U.S.-China Trade War’s Next Target: Capital Markets

To Clients, and later in a Seeking Alpha article on June 19th of this year, I alerted to the threat of US blocking US Investments in China…

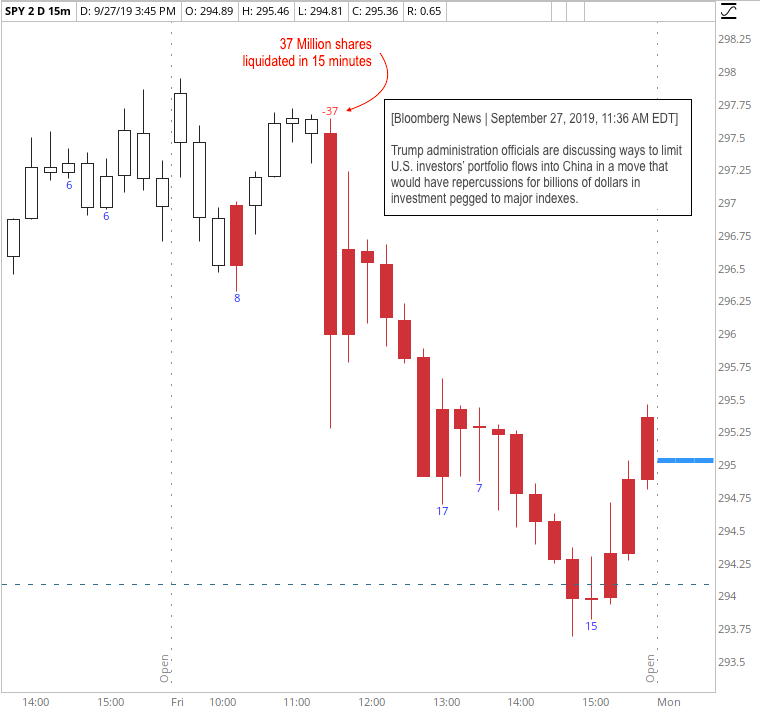

Then THIS happened Friday: H/T @nextsignals

From Bloomberg soon after:

White House officials are weighing strategies to curb U.S. investors’ portfolio flows into China, ramping up the trade war ahead of planned talks, people familiar said. Stocks slipped on the news, and Alibaba and JD.com plunged 5.2% and 6% respectively.

The move would impact billions of dollars in investment tied to major indexes. Options the administration is discussing: delisting Chinese companies from U.S. exchanges, and restricting Americans’ exposure to the country’s market through government pension funds.

Here’s how Wall Street reacted.

“The limitation of American pension funds access to Chinese markets would see massive portfolio swings that spells disaster for the tech sector. This threat is harsh reminder that we could very easily see trade talks fall apart next month.” Ed Moya, senior market analyst at Oanda

Here’s what I witnessed and called out in my Live Trading Room. Clients witnessed a flurry of SMS/Email/Web Trade Alerts.

- Safe haven bets – bonds, gold, dollar, yen – didn’t react after the news was released. USDCNH spiked then settled.

- Volatility emerged, but not with a vengeance.

- Many sectors were nonplussed. Banks and Retail held bids and SPY didn’t really dump until after Nasdaq did. Small caps were least affected. Value plays rose.

- Damage was relegated to all-things-China. And Unicorns. And Semis (in part from Micron’s terrible Earnings report – see below).

- China-heavy EEM, MSCI and KWEB etfs were solidly sold, and related China shares just let go.

Curious how the KWEB etf – heavily weighted with Tencent and Alibaba – had decoupled from Nasdaq back in May. The move lower on Friday was even more dramatic: -5% for KWEB to Nasdaq’s -1.2%.

Micron ‘Beat’?

Tech stocks sold off hardest Friday, but part of that was disguised in earnings horror, even if not a ‘miss’, as Micron showed both profit contraction and disappointing guidance outlook:

- Micron saw its earnings per share drop 84% YoY from $3.53.

- Revenue for the quarter was down 42.30% from $8.44 billion during the same time last year.

- The quarter also has operating income coming in at $650 million, which is a 85% drop from $4.38 billion.

- The Micron earnings report also has net income of $561 million being down 87% from $4.33 billion in the same period of the year prior.

- Operating cash flow at the end of the quarter was $2.23 billion, as compared to $5.16 billion in MU’s fiscal fourth quarter of 2018.

Also they guided lower with gross margins expecting to drop and capex spending to significantly slow _ FY20 capex budget of $7B-$8B, down from reported FY19 capex of $9.1B.

