This is What I’m Watching Most Closely

Delayed Reaction Speaks Volumes

Iran has a new partner. It’s a big deal and it should be infuriating Trump.

China and Iran flesh out strategic partnership, 3 September 2019

Staggered 25-year deal could mark seismic shift in the global hydrocarbons sector

- China will invest $280bn developing Iran’s oil, gas and petrochemicals sectors

- may be front-loaded into the first five-year period of the deal

- with further amounts available in every subsequent five-year period

- will be another $120bn investment in upgrading Iran’s transport and manufacturing infrastructure

- Chinese companies will be given the first refusal to bid on any new, stalled or uncompleted oil and gasfield developments

- Chinese firms will also have first refusal on opportunities to become involved with any and all petchems projects in Iran

I retweeted this @ForexLive news by 8AM ET morning of the 4th. I fully expected Trump to retaliate as this China move clearly went against US sanctions on Iran. But crickets from Trump/White House. And yet, I fully expected a rug-pull after the gap up on Wednesday the 4th so I stayed short versus cover. Omg, still more crickets. The entirety of the day passed. Then Thursday we had a Yuge gap up above the 50D and my ‘cover shorts’ $2945 SPX price target was taken out! ARGH!. So now I’m thinking, something is up with this very unnatural response from Trump; he’s not known for his reserved contemplation. That’s what prompted me to look for reasons for the strength and why I penned my post:

Market Thoughts: What If There Is A Trade Deal?

