by Samantha LaDuc | Jan 12, 2021

Market Review for January 11th, 2021 Consensus on the outcomes would imply that no matter what, the market is going higher (in the long run) regardless of the near term action in the coming weeks..but there are several unknown/unknowns to consider at the moment that could derail those implications: – US internal Gov situation (dicey) turning worse than it is […]

by Samantha LaDuc | Jan 7, 2021

Market Review for January 7th, 2021 This week has been interesting… Yesterday the US Capital building was ‘taken’ by bandits but then subsequently ‘given back’ in the same day???…to that, the A$AP Call Buying Guild issued a statement… And they were correct, $IWM rallied 4% yesterday even with the ‘events’ and tacked on another 2% […]

by Samantha LaDuc | Jan 5, 2021

Market Review for January 4th, 2021 VIX and the volatility proxies started moving right at the open today. All those hungover from the long holiday weekend were really not paying attention. By 12PM they were like: Measuring our favorite indicator as of the last 60 days we head over to single stock call buying…it was trading day number […]

by Samantha LaDuc | Dec 29, 2020

Market Review for December 28th, 2020 Today was all about BTC…and when I looked at Bitcoin-Twitter this all I could think… Measuring our favorite indicator for November/December we head over to single stock call buying…it was trading day number 26 out of the last 27 with a sub 0.60 reading…finished with a 0.33 reading…back to normal for this cycle today and […]

by Samantha LaDuc | Dec 28, 2020

Market Review for December 27th, 2020 Quick glimpse of Bitcoin cult right now this holiday weekend… On the same note, here is a glimpse of the A$AP Call Buying Guild (affectionately renamed because the ‘Gamma’ reference just isn’t enough for this…it needs better)…this was overhead at family Christmas dinners across the country when speaking to grandmas: “all you gotta […]

by Samantha LaDuc | Dec 18, 2020

Market Review for December 17th, 2020 We are live on the scene where we have caught an overthetop Bitcoin HODLer…doing their best Rick James impersonation to everyone on Twitter today (Charlie Murphy)… Seriously, if we are not even bearish bitcoin in the long run we are getting punched in the face lmao…congrats though on the longside…killer trade […]

by Samantha LaDuc | Dec 17, 2020

Market Review for December 16th, 2020 Gamma call buyers doing their calculations prior to the FOMC announcement and zoom presser… Measuring our favorite indicator for December we head over to single stock call buying…it was day number 20 out of the last 21 with a sub 0.60 reading…finished with a 0.44 reading…appetite was reinvigorated today… Mr. Greedy is still eating that G-amma on […]

by Samantha LaDuc | Dec 16, 2020

Market Review for December 15th, 2020 Gamma buying crew just getting those last minute calls in before the FED meeting tomorrow because they think VOL about to get smashed again like one of McG’s opponents…. Measuring our favorite indicator for December we head over to single stock call buying…it was day number 19 out of the last […]

by Samantha LaDuc | Dec 15, 2020

Market Review for December 14th, 2020 We got the vaccine distributed today…and then we got London locking down on a new strain that they can’t get under control. About right for 2020…here is the year in review… Measuring our favorite indicator for December we head over to single stock call buying…it was day number 19 out of […]

by Samantha LaDuc | Dec 14, 2020

Market Review for December 11th, 2020 The amount of froth in that space is palpable. Back to single stock call buying…it was day number 18 out of the last 19 with a sub 0.60 reading…and today did start to leak out towards the end of the day again and finished with a 0.49 reading…is the appetite starting to fade b/c this is […]

by Samantha LaDuc | Dec 11, 2020

Market Review for December 10th, 2020 A toast amongst call buyers today at the close… Single stock call buying was day number 17 out of the last 18 with a sub 0.60 reading…and today did start to leak out towards the end of the day and finished with a 0.38 reading…is the appetite starting to fade? Mr. Greedy is […]

by Samantha LaDuc | Dec 8, 2020

Market Review for December 7th, 2020 Gamma call buying crew looking for the flag on the play after throwing the interception today: Single stock call buying was day number 14 in a row with a sub 0.60 reading… UNTIL TODAY Single stock call buying closed the day with a 0.67 reading…meaning that it is no longer in ‘the hole’…and potentially […]

