Table of Contents

WEEKLY FISHING PLAN

Each Sunday/Monday I post my Weekly Fishing Plan for Clients. Please keep in mind, we need to be flexible when fishing. We can start with a plan on where to fish for the coming week, but weather can change quickly, so daily updates will be posted referencing this living document so as to better set and adjust expectations around where I want to fish, when it’s a good time to fish and when it’s time to wait or cut bait. To Great Fishing!

WEEKLY FORECAST

- US Market Indices: Rising Tide Lifts All Boats

- Top Risks: What Moves Below The Surface Can Kill You

- Key Charts: Better to Swim With The Current Than Against It

- Earnings Strategy: To Fish or Not To Fish

- Upcoming Market Moving Events: Bait

US Market Indices

After the most recent pullback in September I gave my expectation for market direction here: Market Thoughts: When Is It Safe To Buy?

|

We are still on track for SPX $3060-3080 before a sizable test – one way or the other! Having said that, Volume on the S&P is at lows not seen since 2007. No buyers. No sellers. How easy it will be to move markets once ‘they’ step in. Careful either way… And Why I wrote: The ‘Numbing Effect’ of Uncertainty

Wednesday is VIX expiration day and Friday’s have been de-risking days, but the Big Events that are market-moving are coming up:

- Mid-Oct: US Treasury FX Report

- 10/24: ECB rate decision

- 10/30: Fed rate decision and $AAPL reports

- 10/31: BOJ rate decision and Brexit extension ends

Top Risks

Earnings Recession

With 19% of companies reported, S&P 500 earnings down 3% year-over-year, slowest growth since Q1 2016.

S&P 500 sales up 2.8% in the past year, slowest growth since Q3 2016.

- The last 3 times S&P 500 earnings growth turned negative following an inverted yield curve…

Q3 2007 (recession began Dec 2007)

Q4 2000 (recession began Mar 2001)

Q3 1989 (recession began Jul 1990)…and when did the Fed start cutting rates after yield curve inversion/earnings decline… Sep 2007 Jan 2001 Jun 1989

Today, the Fed started cutting rates in July and is expected to cut for a 3rd time on Oct 30. They are acting as if we are heading towards recession. @charliebilello

Repo Matters

$29T in Global USD Bank deposits. $20T of it is “owned” by foreigners, and it’s leaving US Banks. @DeepThroatIPO

JPMorgan Warns U.S. Money-Market Stress to Get Much Worse

Short Volatility

The Short-Volatility Trade Is Now So Big It’s Starting to Break

The February 2018 VIX blowup was like a heart attack for short vol. The more persistent threat — the shrinking volatility risk premium — is more like a degenerative disease afflicting the trade. @LJKawa

Momentum-To-Value Rotation

Private equity managers won the financial crisis. But will they cause the next one?

AAPL and FED Report

Oh the timing: $AAPL (with $FB) report just before FOMC October 30th. Individually they can cause a market pullback. So what are the chances both $AAPL + Fed disappoint, together? Keep in mind: Oct 30th fed cut expectation is now at 91.4%…

“….if the market thinks the only thing which is keeping it elevated is the prospect of more “cuts” down the road, then it’s going to fit to that model appropriately.” @MacroMorning via COMPENSATION & INCENTIVES

With 92% probability of Fed cut next week, Powell could be setting up market for disappointment.

$AAPL is a sell here pic.twitter.com/GhHiCztr9c

— Thomas Thornton (@TommyThornton) October 20, 2019

Impeachment

Steve Bannon predicts “focused’ Pelosi will impeach Trump in the next six weeks

Key Themes

Small Caps Lead

Small caps have run the most (compared to other indices) as they are comprised heavily of regional banks (which like the recent move higher in rates), so this is my focus for watching market sentiment:

Rates Matter

Speaking of higher Interest Rates, that call was well timed, but now that the 20-year has reverted to its mean (red trend-line), there will be many eyes watching if it bounces, or not. Gold, Silver and Miners move in lock-step of late so this is the Macro trade for many. And with that, the USD is also on important support…

Sector in Focus: Transports

I have presented this chart in recent posts, most notably my Intermarket Chart Attack wherein I said my IYT:SPY ratio work looked short-term bullish. We will see if it can ‘jump the shark’ at resistance.

Rotation Focus: Momentum-To-Value Continues

I have been focused on this rotation before it even became a rotation: Monday Massacre. One look at IGV, MTUM, FFTY components and you will see that Unicorns are not flying so close to the sun anymore – WeWork was The Tell

And here’s the ONE BIG THING to keep in mind:

If they sell $AAPL $MSFT, why buy anything else? We may get to a point where Money Managers sell good stocks to make up for huge losses in private equity portfolios.

Earnings Strategy

I already wrote about this in the “Earnings Season” section of the latest Gone Fishing Newsletter.

Prefer this season to focus on “Value” plays as my intermarket analysis points to rotation (finally) from growth into value. I prefer cheeky directional (underpriced options), sold straddles (big IV), ratio backspreads (ie. 2 calls, 1 sold call), and financed spreads (ie, call spread financed with sold puts against) as fave option tactics. Otherwise, I prefer to sit it out and chase afterward!

