Table of Contents

Hi Everyone, I hope you are enjoying your weekend. Quick housekeeping item – If you are not yet using our LaDucTrading.slack.com workspace, and do not know how to get access, please reach out to [email protected] for assistance.

Highlights From This Week’s Live Trading Room

Note: Andrew here. I will be assisting Samantha in summarizing the action from inside her live trading room as Samantha and I capture and and manage the Brokerage-Triggered Trade Alerts. Moving forward we will be providing in-depth and in-context trading set ups and analysis via SLACK:

Announcing New Member Feature: SLACK Attack

Trade Alert Reminder: To activate/switch portfolios for Trade Alerts, go to Manage Trade Alert Categories under your Membership Dashboard and update your preferences. Trade Alerts are sent via email and SMS (if opted in) as well as posted under the Trade Alerts page. To access the open/closed trades, go to Live Portfolios. Enjoy the review and please let us know how we are doing: Live Trading Room Trade Of The Day Feedback.

Market Recap

Congrats on making it through another options expiration month Team! While the week leading up to opex can often be boring and uneventful, this past week was anything but. The S&P 500 spent the beginning of the week straddling the weekly value area high (VAH) before slipping below support. Heading into next week, we need to be open to all eventualities, including the fact that we could explore lower levels in the headline indices before stabilizing:

We closed at the weekly point of control (POC) at ~3750 for SPX. The next reference point to the downside is the weekly value area low (VAL) at 3690. While both the S&P 500 and Nasdaq 100 had negative weekly performances, small caps were the standout, notching a +1.55% week:

This divergence was driven primarily by weakness in the megacap FANG stocks. Given the high level of concentration in these names for both the SPX and NDX, it is difficult to make any upward progress when they come under pressure.

Sentiment/Positioning

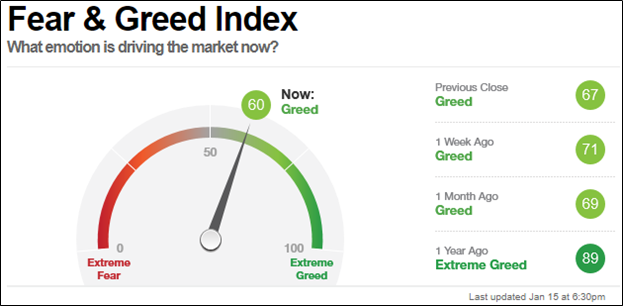

While we did see the first bout of weakness since the Georgia Senate runoff election this week, sentiment remains elevated. The CNN Fear and Greed index decreasing from a reading of 71 last week to its current reading of 60:

Options players reached a level of extreme complacency by midweek, with the Equity Put/Call Ratio dropping to a reading of <.35. This quickly reversed to a more balanced level of .45 as markets turned lower Thursday and Friday:

SentimentTrader examined the behavior of small retail call buyers specifically. It appears that the average retail trader has gone ‘all in’ with leverage. That usually ends well right?

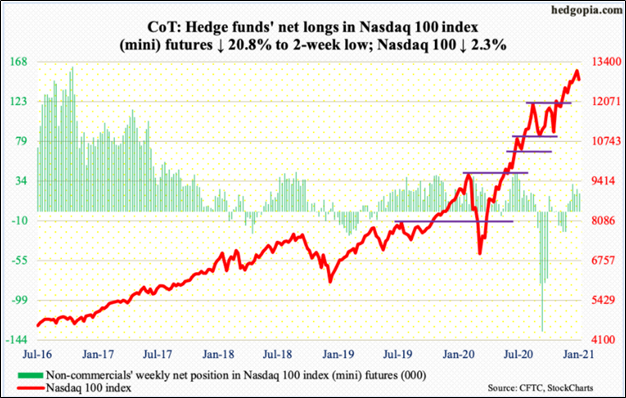

Hedge funds remain short e-mini S&P 500 futures and long Nasdaq 100 mini futures as of Tuesday 1/12. Given this dynamic, the pain trade remains to the downside in the mega-cap tech monopolies:

Fixed Income

The yield curve flattened slightly last week, with the 2s 10s spread narrowing from .980 to .959. As fresh stimulus is rolled out by the incoming presidential administration, we will be on the lookout for continued curve steepening and any ripple effects that could create for equities:

There are still no signs of stress in the credit market. High yield bond spreads hit a cycle tight of 758 basis points:

