Table of Contents

Market Thoughts

In follow up to my April 5th client post – Intermarket Chart Attack: Digestion, Indigestion – this one will be entitled Gluttony, because even if you don’t have the stomach for it, we are called on to feast again, whether we want to or not.

The Fed came out Thursday, just before jobless claims of 6.6 million were reported, and did what the Fed does best: backstop banks and markets from failing.

So let me repeat for emphasis: Moments before a massively depressive economic release, the Fed dropped its latest jaw-dropping monetary response to it. So in just the past three weeks, nearly 16.8 million Americans have lost their jobs (that’s who have filed anyway), or roughly 10% of the entire workforce, and stimulus disaster relief has tallied $8.5 Trillion.

So is this Fed backstop an all-clear to jump back into equities with both hands? CoronaVirus headlines will continue to dominate sentiment, and policies will likely influence price. Leading into Thursday’s historic Fed-bond-buying announcement, credit markets had already stabilized and U.S. stocks just posted the biggest weekly gain since 1974. Over the last 13 sessions, the S&P 500 gained 24.7%.

It’s disquieting to see rising share prices in the face of such poor economic news, especially after former Fed chair Janet Yellen said GDP could fall by 30%, and unemployment is already at 12% to 13%. But it makes sense in context:

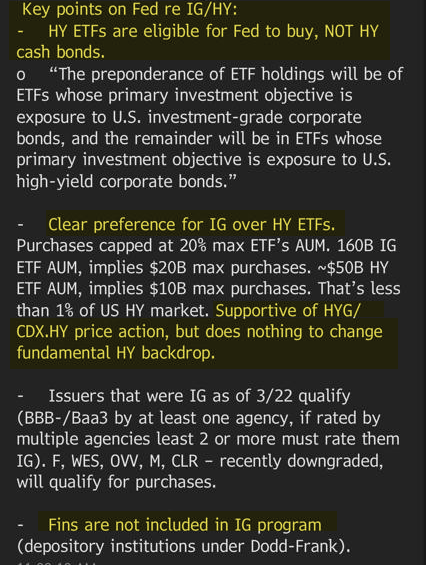

On the day of the market low, Monday March 23, the Fed came out with it’s massive unlimited QE announcement. Today, it unveiled a massive $2.3 trillion program to include buying high-yield bond ETFs, like HYG. Curiously, we noted in my live trading room Wednesday massive put selling in HYG and Thursday it jumped over 7.5%.

The Fed is not trying to buy HY like the IG program -The Fed is only trying to save a few select nationally important firms, like Ford – that’s why it was back dated to March 22nd. @RealTianZeng

In the four weeks since the Fed slashed interest rates to zero, restarted bond purchases and rolled out an unprecedented range of programs to limit the economic damage from the outbreak, the central bank’s balance sheet has jumped by about $1.7 trillion. Bond holdings surpassed $5 trillion for the first time. Reuters

Desperate times call for desperate measures:

Bottom line … the Fed will buying, in essentially unlimited size, everything but equities.

Anyone doubt if the S&P 500 makes a trip back to the March 23 lows they will buy stocks too? https://t.co/7XifkGilLs

— Jim Bianco biancoresearch.eth (@biancoresearch) April 9, 2020

Fed’s only limitation:

POWELL: FED'S ABILITY TO LEND, CREATE MONEY LIMITED ONLY BY THE LAW

— *Walter Bloomberg (@DeItaone) April 9, 2020

But trusting the Fed AGAIN with a bullish thesis is to trust that the goal is broad currency debasement.

Another Rubicon was crossed today, with the BoE announcing MMT or to use a less polite term monetary debt debasement. Essentially, the same is happening here in US. Thus we pivot to a general inflection point in macro with utterly profound implications!https://t.co/5fuJNeADPH

— Julian Brigden (@JulianMI2) April 9, 2020

I trust America/Americans will rebuild because we are wired that way, but the knowledge of this large scale crony capitalism (theft by the rich) in a time of crisis on the most vulnerable is unconscionable. But Fed is trying to get us to look past that and go about our ways investing and speculating in markets. They are incentivizing us to.

The #Fed has made it clear that it will not tolerate prudent and responsible investing.

— Scott Minerd (@ScottMinerd) April 9, 2020

Just remember, the stock market is not the economy . . .

