Market Thoughts

Samantha is traveling to NYC for meetings, presentation at the Benzinga conference and sourcing apartment for her daughter doing an internship at an architectural firm this summer. She will be busy and away from her trading desk for the remainder of the week.

Here’s Samantha’s MarketWatch article:

@WallStreetJane here filling in with some thoughts:

It’s all good, man. That’s what the market’s telling us – at least for now.

The Iran actions and Trump’s subsequent threatening tweet couldn’t derail the rally, with the S&P closing at an all-time high. Trump made sure to tout the stock market performance this morning, but left Powell and the Fed out of the mix. I’ll wager Powell is just fine with that.

With stocks closing at extended levels, the dollar falling to its lowest level since January, the 10-year yield falling below 2%, and gold rallying again, nearly reaching $1,400, I think it’s reasonable to assume we’re going to see at least some reversion over the next week. For now, as traders like to joke, we’re heading in to risk-free Friday.

Stocks of Interest in the News

BA: Airbus wants to kick em’ while they’re down. Unsatisfied with easily beating Boeing Co. for orders at the Paris Air Show, Airbus SE promised a fight to unravel the expo’s biggest sales coup, the U.S. planemaker’s $24 billion deal for its embattled 737 Max planes.

GLD: Gold today made me think of the time I banged my head on the window outside a jewelry store. I was so entranced by the sparkly jewels I just kept leaning closer and closer…smack in to resistance. GLD had a massive run today, right in to overhead resistance from July 2016. Paul Tudor Jones again knocks it out of the park with his gold and stocks call from last week. To wit: “I think one of the best trades is gonna be gold. If I had to pick my favorite [bet] for the next 12 to 24 months, it’d probably be gold.”

ORCL: Oracle reported adjusted fourth-quarter earnings of $1.19 a share on revenue of $11.14 billion, compared with the $1.07 a share on revenue of $10.93 billion expected by analysts.

Oracle Corp. shares rallied to close at a record high Thursday after the database giant showed signs of long-awaited growth in cloud-based services and analysts responded by boosting price targets on the stock. On the conference call, Co-Chief Executive Safra Catz said she expects first-quarter earnings of 80 cents to 82 cents a share on flat to 2% revenue growth, or revenue of $9.2 billion to $9.39 billion, given currency headwinds. Analysts, who had expected first-quarter earnings of 80 cents a share on revenue of $9.33 billion, raised their average estimate to 81 cents a share while trimming their revenue estimate to $9.28 billion.

TSLA: Goldman Sachs throwing cold water on Tesla bulls today with a note stating, “Tesla’s second-quarter sales “should be fine,” likely meeting or narrowly missing Street consensus, but for the second half of the year and beyond Wall Street’s sales estimates for Tesla “look high considering there are fewer levers to pull to stoke demand going forward,” Just last week Elon stoked the share price higher by stating there’s no demand problem. So who’s right? Just for the sake of argument I’m going to go with the side that has less skin in the game.

SLACK IPO:

Slack opened at $38.50 on the New York Stock Exchange Thursday, well above the reference price of $26 that was set for the shares. The stock traded at $40.60 at 2:48 p.m. in New York, giving the company a market value of $20.6 billion. The fully diluted valuation is even higher.

That’s a huge increase from Slack’s last private funding round in August, which valued the company at $7.1 billion. Thursday’s debut makes Slack the second-most valuable technology company to reach U.S. markets this year, topped only by Uber Technologies Inc. $75 billion value and bypassing Lyft Inc. at $18 billion.

Macro Matters

Oil was up over 5% on the day with the Iran tensions and fed rate cut talk.

Brent crude, the global benchmark, settled up $2.63, or 4.3% at $64.45 a barrel. U.S. West Texas Intermediate crude rose $2.89, or 5.4%, to $56.65 a barrel. Brent’s premium over WTI narrowed to its lowest since April. The move came as U.S. crude rose more quickly than Brent due to the tailwind provided by potential Federal Reserve policy, said Bob Yawger, director of futures at Mizuho in New York.

Reuters has an interesting piece on Oil today: Probes and squeezed profits change the oil trading game

For the world’s biggest oil traders, it feels like a return to the 1980s when earnings were diluted by an abundance of crude.After three decades of stellar expansion and booming revenues, profit margins at Vitol, Glencore, Trafigura, Gunvor, Mercuria and other merchants have been squeezed by a market again awash with crude and amid stiff competition from national oil firms. A raft of high-profile U.S. probes into trading activities are also shaking up the business, echoing the transformation that followed the 1983 U.S. indictment of Marc Rich, the godfather of global oil trading.

