Table of Contents

Market Thoughts

Symmetry:

The S&P 500 has recaptured exactly 21.5% from its intra-day low on March 23. It remains down a similar 21.5% from its intraday high on February 19. While not as beautifully symmetrical, after yesterday’s gains, the Dow, and the TSX are all higher by more than 20% but still lower by similar percentages. The Nasdaq is +19.3% but still down 19.6%. Francis Horodelski

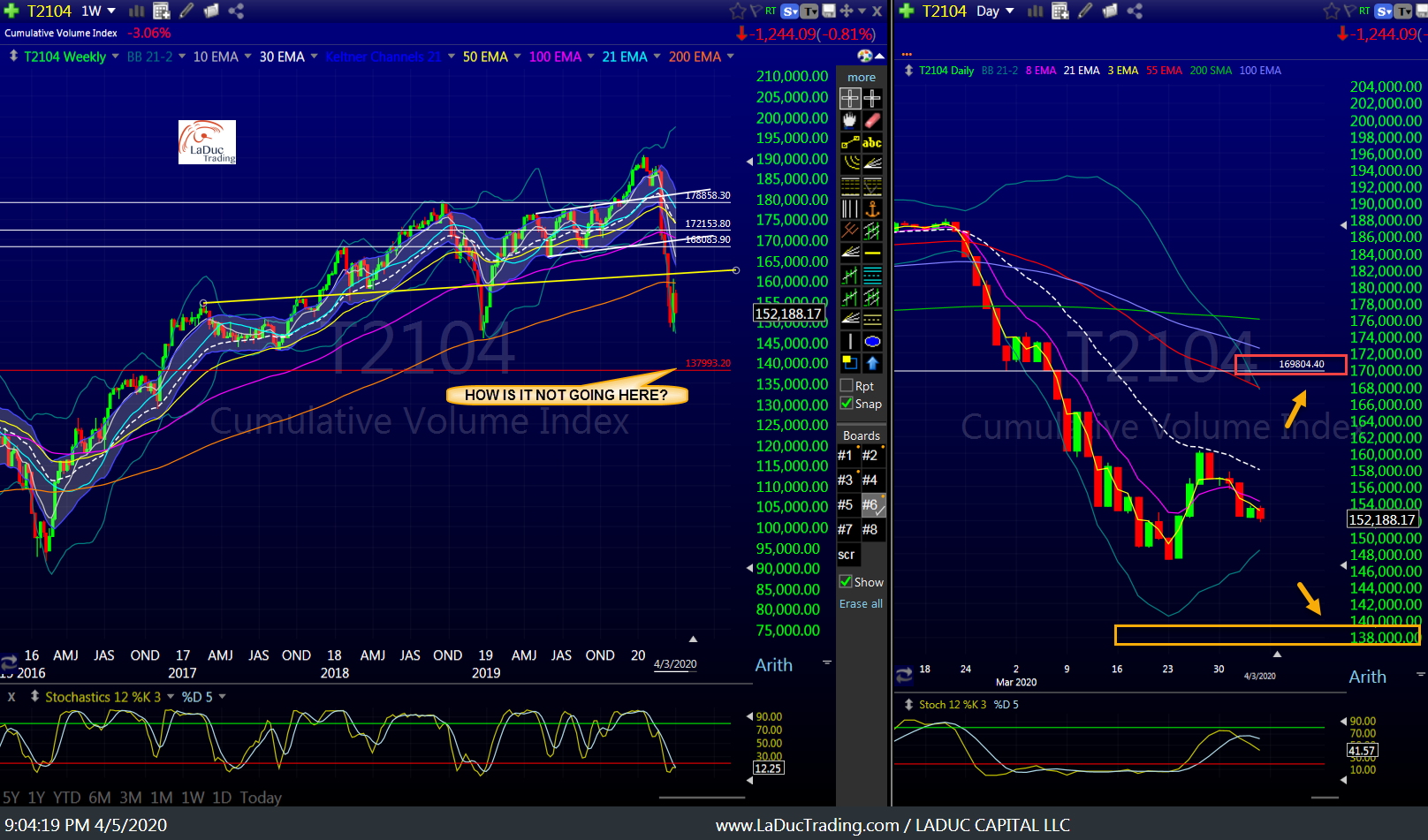

Markets gapped up this morning, then faded hard at 10ET – on no news – before recovering around noon. My read during the fade was that it was in fact a test of the resolve of both bulls and bears chasing, and that the hard fade was likely a head-fake and would reverse higher given my cumulative volume indicator was firmly bullish. With that, I still see SPX $2800 now getting tested before snaking lower next week.

