Second Half Market Thoughts

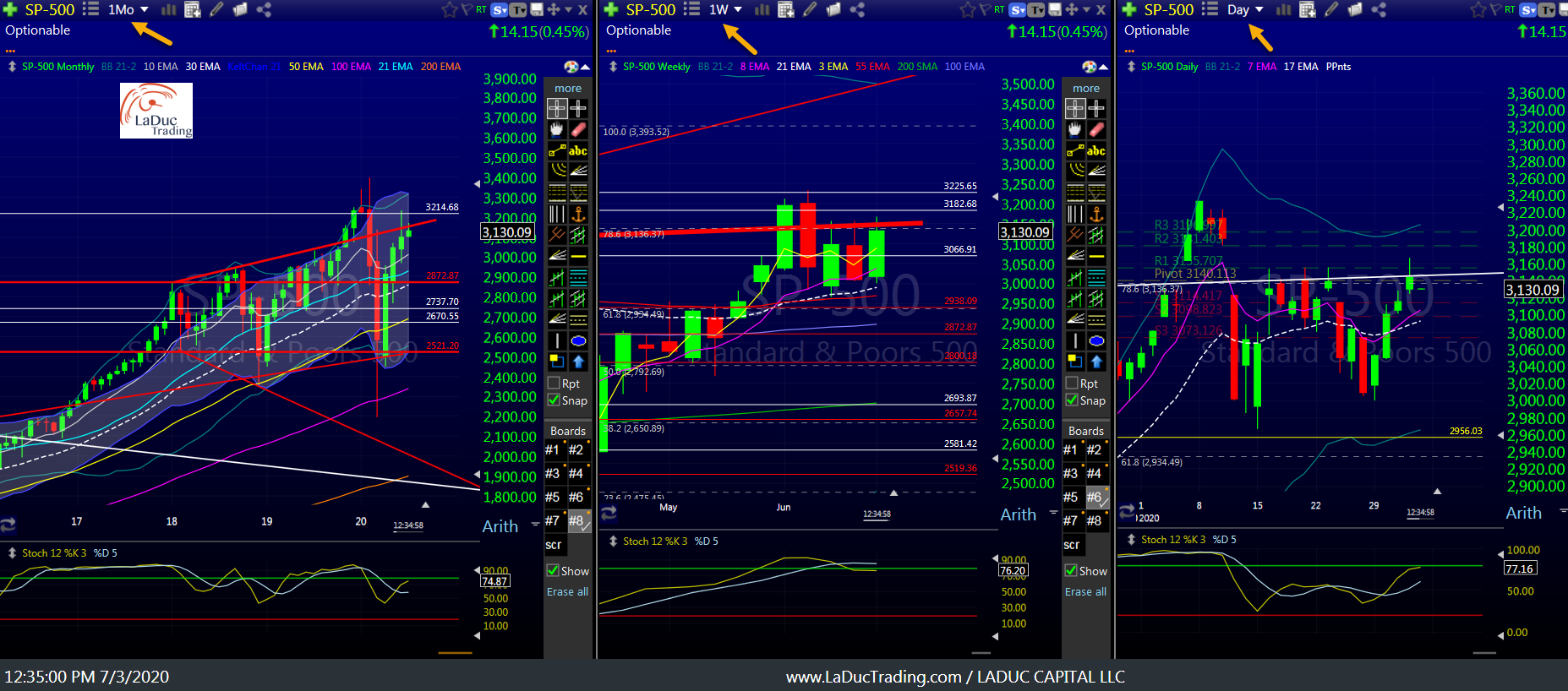

By my estimation, and as I’ve warned in my live trading room past month+, Summer Trading will likely include wide swings – in both directions, between SPX $2950-$3250. More than likely, Treasury will keep cash handy to use to support the market and keep it from dropping into the Election. Still, I expect an election swoon, that is then followed by the invisible ‘hand of God (a.k.a. Fed/Treasury)’ that sends the dip-buyers into panic buying mode running SPX into $3500-3600. If we manage to push through $3250 this summer, then game on sooner! But either way, I doubt that negative COVID impact or earnings disappointment will derail the rabid speculation in stocks that has been enabled by US government liquidity, USD international cash swaps, and direct corporate bond buying by the Fed.