Coronavirus crisis could plunge half a billion people into poverty: Oxfamhttps://t.co/Uc5S7HAQJJ

— Win Smart, CFA (@WinfieldSmart) April 9, 2020

Can We Trust The Fed Rally?

Let me first rant a little, because the realization on first blush is that the Fed once again puts bank profits over people. I found this Fed intervention more jarring than any prior action because it’s void of real economic value where we desperately need it most at a time when we desperately need it most. Accepting the “invisible hand of God” in markets by Fed when economy is functioning is one thing, but we NEED a benevolent hand NOW for the other 99%! I hate what’s happening to Main Street. I’m not worried about Wall Street.

Your advantage in this market is empathy/experience, S. Regarding your tweet, some only have weeks for survival. I’m struck at some who think technical analysis will provide all the answers as to when we’re bottoming. This is a health/medical crisis with vicious knock-on effects. @jennablan, U.S. Markets Editor of @FinancialTimes

My answer to Jennifer was that we can all use more empathy. That may be why we are in a crisis in the first place. And sometimes, it takes a crisis to create the will to make big changes. Not maintain status quo but fix what’s really broken! Sadly, there is NOTHING Trump, Fed, Munchin and Congress will do to stop from manipulating markets + American’s perception of reality to protect their turf.

Credit Leads Equities

so risk of virus or virus-induced credit event, dollar crunch, mortgage crisis or economic depression is no match for US Government collusion. $SPX https://t.co/uEyNcR4VJG

— Samantha LaDuc (@SamanthaLaDuc) April 9, 2020

With that, I doubt the US Gov will stop socializing business losses and focus on individuals any time soon. We could use social healthcare and welfare right now over bank/Corp bailouts. Maybe with all the fake money printing, we will get both!

Deglobalization in the time of CoronaVirus + political impotence + monetary theft is not the perfect market short! America is, sadly.

Painful realization:

To be bullish markets despite Coronavirus depression is to TRUST in the Fed + Munchin + Congress + Trump to save the US REAL economy.

Plus, to be bullish markets is to TRUST Trump + Putin + Saudi Prince to save the US Oil market.

And this is ultimately what frames my view of government intervention in markets and lack of political action in the fight against CoronaVirus: SKEPTICAL.

But I can compartmentalize that while I analyze price action and macro themes, so here goes.

- My Intermarket and Technical read says market action is constructive/bullish.

- My Macro and Fundamental read says USD makes the weather and its rate of change determines the intensity so careful.

- Quants are quiet for the most part but Sentiment around CoronaVirus is not.

Intermarket Analysis

I like to study outliers and Rate of Change (ROC) indicators against price action. When I’m looking at an outlier that IS a Rate of Change indicator, I take special notice. The ROC in SPX is unprecedented and momentum is clearly bullish now, although support underneath price is still questionable and market nerves are still shot. As with the ROC gyrations that set up a bottoming process over a 6-mo period in 2008/2009, we too should experience a similar period of chop and drop. But Fed just said they are open ‘to anything’ so buying equities is still in their toolbox and markets would be hard-pressed to break very hard for long with that type of maintenance plan.

