The Daily Market Catch

Top market-moving themes and insights – Delivered free to your inbox.

The One Big Thing

Back on October 2nd I suggested to clients markets would run up into Oct. 31 – and target SPX $3060 and NYSE $13,333 – with lower prices starting in mid-November through the end of the year. I consider current price action around this level to be ‘cruising altitude’ before it gets a little bumpy again.

In my article for MarketWatch, I predicted higher yields:Despite the Fed’s support, this stock market is headed lower

Then, just last week we had a historic move lower in bonds for which I was positioned for clients (short bonds and gold, long value and commodities).

Top Charts

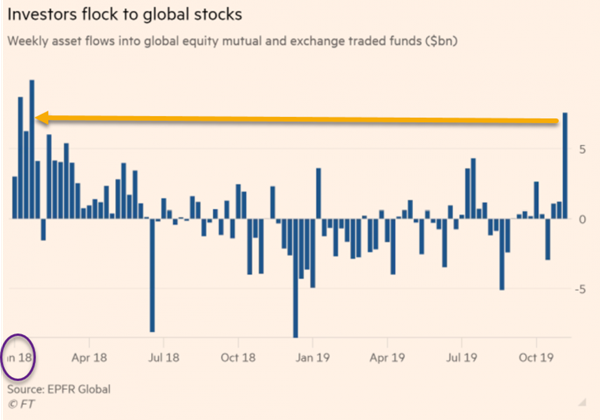

Bulls are rejoicing that money is finally starting to flow back into the equities market as we break all-time-highs. Yeah, it’s a sign, but one eerily similar to the last time funds flooded back in… January 2018 before a large, sudden surge in volatility caused the Volatility ETN “XIV” to implode – famously called, Volmaggedon.

It also sparked one of the most violent moves in U.S. equities in history, with the Dow Jones Industrial Average slumping more than 6 percent in just six minutes.

Top Tweets

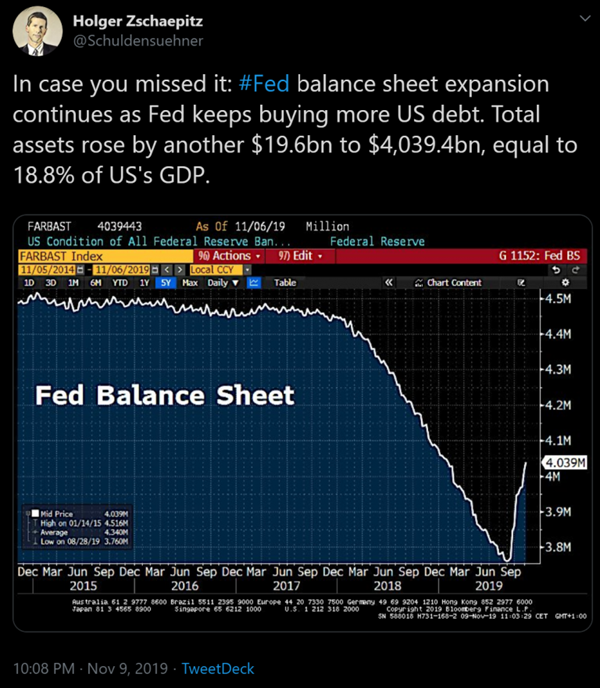

Curious the timing with the “non-QE” injection of cash into the system from the Fed to happen to coincide with the bullish move higher in stocks during the same period…

Top Trades

It’s happening: the largest speculative short position in VIX history – and just as public hearings commence on Trump’s Impeachment investigation and year-end Treasury funding obligations could trigger Repo Madness again.

As I always like to say…

“Outliers With Velocity Revert”

Top Reads / Videos

Marc Chandler is a friend who writes a daily blog. Think of him as the weather man on currencies, global equities and treasuries. He does both a review of the day/week as well as forecast. Of greatest value: his balanced view of markets like very few have, and as such he is constantly on TV explaining things calmly and clearly. Here’s a great example: Caution: Prices Diverging from Macro Drivers

For more charts and links like these check out my twitter feed.

To Great Fishing!

Samantha LaDuc

Founder LaDucTrading

CIO LaDuc Capital LLC

Thanks for reading – Curious how I help active traders and investors like you? I fuse macro analysis with market-moving news, give it context and actively trade while supporting clients who do the same.

Not a member? Here’s some more FreeBait – Fishing Stories and Trading Videos.

Want to forward this email? They can sign up for The Market Catch here.

New to trading? Learn How To Trade!

Become a Member – To get Samantha’s insights on macro inflection points and market-timing calls:

Read: Macro-to-Micro Weekly Newsletter – “Gone Fishing”

Follow: Brokerage-Triggered Trade Alerts – “Big Catch”

Participate In: Live Trade Room – “Fishing Club”

For Institutions – Gain from Custom Consulting and Allocated Trading