Here’s the kicker: the analyst expectations were SO LOW going into this report that the sub-heading on Micron reads:

MU beat EPS and revenue estimates for the quarter

Yeah, That.

Oh, And these are results BEFORE China Retaliation from recent escalations!

Anyway, Micron finished down 10% for the day but other chips suffered as well.

Manic Monday?

Then Saturday, as expected Friday, White House talked it back:

U.S. Treasury Says No Plans to Block Chinese Listings ‘at This Time’ – Bloomberg

But I contend the psychological damage has been done. The threat unveiled. It is one thing to quietly know that US and China’s selfish interests may not align, it’s another thing to have Trump bring to the forefront that he is escalating the Cold War with China that now encompasses Trade, Economic AND Capital Wars.

As of Fed 2019, China had 156 companies listing ADRs in the US. Total mkt cap = $1.2T, Alibaba is the largest at $438B.

Forcibly de-listing $1.2T of companies in the US, and threatening their financial position into default, would badly hurt the US. @biancoresearch

- Even if talked back, Trump considering limits on US portfolio flows into China should make wealth managers (PM/MM/HF folks) think seriously about derisking.

- Fund flows, which had been strong into last week, reversed hard and ended as ‘net sellers’. U.S. equity funds saw the largest weekly outflow since early Aug ($12bn).

- Month-end rebalancing – may or may not be over..

- Buyback black-out starts – and increases over the next 3 weeks.

- October 1st kicks off Impeachment inquiry, and Japan’s Tax hike

- October is of course known for it Volatility

- China can retaliate and Trump can tweet a trade war escalation.

- Recent action rhymes with last Fall 2018 where we topped after September Expiration and sold off 20%.

- Importantly, the repo market may get even crazier – and the NY Fed knows it!

I commented that I found the timing of this floated headline curious: most in China were sleeping, their markets closed next day and then only open Monday for the week as they go off-line to celebrate the CCPs 70th Anniversary. I mean, that is just a provocation – even if they talk it all the way back!

And even though did recant of course, ‘China’ responded unofficially with escalation:

China calling Trump’s bluff?

White House considers delisting Chinese companies from US exchanges? Many Chinese investors have complained all these years that they are unable to enjoy benefit of explosive growth of Chinese internet companies since many of them are listed in the US. Interesting. https://t.co/fucV1nfUpY

— Hu Xijin 胡锡进 (@HuXijin_GT) September 28, 2019

Bullish Technical Bent, Maybe

Despite my above reasons for carrying new positions short over the weekend, I can also see a bullish market bent for theorizing that all of the recent headlines are to disguise an upcoming trade deal with China. I don’t see it, never have, but market sure seems to – by continuing to stay up! I can also see the bullish economic bent that the Fed will continue to be supportive. And it has! But market hasn’t risen!! Seriously, there has been a combined message and combined fire power of ‘Fed heads’ and Fed watchers who seemingly agree that rates and/or QE is necessary to stabilize Repo, offset Trade Wars and generally try and protect from an equities drop of significance. Since none of the above markets convince me, even a little, I can at least agree with this technical chart read, best summed up by Lawrence McMillan:

- If $SPX were to close below 2940, that would be a direction-changer, from bullish to bearish. But so far, it hasn’t even been tested.

- Despite some deterioration in several indicators over the past week, the put-call ratios remain on buy signals, as their 21-day moving averages continue to decline.

- Market breadth has probably seen the worst deterioration of all. As a result, both breadth oscillators are on sell signals now.

- Volatility indices have moved a bit higher over the past week, but they are by no means giving sell signals yet. $VIX rose above 17 briefly, even closing at 17.05 one day. But it quickly retreated back below that important level and back below its 200-day Moving Average. As long as $VIX is below 17, stocks can continue to rise.

Market-Moving October Dates

Earnings season starts up soon and with that earnings estimates have continued to fall:

“Street analysts and strategists have really pulled in their growth expectations.” Brian Gilmartin

Other dates of interest beyond earnings reports:

- 10/1: Impeachment inquiry, Japan Tax hike, RBA rate decision

- 10/4: Full trade balance report with China

- 10/15: Tariffs on $250bn Chinese imports rise from 25% to 30%

- 10/17-18: EU Summit

- 10/20: Swiss Elections

- 10/21: Canada Elections

- Mid-Oct: US Treasury FX Report

- 10/24: ECB rate decision

- 10/30: Fed rate decision

- 10/31: BOJ rate decision and Brexit extension ends

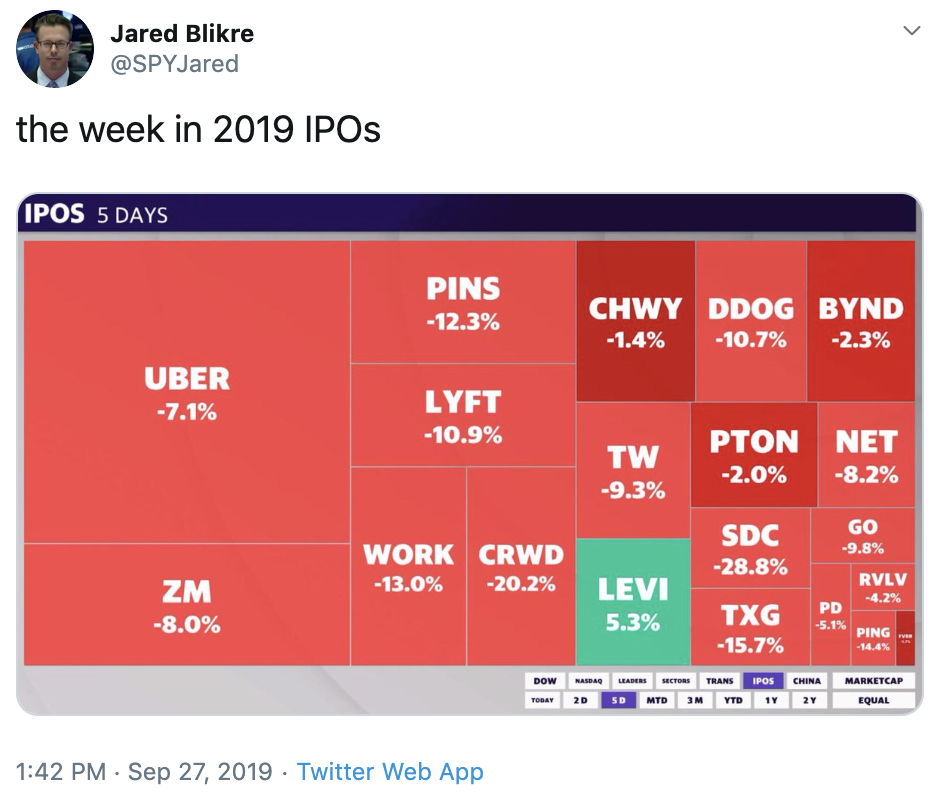

IPO = Is Probably Overpriced

Whereas IPO is living up to its moniker, “Is Probably Overvalued”, beloved Growth stocks have also been in deep distribution:

- ROKU is down -43% from recent highs (14 days!)

- SHOP -25%

- CRWD -47%

- ZS -47%

- AYX -28%

- OKTA -30%

FFTY (IBD 50 ETF GROWTH NAMES) down -11% since peaking in the middle of July, the S&P 500 is only down -.60% since then, the Nasdaq 100 -2%, and the Russell 2000 (small caps) are only down -1.73% since FFTY peaked on 7/19/19. Frank Zorrilla

My point in highlighting this mess:

- Venture Capitalists / Private Equity have made a lot of money from these Silicon Valley ‘innovators’, but the Pension Funds that bought into the hype may not do so well. And that’s a bigger market and economic risk.

- Softbank – the poster child for hyper-growth valuations, may now be experiencing hyper-growth losses and that can also pose a risk to not only speculation but also pile-on selling in IGV and IPO plays.

- And the bigger market-timing concern…

Will Big US Tech Follow Unicorn Sell-off?

