Clearly we can tell what Americans like to do most the past 8 yrs: Order DPZ pizza +3600%, watch NFLX movies +1900% while drinking alcohol STZ +800%!

Well, as Market Watch notes, staying home versus eating out is gaining traction as the restaurant recession may have arrived.

‘Over the past six months restaurant industry traffic growth has come to a standstill and quick service restaurants, which have been the traffic growth drivers, are now experiencing a slowdown in visits.’

Bonnie Riggs, NPD Group

The average restaurant bill has climbed 21% in the past decade, and the gap between eating in and eating out has consistently widened. The NPD has estimated than 82% of all meals are now consumed at home. I would contend, if that’s the case, then alcohol sales in restaurants will also suffer.

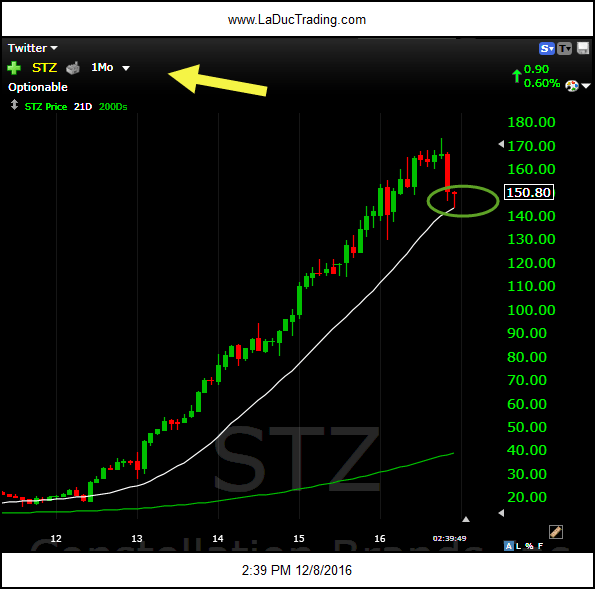

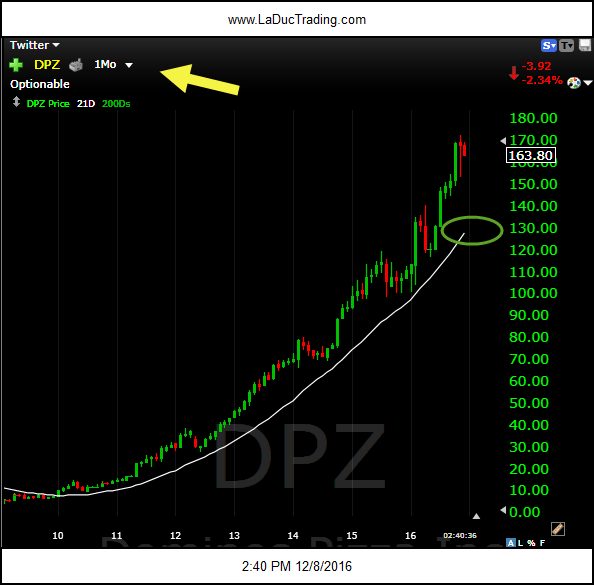

Actually, for me, alcohol was The Tell that trouble was likely stirring in the restaurant space. Back in May of this year, I noted I was short Constellation Brands (STZ) based on global alcohol sales dropping for first time in 20 years. I caught the knee-jerk reaction short in STZ from $162-154 before it bounced off the 100D and climbed back up to the $172 area. Right before the presidential election I noted that I was fishing around restaurant shorts, in addition to alcohol, as I envisioned Dominos Pizza (DPZ) might get hit should Trump get elected, given his stance on immigration deportations. Dominos and Constellation both dumped ~8% immediately following the election, with DPZ recovering half the loss and STZ continuing to lose additional ground.

Given the very large advances and very strong uptrends in both these plays over the past few years, pulling back in time and space to view a monthly chart can indicate safer areas to enter swing shorts and longs. In the case of STZ, despite being under its 200D on a daily chart, it is now on decent monthly support and a bounce candidate for me. Given STZ is further along than DPZ in its pullback, it likely bounces but in time will likely retest this major support level, and if the restaurant recession theme continues to gain attention, and STZ no longer qualifies as a cozy ‘hedge fund hotel’, support will give way and the trend will end.

DPZ on the other hand has a lovely reversal signal on it’s monthly chart (morning star reversal for candlestick lovers), double top on its daily and about a 30% mean reversion to decent support around $130. My bet: it’s going there in the next few months and that’s where I’m placing my bets.

Another theme I will look for to further gain conviction in a trend reversal thesis for alcohol and restaurant stocks: food inflation. Although corn, wheat, rice, soybeans and such are cheap input costs for these companies, should they rise (and if you follow my inflation thesis you know I believe they will), then food costs will get a whole lot more expensive and squeeze profit margins which will drive down these high-growth plays in a big way.

Toppings aren’t just extra on your pizza; they are a process in stock valuations.

Friendly Note:

It’s easy to subscribe to my Free Fishing Stories/Blog.

You are also invited to Come Fish With Me!

Thanks for reading and Happy Trading,

Samantha LaDuc