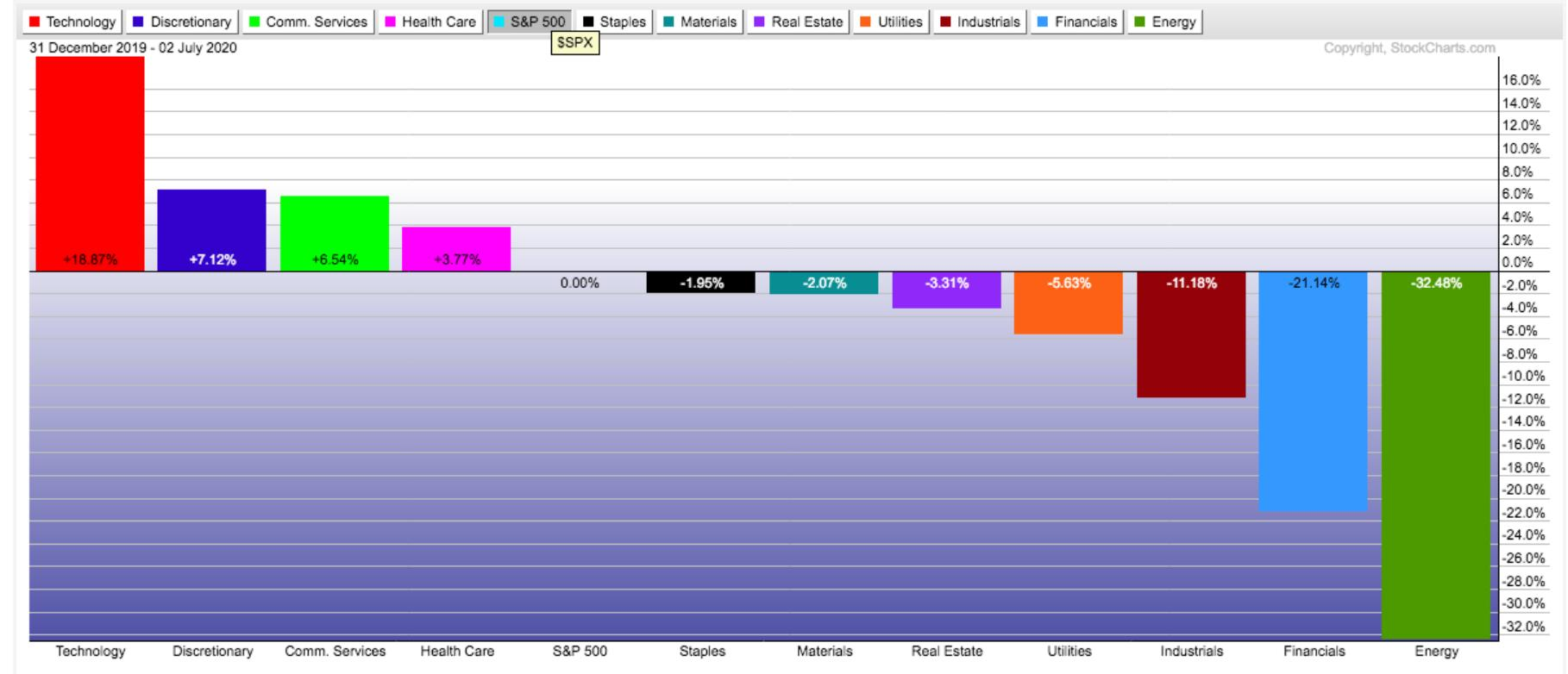

Sector Rotation in 1H 2020

When you look at what the average stock for the first part of 2020 performed, you can see that its performance more closely resembles the economy, which is nowhere close to recovering from the damaging effects of a near-national COVID lock-down after the market crash of February and March.

As of June 25, the NASDAQ Composite was up 10.71% for the year while the median stock within the index is down over 16%. This means that the median stock within the NASDAQ is underperforming the index by nearly 27% as Apple, Microsoft, Alphabet, Amazon, and Facebook dominate the NASDAQ. Financial Sense

Technology is the clear winner and the only sector to hit a new record (led by tech growth stocks like Apple and Microsoft). Other gainers include Consumer Discretionary (led by Amazon.com); and Communication Services (led higher by Alphabet, Facebook, and Netflix). The COVID pandemic has also given a boost to healthcare stocks, but the other seven sectors have not only lost ground, but have lagged behind the S&P 500 (which is down -3.1% since the start of the year). Energy, Financials, and Industrials have been the year’s biggest losers.

