Market Moving News Today

JUST IN: Tariff Man strikes again, tweeting the US will be implementing a 5% tariff on all Mexican goods coming to the US starting June 10th and will gradually increase until, “the illegal immigration problem is remedied.”

Corporate debt markets are worrying some Bond Kings with Pimco calling the market “probably the riskiest ever” and “the area of most concern for us”.

The Federal Reserve continues to say the economy is solid, but Vice Chairman Richard Clarita said today, “They’re watching for further signs of slowdown, ” signaling a possible rate cut.

Economic reports today included a downward revision of first quarter GDP of 3.1%, pending home sales data that came in unexpectedly declined by 1.5% in April, and wholesale inventories rose in the month as durable and non-durable goods increased.

Equities finished mostly flat for the day, while bonds continued to rally. $TLT closed at its highest level since 2016.

Trade War Update

“This kind of deliberately provoking trade disputes is naked economic terrorism, economic chauvinism, economic bullying.”

China’s Commerce Ministry:

If someone suppresses #China’s development with products made with #RareEarth China exports, it’s unacceptable; China will never compromise on key issues; US’ recent moves damaged atmosphere for trade talks; Further progress depends on #US’ sincerity

Meanwhile, China’s Ministry of Commerce spokesman, who said trade talks hinge on the U.S.’s “attitude and sincerity,” and that the Trump administration’s “various tricks” have escalated tensions. Another accused the U.S. of “economic terrorism”

Trade Ideas Today

Afternoon Thoughts:

Theta Decay Killer kinda day. No Volume. No Movement. So will it be: never short a dull market? Gold and Bonds a bit spikey but otherwise, market may be waiting for more data and EOM!! Tonight: Japan reports CPI, Industrial Production, Retail Sales and Unemployment. Friday May 31 The final day of the month may see some rebalancing so expect volatility. Globally we get the release of South Korean manufacturing and retail sales data, with the highlight being the China NBS PMI data. German retail sales and inflation is also due as well as Indian and Canadian GDP for Q1 along with US PCE income, prices and expenditure data. Chicago PMI is also out. The US PCE is most important.

Morning Thoughts:

I think we could very well fill the gap at SPX $2850 – for me, there’s a 25% chance we bounce violently Thursday into Friday but a 50% chance we come into a big gap up on Monday. Keep in mind, I am squarely focused on that 6th SPX gap fill around $2718 and believe next Friday – with the ECB and nonfarm payrolls – we will set that in motion for mid June. Monthly candles will be forboding but stocks and indices can retrace up to half of that candle and still reverse lower soon after. I am watching for a bounce in rates to confirm a rotation out of bonds and back into equities. Let me put it this way: it would be very very healthy if the above scenario plays out and very unhealthy if we break 2.2 $TNX.

Stocks of Interest

$VEEV reported Q1 earnings last night and the market was keen to provide continued fuel for the parabolic fire. A move above $146 is bullish, with the stock closing strongly at $156.93.

$SNAP: UOA Jun7 $12C at .44 in accumulation, Must stay >$11.75BO for chase to $12.50/13 at 100W.

$DLTR: reported Q1 earnings this morning, with EPS inline to estimates and revenue beating slightly. The stock rallied and although it closed off the highs, a close above $96 is bullish.

$AAPL: Puts buyer came out in force today with AAPL weakness and UOA JUL 5 $170P PILING UP–trading at $3.30 when noted.