Think AAPL, MSFT, GOOG…

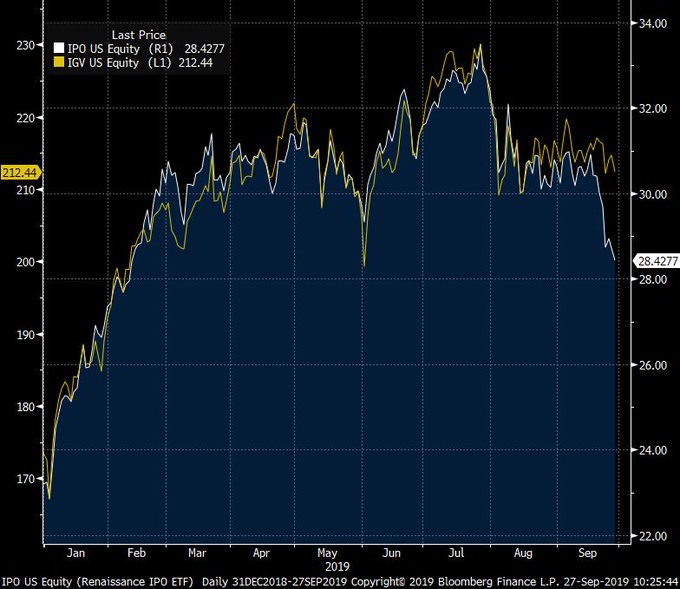

Software (biggest S&P 500 industry group) has tracked the IPO ETF pretty tightly until the latter really started to fall out of bed ~10 days ago. @LJKawa

My favorite whipping boy – IGV – comprised of so many Silly/Silicon Unicorns and P.E. love-children – is now on its 200D, whereas many of its component companies are already below. The ones that aren’t likely catch down soon. The question for so many traders is this:

Is this a bounce or trounce set up for IGV, as it forms a classic Head & Shoulders pattern:

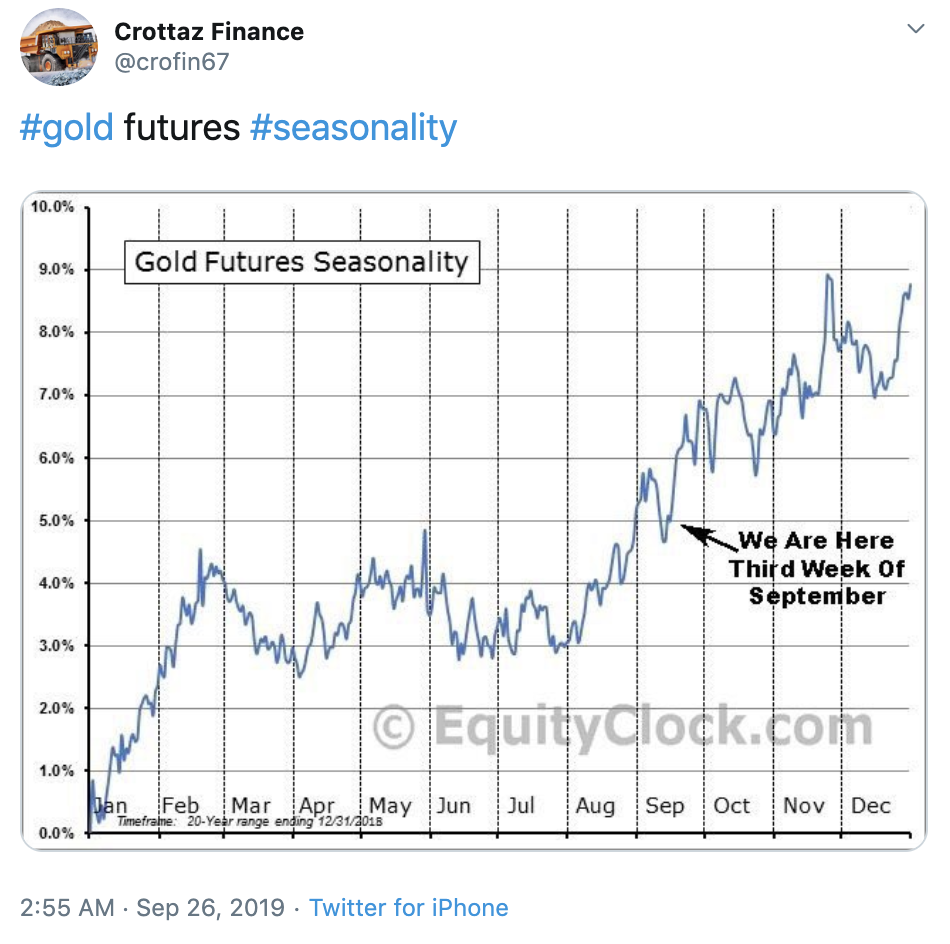

Gold Seasonality and Fed Cuts

Speaking of Head & Shoulder patterns, SPY and GLD sport them as well. These patterns, by the way, can be EITHER reversal or continuation patterns. Time will tell but Gold does typically have seasonality in this time of year. Also, there is pressure on the Fed to cut rates and Gold likes that, typically. Higher USD has been my call for months and it doesn’t look done. Gold doesn’t have to track with $DXY, but it sure is helped when USD falls. We should know shortly.