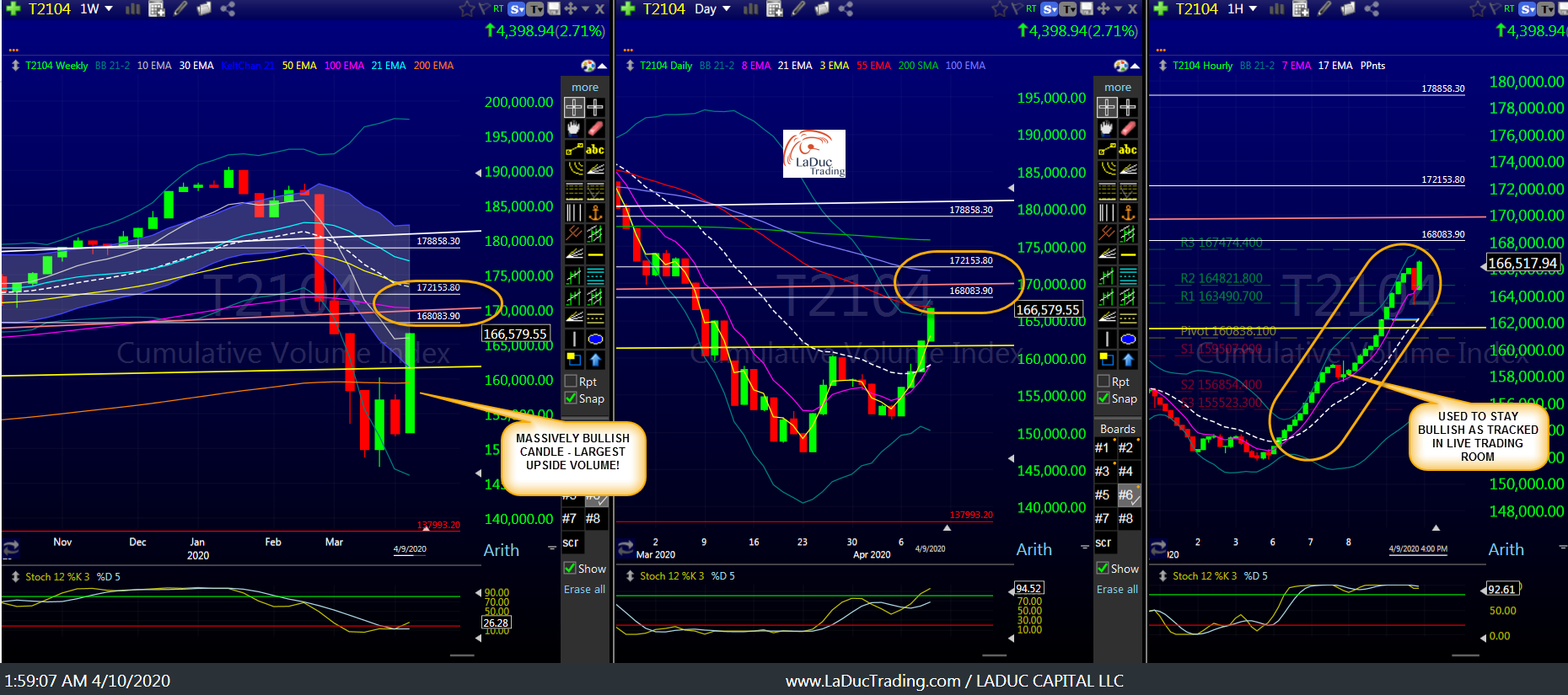

My Intermarket Volume indicator was The Tell the market had bent up and was accumulating demand/buying week of March 24th and again under the squirrelly price action of SPX this week. This is how I remained bullish all week as demonstrated often in my live trading room – with emphasis on Value plays over Momentum, especially REITs, ENERGY, RETAIL, INFRASTRUCTURE.

McClellan Summation for SPX was/is also bullish.