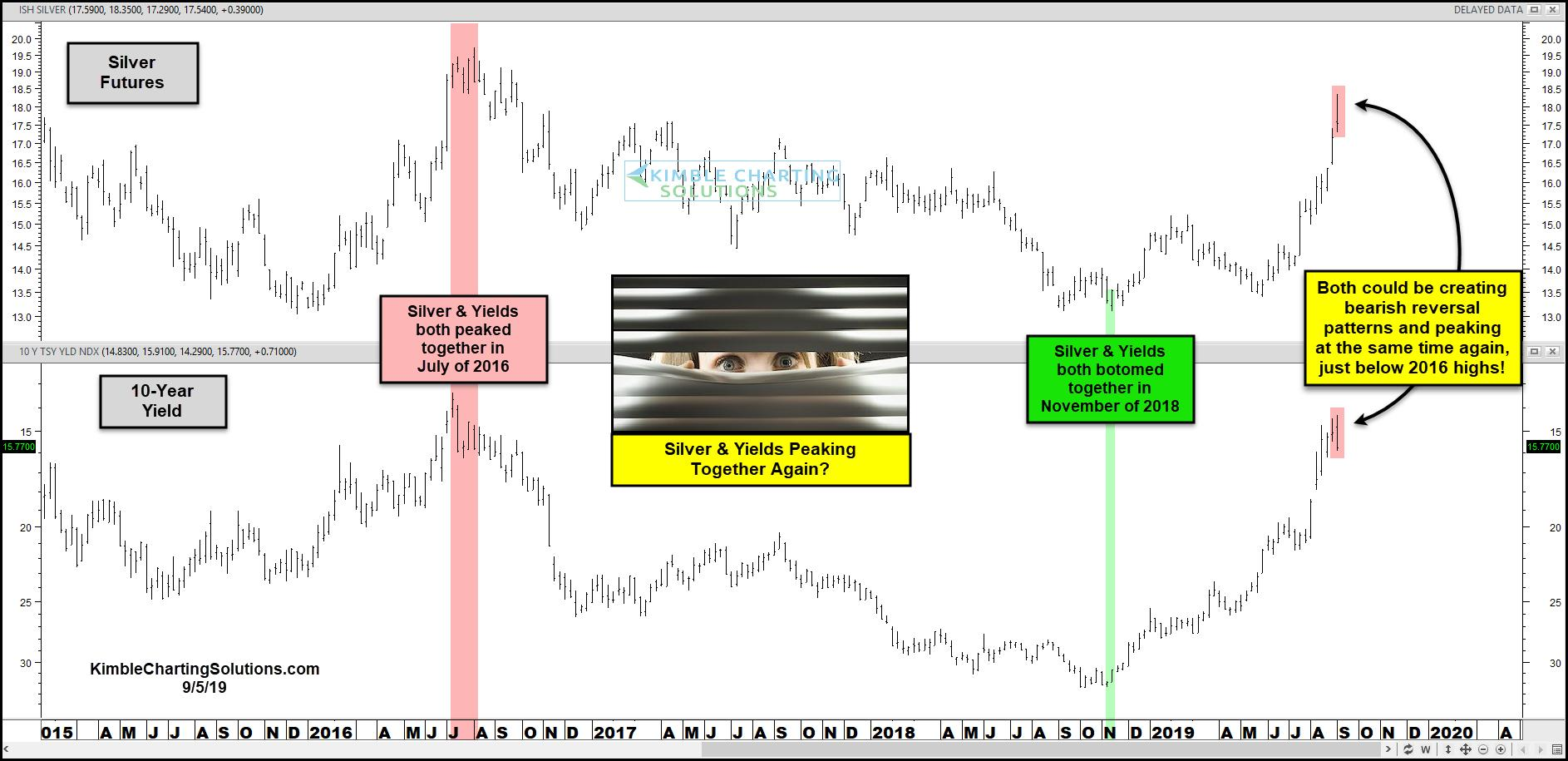

Add to that the risk-off trades of Silver, Gold and Bonds (which I timed with precision) reversing strongly/selling-off were now making the rounds, justifying the big rally in stocks.

“I think these metals are parabolas with a case of vertigo”

So how did that Bond Short call work out? $TNX $TLT Largest 1d percent change up move in the 10yr since the 2016 election.

You can follow my actual trades here:

Brokerage-Triggered Trade Alerts!

UNITED STATES WILL CONTINUE TO IMPOSE SANCTIONS ON WHOEVER PURCHASES IRAN’S OIL OR CONDUCTS BUSINESS WITH IRAN’S REVOLUTIONARY GUARDS AND NO OIL WAIVERS WILL BE RE-ISSUED @FirstSquawk 11:02 AM · Sep 8, 2019

Updates on Recent Posts of Importance

The following articles are first provided to fishing club members each week to identify macro inflection points and actionable micro trade set-ups. Join Samantha for her Forward Looking, Forward Thinking market timing analysis and trades.