I posted this same chart this weekend as I could see it going higher before coming back into 2016 lows:

In my live trading room I have been tracking the MASSIVE distribution of selling that has been occurring in this indicator of Cumulative Volume since Tuesday February 25. It has served as a playbook of sorts in alignment with another dozen breadth indicators and in support of my market timing calls that have guided my ability to time The Turn February 18th through Friday March 20th. Here is my estimation of where we are headed in the coming weeks – chop then drop.

As I mentioned in my trading room, take care heading into Thursday:

- OPEC meeting disappointment potential (buy rumor, sell news?)

- Jobless claim shock (buy rumor, sell news?)

- Weekend risk (just sell?)

If accurate, this would put us into a down Monday.

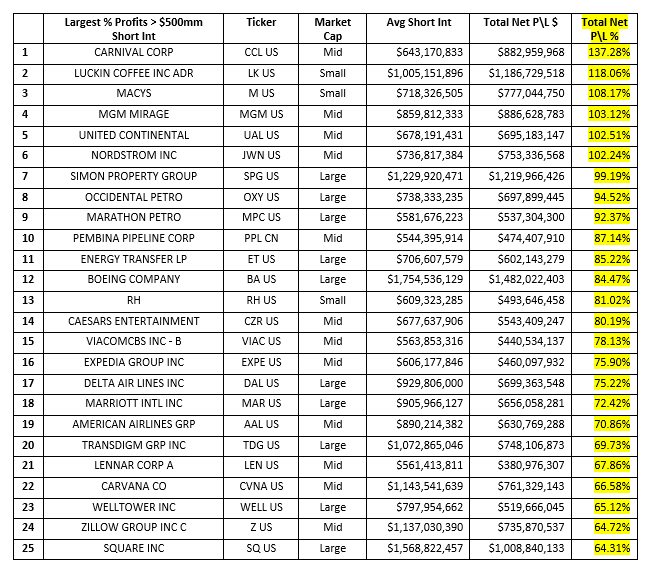

Short Squeeze Candidates

There is some great fishing in short squeezes. Whether recommending CCL Monday at open on Saudi asset stake (stock has risen 30% in 2 days) or REITs pre-market Monday like SPG (up by same amount ~30% in 2 days), stocks heavily sold/shorted can have strong oversold bounces. Here is a great report on the top “Short Squeeze” AND “Profit Squeeze” candidates.

Short Squeezers

Profit Squeezers

Mortgage Crisis Silver Lining

I have written and highlighted my concern with clients regarding a simultaneous Commercial and Residential mortgage crisis yet unaddressed and still lurking under the market.

Global economic contraction introduces very real default risks in corporate credit markets and makes mortgage lenders less willing to lend – sending both MBS and Commercial MBS into free-fall as we witnessed past week and I warned about.

Just on the residential market alone, there are roughly 15 million households, around 30% of American with FED-BACKED LOANS (doesn’t include those that aren’t), who could theoretically stop paying for their mortgages, and if people can’t/won’t pay for their mortgages, then mortgage servicers will not have the capital needed to cover those payments to MBS holders.

I wrote about it in more detail here: Small Business and Mortgage Bailouts Make Banks Nervous

And this article today illustrates the growing problem:

BREAKING: Mortgage forbearance requests jump nearly 2,000% as borrowers seek relief during coronavirus outbreakhttps://t.co/5vbo5C2VC9

— CNBC Now (@CNBCnow) April 7, 2020

Then a client responded with his view, as he is in the business of MBS and credit directly:

yes the mortgage mkt is a mess, but the marks on some of the stuff are 10-15% below the liquidation value of the collateral assuming a 20-25% unemployment rate for 12-18 months, which I do not think is possible under any virus scenario (there’ll be treatments/vaccines before then, that will likely reduce mortality to flu-like rates). In the non-agency space things are even worse and pricing agencies are doing opposite of what they were doing during GFC, which is under-mark securitized products to levels that make no sense. We are close to a fund that deals w/ non-agency paper and they are regularly selling paper 10-20% above where pricing agencies marked the day prior(these are Level II/III assets). Long way of saying that imho there’s way more bad news already priced in mortgages than can possibly come out, and they have not bounced off the bottom at all so far. You are paying $0 for what I’m telling you , and it may not be worth even that, but staying in the A and higher quality range, w/ a 2-4 yrs range AND sticking with funds that have NO leverage, I think there are some exceptional risk/reward opportunities especially in the non-agency space.