The following is a summary of trade ideas plus Samantha’s market thoughts and Macro-to-Micro analysis presented from her live trading room. Not every trade set-up Samantha discusses will be captured in her trade alerts. Her focus for clients is on scanning and synthesizing market moving news, money flow, volatility and risk:reward for highest probability trading set ups across multiple asset classes and time-frames using stocks, options and futures. Samantha will make best efforts to offer up custom analysis for clients inside her trading room while also setting up risk-defined trades via her trade alert service.

Reminder: To activate/switch portfolios for any of the offered Brokerage-Triggered Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open and closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

Market Action

Back on July 7th I offered up my Top Sector Picks – “Staples Rotation”:

there are sectors at resistance and precariously so: XLY, IGV, XLK, MTUM, FFTY.

Besides XLP (Staples) looking to break higher (with XRT and SMH), XLV also looks bullish for continuation

with IHI.Within XLV space I like ABT, GILD followed by JNJ, AMGN, NVS, BMY, BDX, REGN, ILMN, ABMD…

So have a look at the charts. That worked – as XLV, IHI, XLP and today XBI broke out while tech sagged all weak. Not only that, but Retail and Semis also remained strong this week, so not bad calls!

This week, Tech took a back seat while I repeated my excitement for IYT and VLUE. Both did not disappoint!

As for chases however, last week was MUCH more fun for intraday chases…

In my live trading room, I caught explosive moves in FSLR, FCX + BABA (last mon), WMT (tues), TWTR + JMIA (wed) – sadly trade alerts weren’t working – but then AMD + ROKU (thurs) triggered and I got some of that. Moving into this Monday I had a feel we would pull back in Tech. We did and SPY + MSFT shorts worked, then helped clients when I saw the Macau news that sent WYNN + LVS flying plus the XME and XLB contingencies (materials, mining). Finally today, it wasn’t a bad catch with BMRA, but man-o-man, other than Coronavirus vaccine and PPE plays (and SPCE!), the indices were painfully flat.

It was mostly choppy intraday this week (and as such got tossed out of BA, ROKU, BYND plays). The one thing the week was good for was confirming that there is in fact constructive action (too early to say ‘rotation’) in the “Paper to Things” move I’ve been discussing, writing about and trading this week. Despite the Tech sell-off which started Monday, SPY seemed determined to stay pinned at $3200 for monthly options expiration Friday.

Under the surface, however, we had continued FANG weakness in addition to the anticipated China pullback.

Speaking of Tech…

NFLX reported after hours Thursday. Growth is slowing. Stock sold off on the news. Curiously, NFLX sold off right into $474 weekly support with an overshoot to $449.50 weekly support – see chart. These lines were already on there…

Earnings season is off to a rocky start – even after Wall Street has cut its estimate for Q2 earnings in half. Delta Airlines reported a staggering loss of $5.7 billion. Wells Fargo bombed its EPS and slashed its dividend by 80%. Even though both JPM and GS crushed it with indecent trading revenue, both stocks sold off after their reports.

Netflix earnings just told us that earnings are 100% priced in, even the best pandemic growth stock couldn’t move the needle on earnings.

The market just sent us a huge message about earnings season. @realwillmeade

One market bullish caveat: Since virus cases have spiked, and death counts risen, more Americans are wearing and requiring masks! I still see potential for a continued rotation from high flying growth stocks to small caps and value stocks. Here’s some more evidence:

Declines in major tech stocks from 2020 highs, thru Thurs:$TSLA -16.4%$FTNT -16.2$CRWD -14.8$INTC -14.6$DOCU -11.6$SQ -10.4$AMZN -10.3$ADBE -9.4$INTU -9.2$CRM -8.5$NFLX -8.3$PYPL -7.7$NVDA -6.1$MSFT -5.8$QCOM -5.2$GOOGL -3.9$FB -3.7$AAPL -3.4

Nasdaq -3.2%

— Tom Petruno (@tpetruno) July 16, 2020

it seemed that traders were anxious possibly due to FANG weakness….Those options have a rapid decay – so if you assume dealers are net short a lot of calls vs long stock as these options bleed out dealers are selling out long stock hedges. In other words if those stocks are just staying flat that still leads to bleed which leads to selling. @SpotGamma

