Table of Contents

The following is a summary of trade ideas plus Samantha’s market thoughts and Macro-to-Micro analysis presented from her live trading room. Not every trade set-up Samantha discusses will be captured in her trade alerts. Her focus for clients is on scanning and synthesizing market moving news, money flow, volatility and risk:reward for highest probability trading set ups across multiple asset classes and time-frames using stocks, options and futures. Samantha will make best efforts to offer up custom analysis for clients inside her trading room while also setting up risk-defined trades via her trade alert service.

Reminder: To activate/switch portfolios for any of the offered Brokerage-Triggered Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open and closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

Growth Over Value Rotation Signs

- GOOGL +13%

- FB +19%

- AAPL +30%

- MSFT +35%

- AMZN +72%

Performance Out-performance or Revision

With headline risk of COVID case counts growing, and with it a Biden lead, while death rates are still low-to-flat, it seems clear the combination of Fed liquidity and low rates has the market thinking perceived economic risks are manageable. Since Fed intervention March 23rd, that has = risk-on. This is evident in high-fliers like AMZN which has almost doubled in 17 weeks ($1600 to $3200) or TSLA stock which has skyrocketed 260% since the beginning of the year making Elon Musk the world’s seventh-richest person (according to Bloomberg).

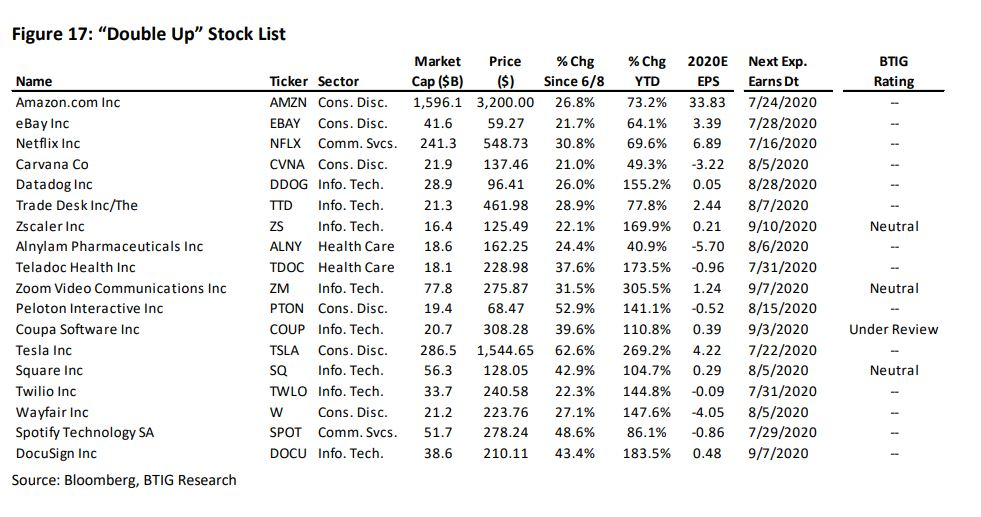

As earnings season for Q2 is about to get under way, here is an idea of where stocks sit:

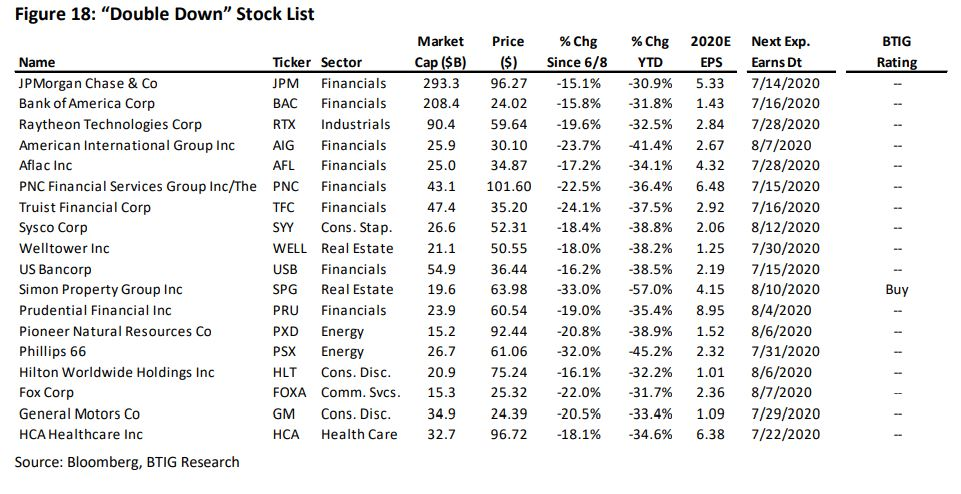

These mostly financial stocks – down 30% to date – still in recession.

These mostly technology companies – up more than 40% more year-to-date – are priced for perfection.

What If Tech Earnings Disappoints?