Metals are Parabolas with a Case of Vertigo

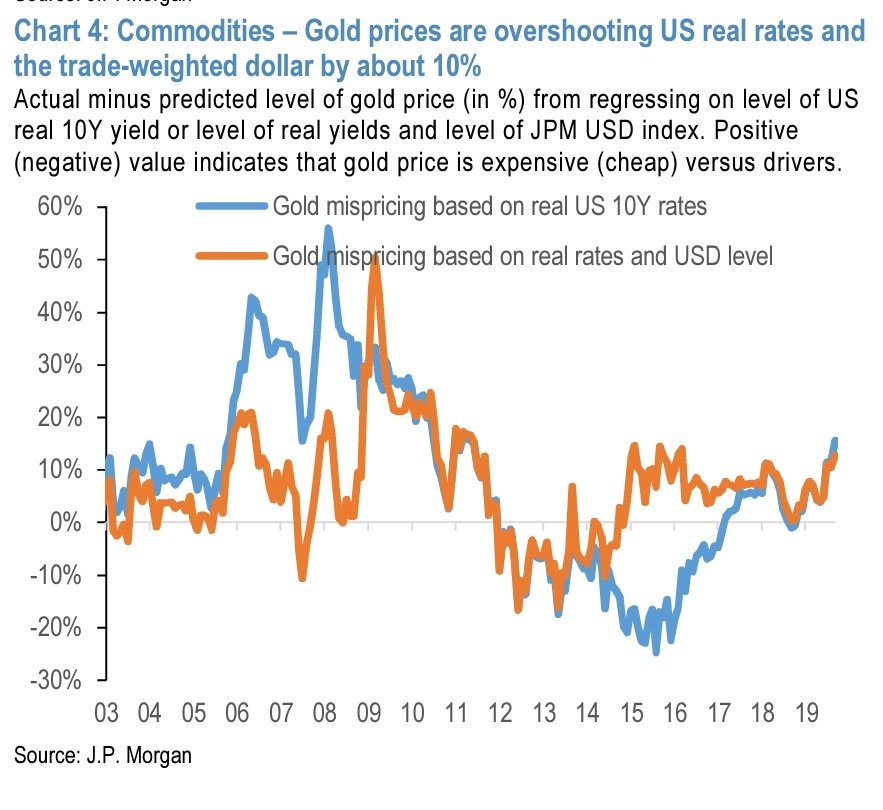

From my post – Market Thoughts: I Sold My Gold & Miners Today – I caught this great chart h/t @chigrl. It’s another sound reason for Gold/Silver/Miners to revert to a mean-of-sorts before relaunching.

As per JPM, Gold prices are overshooting US real rates and the trade-weighted dollar by about 10%

From my post – Market Thoughts: Spying a Bond Pullback – as reported in Barron’s: Treasury Bonds Are Now Riskier Than Stocks

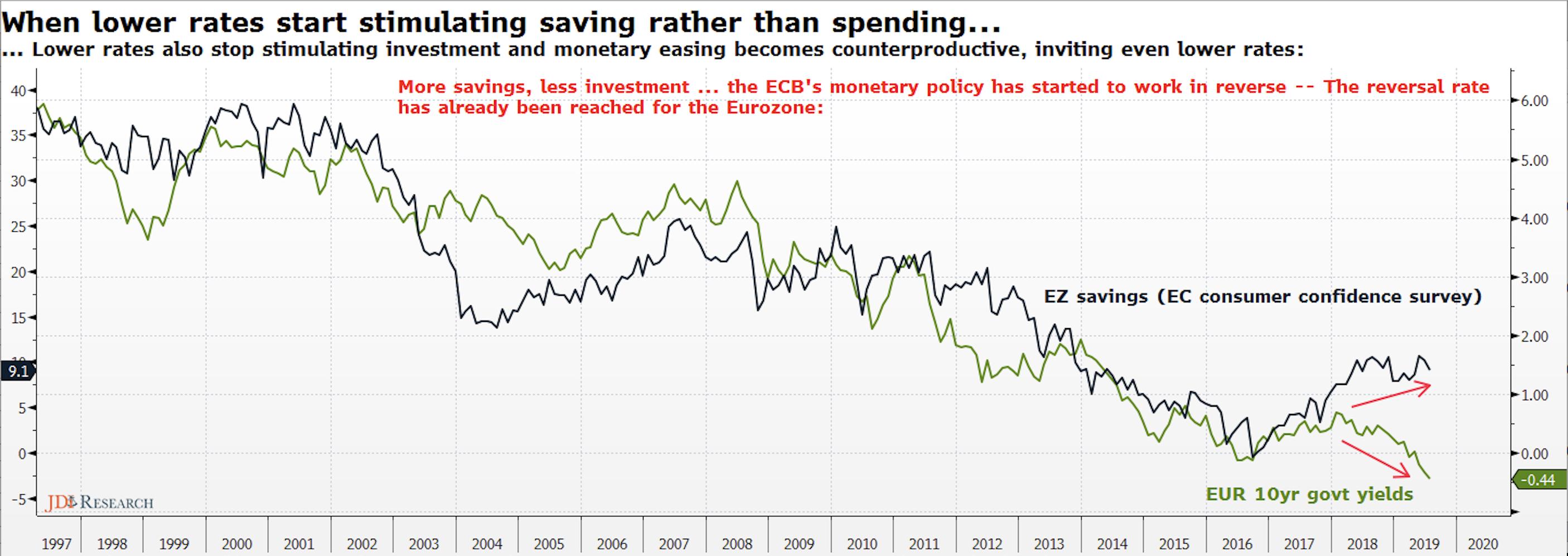

- Low Interest Rates: The Addictive Policy Drug of Choice

- Negative Interest Rates Threaten the Financial System

- Jim Grant: Living With Negative Interest Rates

- Bank margins and profits in a world of negative rates

And this awesome chart by @JulietteJDI that demonstrates how lower rates stimulate savings over investment and spending – the opposite of the desired policy objective…

What Happened To Volatility?

