Julian, I hate gmail. It does terrible things to flow of images when trying to create context. This is a private link – only you get it FYI.

As for your question of whether I think this Momentum-to-Value rotation call I made in early September will continue and whether it will be driven via “reflation and value rallies” like 2016 or via “recession and growth implodes”, the answer is, YES: Reflation then Recession.

I hope you could make heads or tails out of my Intermarket charts and market thoughts. I meant it when I said that I can see a scenario (outlier as it may be) wherein the Growth:Value divergence closes based on whether Trump is Impeached or not. It is not my base case, mind you, but it sure would explain that RSP:SPY chart. It would also help me justify my market call for higher rates, oil, even dollar.View Post

All that aside, let me respond with my chart read to your well-written and thoughtful macro-to-micro post you shared: MI2 Trader Recession or Reflation

Goldman Sachs has suggested that we will get a “hawkish” cut, i.e. one and done. We hope they are wrong because it would undermine the three key elements we believe are

necessary to sustain the cycle; higher stocks, lower bond yields and a weaker dollar.

I hold the opposite view: lower stocks, higher bond yields, stronger dollar.

I gave my pitch for equity pullback in my posts. I have suggested since Oct 2nd a Turn at SPX $3060~ and NYSE $13,333~. Who knows, but I have to work with what I’ve got.

You likely saw the Stock-Bond chart I posted that helps me foretell a market turn in Q4. I am picking mid-November. It will be interesting timing perhaps with the next LEI report. September decline (Aug -0.2% revision) sets stage for possible negative print next month. Every US Recession has been preceded by 3 negative months of LEI but 4 negative prints would turn bulls south quickly I believe. There are so many other reasons mid-November could be event-driven, but for now this is my expectation.

Here’s my Big Picture USD chart which is still bullish in my view:

Gold (silver, miners) has not been tightly coordinated with the dollar of late, but it has been with USDCNH – especially since Oct 9th. I see a quick bounce then lower.

Bonds have a smidgen left to drop (gap fill) before proper bounce territory but that’s when it really gets interesting. I called that Bond short to the day with a 1.94% in TNX. I am now thinking we take that out, but it’s early innings.

Agree wholeheartedly:

Let’s face it, if we get a recession and a bull steepener, who is going to want to own growth with high multiples, multibillion-dollar losses, all of which are dependent on high revenue growth? Alternatively, if it’s reflation and we get a bear steepener, then value is insanely cheap.

And it is that selling of Momentum-into-Value that depresses indices as the short-volatility trade reverses.

Disagree halfheartedly:

But our bet is that whether we end up in a recession or whether the Fed pulls off reflation, a lower dollar is part of the equation.

I contend rates are moving higher and trade deal of any substance will not materialize – neither of which is consensus.

Why EU banks will trade higher: DB follows the 10y bunds. And higher rates will pull commodities up with it.

Recession from slowing earnings growth:

CEOs, faced with uncertainty and economic weakness, will accelerate cost-cutting into year-end, guaranteeing a US recession in early 2020.