I am Bullish: RTN, TWTR, SNAP, HOG

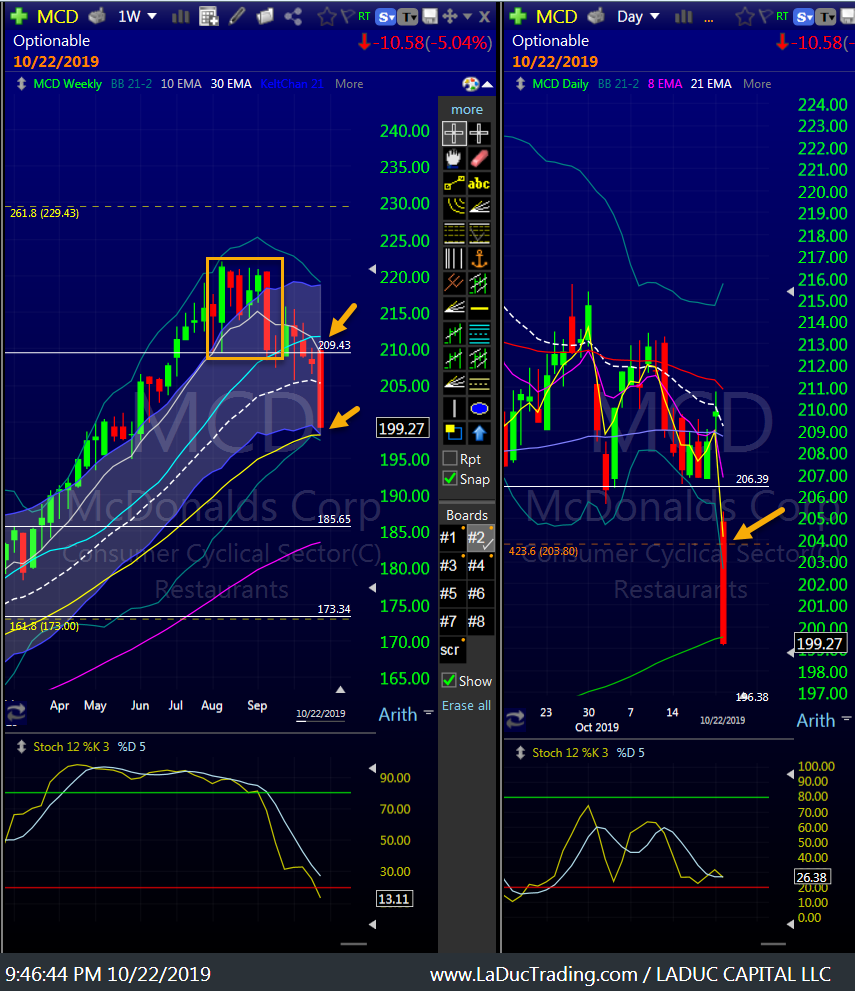

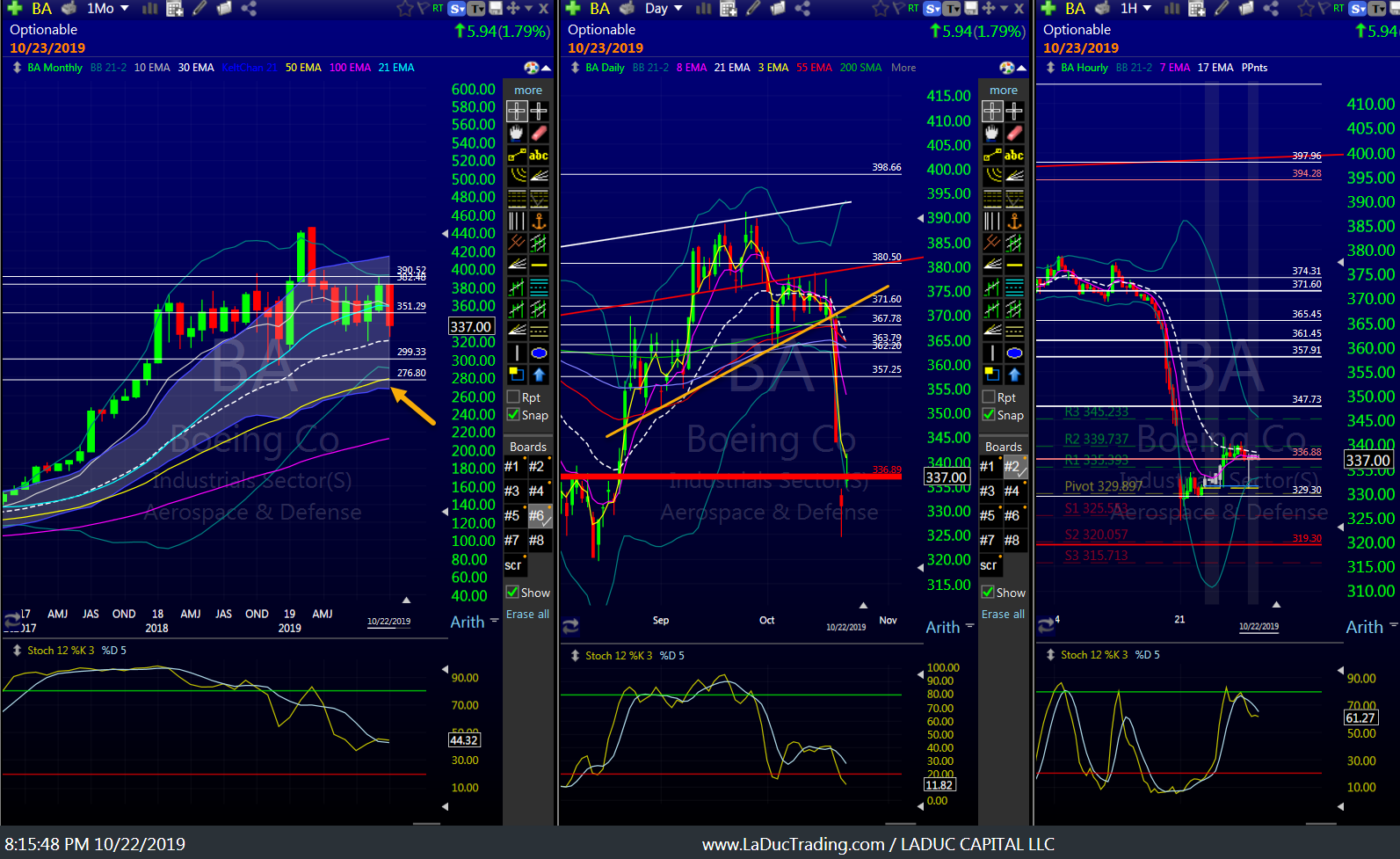

I am Bearish: MCD as suggested September 15th below $215, CMG, INTC, BA

Upcoming Market Moving Events

US and Global Economic Calendar: View Economic Calendar

Wednesday is VIX expiration day and Friday’s have been de-risking days, but the Big Events that are market-moving are coming up:

- Flash PMI prints Thursday and given past slowing PMI reports, these will be closely watched for more signs of coming recession.

- Mid-Oct: US Treasury FX Report

- 10/24: ECB rate decision

- 10/30: Fed rate decision and $AAPL reports

- 10/31: BOJ rate decision and Brexit extension ends

For more color, find the section “Here’s the Uncertainty for the Coming Week” in the latest Gone Fishing Newsletter.

DAILY FISHING PLAN

- Trading Ideas: Casting for Good Trades

- Trade Review: The Catch

- Study: Fish Stories

- Taking Down a Shark (the out-sized profitable trades)

- The Ones That Got Away (the losses)

- It Was “This” Big (didn’t trade it but should have)

Trading Ideas

Trading Ideas from my Live Trading Room will be captured here intra-day and an email sent letting you know a Daily Recap is posted.

* Note abbreviations