Remember my article from summer: Silver and Gold are the new VIX? Well might be time to reverse that soon:

Lastly, I’m watching the Yen:

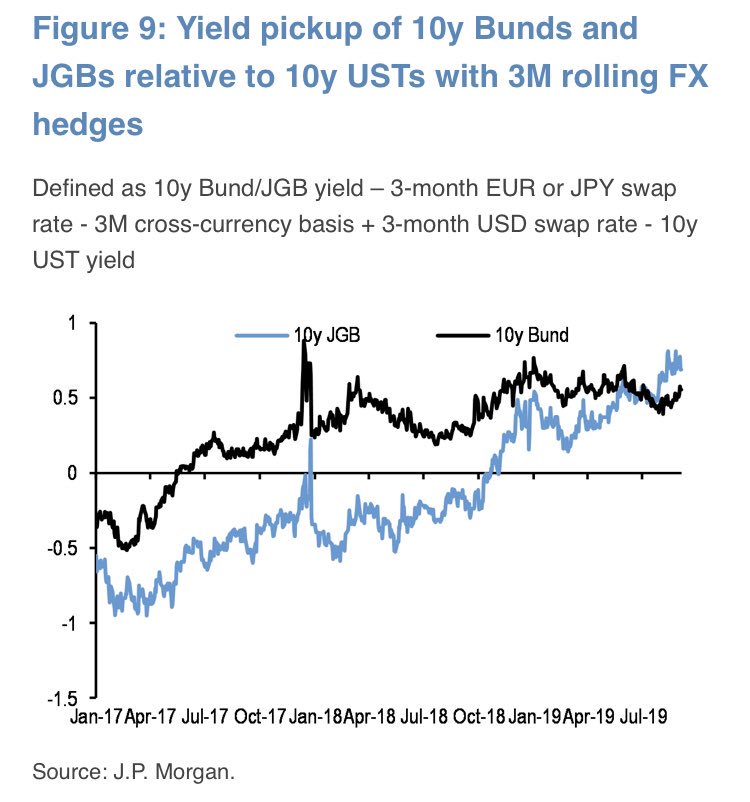

Foreign investors have been buying Eurozone and Japanese bonds this year as 10y Bunds and JGBs offers yield pick up relative to 10y USTs w/3M rolling FX hedges. Foreign investors have bought ~$210bn of Eurozoz (of which around $130bn of govt bonds) & $70bn Japanese bonds in H1’19 @schudlensuehner

My Interpretation: Right now we have a strong US Dollar. When this trend reverses, it will be very bad for Bond holders. And stocks. Just as both bonds and stocks sold off violently in January 2018. The result will also be bad for JGB as investors unwind their long JGBs & Bunds, forcing UST yields higher.

Macro Really Matters.

Earnings Calendar

For this week I like/have GME Long and will try a small RH short. To follow me:

Brokerage-Triggered Trade Alerts!

#earnings for the week $ACB $ZS $KR $AVGO $RH $HDS $PLAY $GME $CTRP $MCFT $DLTH $LOVE $LMNR $TLRD $ASPU $ORCL $GFN $PHR $WDG $LAKE $FARM $UEPS $PCYG $OXM $EFOI $LPTH $AMRK https://t.co/lObOE0dgsr pic.twitter.com/vNe2R8hYNu

— Earnings Whispers (@eWhispers) September 7, 2019

Economic Calendar

Stocks of Interest

All eyes turn to Cupertino on September 10 for the Apple (NASDAQ:AAPL) product event. Apple is expected to release two higher-end iPhones (5.8-inch and 6.1-inch OLED) and a lower-priced LCD iPhone. A processor upgrade and triple-lens camera in the back are expected for the OLED versions. A new Apple Watch is also likely to be displayed, while it’s possible new Macs, AirPods, Apple TV+ details, Apple Arcade news and other gadgets could also be unveiled if those reveals aren’t held back for separate events. Pricing on all the above hardware will be interesting. Does Apple management assume the December 15 tariffs on Chinese imports won’t be a problem? SeekingAlpha

Remember, I run a LIVE Trading Room and offer Day or Week Passes if you want to check it out!