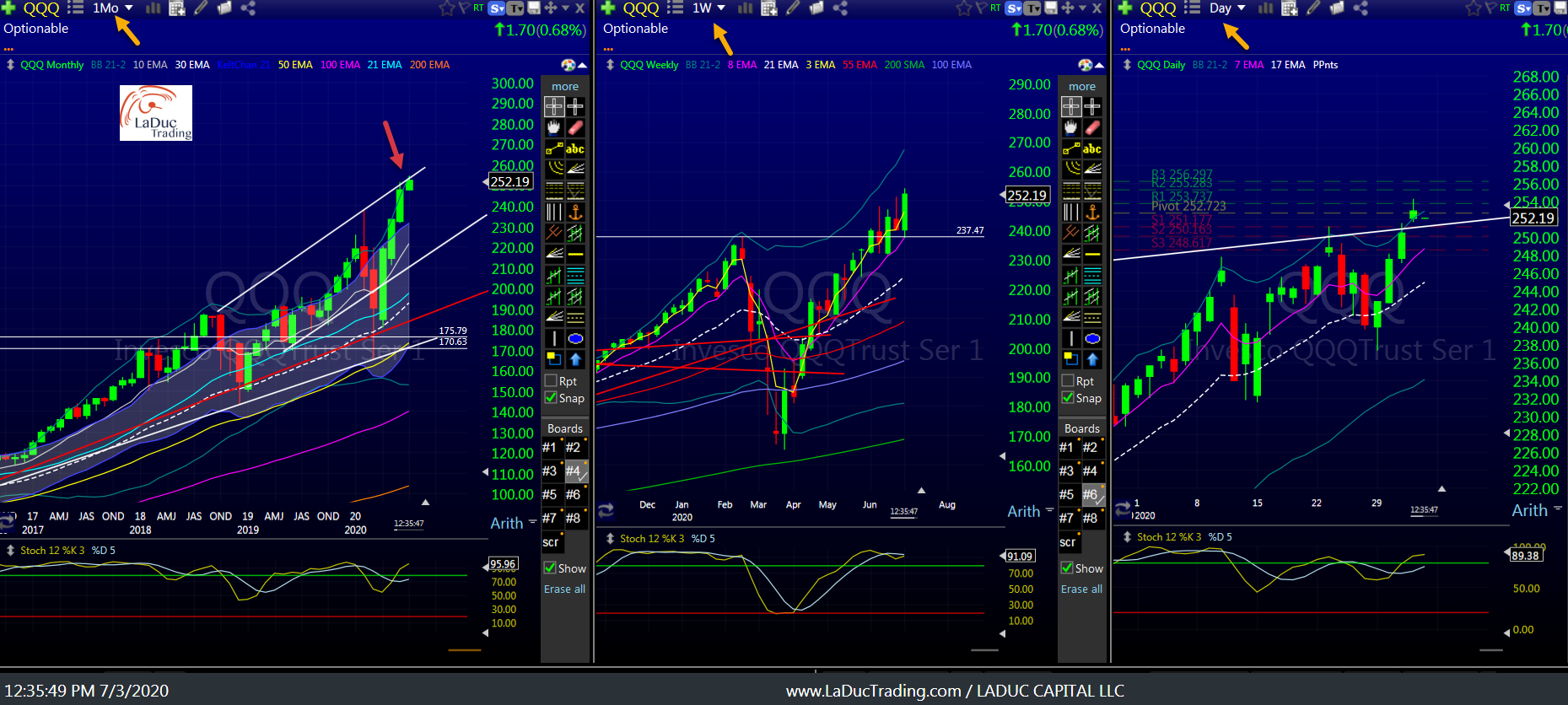

Risks to the market upside include a US Dollar spike, but with international cash swaps fully enabled, foreign exchange has been feeling little pain from a rising USD (and/or shortage). What I firmly expect to temporarily flush stocks is a rate spike. But it won’t stick. Still, it is the most destructive force that could knock Tech off its pedestal of ‘growth at any cost’. It would also send a wee bit of panic into the Bond Bulls’ hearts (think unwind) as well as short-covering frenzy on value names.

What else would derail the continued market ‘stability’? A market paralyzed from political inaction from a failed election. Another words, market will move directionally assuming there is an agreed and legitimate President elected. If either side contests, or Trump delays the election all together, then the uncertainty will breed uncertainty. People and market participants will grow anxious and with it risks of Civil War. Whatever the cause of anxiety, given the unprecedented monetary and fiscal stimulus being thrown at the COVID economy, and despite pain on main street and global growth contraction, I can see a post-election scenario that gets bid up regardless – much like the past 3 months – by hungry money managers chasing asset price returns in expectation of more Fed intervention.