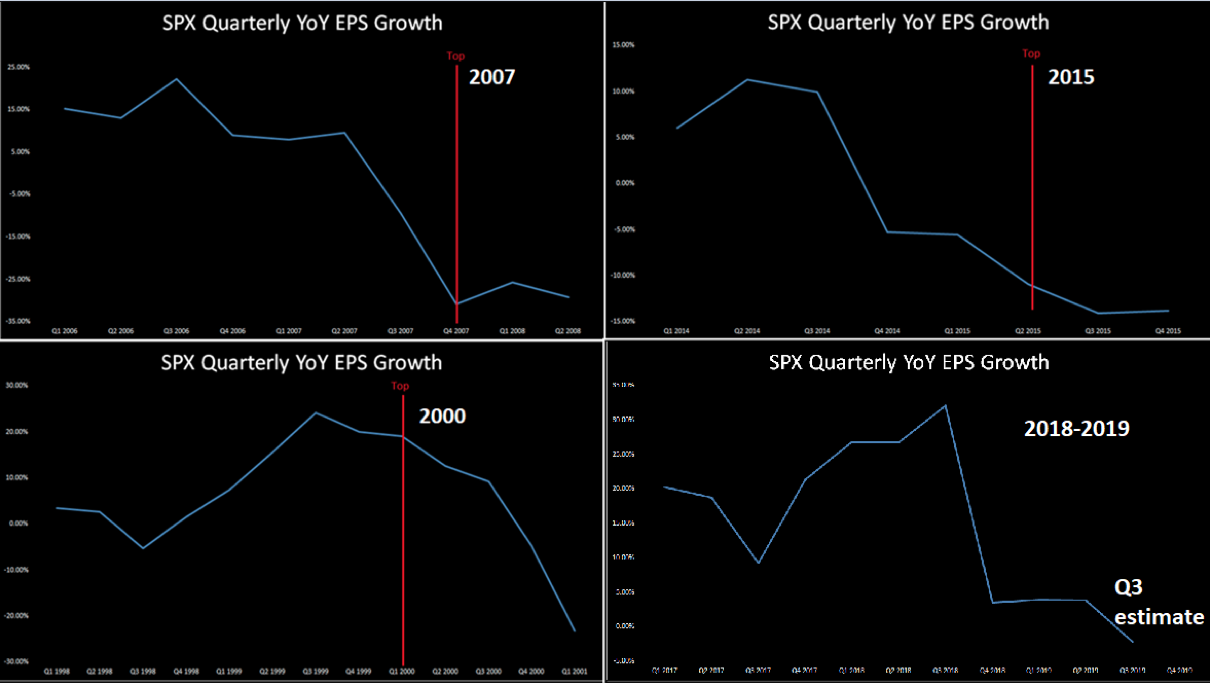

That and slowing earnings growth is often a precursor to a major correction, even top: charts courtesy Ed Matts

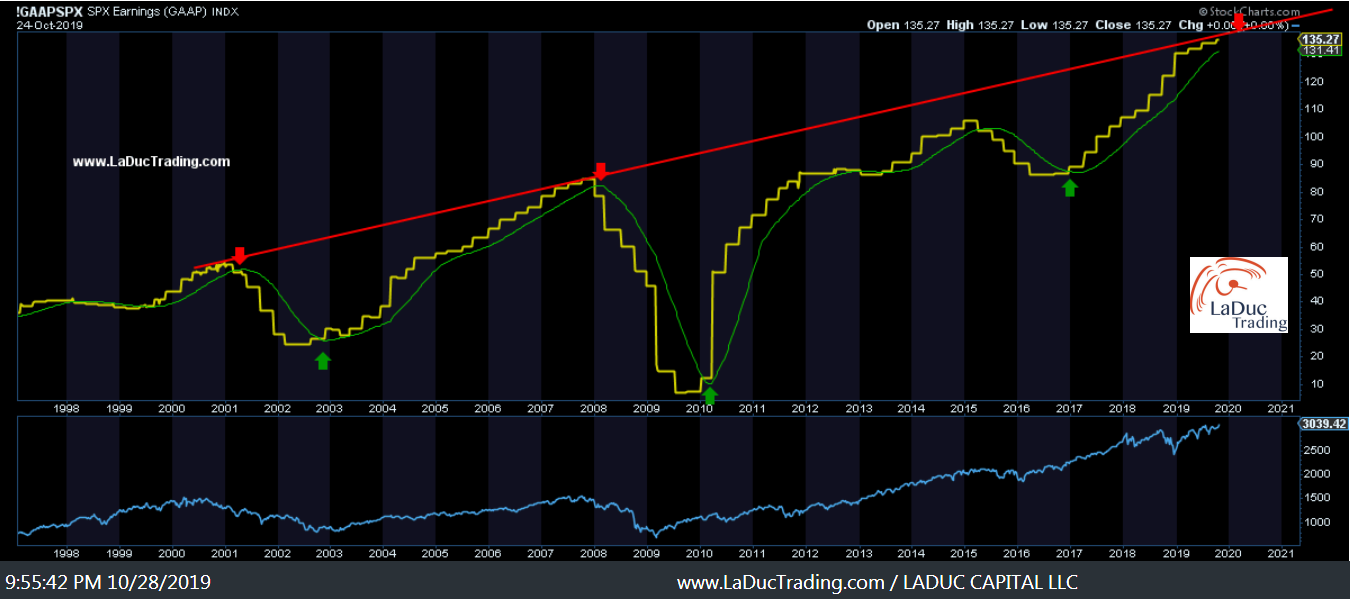

I like my unconventional GAAP-swag version to help confirm/time the turn toward Recession, but as you can see, we aren’t even reversing yet…let’s see how this looks end of earnings season…

I await your feedback on my posts, if you feel like offering it. And learning if any of the above was of value.

Like most things, any believable prediction of the future will be wrong. Any correct prediction of the future will be unbelievable.

–Samantha