Intraday Charts

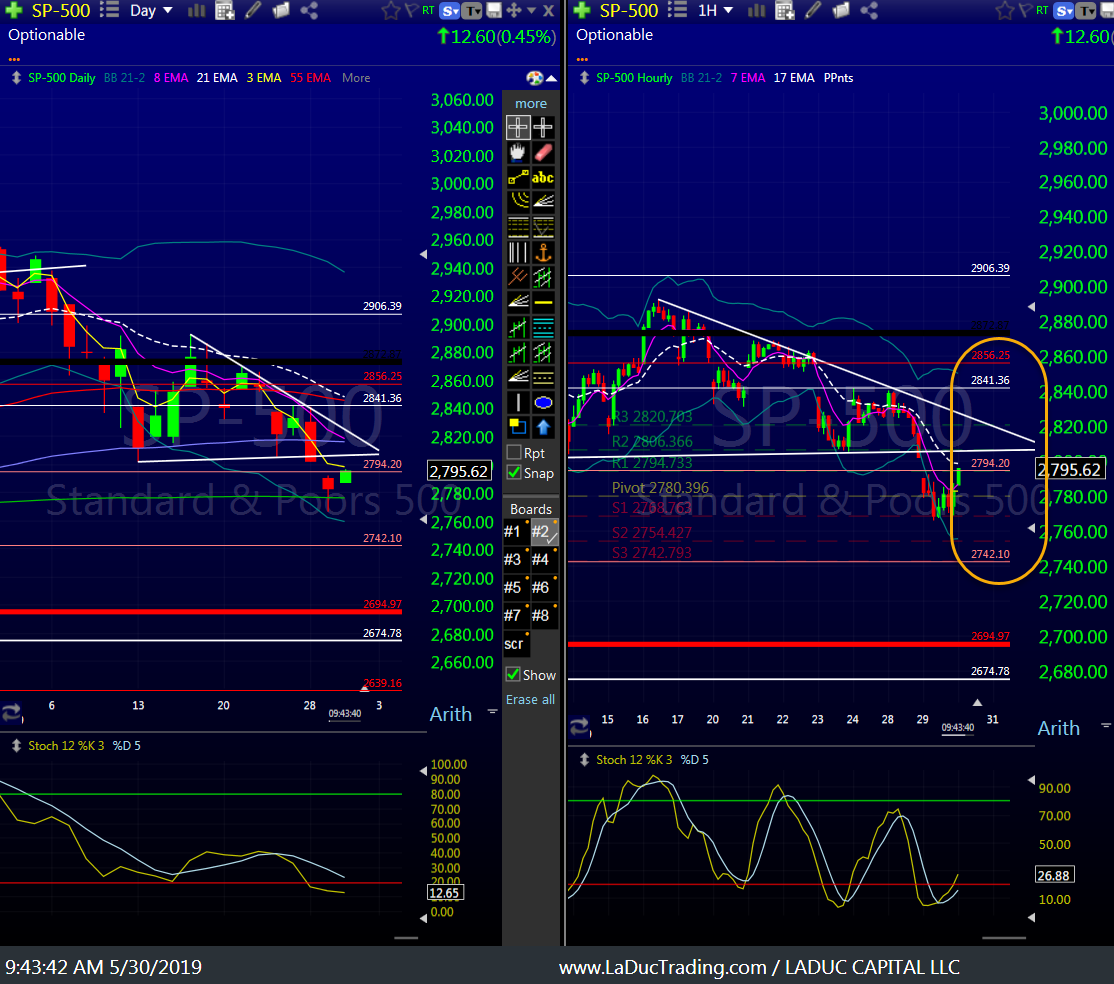

SPX GAP FILL UPDATE

UPDATE: Remember my comments last wk on EXPECTED MOVES need to get defended, or else? Well, last wk it was $52 and bounce strongly. This wk EXPECTED MOVE was ~$42 due to shortened trading wk so $2784 (also my 4th gap fill). It blew thru now so…. next gap fill level coming up: $2743 (before $2718 likely next wk)…

Trades Closed Today:

$AAPL Swing Trade; May 31 182.50 Puts entered with a thesis of China Trade War fears. The reminder of the trade was closed today with an aggregate profit on the trade of 209%

Client Posts This Week

Macro Matters

For example, the peak of the US curve inversion prior to the financial crisis was in March 2007 when 3 Mo T-Bills fell as much as 71bps below the 10-year. In that month, non-farm payrolls rose 152K, which was slightly above the 12-month average of 146K. The ISM non-manufacturing index was at a healthy 54.3. The retail sales control group had risen 0.9% and had only posted a single negative print in 18 months. Consumer confidence was near a six-year high. A year later the economy was in shambles. Ashraf Laidi

Interesting Reads

- Morgan Stanley’s Gorman says stock collapse is unlikely.

- Stop blaming the trade war for everything.

- We all need to calm down about rare earths.

- What could happen if the yuan slips to 7 per dollar.