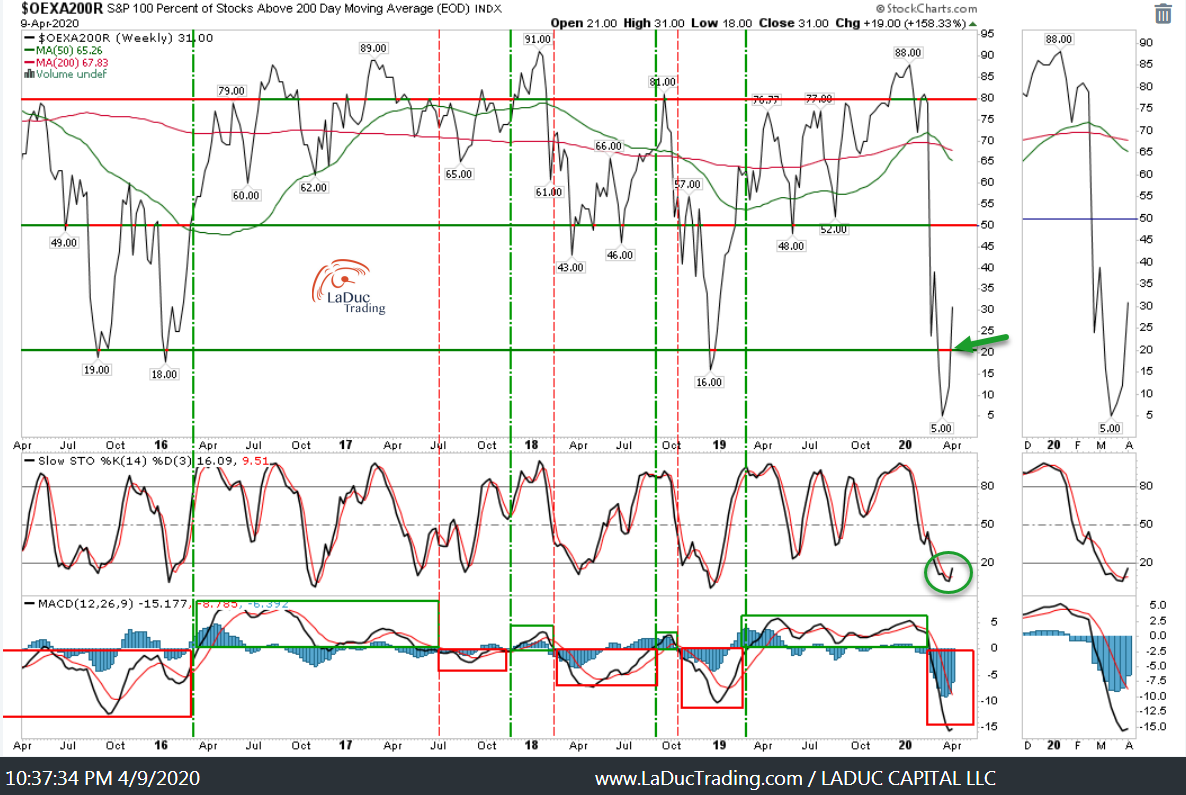

The percent of stocks above 200D has risen sharply off the bottom – from 5% to 30%. Unsure if we retest lows based solely on this indicator, but the typical action is to retest lows.

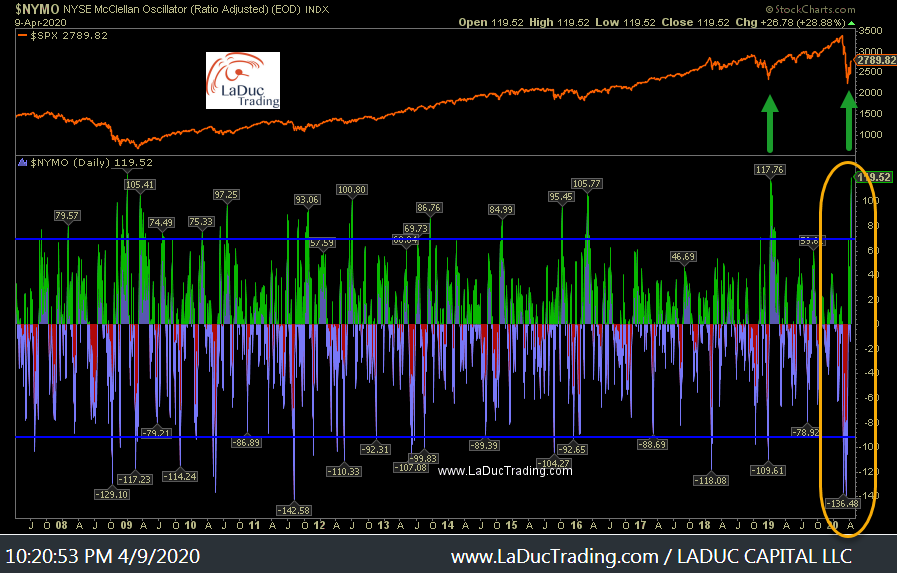

Breadth has exploded:

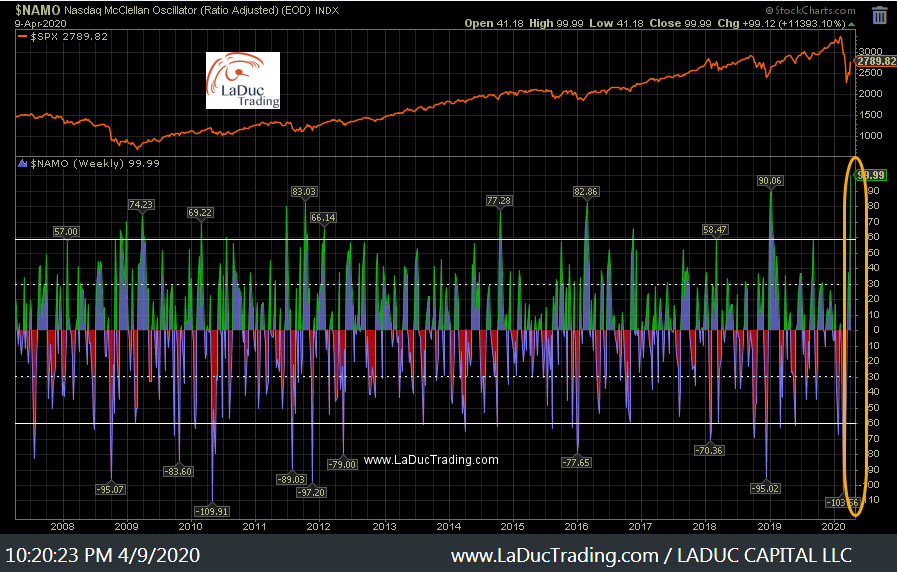

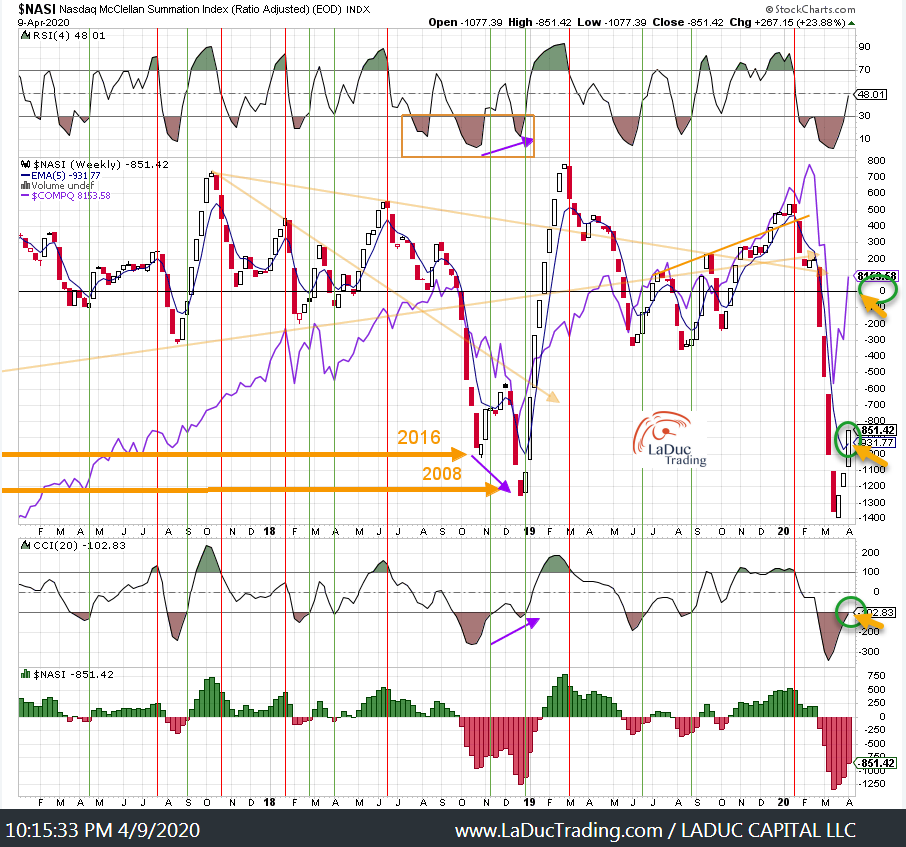

The following two McClellan Oscillators for both NYSE and Nasdaq indicate bullish extreme momentum.

Nasdaq McClellan summation index has just triggered long after making indicator lows worse than 2008.

