Market Thoughts

Pre-Fed Waiting is painful, at least this FOMC meeting where it could go any number of ways. Analysts will deem the decision Hawkish or Dovish and debate it for days. Regardless, I do not see sustained market strength even if the initial market reaction is relief rally.

- Hawkish: Powell says slow down, we need more data before cutting, but says they will IF they see the need. No “insurance cut”. They don’t even move up the balance sheet run-off from September to July. Equities may run higher into FOMC, but then quickly reverse post 2:30ET press conference. I have to admit I’m spying a yuge $2.6B option at USDJPY $108 that ‘needs’ to get hit Wed – so whether that is before or after FOMC – but I’m betting after. If this scenario plays out, bonds and USD continue higher, equities and gold fall.

- Dovish: Powell announces July rate cut likely as “insurance” against trade war impact (without saying those words of course). May even move up the end of QT to July as well. Uber Dovish: Powell announces June rate cut and moves up date of QT. This is the most unnerving so I will try and put it out of my head.

ALL EYES ON THE DOLLAR. It’s that simple.

And this chart:

Here’s a Bull’s Case: Andrew Garthwaite, Credit Suisse (h/t @themarketear)

Why could there be a melt-up?

i) The ERP on Credit Suisse EPS numbers remains very high (5.9% versus a warranted ERP of 5.4%) – market peaks have seen an average ERP of 2.3%

ii) The 13-week MA of earnings revisions has decoupled from falling PMIs, and when earnings revisions trough, markets typically rise by 13% on average, compared with c.2% so far

iii) Most of the margin improvement in the US is structural (tech, taxes and rates), while the cyclical threat of higher labour costs has diminished in the near term given the slowdown in wage growth and rise in productivity

iv) Positioning is cautious ($145bn in equity outflows YTD)

v) We have seen the longest spell of negative global macro surprises on record, and our base case remains that global PMIs are close to a low

vi) Central banks around the world are entering a new easing cycle at a time when US financial conditions are already very loose and consistent with further rises in markets.

v) We have seen the longest spell of negative global macro surprises on record, and our base case remains that global PMIs are close to a low

vi) Central banks around the world are entering a new easing cycle at a time when US financial conditions are already very loose and consistent with further rises in markets

Here’s a Bear Case: Andrew Sheets (head of cross-asset at Morgan Stanley)

“bad is good” is bad

We strongly disagree with this ‘bad is good’ logic. The expectation that easing central bank policy can offset weaker data is at odds with both a broad swath of historical data and basic monetary theory. But since many in the market disagree, this feels like a good time to restate our case…weaker economic data have a major impact on confidence, causing further softness as businesses and consumers pull back, and making investors less inclined to pay up for promises of future growth. No economist, at least none we’ve met, will tell you that central bank policy is intended to eliminate swings in the business cycle.

Stocks of Interest in the News

H/T “snacks” by Robinhood

- Spotify… The Swedish music streamer just called shotgun on your commute with “Your Daily Drive” — That’s Spotify’s new custom playlist to replace your local morning radio show with a combo of music and news (@Spotify what about traffic and weather?). If Your Daily Drive wins ears, it could eat into conventional radio’s shocking 17% share of American adults’ daily time spent with media.

- Lunch on the Grubhub team… Your late-night meal hero’s stock jumped 8%on word Amazon is out of the food delivery kitchen — “Amazon Restaurants” officially shuts down next week. Now Grubhub has to worry about Uber Eats, Postmates, and DoorDash. Together, those 4 leaders control 90% of online-ordered US food delivery (Amazon only nibbled 2%). But Grubhub can’t get comfy — Amazon just led a $575M investment in the UK’s fast-growing Deliveroo.

BID – Sotheby’s to sell itself and go private after trading as a public company for the past 31 years. Sotheby’s stakeholders will receive $57 per share in cash as a result of the transition, a premium of 61% to the company’s stock price on Friday.

BA- Boeing, in the midst of defending its grounded 737 Max jets, says global demand for new airplanes is stronger than it previously thought. The aviation giant released its long-term industry outlook at the International Paris Air Show on Monday, raising its global forecast for the commercial aircraft industry over the next two decades.

Macro Matters

Empire State manufacturing index posts largest-ever drop into negative territory in June. Index declines 26 points to -8.6, first negative reading in more than two years.

Home builder sentiment slides as familiar worries dog construction firms.

As a financial and commercial center, what happens in Singapore is often reflective of broader economic trends. The city-state reported May export figures, confirming that the regional adjustment continues. Non-oil exports fell by double-digits, year-over-year for the third consecutive month (-15.9% after a 10% fall in April, and -11.8% in March). A Reuters poll found a median forecast for a 16.5% decline. Electronics is an important culprit. Electronic exports plunged 31.4% year-over-year after a 16.3% decline in April. Exports to China and Hong Kong were off 23.3% and 24.8%, respectively, but double-digit declines were experienced broadly (e.g., Japan, Taiwan, and the EU). The US was the exception. Singapore exports to the US rose by 0.2%. Marc Chandler

Nearly 2 million Hong Kong residents, young and old, joined a march on Sunday that lasted late into the night to express their frustrations with Lam and the extradition bill, backed by Beijing. Many stayed on afterward.