by Samantha LaDuc | Dec 7, 2020

Market Review for December 4th, 2020 We are living in a time of negative interest rates, easy money, and unintended consequences…FEDsury has in fact created an abundance of inflationary effects – just not in the areas that they looking for it. AND …until the single stock call buying frenzy completes…which to my eyes seems unfinished (and you will […]

by Samantha LaDuc | Dec 4, 2020

Market Review for December 3rd, 2020 Single stock call buying was day number 13 in a row with a sub 0.60 reading… Today we are experimenting with videos for the summary and including market indicators into the discussion: CLICK HERE (about 10-12 min for just my ranting about the day…but don’t stop there – the “Under the Hood” video […]

by Samantha LaDuc | Dec 3, 2020

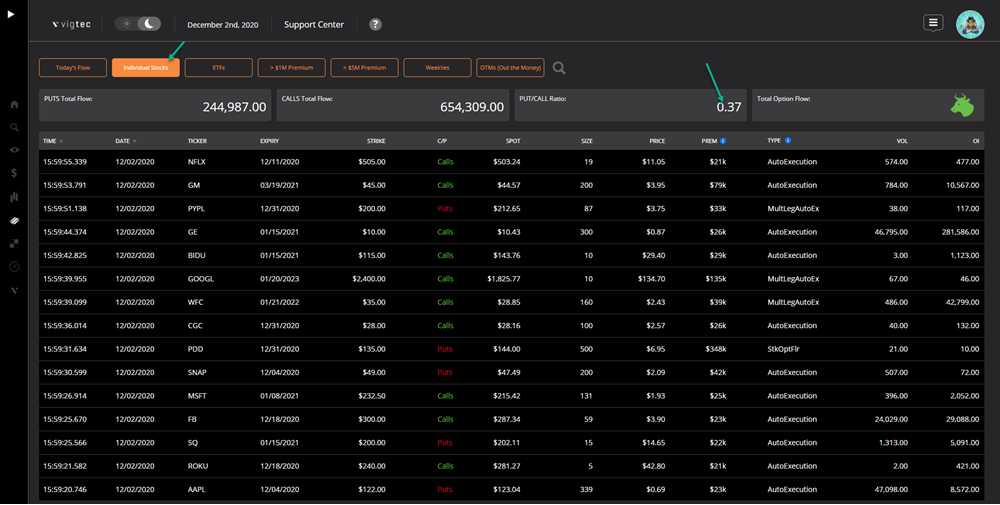

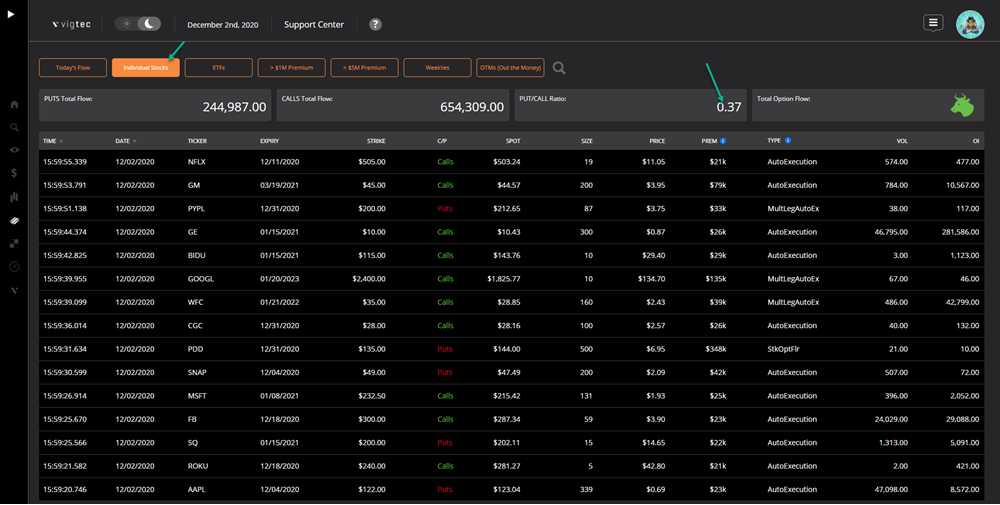

Market Review for December 2nd, 2020 It looked like the Russell 2000 was just about to roll at the open this AM…and then the gamma crew call buyer effect took hold and the buy programs kicked in. Here was a live shot of bulls walking away from the crime scene on...