The volatility market makers think similarly judging that 6M/1Y VIX has been inverted every day since 2/21 – when we started to crash 35%. Despite being 4% from February highs now, SPX has not fully recovered and yet VIX has stayed elevated. When VIX6M > VIX1Y it means VIX is expected to be higher in the near-term, lower in the long-term. This seems counter to the prevailing headline risk of increased market risks from COVID impact on Winter flu season not to mention already hard-hit economic sectors contributing to unprecedented permanent job losses and upcoming election drama. But that is how I interpret this one indicator: SPX has the headwind now (summer months) tailwind later (winter).

Shopping List: Next Big Catch

Should the above thesis prove correct, I have a list ready to go long. A (partial but meaty) list of the set-ups I will stalk, trade and position into. Ideally, I expect better entry points for some in the upcoming weeks and months, but wanted to offer up my shopping list right now with an offer to update monthly.

Obviously, sector news flow and company-specific stock analysis will dictate whether any of the following stay in my list. Also, tide lifts all boats, so a bullish bias is based on a cooperative market… SPX is bullish >3225, bearish below 2950; otherwise, embrace the summer chop!

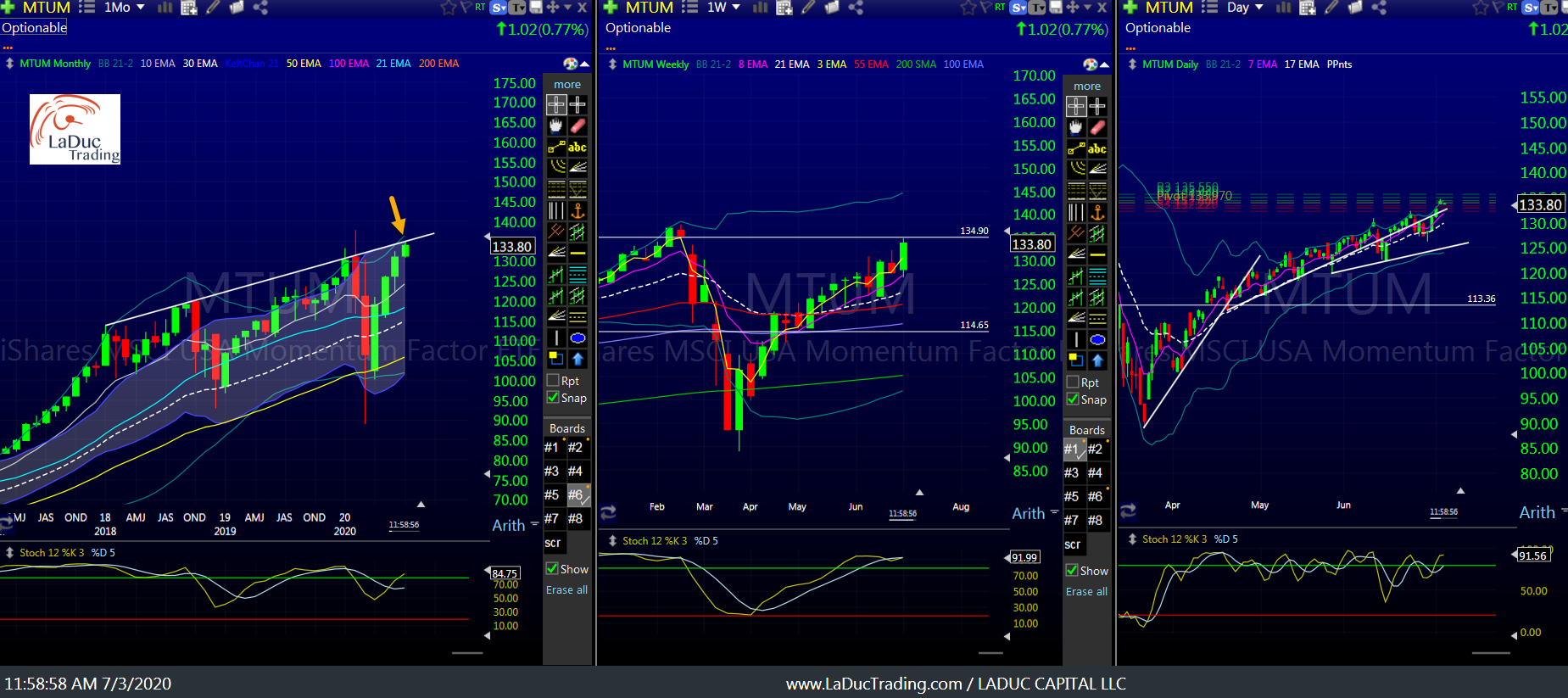

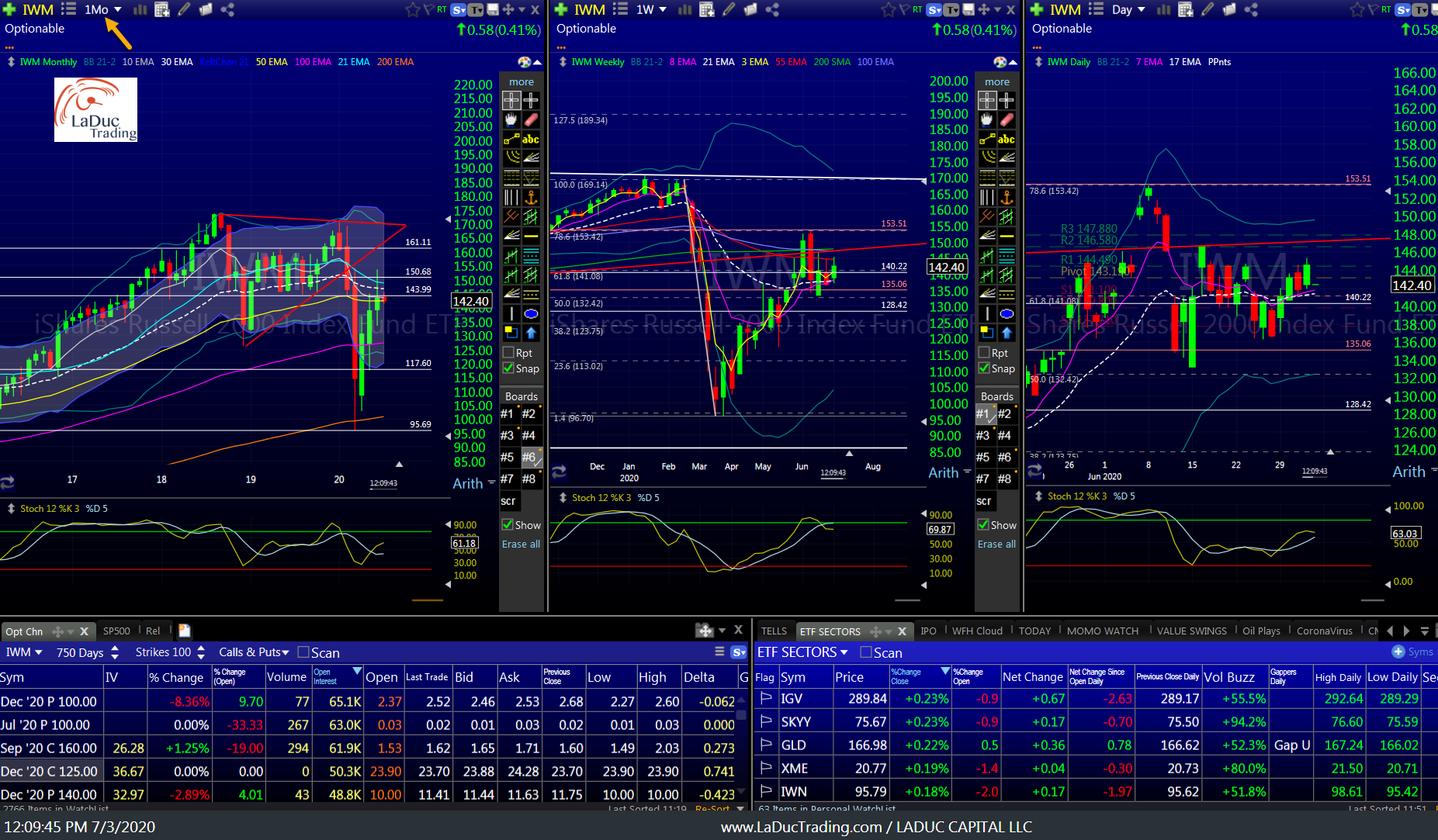

I expect a rotation from Momentum to Value based on a rate spike. If so, IWM should have a tailwind with cyclicals, financials and commodities leading.