Fed is Tightening Until They Do This

Forward US yield curves remain inverted with 50-75 bps of more rate cuts priced. Concept of mid-cycle adjustment is misguided, Fed easing cycle to last well into 2020. Michael Sedacca

Run On Repo

Nice summary on how the Funding Storm has somewhat passed:

John Williams continued to lay the groundwork for balance sheet expansion, Jim Bullard talked up the merits of a standing repo facility, former Minneapolis Fed chief Narayana Kocherlakota cited an onerous regulatory regime in warning that “something is very wrong” and a pair of former Fed officials advanced a series of proposals for addressing the situation, in the process rolling out the by-now-familiar call for $250 billion in near-term asset purchases to alleviate reserve scarcity and reestablish a buffer.

As BNP puts it, “small changes in demand for cash have large impacts on rates as we approach reserve scarcity”. We’re witnessing that “highest US Treasury supply ever at USD230bn/month of UST auctions to finance an increasing fiscal deficit”, BNP writes, adding that the increased front-end supply has seen “outstanding T-bills growing from 11% to 15%+ of total debt!” (exclamation point is in the original). Meanwhile, reserves have fallen from 64% of Fed balance sheet liabilities to just 36%.

With the pressure from financing the budget deficit set to persist, the oversupply of collateral against overburdened banks who are now wary of how they deploy their reserves has stressed the repo market. “This and the current low levels of excess reserves will have to be addressed more permanently by the Fed”, BNP notesIn order to avoid reserves scarcity and maintain an abundant reserves system we estimate, the Fed needs to inject USD250bn of reserves and commit to USD120bn/year in organic balance sheet growth:

- USD100bn to move away from scarcity +

- USD150bn volatility buffer +

- USD120bn (USD10bn/month): organic balance sheet growth to stabilize reserves offsetting liquidity (expected at the October FOMC meeting)

Again, this just underscores the extent to which the Fed will have to announce the resumption of permanent open market operations at the October meeting. It’s now baked into most banks’ base cases.

For us traders it comes down to deciding if we trust the Fed NOT to muck up the next FOMC meeting October 30th!

Trade Matters

Economically speaking, even before the Friday news on China Investment Controls headline, we had a lot of bad global economic reports last week: H/T @biancoresearch

• Terrible global PMI

• Terrible German ifo business confidence

• Awful South Korean Exports

• Giant dive in US Consumer confidence

• Disappointing US consumer spending.

Hard to believe the above data only moved the SPX 20 points until the Friday headlines hit, and even then SPY was only down .4% on the day. Even harder to imagine is how US companies can shift embedded-supply chains as trade war tensions and US/Global Manufacturing Recessions escalate:

Washington’s trade war with Beijing has created supply-chain headaches for U.S. firms that rely on Chinese imports, at the same time capital spending slows in response to weaker global growth. As a result, manufacturing has gone from a bright spot to a soft one.

The tariffs are also obscuring the true picture of economic growth: Boosts in exports and inventories tend to provide temporary strength to quarterly gross domestic product, while emptying warehouses weigh on GDP — a phenomenon that in the past year has bounced the data around. The higher prices have also filtered through somewhat into inflation, and the consumer outlook

Overall, global goods trade was weaker in August. The merchandise trade gap barely budged (it widened, but less than expected), with exports ticking up slightly and imports rising 0.3%. Watch for the full trade balance report Oct. 4, which will provide more detail, including a regional breakdown. Katia Dmitrieva

On China: Best To Be Safe Than Sorry

A follower on Twitter commented on the current threatening headlines that would kick China out of the US Market and Economy can best be explained as:

Classic competition between two opposite economic systems. US companies operate in a free-market economy that respond to the laws of supply and demand. China’s companies operate in command markets with centralized control of supply and demand. @vinent4trustee

To which I responded it sounded more like a case of marriage gone bad with two countries appearing like they are trying to get divorced (although they tell the kids they are trying to reconcile every so often). Basically at one time selfish interests aligned, but they no longer do, but there is the matter of shared property and ‘other considerations’ to divide so the break-up is final (and damage inflicted is too).The risk is that during the process, anger makes the ‘divvying up’ more painful and messy and impacts everyone, in potentially very emotionally and financially negative ways.

Shared Investments

It is estimated by economist Carmen Reinhardt that China owns about $3.4Tn USD in assets plus $1.5Tn USD in loans via the “1belt-1road” initiative. Loans are structured in such a way that debtor countries got RMB to purchase Chinese goods/services but need to repay in USD. Further, there is also about $1.6-1.9Tn USD Corporate debt issued in the US, using Chinese assets as collateral, mostly via Caymen shell companies. Let’s just say defaulting on those would be ugly.