- PT=Profit Target, SL=Stop Loss

- BO=Breakout, BD=Breakdown

- CS=Call Spread, PS=Put Spread

- TL=Trendline, PB=Pullback

- UOA=Unusual Option Activity

Monday: BA, RTN, TEVA, PM, MO, SHOP, NFLX, MA, V, GME, HBI, FL, URBN, GPS, ANF, M, BSX, SNAP, TWTR, HOG, MCD, XBI, IYT, XRT, COTY, UUP,. NTNX, CGC, FCX

- FCX has been a suggested long since it got>8D (yellow arrow on D), and moved > TL resistance/10 WK. Risk: EPS 10/23 and USD bounce. Suggested Option: Jan 2020 $10C $.63, Dec $10x11 CS $.40 (to make $1), Nov $10C $.36, or creative “Inside Ratio Call Spread” for scratch (zero cost):

- CGC as bottom fishing play since last week. Long if it can get/stay >$21

- NTNX gorgeous inverse H&S on WK I’ve stalked and even played over the weeks. It’s an oversold Cloud play >10/21WK. EPS not until 11/26 + rises when other cloud plays fall. Like Jan $27.50x30 CS.

- Macro Theme: DXY or UUP likely to bounce off $26.55 which is 100D/21W.

- COTY +12% is a chase/swing as long as it stays >$11.

- BBBY is one of fave oversold retail plays. Closed last week on 10/11 at 200D when $13 + suggested CS at $12 w $15PT.

- XBI IBB swing long suggestions as they are oversold relative to peers and with nice cradle patterns on weekly.

- XBI, IYT, XRT as fave oversold sectors long.