Recent IPOs had been great fishing for us from Nov 2019 – Feb 2020. It has again been THE sector to be in since the market COVID lows March 23rd. There are still names in this sector I like. A lot. But I also suspect the parabolas of late in some high-fliers will reset lower and present great fishing opportunities again.

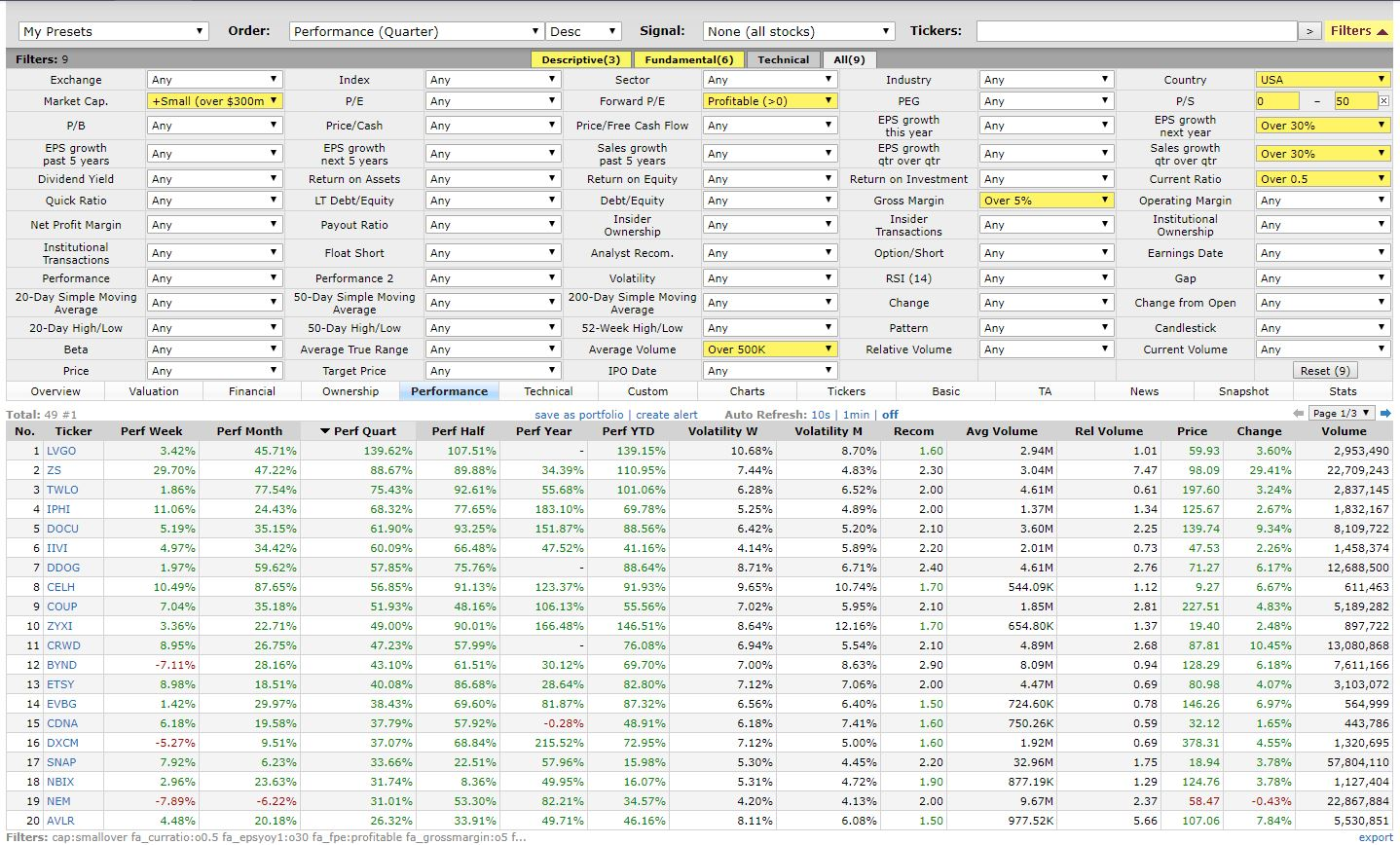

Here’s a look underneath the excitement… valuations rising from high-growth expectations in this New Gig Economy:

And who are we to judge? This Is what success can look like in the long, long run:

The Top Performing Stocks in SPY past 20 years are names many would have a hard time believing were the Top Performing Stocks past 20 years!!

