by Samantha LaDuc | Dec 2, 2020

Market Review for December 1st, 2020 Bears are getting put into a padded room and given a straight jacket with all this gamma reinforcing call buying…moar call buying…moar call buying…moar call buying… BUT… $VIX closed up +0.97% $VVIX closed up +2.18% $VXX closed up +0.99% $UVXY closed up +1.26% $SVXY closed down -0.46% Jumping right into the big 3 macro economic drivers: COVID19 – Nothing […]

by Samantha LaDuc | Dec 1, 2020

Market Review for November 30th, 2020 Last day of what has felt like the longest month (started with the ‘Election’) of the longest year ever (2020 is the gift that keeps on giving)…and it was not disappointing today. There was overnight action that was erased at the open, to be followed up by a 1-2% […]

by Samantha LaDuc | Nov 30, 2020

Market Review for November 27th, 2020 Wednesday and Friday are two of the most thinly traded days of the market year. They were fairly eventful, but just not in equities. Before we get there, let’s start with Volatility. The space was heading for the dumpster early in the session and then abruptly turned around 100% and […]

by Samantha LaDuc | Nov 24, 2020

Market Review for November 23rd, 2020 Joe Biden is in. Janet Yellen is in. So there are no more questions it appears for the market to ‘worry about’. There is no more Trump Admin either so what is Twitter going to do? Let’s get right to it starting with Volatility. The space was muted today […]