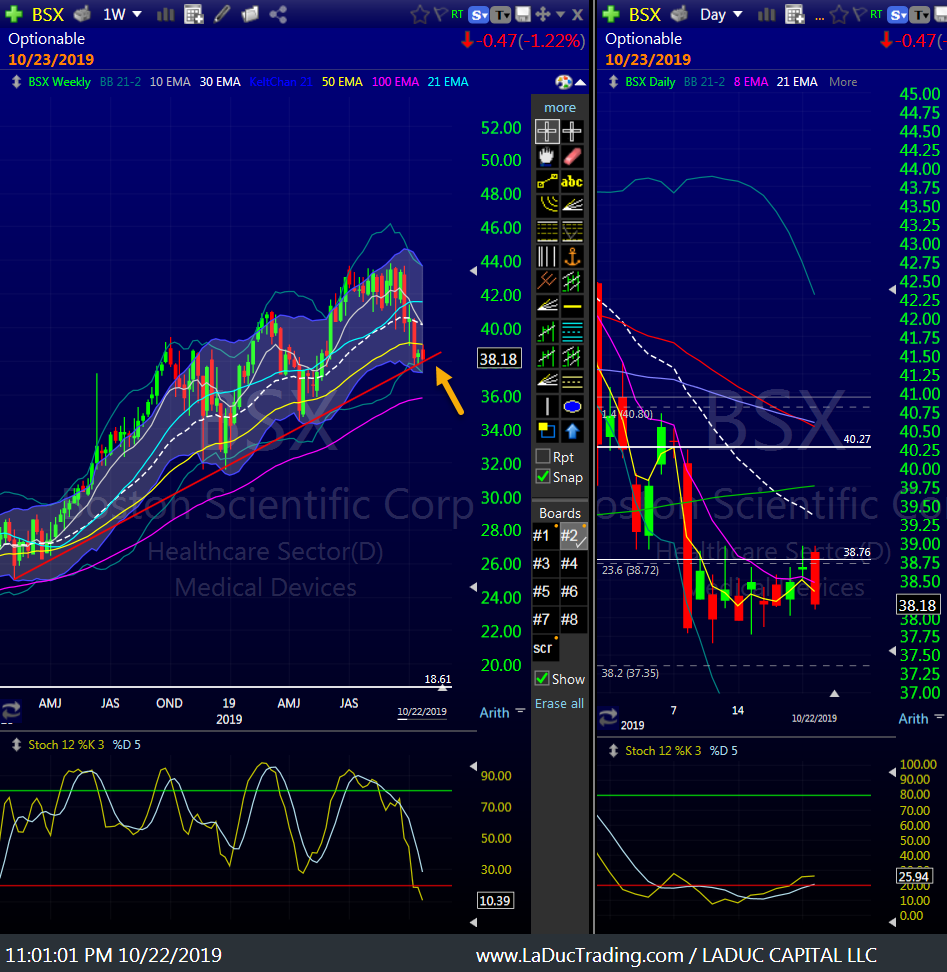

- BSX, SNAP, TWTR HOG as fave EPS plays long, MCD short.

- M has new flagship store opening this week and JWN looks great for higher – two other fave oversold retail plays with LB

- URBN, GPS, ANF also look great – again, oversold XRT plays as Momentum-to-Value continues.

- GME, HBI Nov $16C for $.65 UOA with 2.8K contracts, FL also in play

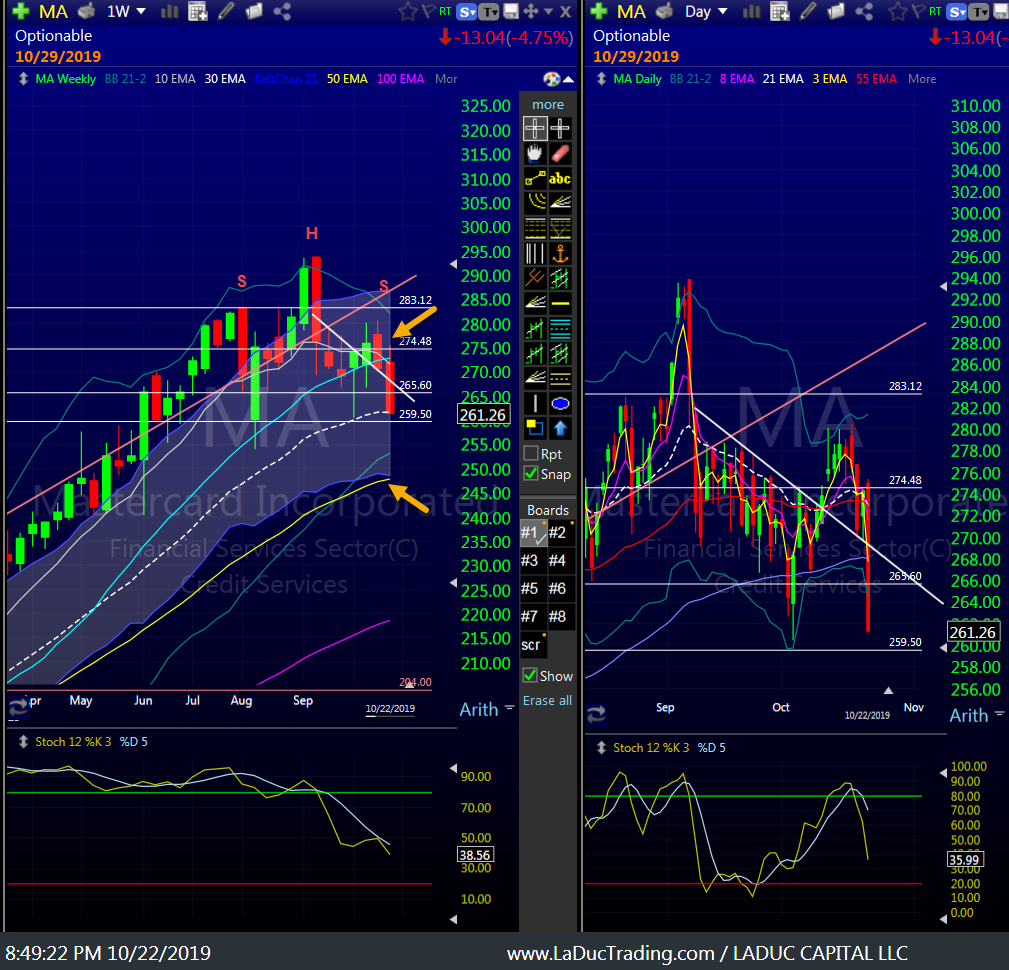

- MA and V in particular but PYPL and SQ as well look to continue short

- NFLX tagged PT of $175 Friday (my Wed PT), but break of $171 = $166 short.

