Table of Contents

The Good News – We Bounced

We got our bear market rally on COVID19 stimulus hopes as Dow rebounds more than 11% in best day since 1933 today as Congress *nears* coronavirus stimulus deal.

- Hold gains for more than an hour. (We did!)

- Hold gains for the entirety of the day through close. (We did!!)

- Hold gains and follow through with higher close on Day 2… (to be determined)

So the good news, $2277 for SPX support held. We had a strong bounce and records were broken.

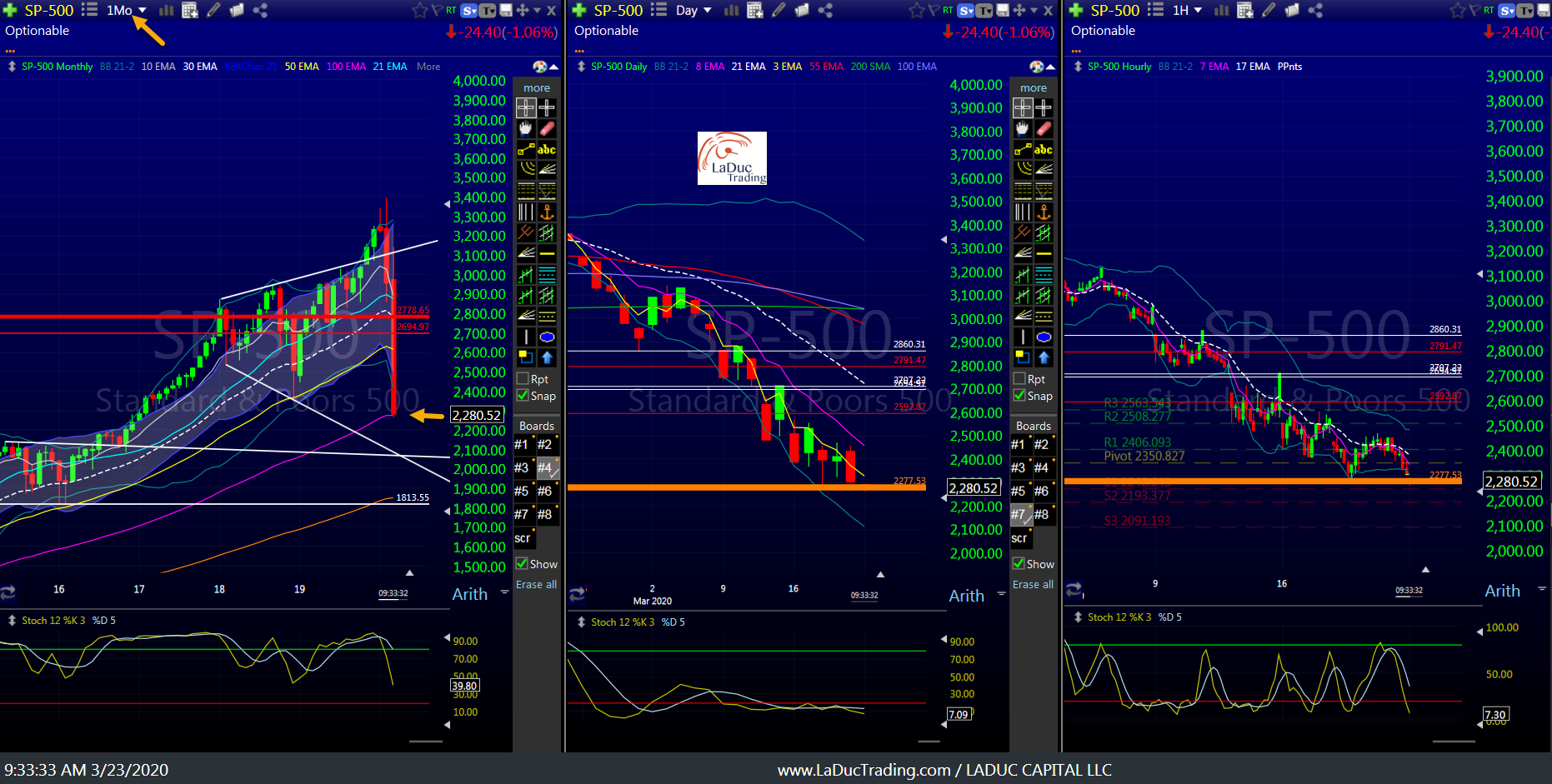

The above chart is what I’ve been using in my live trading room as a guide – $2277 is yearly support and 100WK – bounce or trounce time. With that, I suggested covering shorts Friday as we await more data with the expectation that sentiment would improve on Congress acting, on Quants covering last Friday’s puts in open interest, on Pensions buying into end-of-month and Technical support holding. Today proved that thesis correct.

Here’s the “Bullish into EOM, Maybe” section I presented to clients for bullish tailwinds Monday: Fishing Plan for Week of March 23 – 27: No Ammo Left

Gamma Relief, For Now

And here is the updated Gamma positioning from Brendan to support the violent move higher today:

Futures are limit up this morning and implied volatility (VIX) continues to get crushed. This vol crush is a big story in options land, and while many complex theories abound I continue to stick with the “inventory” theory. As a refresher on volatility as a catalyst we believe that lower implied volatility (IV) translates into higher stock prices because as implied vols drop that lowers put prices. This in turn leads options dealers to buy back short futures because they are overhedged. This can cause a snowball effect, particularly if we can actually sustain both lower volatility and hold higher SPX prices. You may be hearing the term “vanna” kicked around, and essentially this is what we’ve been waiting for: a “Vanna rally”. Vanna is the rate of change of delta for a given change in IV. As IV drops, dealers may be overhedged short and have to buy back futures. As it currently stands we would consider upside targets on a rally to be 2400, and possibly 2500 due to the amount of open interest at those strikes. @SpotGamma

Just because we had a strong bounce doesn’t mean it won’t be challenged…

BTD or STR?

If Trump allows it – he didn’t last week – we will have horrific Jobless Claims reporting Thursday morning which will cause volatility. We also have COVID19 headline risk hourly, especially as it relates to NYC. (Governor Cuomo, by the way, did an excellent press conference today presenting excellent data and leadership. I highly recommend watching it.)

Despite Mnuchin promising a signed bill, Congress is far apart on a stimulus package and the longer they wait the more destabilizing to the market. But I think the combo effect of sentiment improving on Congress acting, on Quants derisking/covering, on Pensions buying into end-of-month and Technical support holding… may give trapped longs some relief.

Before moving lower into $1700 SPX price target in Q2-3….

Top Five Risks

To that end, here are my TOP FIVE RISKS I will be watching closely:

- Trump reopening the economy – too soon would crush it even more.

- Credit Stress Still – $HYG – implying a default rate of roughly 40%!

- Scramble for CASH – Risk Parity: “the OTC derivatives world could be about $25 trillion short on margin”

- Mortgage Bonds – The Bad News – Mortgage Companies Pricing In Calamity

- Bank Run Risk – Fed reduces banks’ reserve ratio to zero starting Thursday, March 26 – Banks don’t have to hold capital.