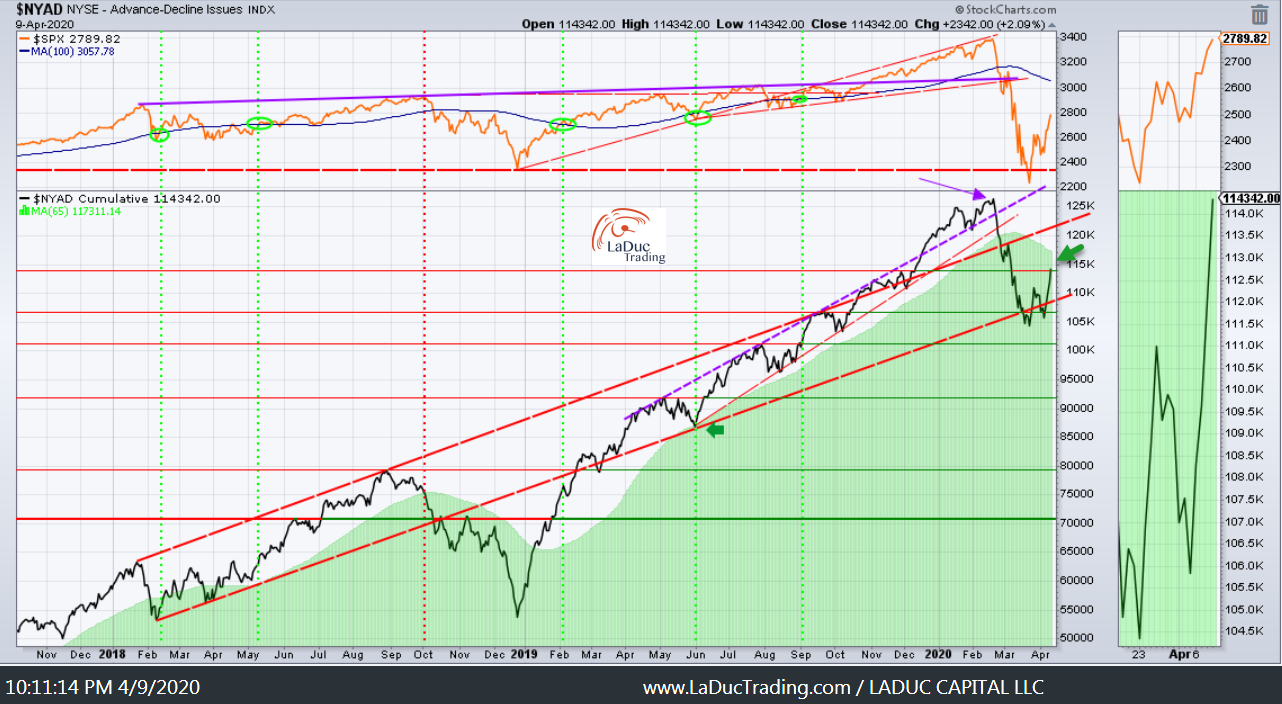

My NYSE advance-decline chart highlights a “W” pattern that needs to hold to be bullish.