- SHOP is a short < $339 wk close

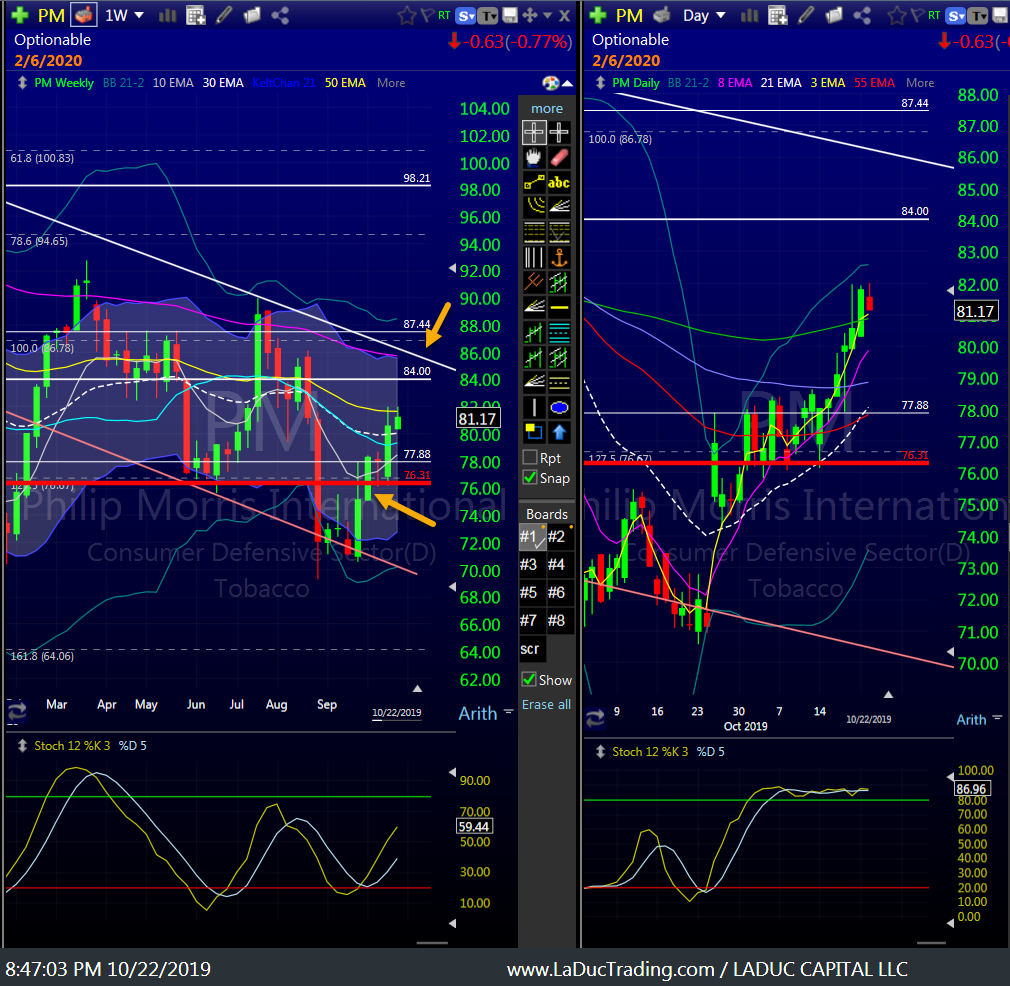

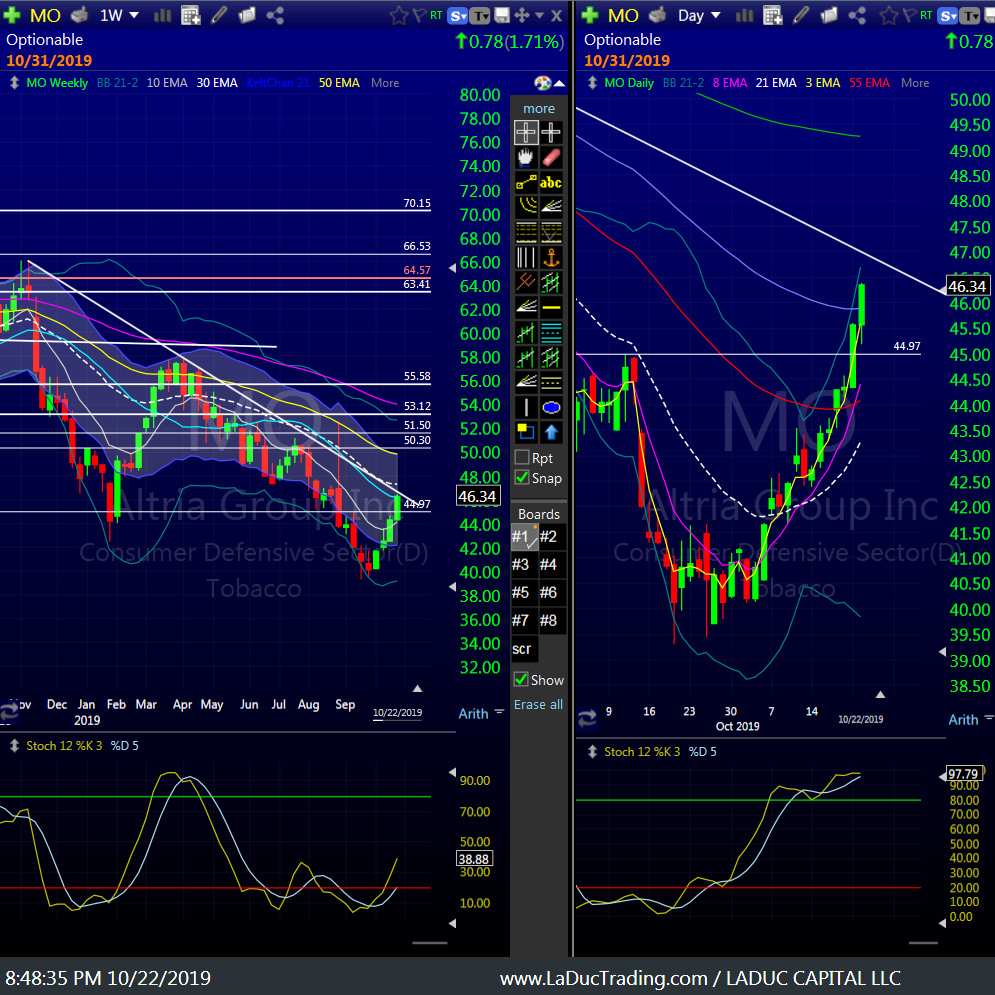

- PM and MO continue strongly off recent lows: recommended at $76 for PM and $42 for MO

- Friday said shippers were extended and due a pullback. They are.

- TEVA >$7.40 w $6.50 stop for Bottom Fishing Trend reversal play w $9.70 PT.

- RTN continued long from last wk recommendations as part of XLI fave plays with FDX, MMM

- BA continuation short from “h” pattern last wk at break of 200D at $368 w $362PT. Left computer at 11:30am Friday for appt (Elizabeth took the Nov $340P and that was my plan as well), but I came back at 3:30PM and BA had already failed $348 so $20 drop! Today, major support at $337 also 100W was taken out with overshoot to $324 (surprised as $337 is MAJOR support). Price outside BB on Wk = Bounce candidate >$327. Big Picture: Above $337 bullish, bearish below. Broken Stock. Have written and talked about this one for months as Major Topping Pattern on monthly.

Tuesday: BA, SNAP, TWTR, BSX, BABA, MSFT, V, MA, SHOP, IGV, OKTA, CYBR, COUP, WDAY, TEAM, VEEV, REGN, EWZ, PBR, VALE, SLB, HAL, NOV, CVX, SPOT, NFLX, TEVA, SRPT, VRTX, PTCT, RTN, BIIB, HOG, NVDA, IBB, XBI, BIIB, MCD

- MCD missed EPS: I’ve recommended this one short for awhile as suggested September 15th. Specifically, I suggested the Nov $210x205PS – spend $2 to make $5 then directional puts after $205 open.

