Market Thoughts: The Week Ahead March 5-9

The Reflation Trade may be in the early innings, again, as last week Bonds dropped as Yields (US and German) spiked along with China’s Shanghai index. The USD continued to hold steady while Gold retreated as rates rose. Stocks traded in a tight range with SPX...

Gone Fishing Newsletter: Have We Reached Cruising Altitude Yet?

The Higher The Better The S&P, from take-off at $2346.58 on December 26 to $2743.35 today, has finally risen to its 200-day simple moving average – almost 400 points in less than 8 weeks. For many traders and investors, what happens above the 200D is...

Gone Fishing Newsletter: Way Strong Still

Here Are Some of My Potentially Bullish Intermarket Analysis Charts My Stock-Bond-Volatility ratio work says “yes, we may have a one-day wonder” in Volatility, but more likely we break the 65D and head down to bottom of the channel. That would mean SPX...

Fishing Idea: Is All That Glitters Gold?

Incredibly Bullish Charts for Gold The correction we experienced last week – wherein $2.6 Trillion was lost in the Global Stock Market – was due to the Velocity of the Rate Spike that triggered an Emerging Market and Volatility panic (the volatility index...

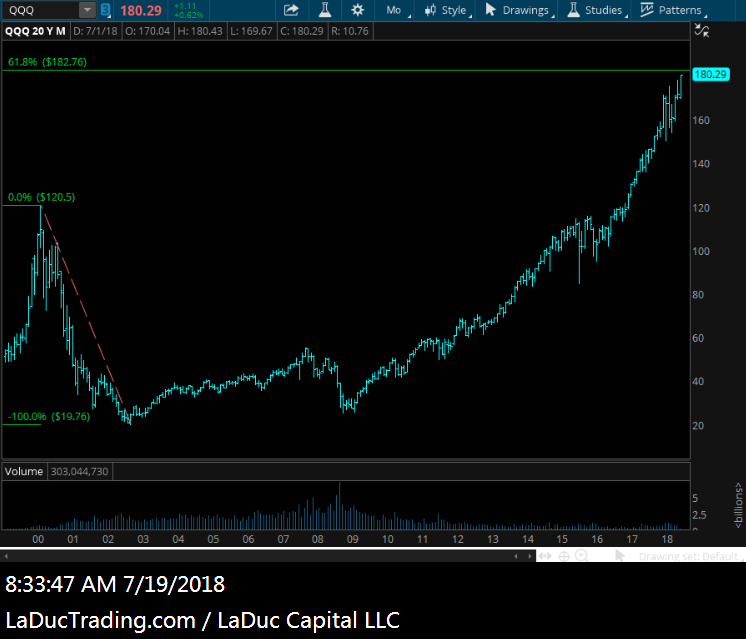

Why I Love Monthly Charts: Short Price Targets Found Here

Monthly Candles are best viewed after the first week of trading to get a bit more perspective on sentiment and patterns forming. In the following charts discussed in my Live Trading Room (captured this Monday around noon), I find more area for downward correction...

Mid-Day Market Thoughts: ATTN: We Have a Two-Way Market!

IF THEY DON’T BUY $AMD, $AMZN AND $AAPL, WHY BUY ANYTHING ELSE? That quote is from me. Just wanted to make sure to use my Teacher’s Voice. Are we getting to that point? It’s starting to look like it. Profit taking can turn into Selling which begets...

Market Thoughts: Mid-Week Review

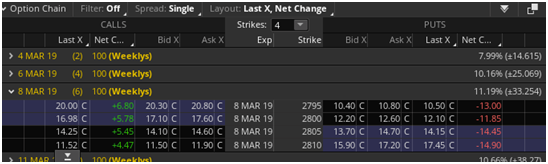

Here were my Market Themes heading into the Week as discussed in my Live Trading Room: Yes Brazil, No China My 9/21 Brazil into Oct 8 Election theme: well these three cost/margin efficient trade tactics, those Risk-Defined financed Call spreads will be over 10X. I...Highlights from the Trading Room Tuesday September 18th

NEW FEATURE : Nightly write-up of what we caught, let go and baited for another day! CHASES Got lucky – saw the $ABBV news. Recommended Sept $95P before news caught on about fraud charges in CA. That meant $1 stock drop for +250% gains. IV doubled. UOA up 4X....