- NFLX: 7/16

- TSLA: 7/22

- MSFT: 7/22

- AMZN: 7/23 (estimated)

- INTC: 7:23

- FB, QCOM, SHOP, PYPL, SPOT: 7/29

- AAPL: 7/30

Sizing up sector shorts in fave growth names should we get follow through to downside post OpEx this Friday and end of Month:

- SOXX

- IPO

- FINX

- FDN

- IGV

- HACK

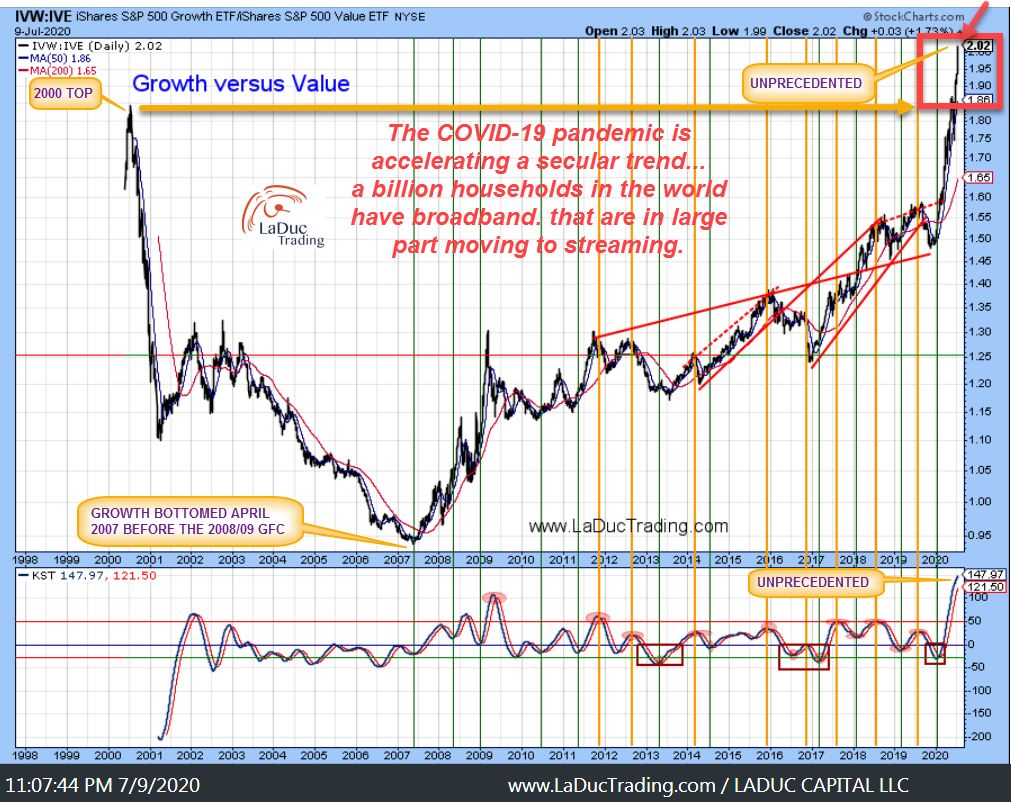

Intermarket Tell – IVW:IVE

Here is my Intermarket analysis tell that Growth was accelerated from the COVID19 panic as billions were sent home to ‘stream’, but at the same time, the moves higher were unprecedented and likely unjustified in total, for now. We shall see if FAANG Options Expiration Gamma Pin Game I referred to Friday comes to fruition but Monday was surely a strong reminder…

Friday I wrote:I believe this is why market isn’t selling. It’s pinned. On these names.And unpinned can equal unwind.

From groceries (KR) to left-for dead tupperware (TUP), toilet paper (IP) to steel (X), airlines (AAL) to autos (F)…. these value plays are aching for a rotation.

Again, I think it started Monday with the NYFANG, QQQ, MTUM, IGV, IPO sell-off. Let’s see if we get follow-through in coming weeks.

Today’s Action

US Closing Prices after opening from gap down:

- #DOW 26642.59 +2.13%

- #SPX 3197.52 +1.34%

- #NDX 10689.5 +0.82%

- #RTY 1428.26 +1.76%

- #VIX 29.55 -8.20%

I had one trade of conviction this morning from my trading room for clients for which all other trades would/could follow: SPY 312.50 to 319.50. And it worked great.

These others were also in play today:

- RIGL – from open at 3.16, ran to 5.25 before settling at 4.13

- XOM – Archna rec’d up1%; it ran to +3.3%

- CAT – looked awesome at $131 today + said so. Next thing I knew it was 136.88 +4.83%

- AA – ran $1 from my mention and looked great for a swing >10.67 but EPS is tomorrow…closed +9.56%

- X – looked ‘bottoming’ (with CLF) and rec’d Fri. Today $X ran from open 7.28-7.82, but needs to get >8 to be ‘safe’ for more than a trade.

- LH (and DGX) – as COVID testing picks up with 7D delay for results (for non-priority patients), this indicates business is good. Closed +5.37%

- BDX – rec’d from last week, cont’d.

- XLP, KHC, JNJ + F – placed trades so yes, I’m starting to add to my thesis of rotation into staples, into ‘value’.

- FSLR and TAN – cont from rec’d last Mon (extended now)

- ABT, JNJ, PFE – cont from rec’d last week from bull flag patterns on daily chart (JNJ has EPS 7/21)

- WYNN and LVS – digested out-sized gains from Mon, which I also caught (Macau quarantine restrictions lifted)

- VBIV – rec’d for months rose 18% intraday to close $4.51 before spiking to $6 AH.

- MRNA – recommended Mon at $64 on expected break-out. It broke out to tag nearly 78, closed at 75 today BEFORE news hit that its COVID vaccine produced antibodies in initial study of 45 patients. Currently at $87 after-hours.

But Big Picture, MRNA is up 311% since Feb 24 recommendation before 20% move AH. A lot of plays in my Coronavirus watchlist are…