Quant Analysis

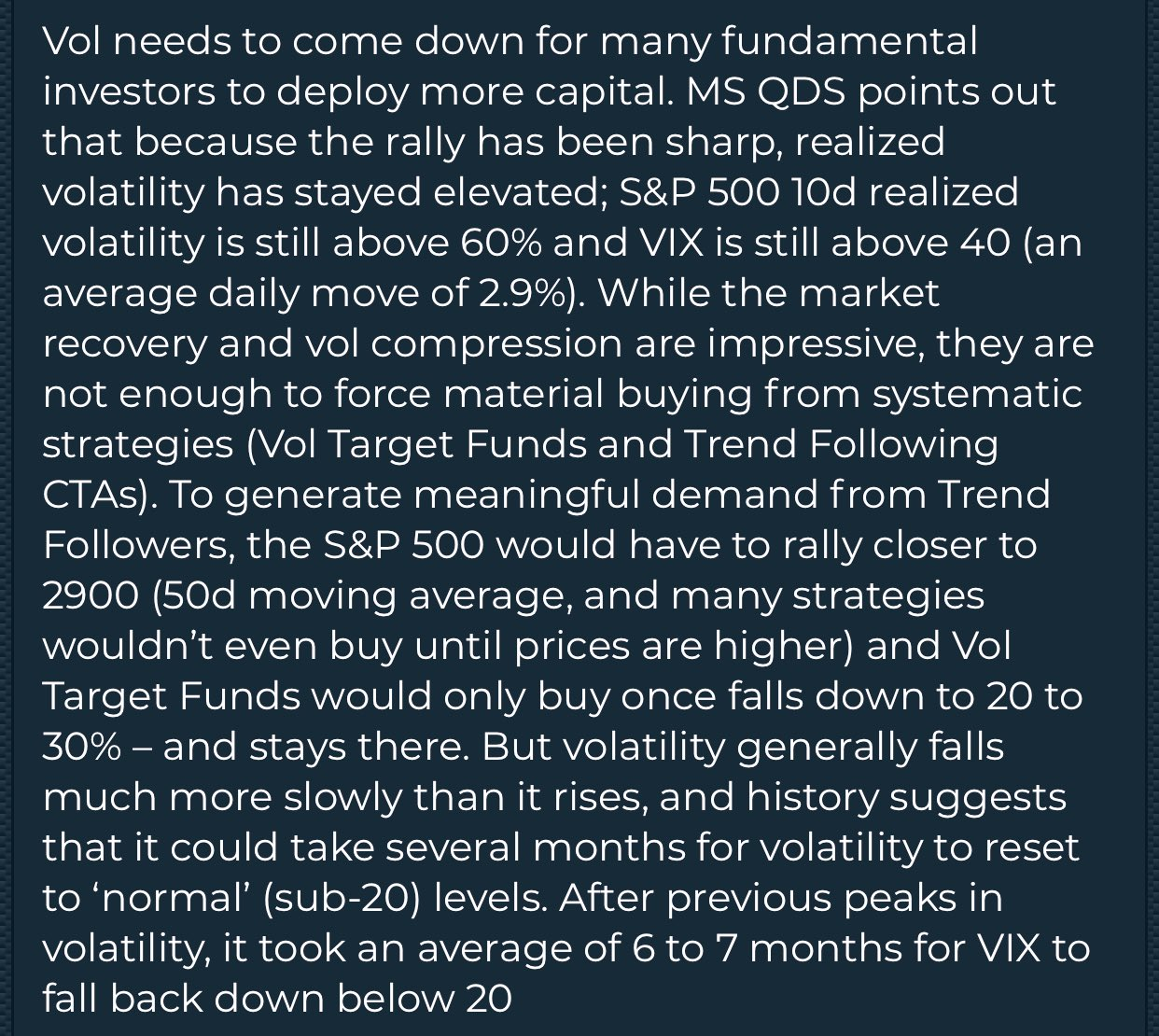

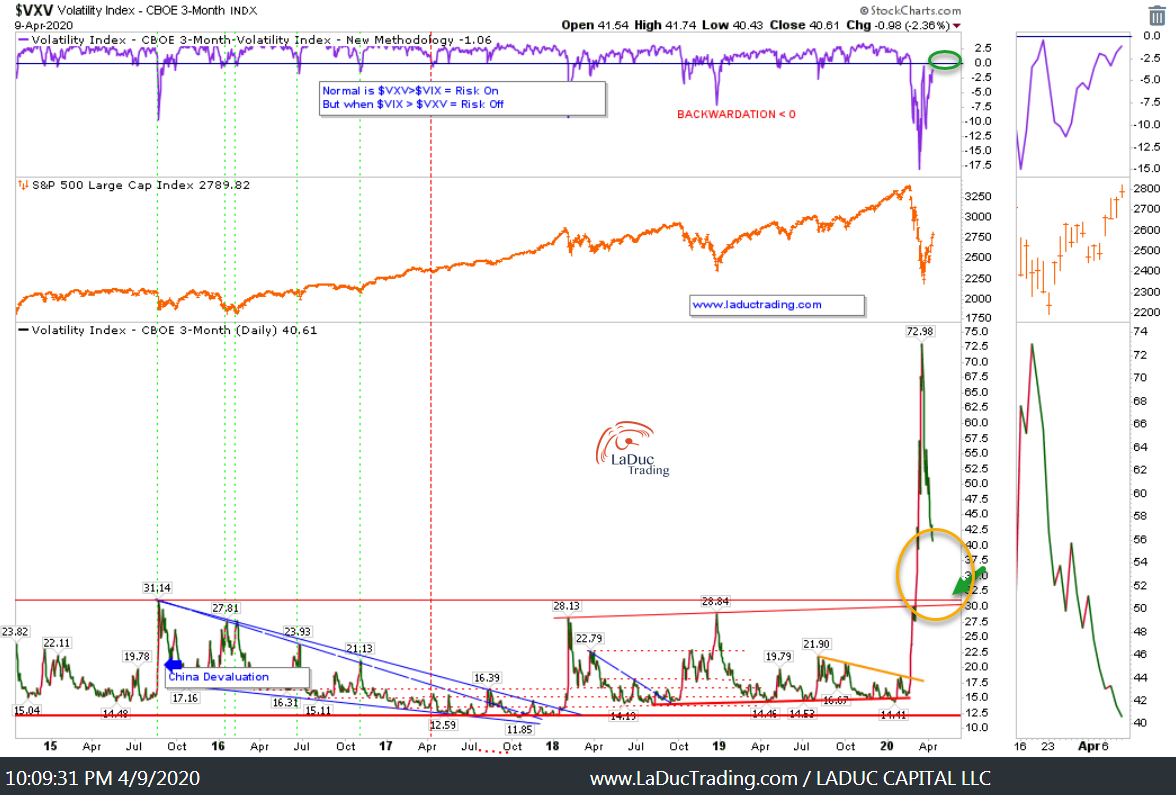

As I have mentioned since options expiration March 20th, short volatility strategies are largely gone (tactically, some physically) so neither a tailwind nor headwind. They are waiting for the reversion to the mean in VIX around $20 before we likely see more SPX call buyers enter and pull markets up. Long story short: they haven’t committed while VIX is in backwardation (2nd chart).

Macro Matters: US Dollar Edition

The economic damage from COVID-19 has tipped the US into recession with talk of depression, so no wonder conventional policy will not suffice. For now, the Fed’s unconventional policy is what is bidding gold and miners. The question I get asked the most is what will happen to Gold if USD spikes – as I believe the Gold trade will continue to get bid regardless of USD movements. And do I believe dollar is still a global liquidity shortage?

Yes – I believe the US Dollar makes the weather. and most nations are short dollars. It will be awhile until the USD retreats sheepishly into irrelevance. As a reminder, according to JPMorgan’s calculations – the global dollar short that has doubled since the financial crisis and was $12 trillion as of this moment, some 60% of US GDP.

Dollar strength continues, while emerging market dollar shortage intensifies pic.twitter.com/9VxEEQYLPo

— Daniel Lacalle (@dlacalle_IA) April 3, 2020

This was timely – given Fed intervention Thursday “tapped” the USD down.

Freaken USD bullish if Fed can’t tap it down pronto. $DXY $TED https://t.co/S4quWxBHgu

