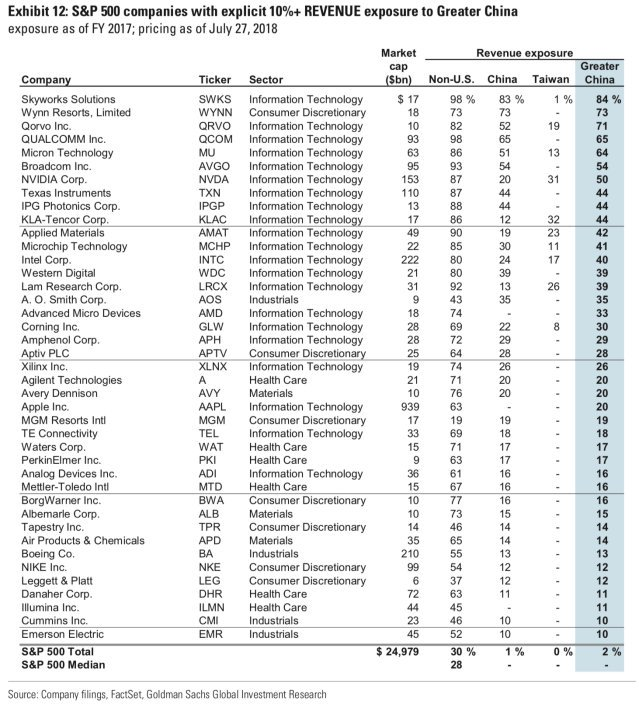

Exposure To China

Just in case Trump gets cheeky again right before the FOMC meeting and decides to berate and bully Powell into cutting rates, causing markets to head south in support, keep this handy list of S&P companies nearby for Short Candidates. You can thank me later.

Economic Calendar

(Note: Yes, I realize I’m late in getting this to you but better late than never…)

The new week, month, and quarter should open strong after encouraging tweets from Trump at the G20 Summit. He said although tariffs will not be reduced, they will not be increased while negotiating. OPEC meeting is expected to confirm continuing oil cuts.

CNY China Caixin Manufacturing PMI (e50.0 p50.2)

USD ISM Manufacturing PMI (e51.0 p52.1)

The RBA did not cut rates last month, but is expected to do so this time.

US Markets closes at 1PM ET for the pre-holiday half day, so the ADP report will be the report of significance to position for NFP report on Friday, which will be important as it is the last big data release before FOMC decision July 31.

EUR Eurozone Markit PMI Composite

USD US ADP Employment Change (e150k p27k)

USD US Trade Balance

USD US Jobless Claims

Thursday July 04

Markets are closed for Independence Day in the US

Friday July 05

The NFP release is what will get traders back from the beach to their desk.

JPY Japan Leading Economic Index

EUR Germany Factory Orders s.a. (MoM)

USD US NFP/AHE/Unemp. (NFP e158k p75k)

CAD Canada NFP/AHE/Unemp. (NFP e8.0k p27.7k)

Earnings Calendar

July 15th, it Begins Again.

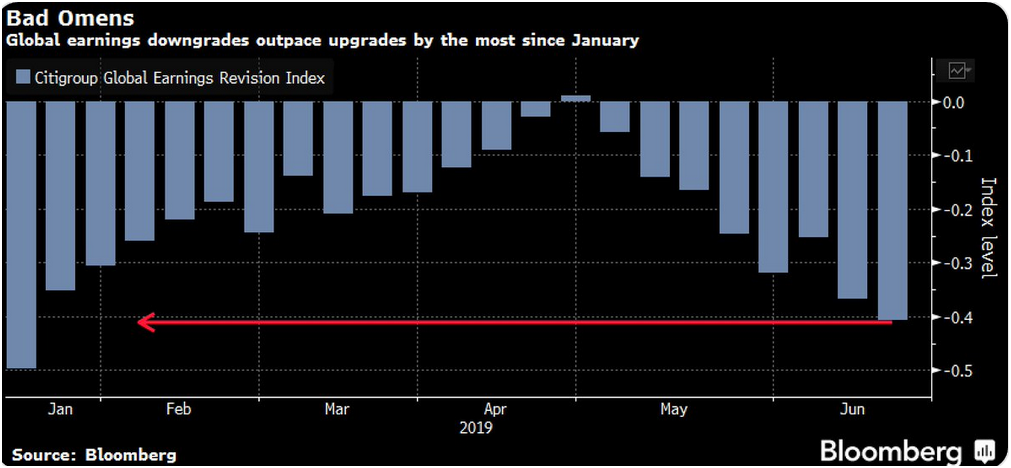

And the Upgrade / Downgrade picture is the worst since January as 2Q earnings season kicks off on July 15. Consensus expects aggregate EPS to decline by 1% year/year, as margin contraction outweighs positive sales growth.

Add to this concern, we also have:

2ND HIGHEST NUMBER OF S&P 500 COMPANIES ISSUING NEGATIVE EPS GUIDANCE FOR Q2 SINCE 2006 – John Butters, FactSet

With that, yes, the bar is set quite low, but it’s set quite low for a reason. Know what you own!

- Non-members can sign up for my Daily Market Thoughts – a FREE BAIT offering found on Fishing Lessons. Spread the word!

- My Trading Room will be closed Friday and there will be no Daily post until Monday July 8th.

- My newly revamped Trade Alerts to include Live PnL of Open Trades, Futures and Allocated Trading will go live July 15th as I had an unforeseen technical issue with Interactive Brokers that has required more testing and time. All Trade Alert clients will be comped a FREE MONTH to my live trading room.

I wish you and your family a safe and celebratory 4th of July holiday!

Samantha