- IBB XBI gapped up on BIIB. I had recommended all in my trading room specifically the Dec $250C – went from $3.95 to $60.

- NVDA has moved nicely up and then this AM news of 5G partnership.

- HOG beat, which I expected, then price hit TL resistance and pulled back. I still like long.

- BIIB almost filled it’s D gap but CITI comments came in cautious so caught the chase lower.

- RTN >$202 with $211 PT as merger partner UTX reported EPS.

- SRPT, VRTX, PTCT are beneficiaries of BIIB news.

- TEVA rose 18% Monday and needs to digest now. Still bullish as bottom fishing play with time.

- NFLX added $2B of debt and stock dropped into my $266PT. ‘Should’ bounce but if it doesn’t it is Strong short into $226.

- SPOT has EPS next wk + I’m bullish: They have 232M users and a partner in China.

- CVX got a license for Venezuela.

- SLB, HAL, NOV are fave oil&gas plays long.

- EWZ, PBR, VALE are Brazilian plays on the move.

- REGN looks ready to move higher. NVS is still fave trend play.

- IGV plays OKTA CYBR COUP WDAY TEAM VEEV still shortable.

- SHOP shortable after 30wk bounce at $300

- V MA still shortable

- MSFT is rolling over near all-time-highs $142.

- BABA broke 200D w H&S on Hr = $160 PT

- BSX has EPS Wed and sitting on WK TL support.

- SNAP, TWTR still moving violently ahead of EPS so plan is to chase after although I am bullish both. Prefer TWTR Dec $42C.