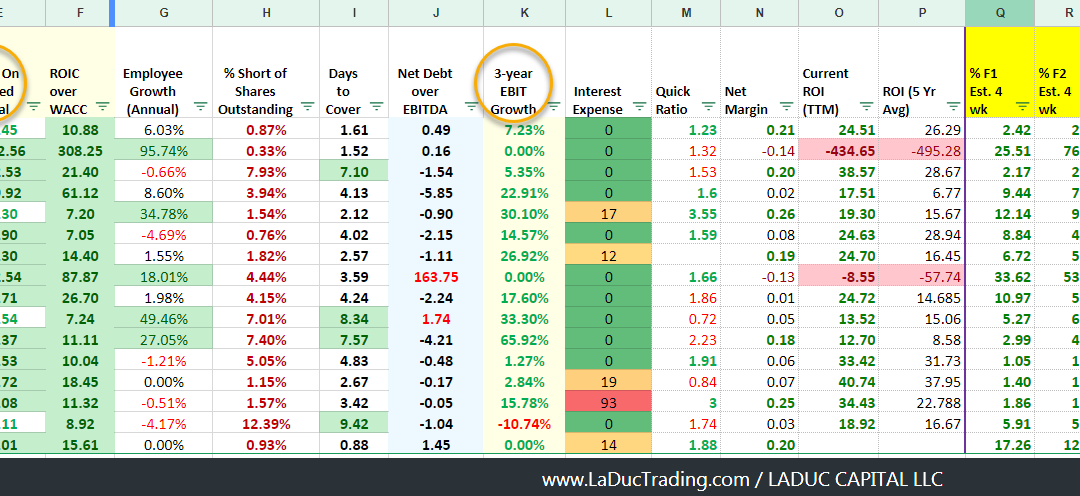

Value Manager Teaches Me About Value

In our LIVE Trading Room Friday, I had the pleasure of engaging with a client who is a Value Investor – a pretty seasoned one. Hans (who prefers to remain anonymous) is a Fund Manager out of Switzerland – a Deep Value/Fundamental type who happens to like...

Gone Fishing Newsletter: Bulls and Bears are Both Wrong

MACRO CALLS RATE SPIKE – $TNX 2.83 TO 3.05% has played out from my call Sept 2nd. $TBT ran from $36 to $39 PT in proportion to the $TLT short I saw lining up on the chart (below). OIL SPIKE: I was fully prepared to fade Crude Oil at $70 today. Instead, I think it’s on the […]

