Europe is leading the rotation party on many accounts.

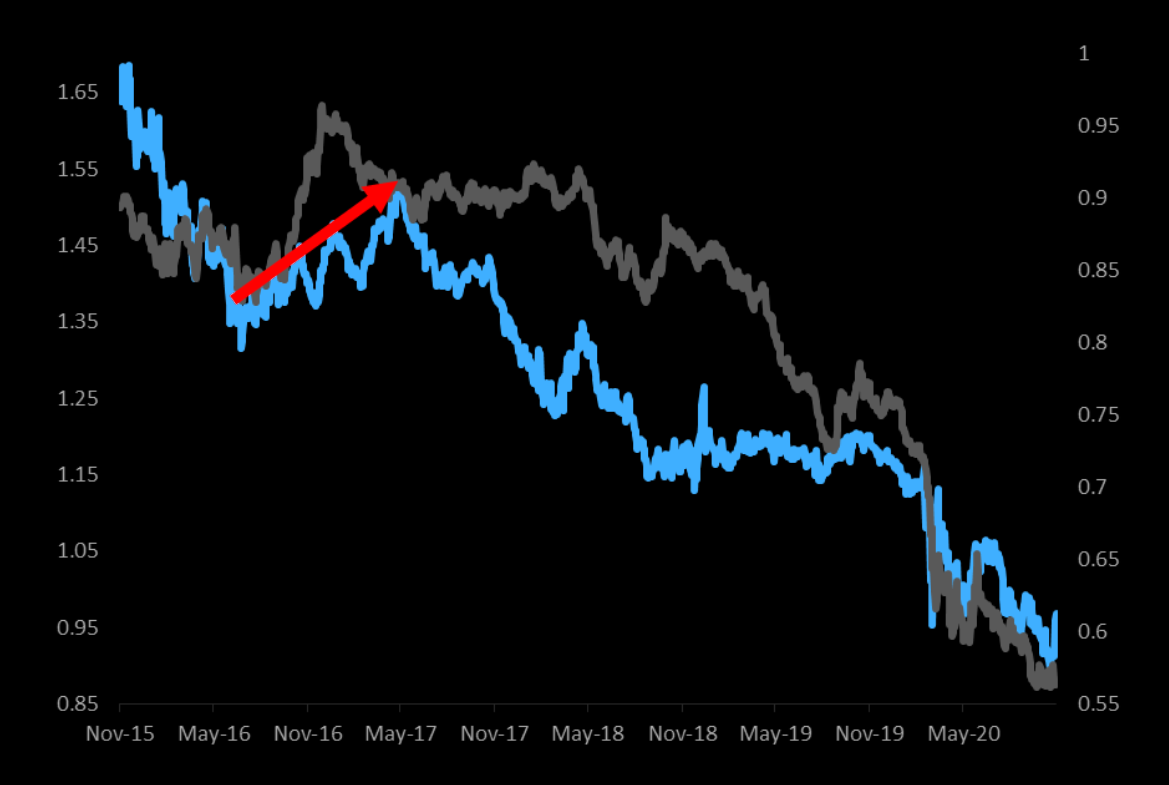

Here’s a chart courtesy @TheMarketEar: Euro STOXX 50 relative to S&P 500 (blue, lhs) shows Europe is leading SPY. Also MSCI Europe Value vs Growth (grey, rhs) shows Value leads.