Trade Wars and More

India has imposed higher customs duties on a raft of U.S goods.

Iran announced on Monday it would breach uranium enrichment limits in 10 days in a move that drew an accusation of “nuclear blackmail” from Washington, but it added that European nations still had time to save the nuclear deal that sets those curbs.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jun. 17th, 8:15 am Happy Monday! These Longs continue to work that I can see in the pre-market: FB and QURE. Two Shorts continue to work: Gold and Oil. I may have top-ticked Gold Friday morning 😆

Jun. 17th, 8:55 am I expect little movement in indices into FOMC then downtick. Note: There is a $2.6B option at $USDJPY $108 for Wed – we’re going there.

Jun. 17th, 8:56 am Not just a bottom fishing play from a few weeks ago but now Swing/Trend play: SPOT “Your Daily Drive” — That’s Spotify’s new custom playlist to replace your local morning radio show with a combo of music and news.

Jun. 17th, 9:02 am Still like GRUB > $72 trendline support – AMZN stepping away from the restaurant delivery business and Online food ordering expected to rise 20% to $56B this year in the U.S., and 16% to $203B worldwide, predicts market researcher Euromonitor

Jun. 17th, 9:25 am Empire State manufacturing index posts largest-ever drop into negative territory in June Index declines 26 points to -8.6, first negative reading in more than two years

Jun. 17th, 9:30 am $DE upgrade, but hard to think it makes it higher than 157. $FB still strong and could head to 190. $GLD really think the top tick in the near term may have been on Friday

Jun. 17th, 9:35 am $NFLX bouncing off 200DMA. If can’t clear back over 350, looking for re-short.

Jun. 17th, 9:38 am $ORCL has earnings upcoming, but eyes on for a chase short below 53.50 and swing short below 54.50

Jun. 17th, 9:39 am Dunkin’ Donuts begins national delivery service rollout$DNKN $GRUB bit.ly/2Rjr9hL

Jun. 17th, 9:45 am LRE short on NKE < 83.50 to 1st PT 81.65 gap fill on D and then potentially 200D at 80.50 soon after. Break there + can see 79.

Jun. 17th, 9:48 am $AVGO tried for post earnings gap down reversal but now fading. Watching for short below 259.

Jun. 17th, 9:49 am Indexes: flat is the new strong

Jun. 17th, 9:52 am $TSLA nice pullback to support and now trying for 225 again. See if it can clear that resistance

Jun. 17th, 9:56 am $CLDR Call buying. High IV, but nice doji reversal and could run. High risk play.

Jun. 17th, 10:04 am $GOOGL still so out of favor. Still below 10WK MA. Could still move higher to 1113 and then 1130, would look to re-short at that level for 1080 PT initially.

Jun. 17th, 10:06 am $NVDA some calls incoming. Can hold above 145 could be good for a long

Jun. 17th, 10:09 am $TSN gorgeous double top. Could move down to 75.70-major neckline if it breaks. $10 measured move possible.

Jun. 17th, 10:30 am NAHB homebuilder sentiment weaker than expected. I still contend bad news is bad news, good news is good news, but market thinks otherwise.

Jun. 17th, 10:34 am That TSN Double Top swing short potential from $80 break with 75.70 1st PT now has way OTM Oct $67.50P for $1.30 (cheap) in play. Small options market so there’s that, but measured move in downdraft is $72 then $66 if that $75.70 Wk breaks.

Jun. 17th, 10:37 am $BA > $352 is bullish for chase on CEO comments and big contract this weekend.

Jun. 17th, 11:35 am That TSLA pullback to 207.50 8D on Thurs was the LRE long w PT back to the 10wk at $225 (where it last tagged and failed pre-mkt Wed). Lots of big option premium earlier this AM was the momentum tell ($9+M premium) giving it the boost to push up now past $225 on way to $231, 244, 260 possible but THAT is heavy resistance. Having said that, trading TSLA is like riding on the hood of a fast-moving car. It can be really fun until it stops suddenly.

Jun. 17th, 11:42 am Flat VIX, bonds, gold, USD, USD/JPY is helping momo stocks run into the hot, hot sun. FB long from last wk got thru $186, can we get 189?! NFLX bounced hard off Daily BB/200D support up into 3 levels of resistance so not surprised it’s pausing at $350. It now looks like a re-short as long as it stays <354 close. BA hot fire flames – thanks Archna! as it stalled only briefly at $352 (alerted then) before exploding higher w/ $358 in sight + 360 strong Res. Small caps, transports, chips – still WEAK! Credit lagging SPX (tell). NAHB and Empire Mfg Index big misses.

Jun. 17th, 11:52 am Updates: SPOT hit $148 and SQ $73. AMD short set up from 33 last wk hit $29.60/21D on way to 29 me still thinks. New short TSN working.

Jun. 17th, 12:00pm Overarching theme is tread water into FOMC.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

Trade Idea Follow Up: $PXD from Friday review.