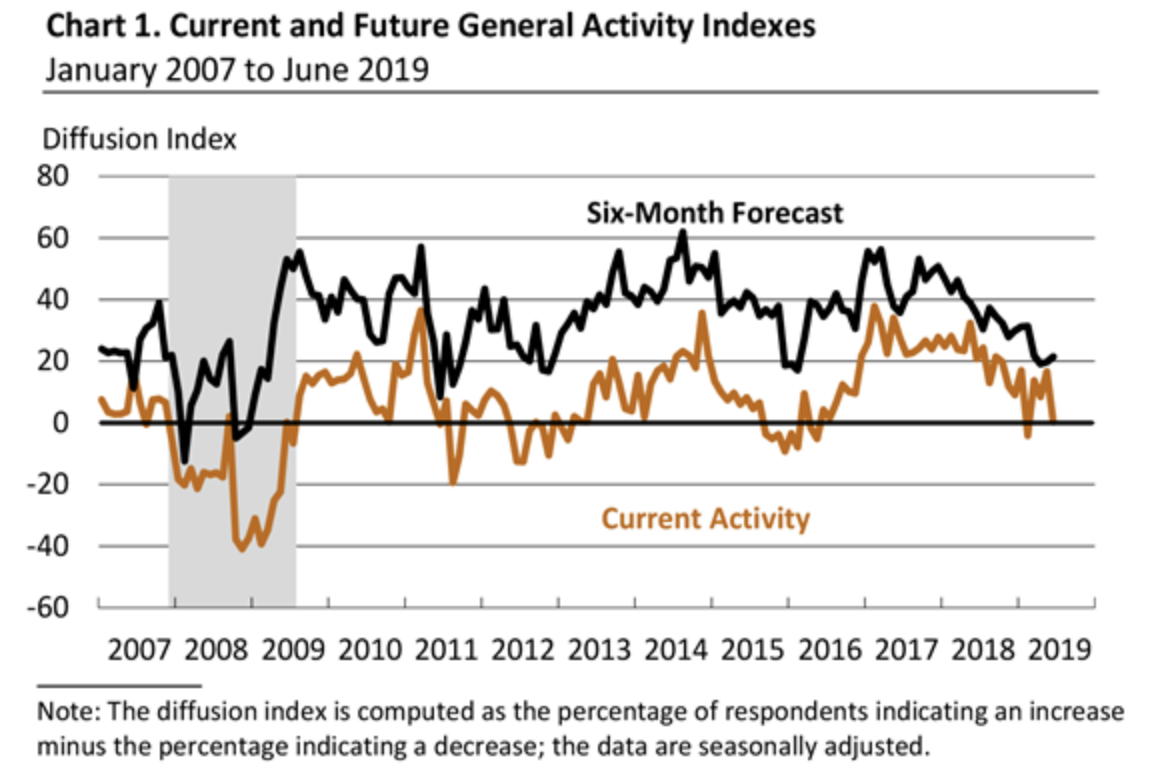

Not that anyone seems to care but the Philly Fed manufacturing index fell to a nearly flat reading for June:

Manufacturing conditions in the region weakened this month, according to firms responding to the June Manufacturing Business Outlook Survey. The current activity index declined to a reading just above zero this month. The survey’s indexes for new orders, shipments, and employment remained positive but also declined from their May readings. Most of the survey’s future activity indexes improved but continue to reflect muted optimism for the remainder of the year.

