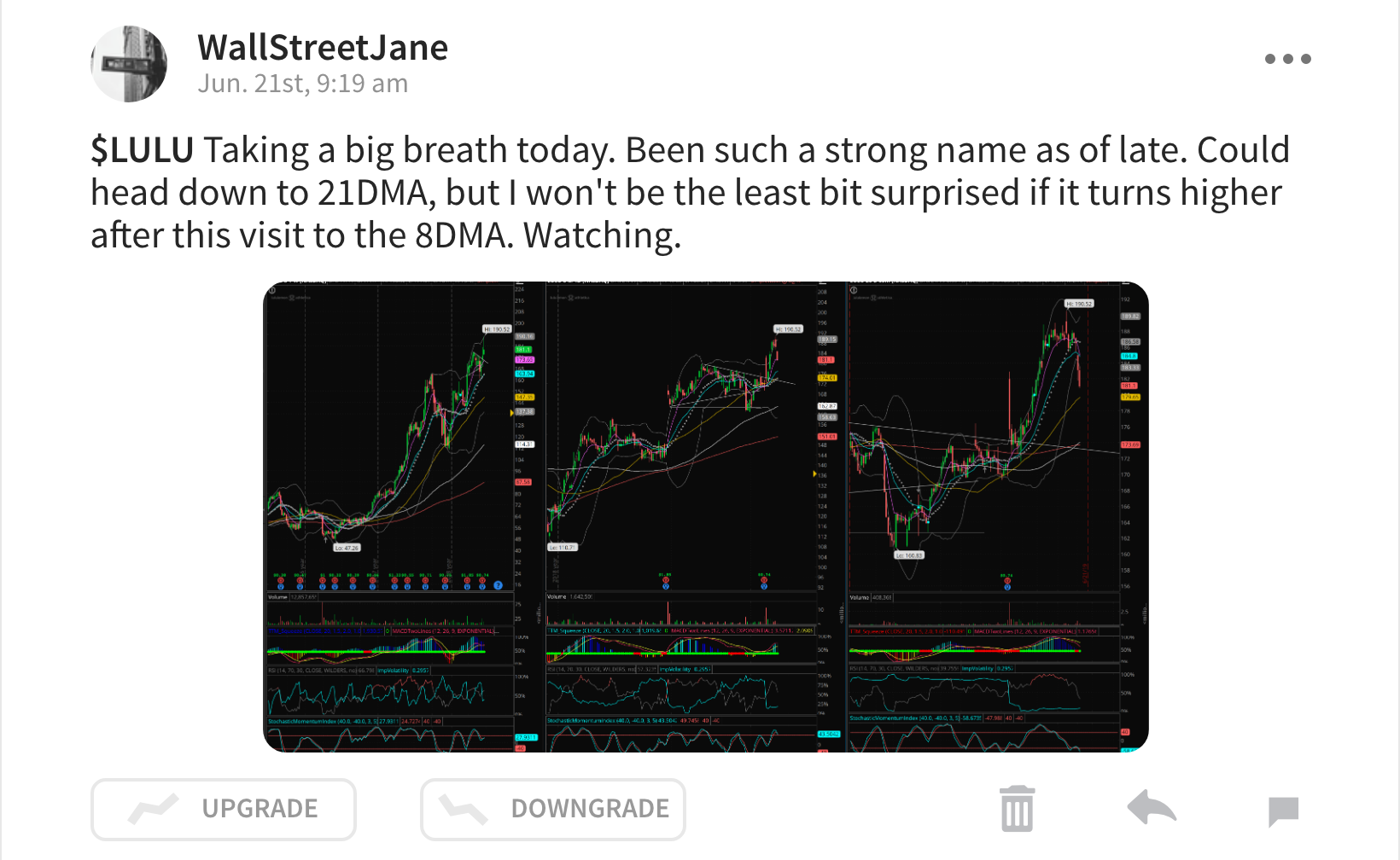

Today in the room I talked about $LULU and the move down after the post earnings rally. It finished the day down 2.48%, but managed to close above the 8D EMA. This will be on watch next week – does it head down to retest that breakout or does it resume the uptrend?

