Segment breakdown:

(Intro) – You will do a simple Introduction. Little background on yourself, little preview to what you will be talking about.

(content) – then you can start with the meat and get into your thesis and explain your charts

(outro) – Make you finally points and sign off.

ABOUT ME

About Samantha LaDuc, Founder of LaDucTrading and CIO of LaDuc Capital LLC

I trade for a living and support clients who do the same. I run a trader education service for Professional Retail clients and allocated trading for Institutional (RIA/HF/PM) clients. As a Chase, Swing and Trend trader, my focus is anticipating volatility at inflection points that move a market, stock, currency, commodity or interest rates.

I run a Live Trading Room, send out Brokerage-Triggered Trade Alerts and write a Macro-to-Micro newsletter. You can find out more by visiting my website: LaDucTrading.com

THESIS

Given the Fed meets tomorrow, although this segment will be released Thursday, I wanted to share my thinking on Where US Rates Look To Be Going Next 6-12 Months. I contend we are getting a Bull Steepener soon, and although this is not market bullish in time, it can be quite bullish for commodities in the coming months. Let’s dig in.

There is a 1:4 chance Fed cuts 50bps. Despite Powell being loathe to cut, he has already signaled Fed will cut. The shock would be if they don’t. The shock and awe would be if they cut 50bps.

I think they go for it: 50 bps. And here’s why: They need to jump-start reflation. Also, I see it in the charts strangely – a Big Drop is coming in front-end yields.

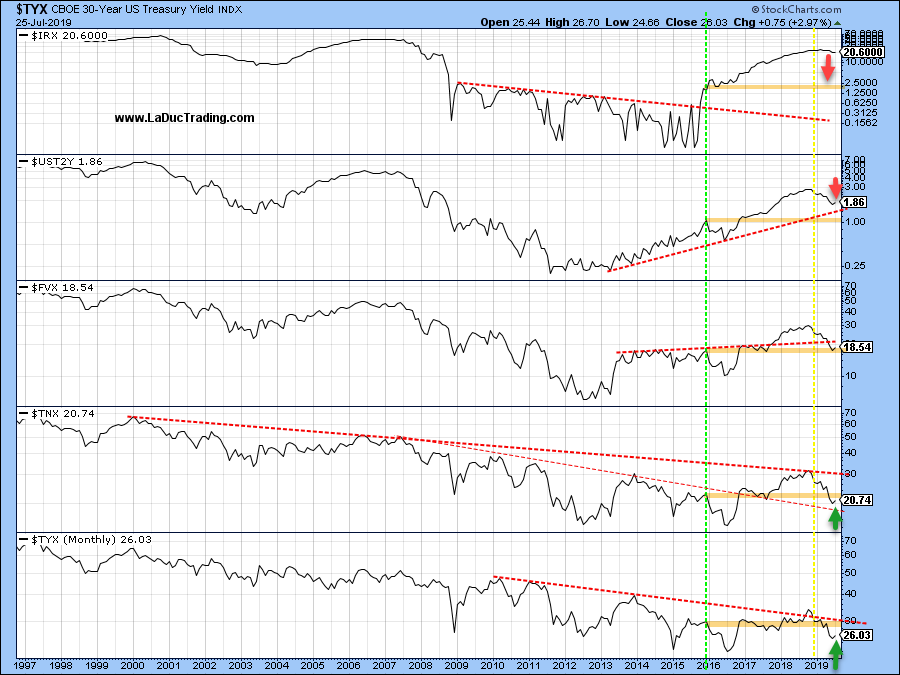

Here’s my chart of the 5 Treasury Yields: from 3-month T-Bill Discount Rate to the 2, 5, 10, + 30-year US Treasury Note Yield. I have highlighted (green vertical line) the Dec 2015 Fed Normalization kick off (1st rate hike since 2008) to the (yellow vertical line) announced (emergency) Fed pause Jan 4, 2019 which followed a rate hike a month earlier. Notice how short term rates have room to fall and long term rates have room to rise, and the 5-year is just right.

Reflation Trade Here We Come?

This move to cut more than expected would send a clear signal they are committed to inflation and that would send reflation assets higher – commodities and related companies, oil and related oil and gas companies, etc.

Even Oversold Transports:

What else would happen if Fed cuts short-term rates very aggressively? Long term rates rise and that will steepen the yield curve. Banks should like that, especially regional ones which can goose the Russell Index / IWM of which 16.7% is weighted with banks.

And What Of Bond Funds?

Bond funds should pause, fall some. Here’s my thinking on TLT:

Do I see any chance of the Global Carry Trade stopping and reversing – the Bond trade of the past 9 years that has been like a freight train:

“On a cumulative basis, bond fund inflows total $1.7trn since the start of 2007, an interesting mirror image of the $1.7trn in domestic equity fund outflows since 2007”

What would cause longer maturity bonds to sell off and longer term yields to rise? Bond Sentiment.

Sentiment is at an extreme from the last decade. Here is a fantastic chart from @biancoresearch that shows some pretty consistent and timely signals for tops and bottoms.

My Macro View Next 6-12 Months

- Fed lowers short-term rates – to better sync with 2-year Treasury Note Yield: ~1.85 now on its way to where they were in Dec 2015 ~1%.

- Bull Steepener in yield curve results.

- Inflation expectations reverse sharply higher: Just as they did of late wherein just 1% expect inflation to rise in the next 12 months vs 80% a year ago (BofA June survey).

- With “Fed-induced” inflation coming as short term rates fall, dollar weakness ensues.

- Commodities Reflate.

- After Munchin withdraws large swaths of liquidity for US Debt Ceiling Spending.

- After October Brexit and ECB QE.

- And After FOMC is done cutting (December?).