by Samantha LaDuc | Nov 23, 2020

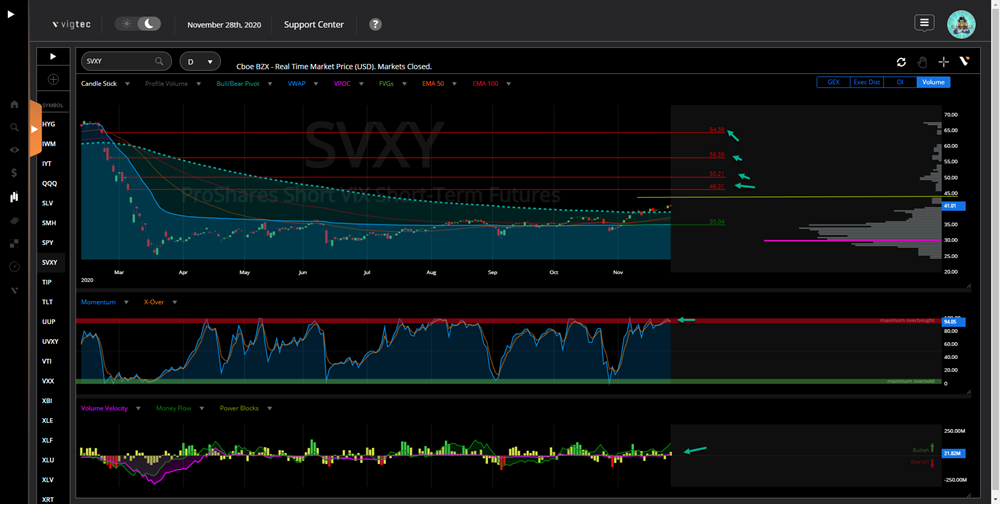

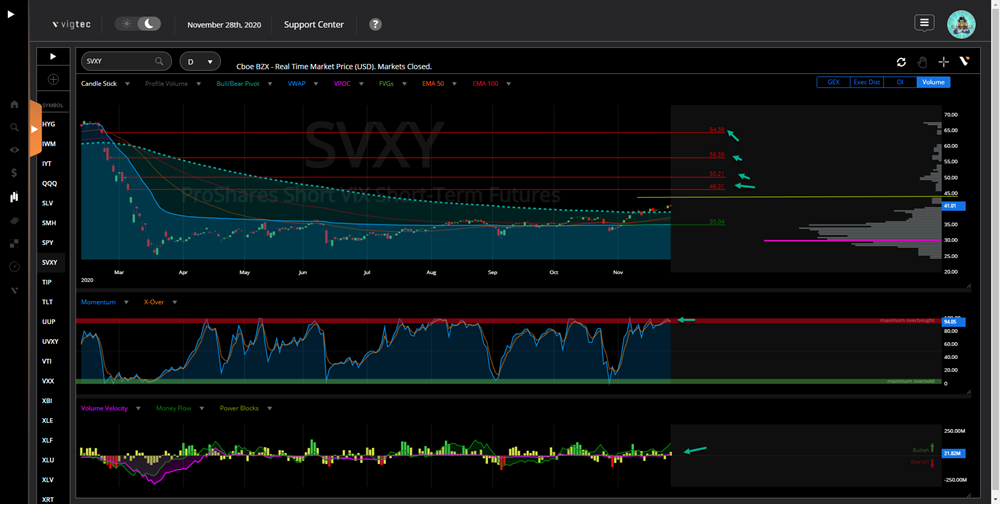

Market Review for November 20th, 2020 OPEX has now cleared so let’s get right to it. Very quickly to cover the volatility space (added volatility of volatility $VVIX and Short Volatility Futures $SVXY): $VIX closed up +2.55% $VVIX closed flat -0.14% $VXX closed down -0.21% $UVXY closed down -0.71% $SVXY closed flat +0.08% Jumping right into the big 3 macro […]

by Samantha LaDuc | Nov 20, 2020

November 19th, 2020 There was nothing happening today which is pretty standard for the day prior to an OPEX. There was a good deal of chop until about 1PM and then the indexes all rallied from off the lows from the beating they took yesterday. Everything was looking good into the close at 4PM for […]