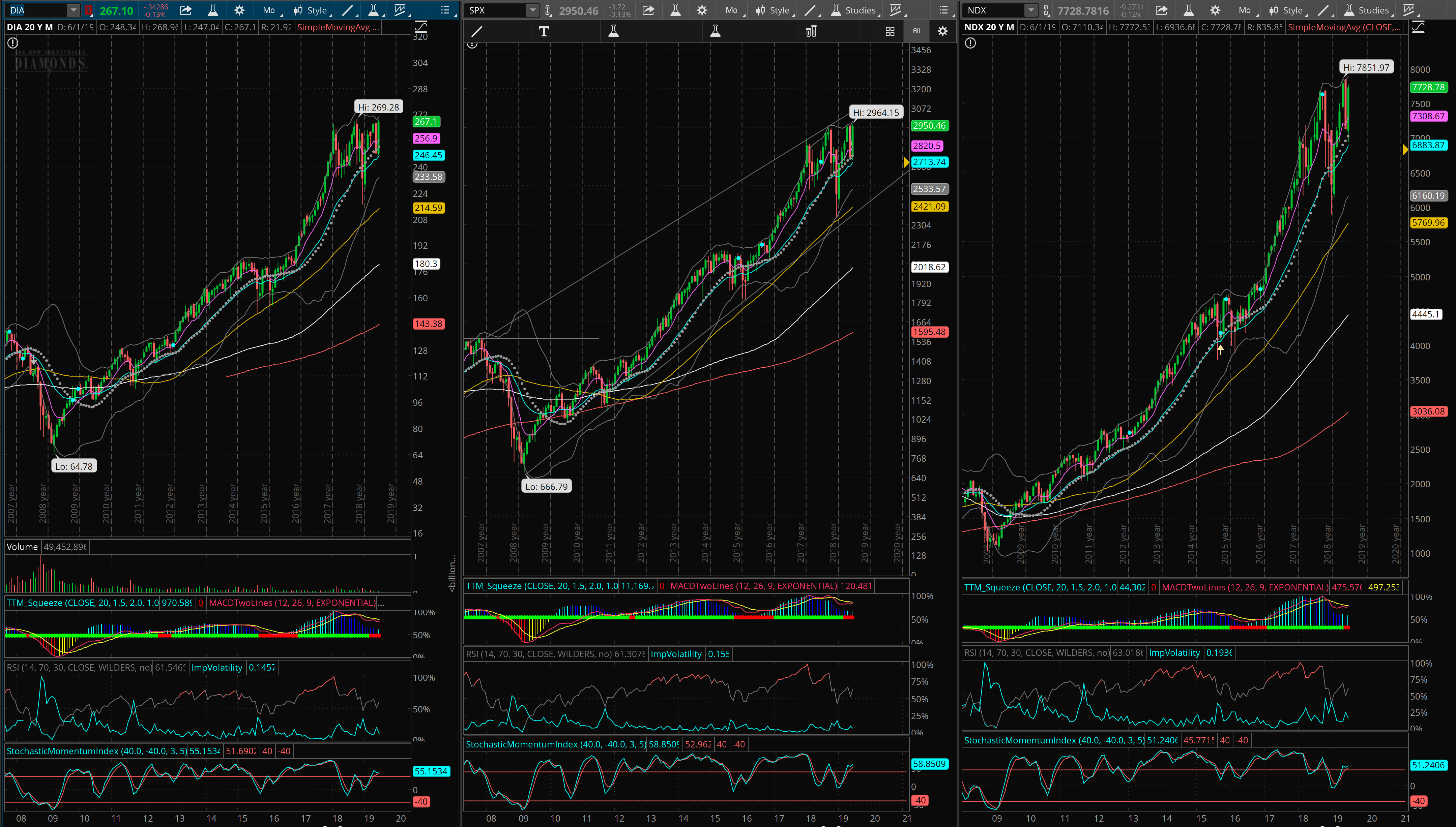

I am a fan of John Carter’s “Squeeze” study and have noticed we are again in a squeeze on all of the monthly indexes (RUT not shown). There was a monthly squeeze on the Dow and S&P just prior to the 2008 fall but, since that time, you can see the only other squeezes were in 2012 and 2016 – and we know where we headed from there. I take all indicators with a grain of salt, but it’s something worth watching.

Great Reads

Not always reaching your potential is okay, but overthinking it is a problem:

Professor Dickson said self-guides as standards that we aspire to are beneficial in giving a sense of purpose and direction in life and promoting wellbeing, even if we don’t always reach them, but turning the focus toward negative self-evaluation and self-criticism is counter-productive.

Bloomberg Opinion columnist Aaron Brown writes today: Poker-Playing Hedge Fund Managers Have an Edge

Some of you may know I (@wallstreetjane) love the game of poker and have played in WSOP tournaments. I think the best point made here is that it’s hard to measure actual stats because you don’t know how many entries a person has had prior to their recorded win / cash. Tournament poker variance is such that you could easily lose money on say 80% of your entries before any significant win. Not only that, poker is one hell of a grind compared to trading.