Trump’s Tariff Tantrum causes the worst May stock market decline since May 2010!

For the month, the Dow Industrial Average fell -6.69%, the S&P 500 dropped -6.58%, and the Nasdaq Composite declined -7.93% as the three major averages posted their first monthly losses of 2019. For the week, the Dow fell -3.01%, the S&P 500 dropped -262% (biggest weekly slide since December), and the Nasdaq Comp declined -2.41%. The Dow fell for a 6th straight week, longest streak since 2011 and both the S&P and Nasdaq fell for a 4th straight week. Hammerstone

But then over the weekend…

- PENCE: U.S. CAN `MORE THAN DOUBLE’ TARIFFS ON CHINA IF NEEDED

- And this just after Trump threatened Mexico with tariffs Thursday night – as retaliation for his perceived threat of immigration flows across the border…

- Then Saturday we learned India will lose it’s “developing nation” status because Trump wants Americans to believe India has not sufficiently opened their markets to US products and manufacturers.

On A Positive Note, so far

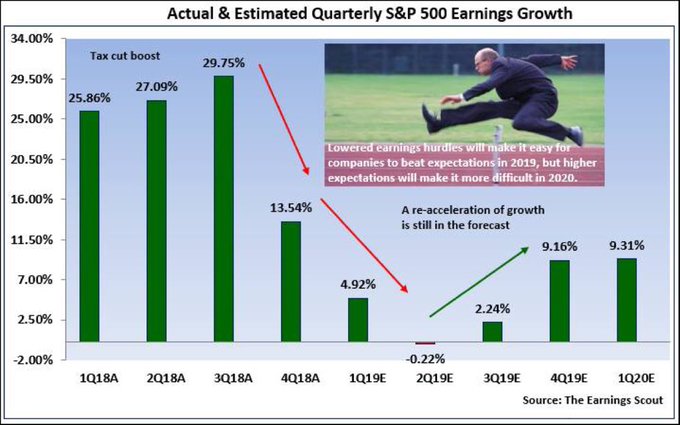

It’s hard to find good news with the headlines and price action, but SP 500 earnings trends are just not that bad (yet). Brian Gilmartin

Here is an update on SP 500 Earnings as of 5/31/19 (Source: IBES by Refinitiv):

- Fwd 4-qtr estimate: $171.47 vs last week’s $171.60

- PE ratio: 16x

- PEG ratio: 3.5x

- SP 500 earnings yield: 6.23% vs last week’s 6.07%

- Year-over-year growth of fwd est:+4.66% vs last week’s 4.76%

For Q2 EPS, this is what is expected:

On The Negative Side

US Foreign affiliate sales could be in danger with the US-China Trade War

Economic Calendar

- Markets gave up four months of gains

- Oil dropped 16%

- Mexico added to Trade War

- New month

- US NonFarmPayroll

- ECB and AUD rate decisions

Monday June 03

Global and US PM prints were released

The ISM manufacturing index fell to 52.1 from 52.8 and is now at the lowest since October 2016. (Last week, the PMI version of manufacturing hit a 10-year low.)

Basically: Global recession fears mount as manufacturing PMIs around the world confirm contraction:

All below 50.0

- South Korea

- Japan

- Taiwan

- Malaysia

- Russia

- Poland

- Turkey

- Czech Republic

- Italy

- Germany

- UK

All 3 stagnating and on the brink of contracting

- China

- Spain

- Brazil

Tuesday June 04

USD Factory Orders (MoM):

- Factory orders sank again last month. Orders dropped 0.8% in the month. Demand was even weaker for durable goods — products such as autos, appliances and machines meant to last at least three years. These orders sank an unrevised 2.1%.

Wednesday June 05

08:00 EUR Eurozone Markit PMI Composite

08:30 GBP UK Markit Services PMI

09:00 EUR Eurozone Retail Sales (YoY)

12:15 USD US ADP Employment Change

13:45 USD Markit Services/Composite PMIs

14:00 USD ISM Non-Manufacturing PMI (e55.5 p55.5)

Thursday June 06

11:45 EUR ECB Rate Decision/Statement (0% hold est)

12:30 EUR ECB Draghi Presser

12:30 USD US Trade Balance

12:30 USD US Jobless Claims/Labor Costs/Productivity

Friday June 07

06:00 EUR Germany Industrial Production/Trade Balance

12:30 USD US NFP/AHE/UnEmp/Participation (NFP e190k p263k)

12:30 CAD Canada NFP/AHE/UnEmp/Participation (UnEmp e5.8% p5.7%)

Earnings Calendar

#earnings for the week $CRM $GES $CLDR $SFIX $BOX $MDB $TIF $CIEN $COUP $FIVE $CBRL $AEO $DOCU $CPB $SMAR $GME $APPS $CTK $ZM $NAV $AMBA $DOMO $DCI $UNFI $GWRE $SJM $CAL $SAIC $PVTL $SIG $CSWC $HOME $OESX $GIII $VRA $CMD $ESTC $BYND $KIRK $OLLI $HQYhttps://t.co/lObOE0dgsr pic.twitter.com/WyPKakWRws

— Earnings Whispers (@eWhispers) June 1, 2019

Important Reads

Worst Month For Retail Stocks Since November 2008. Click here to read the report

Why President Trumps Move Against Huawei is Such A Big Deal

Hear a conversation on macro and markets by Jeffrey Gundlach and @DiMartinoBooth