Wouldn’t it be fascinating if this list got turned around for the 2nd half of 2020? Well, I’m not ready to bet large on that, but I will bet that we will have opportunities for sector rotation shifts around Infrastructure and Fiscal policies that will produce higher inflation expectations that will drive many opportunities for the rest of the year.

Looking Forward to 2H 2020

The Volatility Feel

History says volatility should abate and the S&P should have a positive return over the next two quarters.

China Outperforming

China took the virus and lockdowns seriously – many would say “too seriously” – but the result of which is that their economy will very likely outperform the US now. Health measures and monetary intervention led economic growth. In the US, Trump’s refusal to react sooner allowed the virus to spread so that now China is in a better position to surpass the US in economic growth. It shows in recent price action for the SSEC, and state-side in KWEB.

China’s Economy Regains Strength After Strict Coronavirus Measures

US Dollar Weak But Not Sick

Assuming the downward drift in USD continues, US markets should be supported. Any sudden shock higher in yields or dollar, however, will change that.

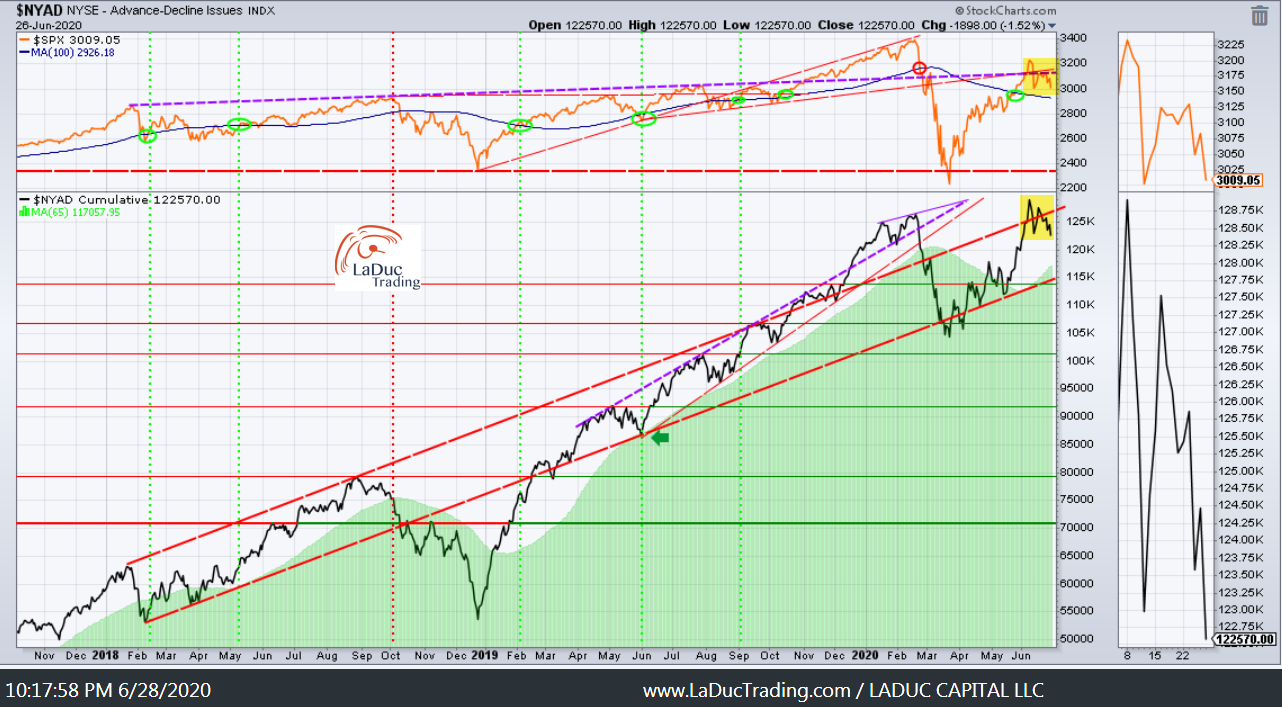

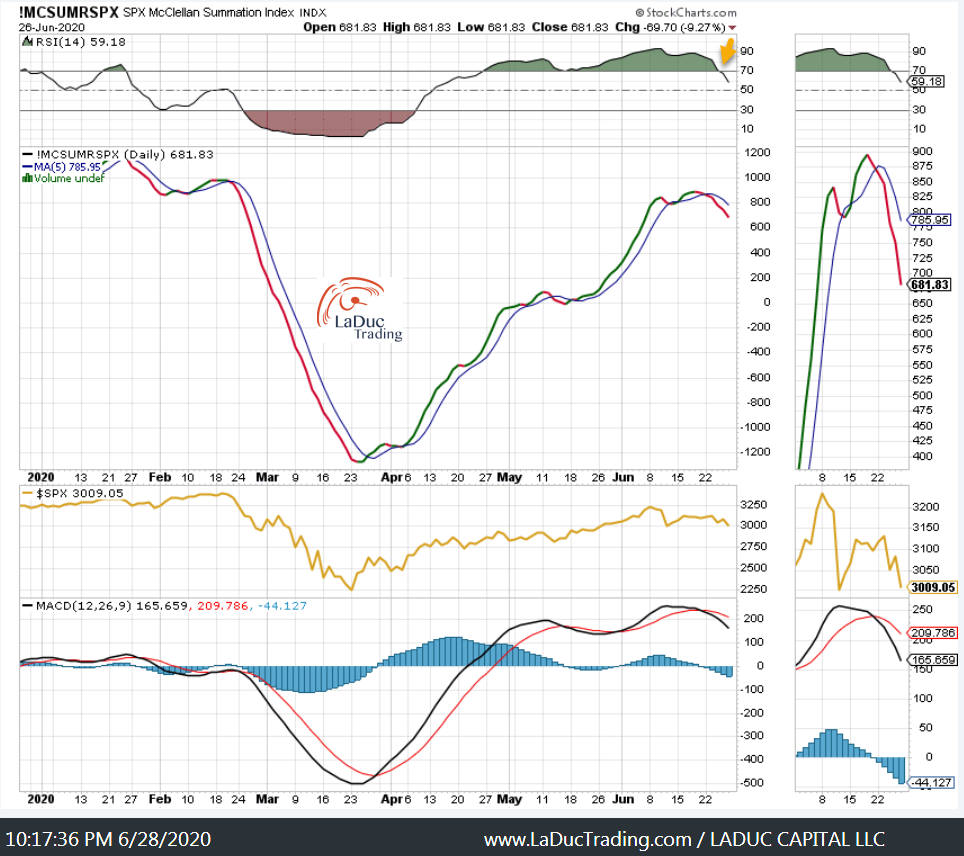

Breadth Continues To Churn

And churn and churn and churn. Think SPX $2950 – 3250.

SPX Divergence

Yes, markets – both SPX and Nasdaq – have been nicely overbought a good spell. Now it seems appropriate to gyrate lower toward oversold.