“We are ruthless prioritizers of opportunity; we don’t get distracted” – $ATVI CEO Bobby Kotick

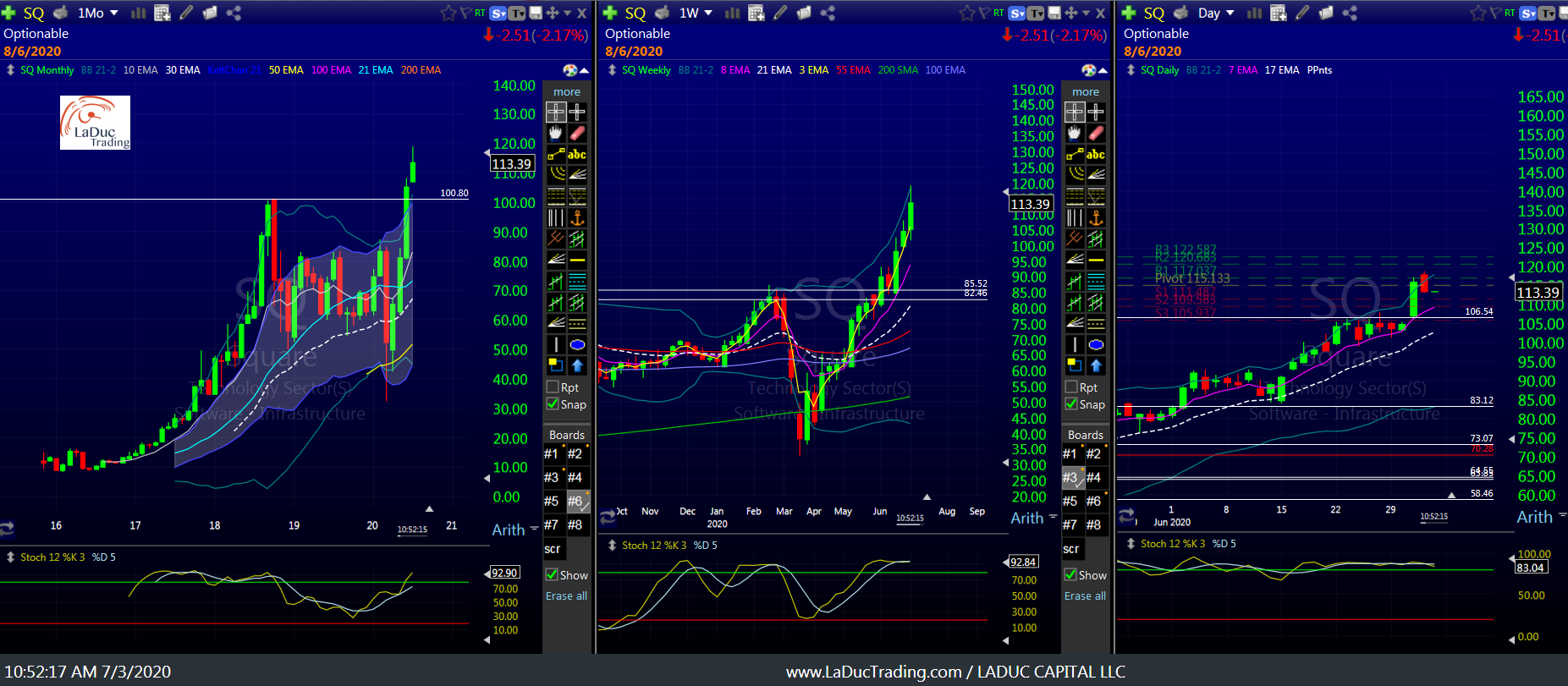

No idea if the following ideas will make it on my list next year let alone in 20 years, but for the second half of this year, here are my favorite “Trend Trading” set-ups (listed in no particular order) that I will be actively trading – some now and some after a pullback.