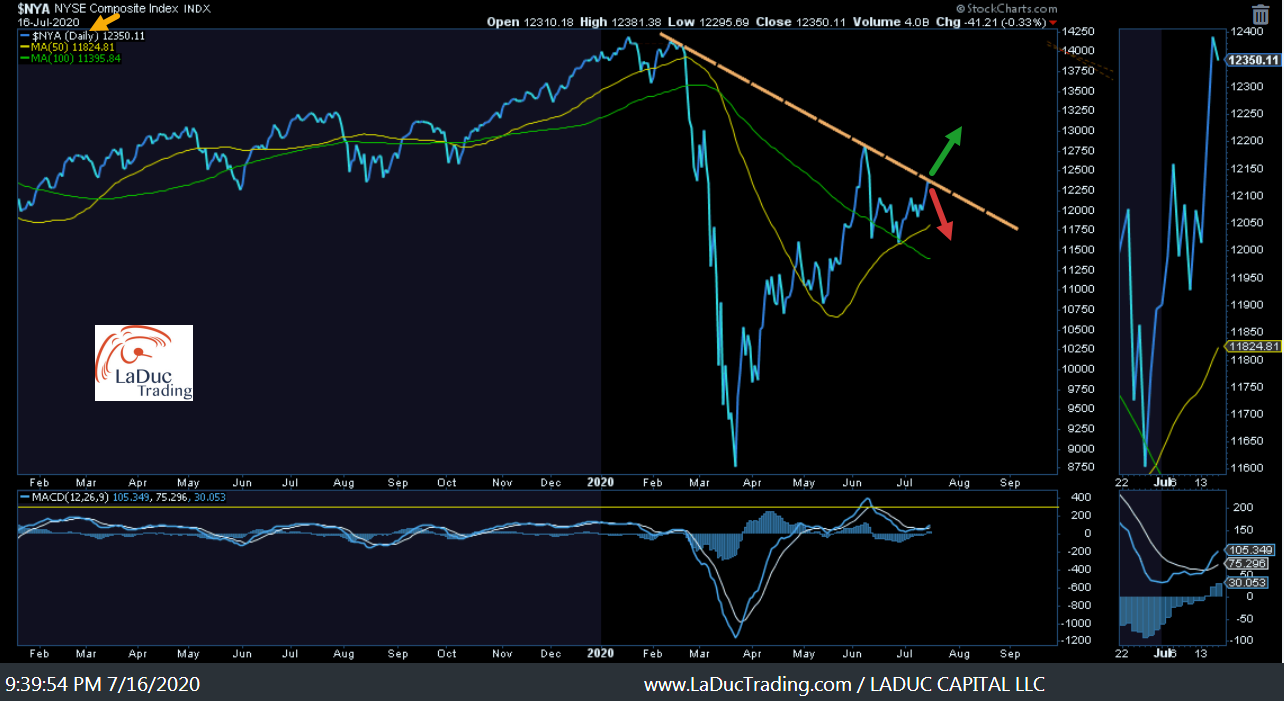

Big Picture, here’s NYSE at inflection point. I’m watching for directional market clues from my Intermarket analysis toolbox!

And for what it’s worth, SPY is still being held up by the Big Five – FAAMG.

As we have discussed several times recently our worry here is that if put buyers suddenly come out dealers will need to sell futures to hedge. This likely brings a move higher in implied volatility (VIX) which makes puts more expensive. Dealers may then need to sell more to hedge and as the market moves lower it brings out more put buyers (its a cycle dubbed gamma trap). In other words things could escalate quickly here, particularly because it seems like we are going to lose a big chunk of positive gamma with this expiration.

@SpotGamma

Now you’ll know why I added some puts in Tech this week and VXX calls today:

That AND… China KWEB has a strong correlation to the US QQQ:

But how sustainable is that if yields rise?

I know I know, ours aren’t. But China’s 10Y yield most certainly is…

So maybe this chart of 3M Volatility will bounce here which is not expected and yet I thought it might not hurt to add some protection post Options Expiry as the “unpinning can equal the unwinding”:

We’ll find out together next week. I wish you an enjoyable, relaxing weekend.