by Samantha LaDuc | Nov 19, 2020

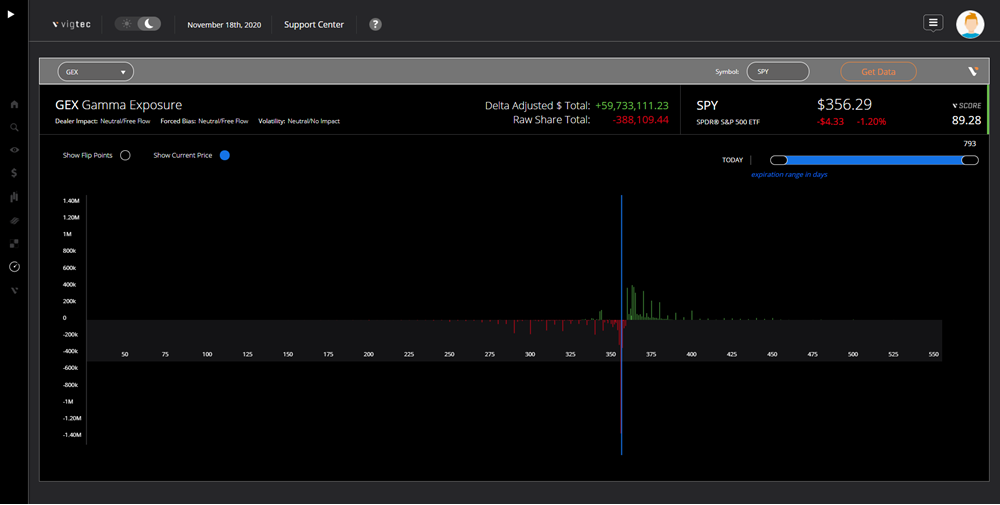

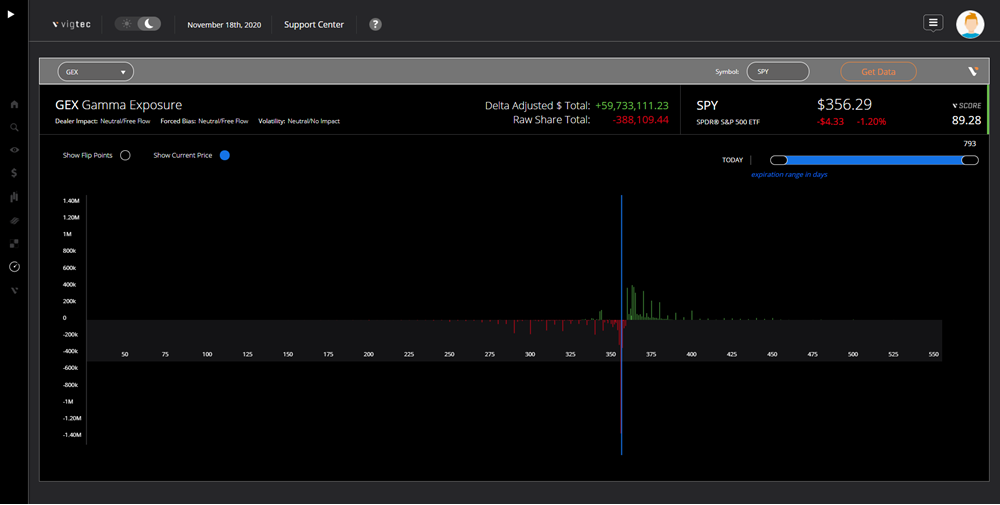

November 18th, 2020 Well around 2PM there was some pretty gnarly news about schools in NYC shutting IMMEDIATELY. I guess its a little more serious than people were taking it. Today was VIXpiration so most short vol positions had been rolled in the AM and the overall positioning (long and short) in volatility was reset […]

by Samantha LaDuc | Nov 17, 2020

Today In The Markets Bulls did not have a $PFE or $MRNA vaccine news in the overnight session last night to create a gap, ramp, and camp open to the markets. In fact the markets opened down about 1-1.5% across the board BUT the FLOWs are still inbound so the $RTY and the $ES rallied all day […]

by Samantha LaDuc | Nov 16, 2020

Today In The Markets Bulls had another early Xmas present last night with another +1-1.5% overnight futures session of gains to walk into the AM session with this morning. However, volatility held firm in the midst of this barrage of equity squeezes: $VIX closed down only -2.81% $VXX closed down -2.83% $UVXY closed down -3.45% Jumping right into the big […]

by Samantha LaDuc | May 7, 2020

MacroVoices Podcast Dr. Lacy Hunt: The Road Through Deflation Toward Eventual Hyperinflation Every now and then you find an interview that needs to be listened to again and again. @ErikSTownsend ‘s interview with Dr Lacy Hunt on @MacroVoices is one such example. @njabrooks I am a student of macroeconomics so I tend to look for the best teachers […]

by Samantha LaDuc | Apr 27, 2020

Clients know I see mortgage stress in the Commercial but also Residential mortgage market to be 1 of the top 5 risks lurking under the market’s price action. I have written about the stress in mortgages: Mortgage Companies Pricing In Calamity Small Business and Mortgage Bailouts Make Banks Nervous And late last week there was […]

by Samantha LaDuc | Apr 23, 2020

I highly recommend this macro analysis: Lacy Hunt: Deflation, Not Inflation, Is Coming. It is a great interview with a very respected economist who expects deflation (including wage deflation), lower treasury rates (despite higher corporate and personal borrowing rates), and banks unwilling to lend new money (despite the Fed/Treasury liquidity infusion) – all of which […]

by Samantha LaDuc | Apr 22, 2020

The “Recurring” in Annual Recurring Revenue (ARR) for Software-As-A-Service might not be as recurring as it literally suggests – especially in a downturn. Here is some “sell-side” tech surveys and commentary inspired by Modest Proposal that highlights this problem and potential trading opportunities, short, in popular Cloud/IPO names. Lots of good fishing in these waters […]

by Samantha LaDuc | Apr 15, 2020

Don’t Tug On Superman’s Cape April 09, 2020 You can put aside your fancy chart patterns, and your in-depth fundamental analyses. The Fed is now in charge of everything, and the Fed is buying. As the late Martin Zweig advised, “Don’t fight the Fed.” After 10 years of having stimulative interest rate policy, the Fed […]

by Jay Reynolds | Apr 10, 2020

This is a new series idea from a colleague of LaDucTrading, Jay Reynolds, who offers up some timely, relevant and personal vignettes on CoronaVirus news that you won’t likely get anywhere else. These posts should be easy to scan and synthesize, with a peppering...