- BA had positive news of 737 MAX production rate and Return to Service w EPS Wed. We shall see…

Wednesday: BABA, NKE, SHAK, CMG., VXX, REGN, FCX, BSX, SNAP, NTNX, KO, BA

- BA post morning EPS said swing long IF if could stay >$348. My Chase idea was it would likely fade $10, and by 11:30 BA broke $348 down to $365 before bouncing. Big Picture this is a broken stock. Will be putting out a Market Thought on BA shortly.

- KO as potential Trend long post EPS with improving fundamentals and not-bad chart. Not a momentum play.

- NTNX fave from past few weeks popped 2.4% after a 17% run this month as it runs into $28.86 /30Wk/inverse H&S pattern with PT closer to $35 in next few months. Options are starting to “make a market’ in this name.

- SNAP post EPS down near $13 at 50Wk. Still not safe to take long. Waiting on TWTR to report 10/24.

- BSX my long EPS idea I didn’t take popped 6% to $40 PT (options suggested + 165%). Nice morning-star-reversal candle forming on Wkly. Again, this is off Wk TL support (see chart below). Now needs to digest this gap up >200D to move higher. Dec $43C .46 were largest strike open today.

- FCX recovered after a brief sell-off post EPS to close up 2%. Very constructive. Still prefer CS assuming it can stay >$9.50 close.

- REGN is fave bio right now as it steadies >10/21Wk crossover. Needs to stay >$300. Options are a tad thin.

- VXX $21x24 CS for Nov (.64 to make $3) are calling me. Will place by Friday.

- CMG suggested chase short when opened at $812 which is also below the 55D with PT of $789.50. It tagged $782.40 before closing at $788. Restaurants were very weak: MCD, SBUX, SHAK – as suggested back in mid-September to short. Does not look done.

- SHAK 1st PT short of $81/30WK

- NKE faded 3.4% on news of CEO departing. Large bearish engulfing on Wk in play. Below $95 is short to $90/55Wk.

- BABA on $168 support, but not convincingly. Break lower = $160PT.

Thursday: TWTR, SNAP, AMAT, RTN, MCD, IGV, GLD, REGN, BSX, NTNX, KO, BBBY

- Besides earnings movers, there was a lot of chop in indices and individual names.

- MSFT traded higher with IGV plays bouncing.

- USD was higher with gold, slv + miners and rates.

- TWTR dropped 20%, TSLA popped 20% – both were outlier events so I choose to buy TWTR as it moved 8.9 std dev on lower revenues but had 17% more UAM (active users per month).

- SNAP above $13 is a long but the 200D wasn’t tagged so may need to wait until a bottom pattern presents.

- Semi’s moved strongly higher on LRCX earnings results. MU announced a new chip to compete with INTC.

- AMAT suggested Nov 53.50C near open as it had large block stock buys in addition to UOA and nice chart. Opened at $53, closed at $55. PT $55.50

- RTN overshot my $211 PT to tag $214 before closing back near $211.

- MCD continued lower and is about to triggers a long-term trend reversal (if indicator breaks < 0 on bottom panel). I have recommended this short since Oct 12th: chart below.

- REGN, BSX, NTNX, CGC, KO, BBBY continued to act well.

Friday: AMZN, TSLA, INTC, GLD, SLV, USDCNH, TWTR, SNAP, PM, MO, RTN, AMAT, NFLX, MCD, IYT, MMM, FDX, UPS, XRT, ANF, URBN, JWN, KSS, BBBY, SLB, FCX, X, XNET, GBTC, VIX, VXX

- AMZN and TSLA: If you like 5min bars then I recommended some good chases with Friday lottos. I tweeted this morning that AMZN would get bought and it opened at $1698 from $1617!! It then proceeded to run at a lovely 45 degree angle to $1764 – no break. My 1st PT was $1722 then/if $1750. It surprised me how strong it was. There was more volume in TWTR selling than AMZN buying and yet…

- TSLA was about letting shorts cover. Said it would take 2-3 days. Well, I expected $324+ to be the pause place, but it hit $330. I saw several Big Bears throwing in the towel on their Put spreads so I guess it’s time to short soon. But I wouldn’t know where. This one is more fun to watch then play unless you are feeling total cowgirl.

- INTC was another recommended chase before open. Swing >$53.30 + Chase >54.25. It tagged $57 in AH last night which was my PT long today. It made it to $56.54 today from $54.19 open. Obviously Semi’s followed with NVDA leading the way. I might mention however that SMH hit some major resistance on this move…

- GLD and SLV were nice short calls in my room based on divergence with USD/CNH. The Dollar/Yuan carry trade leads gold of late and it was tanking while precious metals were hovering near resistance. Why convicted? SLV gapped up to $17.09 which is monthly resistance. Above is surely bullish, but as suspected, the pullback was quick and vioilent. I am still on the fence which way the metals will run but I have my doubts it is higher. Sorry. I think GLD fills that $136 gap before it is ready.

- TWTR has surprisingly had no bounce. It is extremely oversold. I am staying long and here’s a great thread as to why. Remember, it increased DAU 17% and put in place protections for privacy. It’s the better product, more trusted product to FB, but FB makes more money and owns their closed-loop eco-system. I’m still bullish TWTR although the price of its stock looks headed to $27.50. Large Nov $32C were bought today so we shall see.

- SNAP was a new addition for me long as threatened if it held $13 support and bounces off the 50Wk.

