I couldn’t make my Market Timing Calls for Clients without the Intermarket Analysis work that I do – which is beyond the Macro, Fundamental, Sentiment and Technical Analysis I provide.

Here’s a cute-ish play-by-play on why and how I use Intermarket Analysis to time actionable trade ideas for clients:

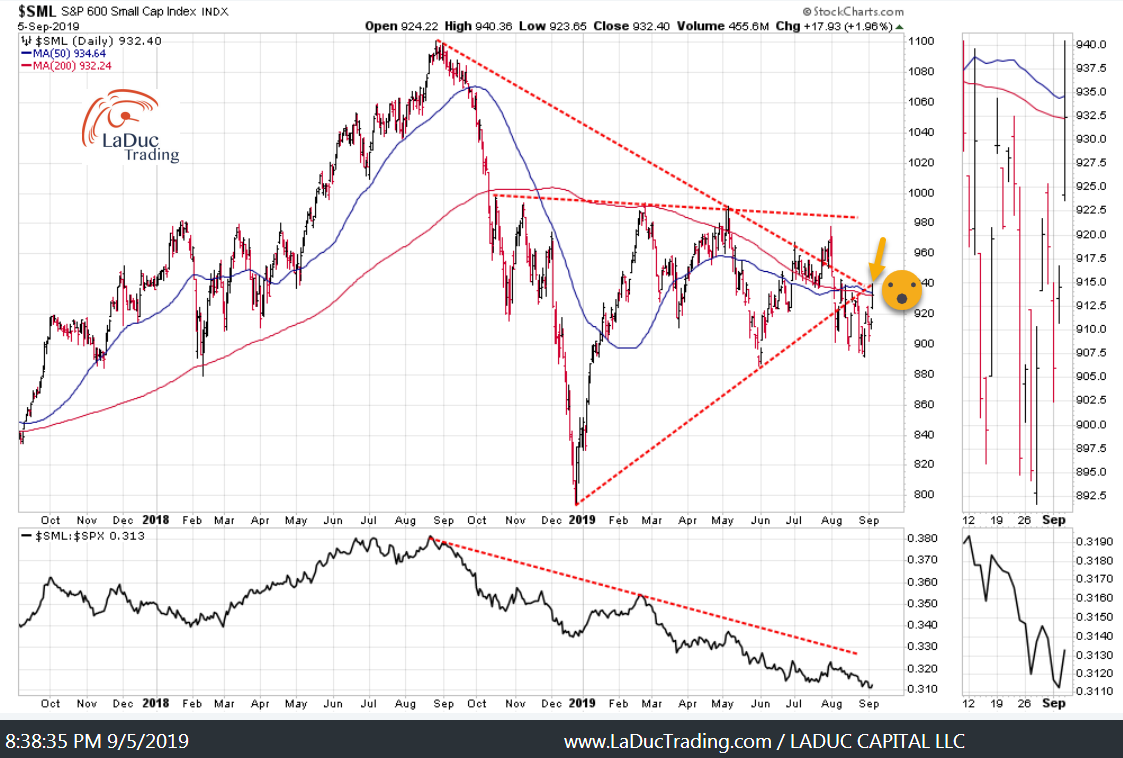

Wrote September 5th: Small caps may surprise to the upside:

Then I shorted IWM and showed clients why:

And, Here We Are:

There is A LOT MORE in these Chart Packs, but I wanted to give you a flavor. To get the whole meal, set sail with me.

Just Published – Intermarket Chart Attack: New Month New Risk

Can Fed Cuts Save US From Economic Recession?

Today markets turned red intraday – not on higher USD (although DXY had broken above highs set two years ago) or on the surge in 10 -yr yields (from BOJ steepening their yield curve). In the past, either of these Macro events would have caused a pause in market’s advance but we have the New-Not-Normal times.

We have a sea change in the world of central banking in that after 20 years of trying to suppress rates, the BoJ now wants higher LT rates in order to save its banking system. A day after cutting its QE plans, their 10 yr JGB auction overnight was the worst since 2016. Peter Boockvar, @pboockvar

Not only was this BOJ announcem