Nasdaq Highs Not Confirming

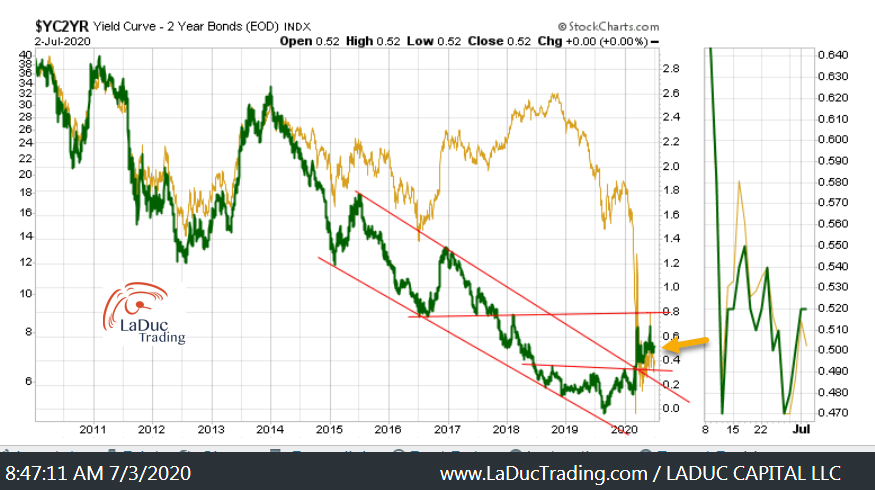

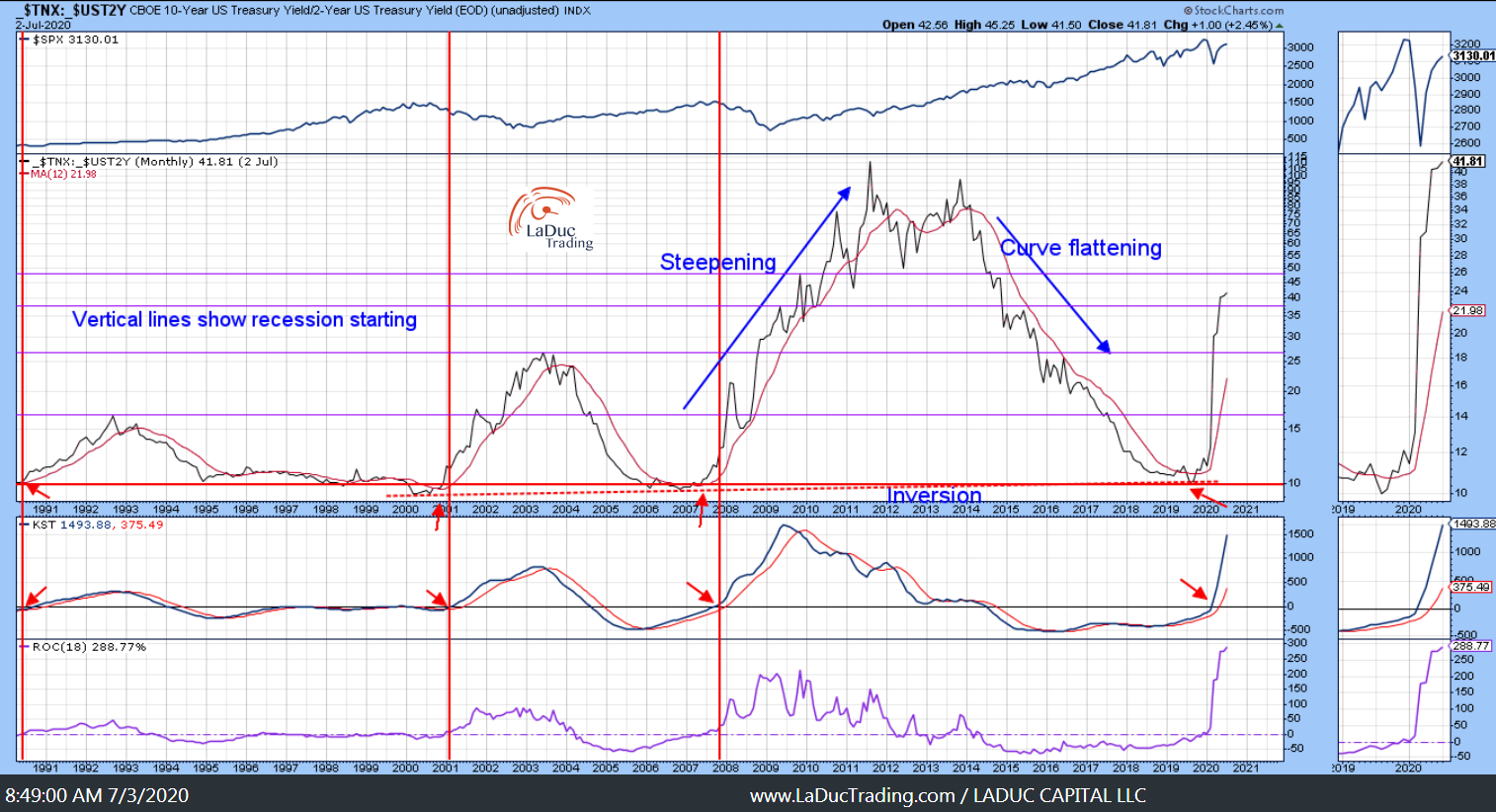

Yield Curve Implies Rate Spike Coming

The 2-year yield curve looks to have based/bottomed and looks firmly higher since Repo madness and negative Oil. I smell a rate spike.

Outliers Revert and Bear Steepeners Flatten

The Bond Proxy trade of Momentum over Value will be tested this summer I’m betting.

Value Poised to Double Bottom”

As Tech serves as a proxy for bonds – with lower yields implying higher growth rates – it may be time to time a turn in Growth plays.

Transports Next to Trigger

Inflation and/or Infrastructure

Silver looks ready to run higher – on either market pullback or ‘less bad’ economic news or Infrastructure bill.

Gold Miners Overbought And Still Bullish

Yes, Gold and Miners are still extremely overbought. And yes, they can stay that way for awhile.