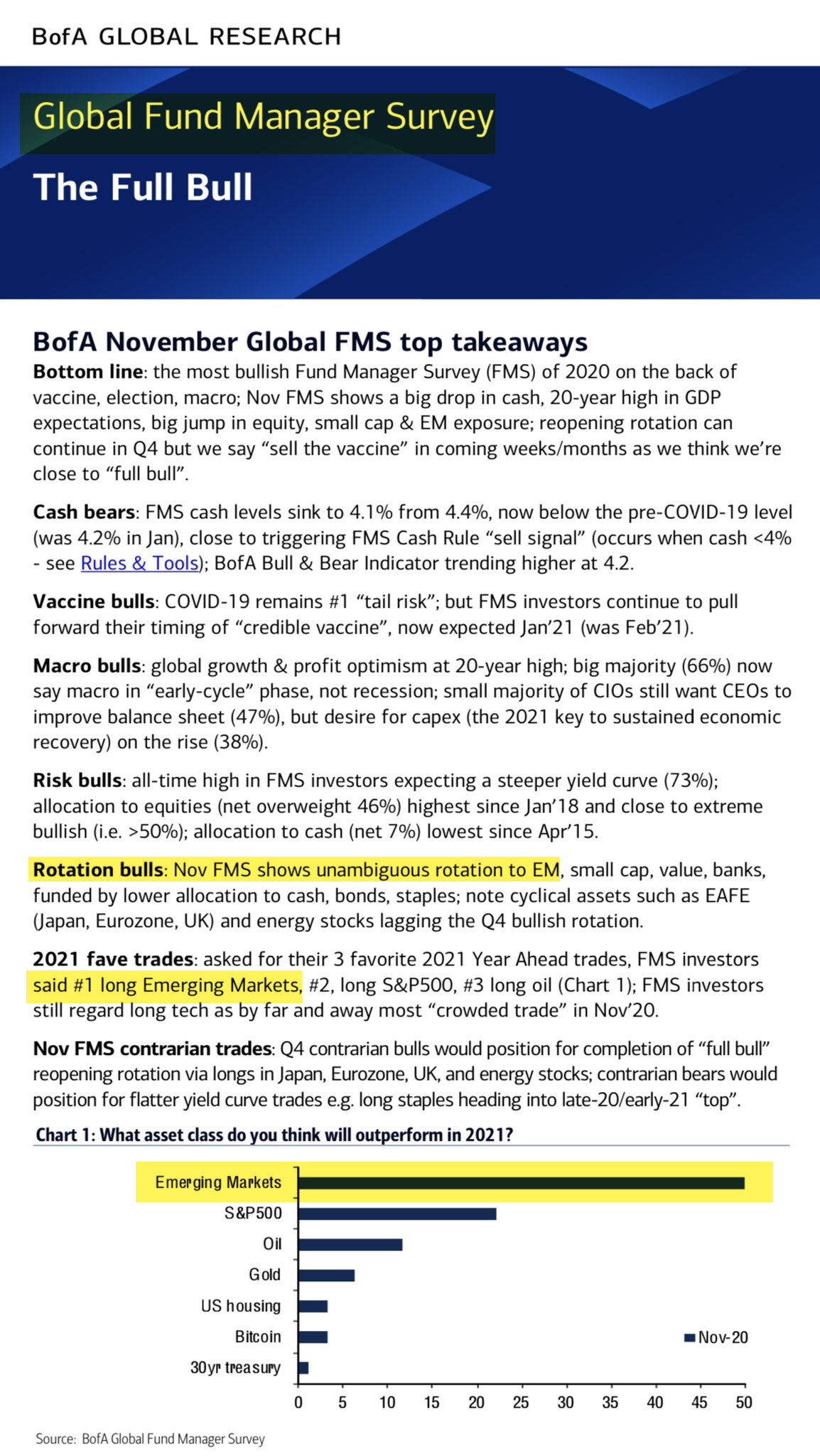

Just so happens the #1 Fave Long for 2021 is Emerging Markets, according to a recent Bank of America Global Fund Survey.

Here’s how it looks should the rotation party continue for EZU (yellow circle on right chart) and where to be concerned if it doesn’t hold (red square):

Why do I point this out as it relates to the Value Rotation theme? Because European stock markets are heavy overweight in the cyclical and value stocks, which are outperforming technology and growth stocks. Spain’s leading index, the IBEX 35, is even up 23% this month with France and Italy’s gaining 20%. Even European Financials, despite negative interest rates, are up 21% for Q4 to date.

If you believe in the vaccine, then you likely believe the rotation rally continues for emerging markets in general and the Eurozone in particular, despite new lockdowns and negative GDP growth, as the market prices in a better future. Just keep in view the German 10 year yield. It has been a great indicator of market direction and has continued to fade with the German DAX, indicating a tepid view of the reflation/rotation story.