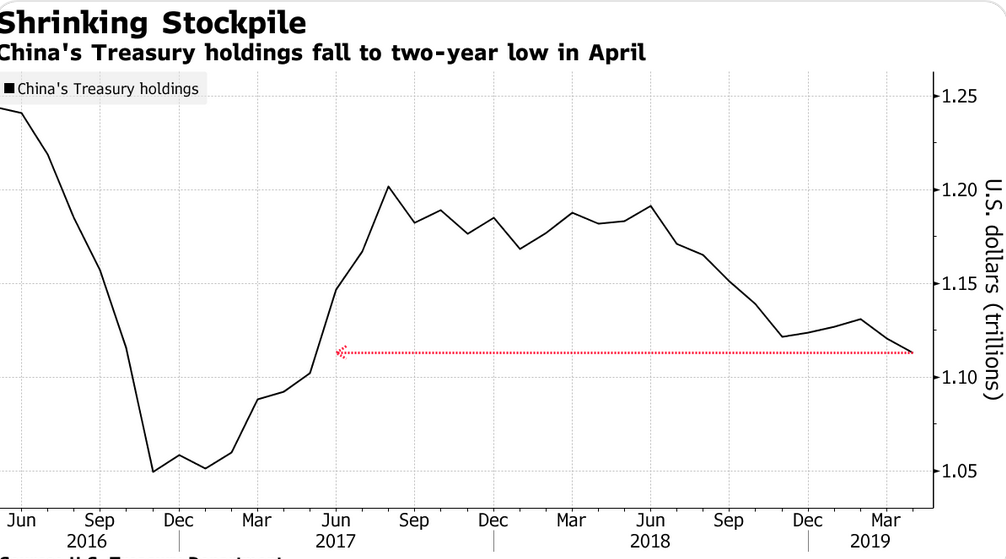

China holds approximately $1.11 trillion in US Treasuries, the lowest level in nearly two years. Despite the drop, China remains the largest holder of US Treasury bonds.

It is worth noting that their holdings have been in decline throughout Trump’s Trade War while adding almost 100 tonnes of gold to its reserves since December 2018.

China index inclusions

Curious the timing… Just 19 days ago, a note was published by The Market Ear that “index inclusions” were in motion, resulting in higher foreign demand for Chinese assets. The rebalancing of the FTSE and S&P indices were to be finalized Sep 23, and MSCI was to increase “the inclusion factor from 15% to 20% and add mid-cap stocks in November”. Curious then to see in that note the expected announcement date of September 26th on whether they will include China in the World Government Bond Index (WGBI). Yup, the SAME day the headline hit that White House was considering China companies be blocked from US listings. If included, the collective inflow of all three major indices including China would be around USD 15bn per month.

Conspiracy Theory or Just Prescient

- “Now that the CCP has provided US$25 trillion of funding to US and global markets (demand), bidding up prices for these financial assets, what happens if the CCP starts selling off these US$25 Trillion in assets?”

- “I’d imagine that they would try to sell the less liquid assets (Real Estate, businesses, private equity, etc.) first.”

- “We can expect to see the yield curve fully invert as the CCP parks increasing levels of money in short term Dollar/Euro/Yen cash equivalents. They will, of course, stop buying bonds…”

- “Generally, the more intimately a bank is involved with the CCP, the more vulnerable it may be.” (Think JPM and DB.)

- Fed: “They’ll spend their days putting out fires, effectively handcuffed and won’t be able to throw a lifeline to the “real” economy.”

- ”…well, currently US M3 (Broad Money) is only US$14.3 Trillion. Like any “Pump & Dump” the CCP is probably going try to be the first one out.”

- “Stock Markets will continue their fits and starts as money managers continue to “buy the dip” redeploying newly printed money from “loans” mistakenly made based on CCP “collateral”. After all, that’s what these money managers have been trained to do …”

- “The FED, ECB, BOJ and BOE are no longer leading the monetary expansion. They are following it.”

- “As CCP liquidity is removed, with real estate and equity markets collapsing, the economy will follow.”

- “Since they are in control of the liquidity, there is a great chance that they will be able to “call the bottom”.”

- “After a few years, the Dollar will no longer be the world’s Reserve Currency.”

The Author’s point was to credit Ray Dalio with inspiring his missive that China is acting against US interest in order to Avoid their own Deflationary Depression which in turns Inflicts Inflationary Depression on the United States. I truly hope this does not come to pass, but again, I include it because it could.