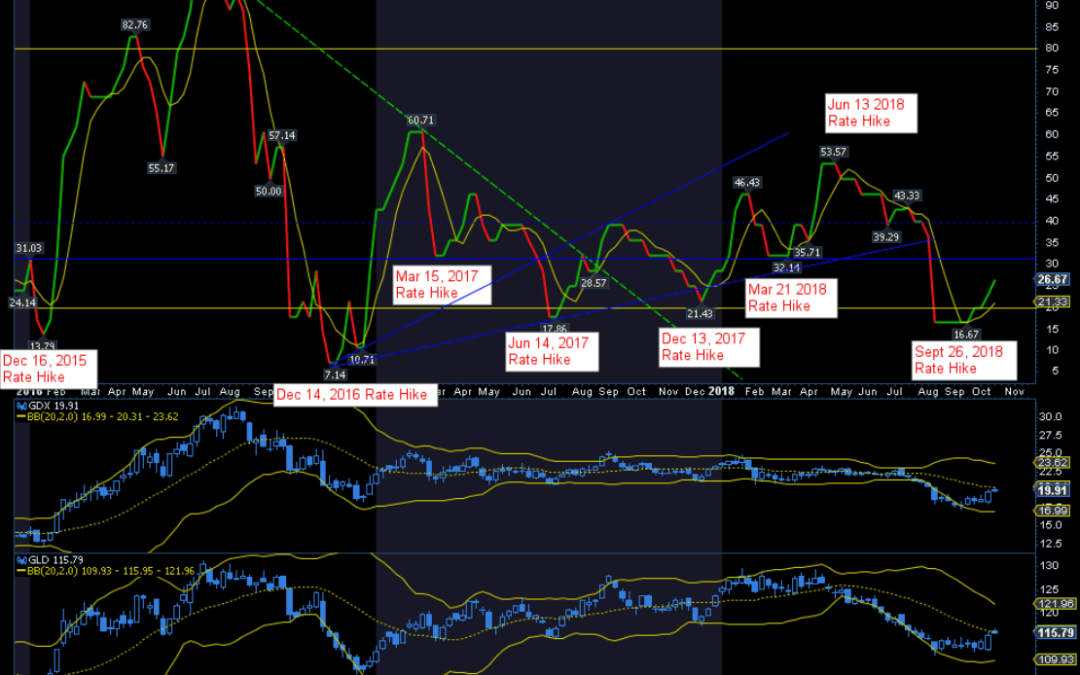

Fishing Idea: Gold Is In The Zone

When is it Safe to Buy Gold? I have written about this subject before for SeeItmarket and my clients. I have been a firm believer that Gold and Miners trade down into a Fed Meeting Rate Hike. Why do I believe this? Because with each rate increase since December 2015,...

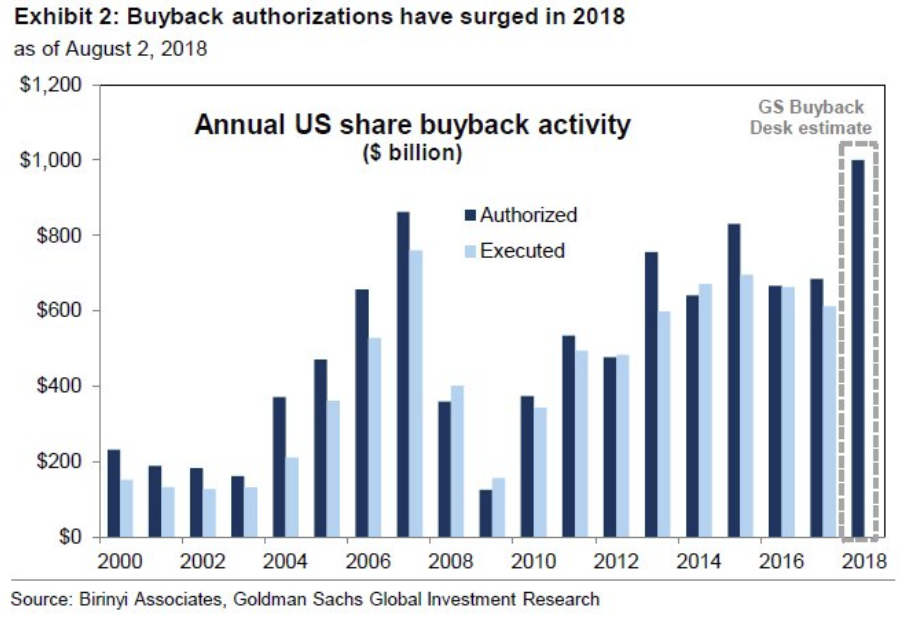

Price Discovery and Stock Buybacks

Main Points: Stock Buybacks and are most often credited for underpinning the market’s amazing Bull Run since the early 1980s, and especially the past ten years. Given our current polarized political arena, buybacks have also been criticized for compounding...

Gone Fishing Newsletter: It’s Heating Up

This is an Intermarket Analysis chart review which graphically represent relationships (strong and weak) that can foretell how the undercurrents are moving to better identify where stocks/sectors/indices are flowing! You can see (and should see) my last Intermarket...