— Samantha LaDuc (@SamanthaLaDuc) April 2, 2020

Fed intervened and dollar pulled back.

If anyone thinks this bounce in markets is sustainable I encourage you to look at the global demand for U.S. dollars via Fed FX swap lines. Until those swap lines recede there's no recovery coming. Far too much stress in the system. pic.twitter.com/uhnZwnmBFg

— David Dorr 🛸 (@daviddorr) April 9, 2020

For a refresher on why cash swaps matter…

I’m going to RT this again – great piece on cash swaps + global USD liquidity shortage – and recommend all of his posts!#WeekendReading https://t.co/VFIy1u0SLA

— Samantha LaDuc (@SamanthaLaDuc) April 4, 2020

And a reminder why Fed keeps trying to fix the big harry problem of the USD global liquidity shortage!

👇 Global contraction in trade amidst USD shortage globally can result in Foreigners selling US assets – from government + corporate bonds to real estate + stocks.

Foreign Holdings of US Assets: $39T gross, $7T Tsy

No wonder Fed wants to break the back of $DXY to keep $SPX bid https://t.co/lf4NkSWii2

— Samantha LaDuc (@SamanthaLaDuc) March 30, 2020

And last but not least…

This matters if you care about the US dollar…

Next IMFC Meeting coming up!

Monday, April 13 to Sunday, April 19More important than FOMC April28-29 or EPS

Dollar swaps rule. #USD $FXY https://t.co/YzCnDHwZ6j

— Samantha LaDuc (@SamanthaLaDuc) March 30, 2020

Here’s what I’m watching as posted to clients March 20th:

USD can fly to $120 – faster than Fed, EM + Markets can handle. If it does, USD will break spirits + bank accounts on the way up and nations + world peace on the way down. Not Safe.