- MO and PM held well and had good news from Trump/White House (not for kids but that’s another story) as it related to removing a partial ban on vaping products.

- RTN continued higher as did AMAT, BSX and NTNX!

- BBBY not only tagged my $14.50 PT but THEN someone came in and sold Jan $14P against it in size. They don’t mind owning around 12.50 if it happens.

- NFLX bounced precisely off my $166 PT to $278. I’m not bullish but that was a nice play for those who took it.

- MCD continued to fall tagging $194 from my suggested short <$215 few wks ago – see charts below.

- IYT plays (one of my fave recommended sectors past month plus) were excitable with MMM reversal off EPS disappointment, FDX continuation and UPS has lots of bullish UOA.

- XNET is a Chinese Blockchain I caught early today after reading Chairman Xi says China will build a blockchain. That set up the Bitcoin space including a 20% jump in GBTC. I commented that XNET had just few thousand contracts in Open Interest after it spiked 50%. By noon, it had attracted about 40K contracts of new Volume and the stock doubled again. Early Innings.

- XRT plays I have suggested for weeks were very active: ANF URBN JWN KSS

- FCX and X had bullish moves above their 10WK, but now we need follow through…

- USO / WTIC Crude continued higher with Refiners – VLO MPC CVI HFC need a rest!. Keep waiting for the XLE OIH XOP XES contingency to play along. In particular, SLB…

- VIX should bounce soon – again Oct 31st is when I expect we start to get a 2-way market again post AAPL earnings release (buy rumor, sell news) and FOMC meeting/press conference. I especially see mid-November for big moves.

- VXX trade was entered in case Impeachment moves or China Trade headlines enter this weekend.

Chart Review

My Price Targets on NFLX were hit: $283 to $275 with $266 and as discussed in the room, $266 was a good bounce area – chart is inside: Market Thoughts: Fading The Pop in Netflix

McDonalds also worked and is still working:

UOA

PROTECTION HITTING THE TAPE LAST FRIDAY

- $XLF Jan ’21 P 24.00 31K contracts $1.19 BOUGHT 10/18 PRE BREXIT

- $XLK Jan ’21 P 55.00 23K contracts $1.30

- $XLY Jan ’21 P 85.00 21K contracts $1.80

- $XLV Jan ’21 P 70.00 20K contracts $1.85

- $XLI Jan ’21 P 55.00 26K contracts at $1.30

- $XOP Jan ’21 P 16.00 27K contracts $1.42

- $OIH Jan ’20 P 10.00 32.5K contracts $.44

Study

-

-

Taking Down a Shark (the out-sized profitable trades)

-

The Ones That Got Away (the losses)

-

It Was “This” Big (didn’t trade it but should have)

-

RULES of Engagement

Volatility, Direction and Time are the three most important components of choosing an option. Expected duration of a trade guides the choosing of an option expiration date. I have learned it doesn’t hurt and often helps to add more time than you think is needed. Generally, I employ Directional (naked) Options in high-probability directional trades expecting increased volatility. Option Spreads are employed for gradual volatility in directional trades. Combination option tactics (ratio backspread, financed spread, butterflies, etc) are most beneficial for event-driven trades as well as for ‘set-it-and-forget it’ type swing trading to capture a trend further out in time.

Most often my options are bought (not sold naked), at the money with highest gamma, or out-of-the-money strikes based on projected price targets. I trade primarily three timeframes:

- Chases (1-3 Days employing options 1-3 weeks out)

- Swings (1-3 Weeks employing options 1-3 months out)

- Trends (1-3 Months employing options 3-6 months out)

Chases are largely news/event driven trades or volatility technical patterns that last a few ‘days’, sometimes just hours. Momentum drives the price action, which can be volatile, so active management is required. Samantha will share chase ideas in her LIVE Trading Room as they happen, calling out and/or annotating charts with entry, stop, profit (ESP) targets. Swing and Trend trades will be posted in the LIVE Fishing Plan (Google Doc) and Trade Log (Spreadsheet).

Trailing stops can be based on percentage of profit/loss of an option, the price level of the underlying, the theoretical price of the option at profit/loss targets… but in most all cases, the CLOSE of the underlying at its moving average guides the trade exit: 3D for Chases, 8D for Swing, and 21D for Trends.

Ideally, we want to use a Macro-to-Micro backdrop to get into a trade but a Micro-to-Macro approach to get out of a trade. By that I mean, when successful, we want to roll profits into further out-dated, higher-priced options, convert directional plays into spreads to protect profits, all the while taking partial profits/adding to positions along the way. We want to turn a profitable Chase into a profitable Swing into a profitable Trend while being mindful that losses are not to be feared but managed.

Consistency sounds boring and trading is neither consistent nor boring. But if we consistently manage our winners and our losers than the results will take care of themselves.

Important Disclosure

LaDuc Trading/LaDuc Capital LLC Is Not a Financial Advisor, RIA or Broker/Dealer.Trading Stocks, Options, Futures and Forex includes significant financial risk.We teach and inform. You enter trades at your own risk. Learn more.© Copyright 2016 LaDucTrading™. All rights reserved:No content may be copied, recorded, or rebroadcast in any form without the prior written consent of LaDuc Capital LLC®.