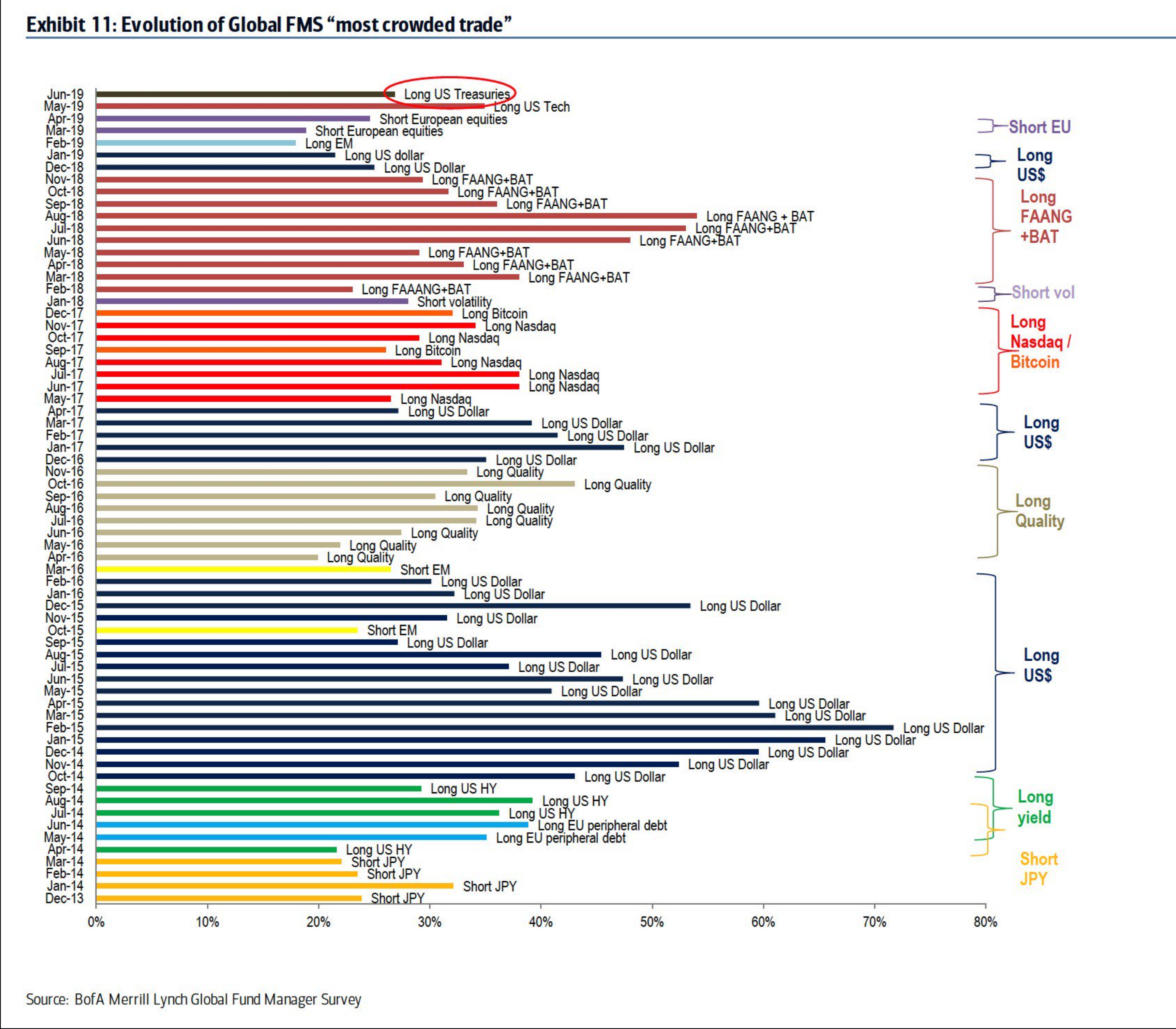

A StockTwits member alerted me to this BofAML “most crowded trade” data.

New EU summit likely as bloc is split over who gets top jobs:

European Union leaders struggled Thursday to bridge deep differences over who should be appointed to some of the bloc’s most prestigious jobs — making it likely they will need to convene yet another summit to sort out the top posts. Keen to show that Europe can react to its citizens’ concerns, the bloc’s leaders gathered after May’s EU parliament elections, determined to quickly wrap up the politically-charged process of choosing the next president for the European Council and the head of the bloc’s powerful executive arm, the European Commission, plus other senior jobs.

Trade Wars and More

China, U.S. to resume trade talks but China says demands must be met:

China said on Thursday it hoped U.S. officials would bring a problem-solving attitude to renewed trade talks in advance of a meeting between Presidents Donald Trump and Xi Jinping next week in Japan. Negotiations to reach a broad trade deal broke down last month after U.S. officials accused China of backing away from previously agreed commitments. A telephone call between Trump and Xi on Tuesday, as well as confirmation the two will meet in Japan on the sidelines of a Group of 20 summit, have rekindled hopes of a detente.

