The following is a summary of trade ideas plus Samantha’s market thoughts and Macro-to-Micro analysis presented from her live trading room. Not every trade set-up Samantha discusses will be captured in her trade alerts. Her focus for clients is on scanning and synthesizing market moving news, money flow, volatility and risk:reward for highest probability trading set ups across multiple asset classes and time-frames using stocks, options and futures. Samantha will make best efforts to offer up custom analysis for clients inside her trading room while also setting up risk-defined trades via her trade alert service.

Reminder: To activate/switch portfolios for any of the offered Brokerage-Triggered Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open and closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

Staples Rocking

Top ranked industry groups outperforming over the past week include Solar, Internet, Software, Medical Equipment, Trucks and Mining. Quite a diverse list. This week, my bet is Consumer Staples.

I caught the release announcement yesterday for clients when $WMT was $121. It ran to $127.55 same day. This morning it is getting upgraded. BofA gives it a 150 PT.

Our $150 price objective is based on 27-28x our F22E earnings of $5.45, which is above WMT’s two-year forward P/E multiple of the past three and five years of 12-13x, but below WMT’s peak multiple of 49x. The multiple reflects an outlook for positive US comps (with positive traffic), US e-commerce and priority market (North America and China) growth, and healthy free cash generation. This P/E is more in line with other high- performing retailers such as COST but still a discount to other global e-commerce retailers.

Downside risks to our PO are the impacts of FX, pharmacy headwinds, food deflation, Walmart’s longer-term ability to continue gaining incremental market share given its large size, a weakening global retailing environment, competitive pressures at Sam’s Clubs and/or Walmart International.

I know we talked about Staples last week, but Tuesday was clearly the lift off day. Can it continue? Did you see the action in PM and MO yesterday? Big range expansion bars that seem to indicate they are putting in their lows. Then this:

Soup sales +15.9% in the past month & in all segments: +14% in condensed, +12% in ready-to-serve & +23% in broth. $CPB sales +15.8% with sales growth in all segments, $GIS +6% and private label increased 9.3%. @Stephanie_Link

While thinking of staples, I immediately started thinking about food inflation and core product pricing for this group. You know how I have been lamenting about a potential yield pop. I also have sensed it looked likely to be a sudden one, just because it looks so repressed. Well, I think I figured out why…

Inflation Is Here

The equities market just doesn’t know it yet.

This is going to sound crazy, but…Chinese yields seem to have become a more reliable tell of global reflation than the US 10y yield.

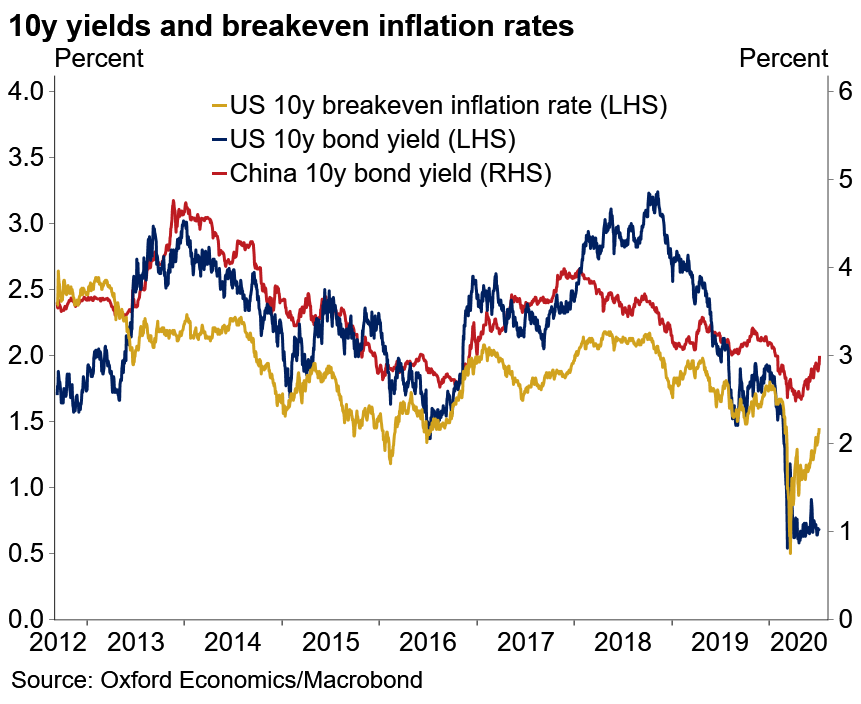

See this chart by @GauravSaroliya: The US 10y is staying pinned down, but break-even inflation rates keep moving higher WITH the Chinese 10y.

You have no doubt also noticed the move higher in Gold & Miners of late. Yeah, I think fixed income markets are smelling this inflation impulse and manifesting the trade in precious metals (gold, miners) and industrial metals (copper, silver) as US Treasuries stay ‘bid’ by the Fed and rates pinned from their implied YCC (yield curve control). Although there has not been an equity/credit risk-off event, to align with a rate spike that *should* be occurring in light of the rising inflation, I expect it will happen – slowly under the radar like this chart, then all at once.

Quick Sector Review + Picks

Markets largely peaked out a month ago: TRAN, RTY SPY, DJIA all peaked 6/8, with at least half the major sectors all showing near-term tops between 6/5 and 6/10. The rally in Nasdaq disguises the internal deterioration. SPY still has failed to take out the above gap and until it does, the stall can create a gravity pull – down. If/when we do get that rate spike, there will be beneficiaries – sectors that are still on lows but constructively so: IYT, XLU, IYR, XLI, XLF. Earnings kick off next week, so we will get a much better feel then.

In the meantime, there are sectors at resistance and precariously so: XLY, IGV, XLK, MTUM, FFTY.

Besides XLP (Staples) looking to break higher, with XRT and SMH, XLV also looks bullish for continuation (with IHI).

Within XLV space I like ABT, GILD followed by JNJ, AMGN, NVS, BMY, BDX, REGN, ILMN, ABMD,