I did end up taking off this $PXD short not long after this post. I’m glad I did because it moved higher the entire day. The loss was minor at -8%. I’ve played this name may times and when it just doesn’t feel like it’s going to happen, it probably won’t. I’ll continue watching that resistance at 147 area.

Trade Idea Follow Up: $EA. Also talked about $EA Friday and how I had taken a short position that day based on a break lower, but that the trade was flat as of close. Today it took a leg higher near the open, but faded all day, closing slightly lower. Daily and weekly squeeze remain in play. My trade remains flat as of close today.

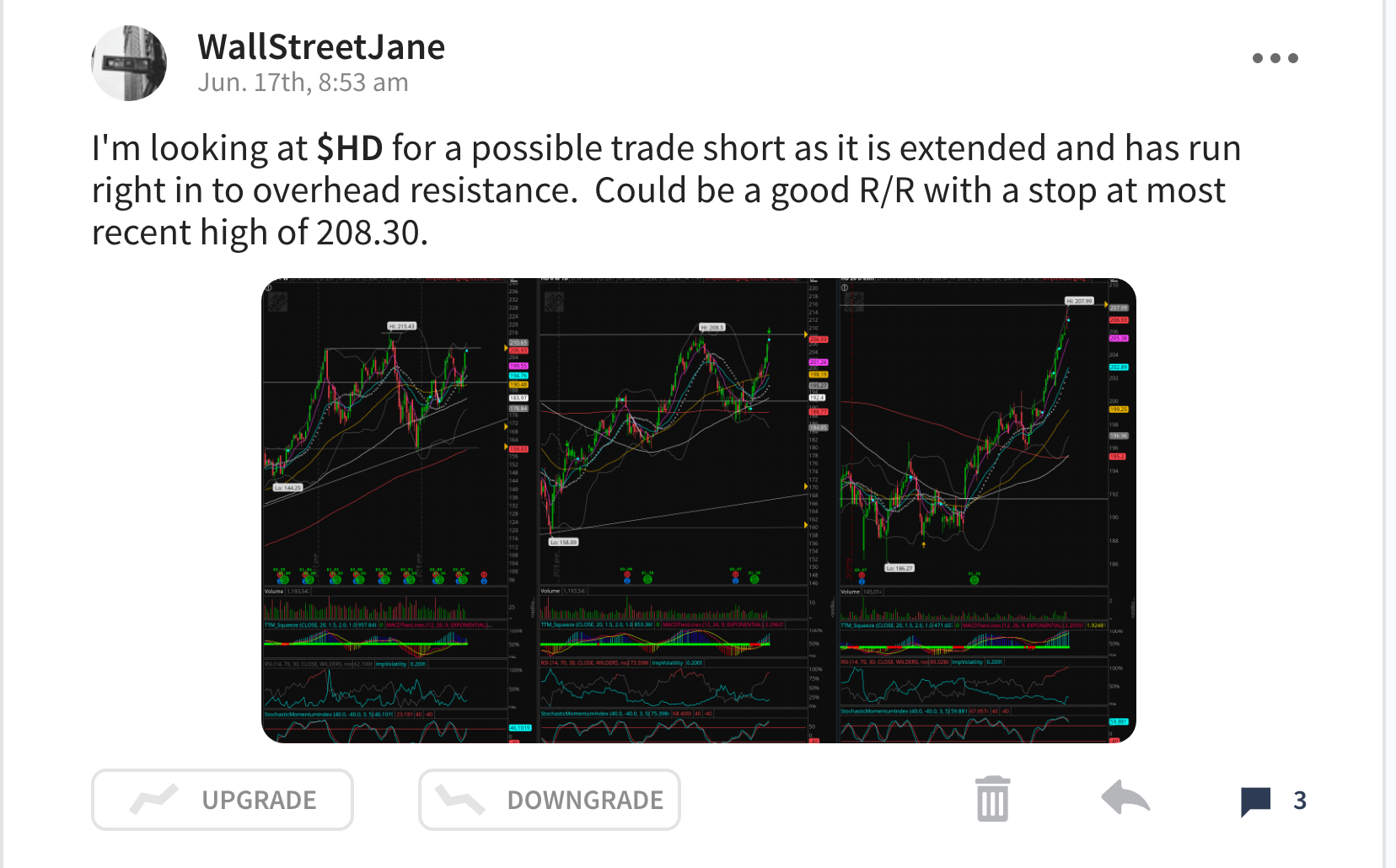

New Idea: $HD Talked about $HD in the ST room this morning:

I did end up taking a small short position as it started to fade this afternoon. Price ended the day with a doji candle. Hourly is starting to cool off. It’s still possible this will just correct through time rather than price so I’ll be keeping a close eye on this and if it doesn’t make any marked move down in the next day or so, I will likely exit.

When trading a reversion to the mean thesis I would argue it is especially important to have a level to trade against. With this trade the overhead resistance appears to be a formidable area to trade against and I will utilize 209 as my hard stop.

Great Reads

Reuters Investigates: How Japan turned against its ‘bazooka’-wielding central bank chief