Here’s the big picture bullish thesis for Gold:

This is a perfect environment for gold to take center stage. Fanatical debasement of money by all of the world’s central banks, super-low interest rates and gold mine operation and extraction issues (to a large extent related to the pandemic) should create a fertile ground for this most basic of all money and stores of value to reach its fair value, which we believe is literally multiples of its current price. In recent months, gold has gone up in price to some degree, but we think that it is one of the most undervalued investable assets existing today. There is nothing else that has its historical and fundamental characteristics, and we think that it is only beginning its inexorable, but impossible to time and place boundaries around, uptrend. The fact that it is so under-owned by institutional investors is astonishing to us in light of the obsessively inflationary policies being pursued by central banks around the world.

(Elliot Letter, 4/16/2020)

And here’s a relationship that bears watching again:

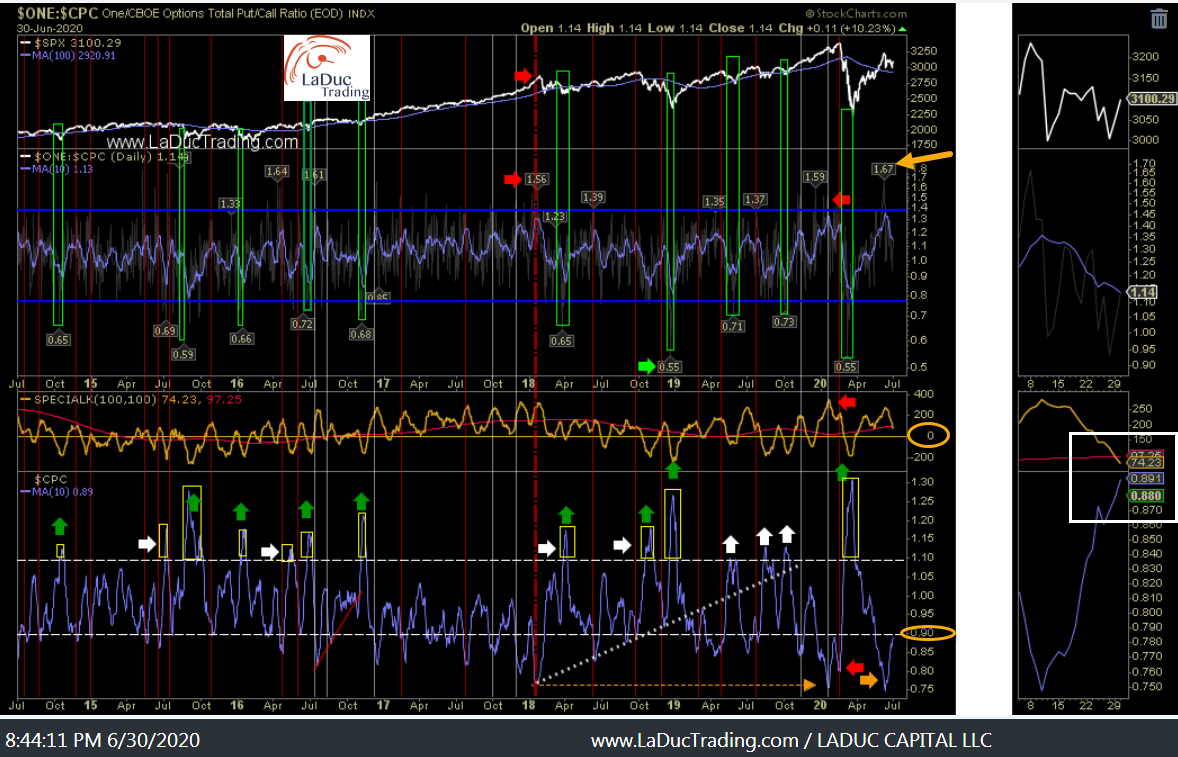

The Next Correction

Timing the next market swoon is a nuanced business. I see it intonating but not confirming, yet.

Summer Trading of Chop

My stock-bond volatility ratio supports both bulls and bears for the next few months.

Risk Happens Fast

My volatility read, however, says we can and will have bouts of ‘risk off’ moments like I have timed past few weeks. I simply don’t see a sustaining trend reversal/correction/crash unless or until the regime change of unlimited Central Bank intervention significantly slows or foreign powers lose faith in our dollar or markets and liquidate assets.

For more ideas and my market thoughts on second half : Second Half Market Thoughts: Fave Trend Set-Ups

I will update with Reflation themed plays once we actually have some follow through on this theme…