Spotlight Trade IPOE

The spotlight trade of the week was my $IPOE trade. I entered this name based on the asymmetric risk-reward opportunity inherent in the structure of the security, and the management team behind it. Similar to a bond, SPAC’s have a par value, which is secured by the cash in the SPAC. For $IPOE, the par value is $10, meaning if my trade had gone south, my max loss would have been $2.18/share, which represents the difference between my entry price of $12.18 and the $10 SPAC par value. $IPOE is run by Chamath Palihapitya, a billionaire investor with a strong track record of investment performance and judgement. My trade was a bet that Chamath would find a good acquisition target and that the market would react positively to it. Several days after my entry, $IPOE announced that they would be acquiring Sofi as part of the SPAC deal, which sent the price of $IPOE higher and provided me an exit point for my trade. I closed this one out for a 53.9% gain:

Samantha’s Market Calls

Samantha’s Macro Market Call on Lower Bonds, Gold, Silver and Miners continues to shine. She did up a video as an overview:

In addition, she had several short-squeeze candidates that more than delivered for clients: GME, BB, BBBY, GM, DDD, MSTR…

Gamestop was one that helped make one lucky client a millionaire this week!

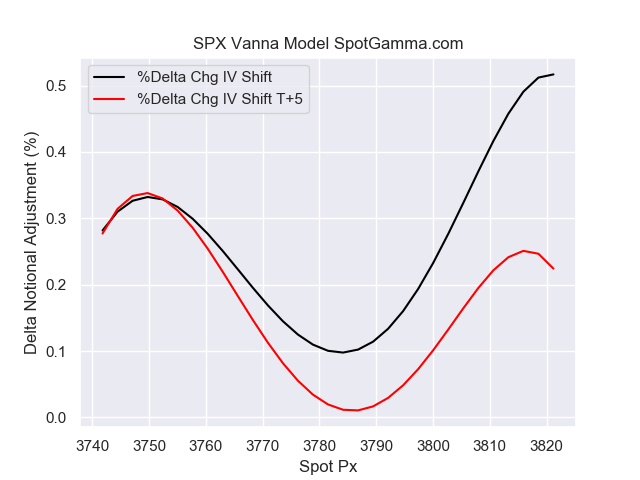

Samantha also pointed out the gamma roll-off and its implications for markets after opex:

https://laductrading.slack.com/archives/C01GJQX4370/p1610998412005300

And more great insights on how to protect and position from a Quant Quake potential to all eyes on MAGA and VIX:

- https://laductrading.slack.com/archives/C01GRMZAK19/p1610729221007600

- https://laductrading.slack.com/archives/C01GRMZAK19/p1610728551005400

- https://laductrading.slack.com/archives/C01GRMZAK19/p1610723542004500

**Please make sure to follow her SLACK channels: Market Thoughts, Intermarket Analysis, Risk On/Off Indicators as well as her Chase, Swing and Trend channels.**

The Week Ahead

Earnings season enters full swing next week. Make sure to come up with a game plan ahead of time if one of the names you hold is reporting results! I will be wathing $NFLX earnings closely, as it is a major component of the S&P 500:

Economic Calendar

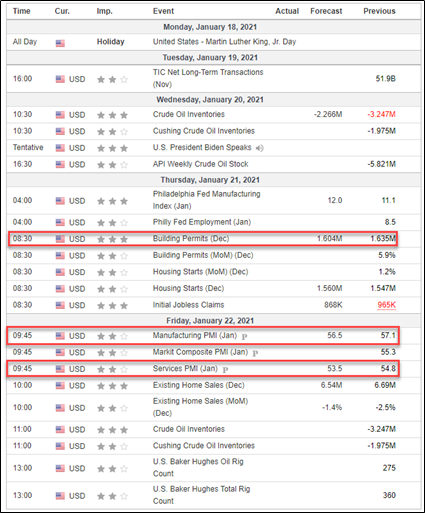

On the economic/event calendar, we have Biden’s presidential inauguration on Tuesday, housing data to be released this coming Thursday, and some PMI data being released on Friday:

One final point I want to touch on heading into next week is that the S&P 500 closed Friday in ‘negative gamma territory’, meaning that dealers will have to hedge their positions in the direction of market movement. This widens the distribution of potential return outcomes next week, so as always, prioritize risk management. I hope you all had a great holiday weekend, and a great week ahead! -Andrew

Announcement and Webinars

Wow, Samantha was BUSY…

Tuesday’s Macro-to-Micro Power Hour was an action-packed discussion around “Dispersion and Decentralization” as a trading theme…

Thursday was a very SPECIAL ‘SPAC Attack’ Webinar with Special Guests that was very comprehensive and supportive of clients’ interests to learn more about this hot trend:

And if that wasn’t enough value, Samantha also prepared her 2021 Predictions for StockChartsTV where she headlined with some very heavy hitters. Check it out!