Trump, Canada’s Trudeau try to build momentum for trade pact:

President Donald Trump and Canadian Prime Minister Justin Trudeau sought to demonstrate a united front Thursday in the uphill effort to get a replacement for the North American Free Trade Agreement over the finish line. At Trump’s insistence, the U.S., Canada and Mexico agreed to an update of the 25-year-old agreement. But the agreement faces opposition from many House Democratic lawmakers and labor unions.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Samantha is in NYC today for her Benzinga presentation. Stop by and say hello if you’re in NYC.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

Is it weird that I work in total silence the majority of the time? Up until about three years ago I would have Bloomberg on in the background every day. I told myself it was just background so it wasn’t creepy quiet, but I came to realize the input of excessive information and opinions really did have an effect on my trading process. The reality is I’m trading price action with a holding period of 2-10 days and, while I certainly need to know the macro landscape, constantly having those ancillary inputs is totally unnecessary and harmful to my results. I am so much more at peace with my results, profit or loss, knowing that I made the decisions alone, based on my own analysis.

From the StockTwits Room today:

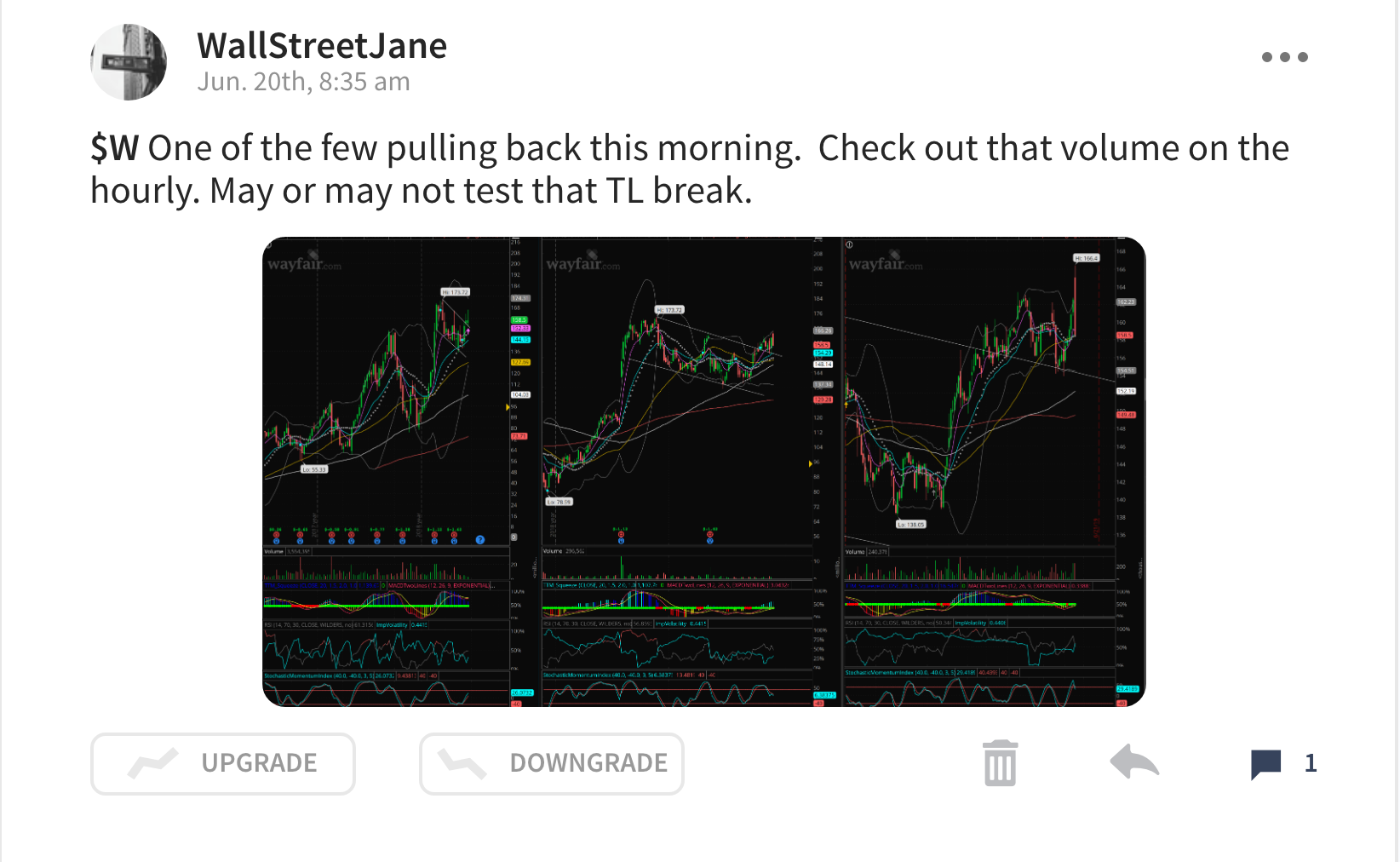

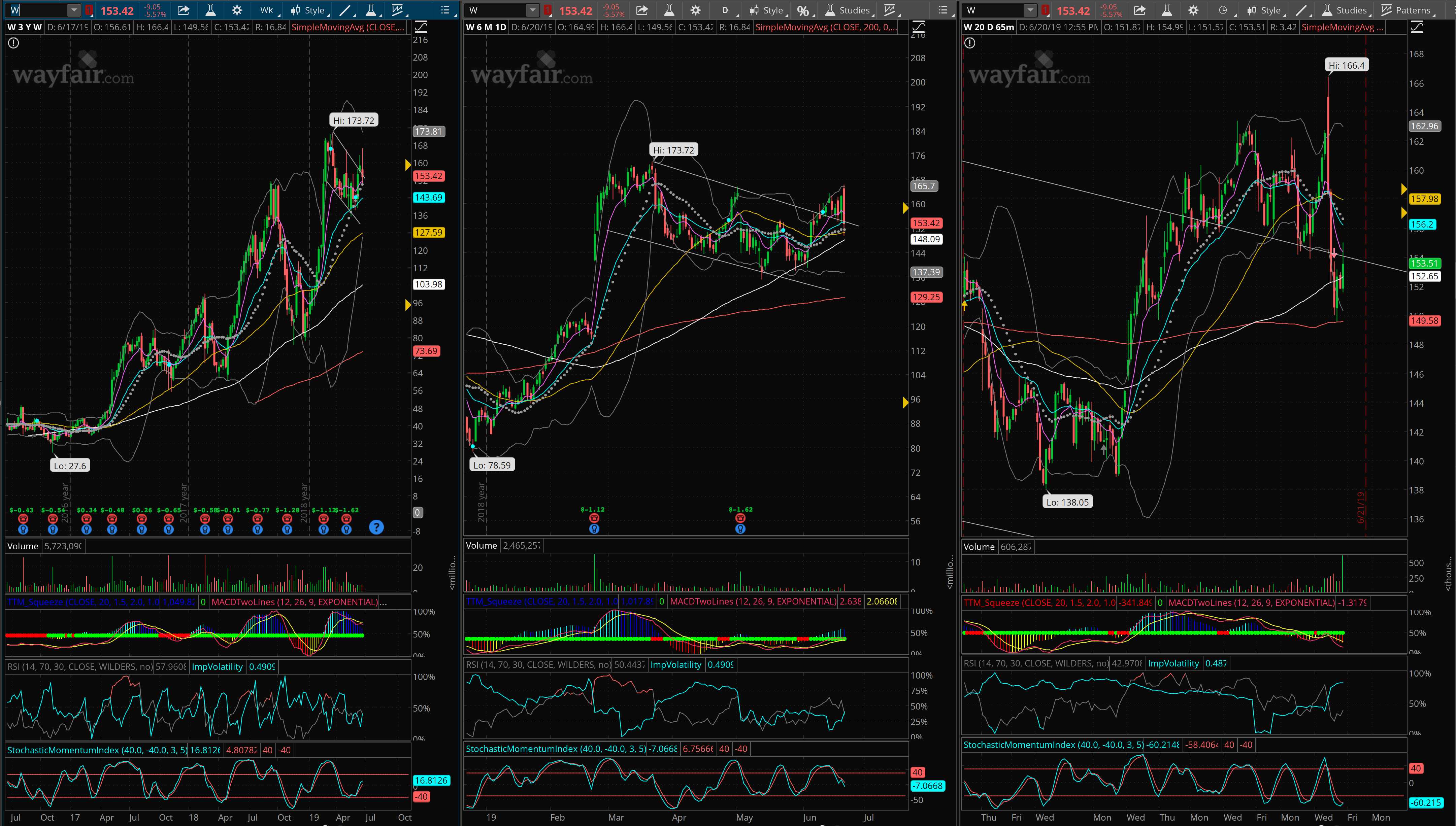

I mentioned retail and it’s stellar performance last night, but Wayfair gave back all of its gains, plus more today. I posted about this weakness and a member was able to capitalize nicely via put options. MT timestamp.

Wayfair more than tested the trend line, finishing off the lows, but still closing down -5.75%. Watching to see if this was a nice test of the moving averages and a bounce is forthcoming, or it moves below 148 and weakness continues.

Great Reads

Uplifting News night:

10-year-old girl climbs Yosemite’s El Capitan – and she may have made history in the process

What a BFF: Dog kept injured woman warm for three days after horrific crash