ROKU, NFLX, GILD, KMDA, NVTA, PAGS, PD, PINS, PTON, RAD, SDGR, SNAP, SPOT, SQ, ZM, ZNGA, BJ, CHWY, CRWD, DBX, FTCH….

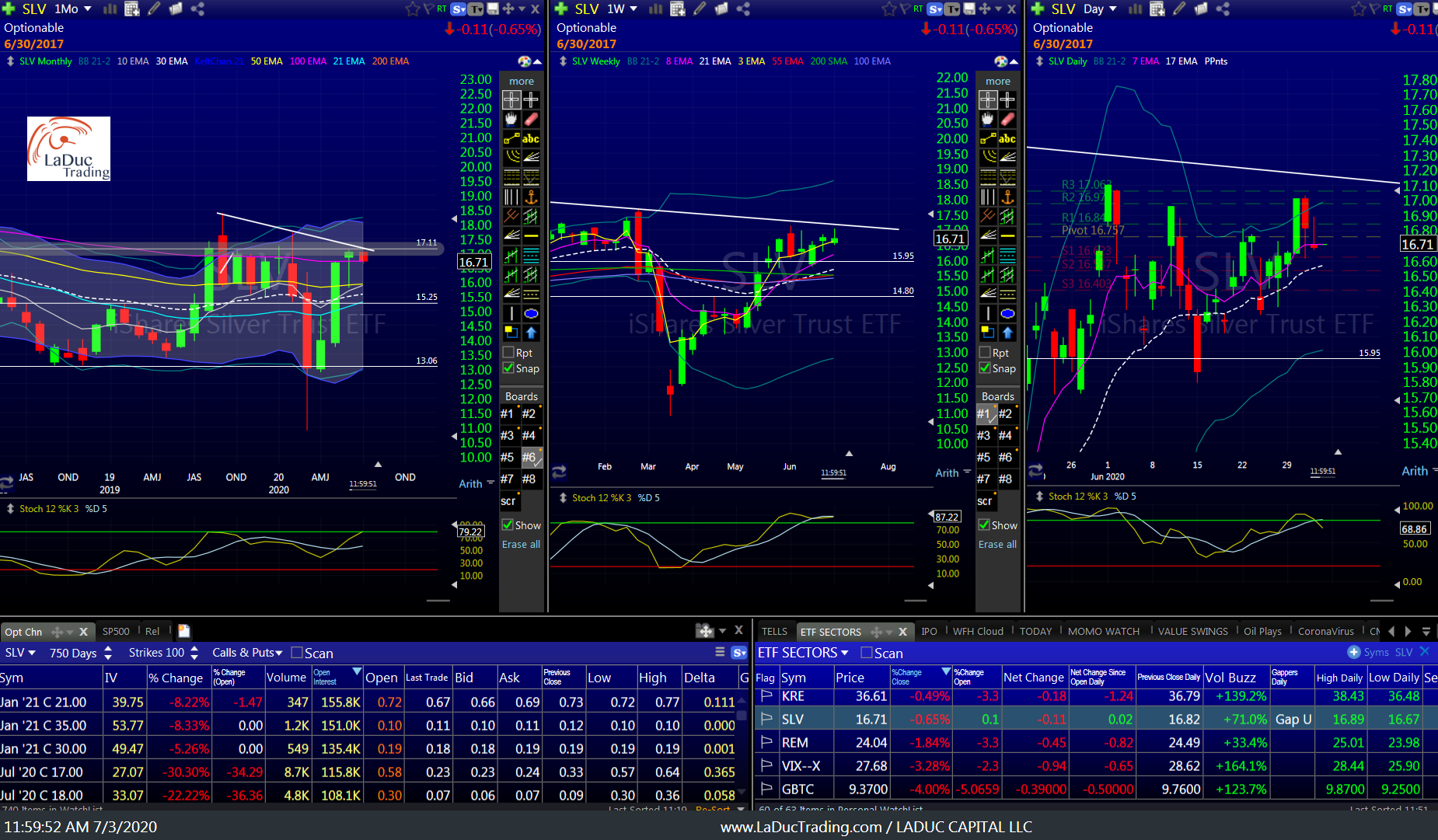

KHC, STZ, TAN, FDX, GME, GOGO, AVYA, VBIV, REPL, JAZZ, GNRC, GBTC, GLD and SLV