Market Thoughts

Samantha is traveling to NYC for meetings, presentation at the Benzinga conference and sourcing apartment for her daughter doing an internship at an architectural firm this summer. She will be busy and away from her trading desk for the remainder of the week.

Here’s Samantha’s MarketWatchMarketWatch article:

@WallStreetJane here filling in with some thoughts:

Super Mario Draghi’s term as ECB Chairman ends this fall – 8 years of playing the game and it’s finally time to fight the bad guy and rescue the princess. But who’s the bad guy and who’s the princess? At this point in his tenure I’m not so sure he even cares. Tell them what they want to hear and he goes out on the proverbial high note. Accordingly, US markets provided a seal of approval by rallying sharply on a day we thought would have minimal action given tomorrow’s FED meeting and press conference.

Trump, unlike the markets, was not happy about Draghi’s remarks and went on a Twitter rant letting all the world know his displeasure. Once that rant was over it was time to knock the FED and Jerome Powell. Reports that the White House explored the legality of demoting the Fed Chairman would seem to further pressure Powell to take the most dovish of positions, but could it backfire? Given the previous dovish 180 by Powell, I wouldn’t put out a bet he’ll go full hawk to spite Trump, but could end up really hammering the wait and see “patient” approach and test Trump’s conviction to entertain a “for cause” demotion. If “for cause” is reduced to, you didn’t do what I wanted, we truly are living in the upside down. I’d say it’s amusing if it weren’t so horrifying.

Stocks of Interest in the News

It could amount to the biggestcatalyst for digital assets in their decade-long existence. Facebook (NASDAQ:FB) has unveiled a consortium to create an open-source digital currency called Libra, set to launch in the first half of next year, which would allow consumers to send money around the world easily and for free. While Libra won’t be run by Facebook – but rather by a nonprofit association and backed by relatively stable government money – the company does have a plan to profit from it with a new subsidiary, Calibra, which is building a digital wallet for storing and exchanging the currency

Solar stocks upgraded at Goldman Sachs: SunPower (SPWR) and Sunrun (RUN) both upgraded to buy from neutral and SolarEdge (SEDG) upgraded to neutral from sell anticipating volume tailwinds in the second half of 2019 given the recent signs of strength in the sector’s financing environment.

NVDA- Nvidia had a strong day closing up 5.41% after it was reported they are joining forces with Volvo on driverless trucks. The companies said the partnership would rely on Nvidia’s artificial-intelligence platforms for training, simulation, and in-vehicle computing to eventually get driverless commercial trucks on public roads and roadways, and the resulting system would be “scalable”.

Samantha here: Yesterday I said LRE long >$145. Glad that worked

Slack IPO: Pros and Cons – June 20th is the official date of the Slack IPO, although the technical term is not an IPO but rather a DPO for Direct Public Offering. Of the cloud software companies to go public over the last few years, Slack may be Silicon Valley’s pet favorite. You can think of Slack as a cloud-based messaging and delivery hub for teams as email is ineffective for frequent communication and projects. The product is simply amazing in terms of productivity and team work flow. From a customer perspective, the cost of the paid product is offset by the time employees save by… Read more

Macro Matters

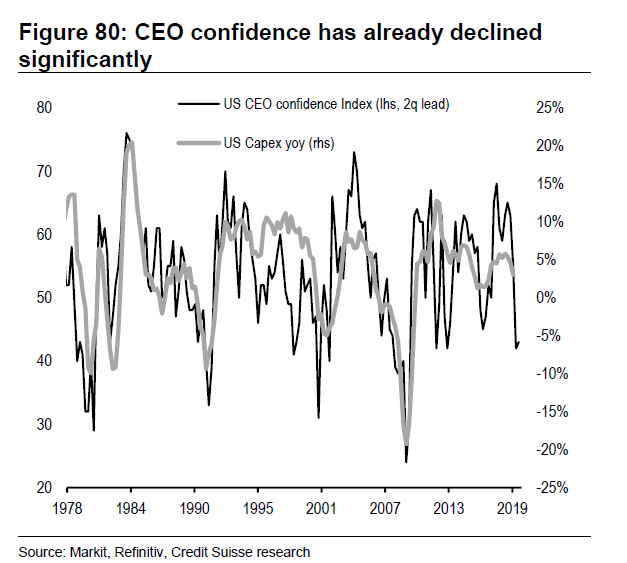

Where CEO confidence leads, Capex follows…

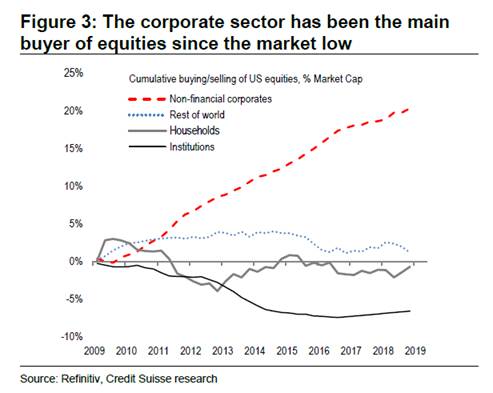

And Black-out Period approaches for Summer trading:

Housing starts slip, but permits rise as all signs point to stronger growth ahead. A mixed bag report with starts, a measure of builders breaking ground on new homes, were 0.9% lower than in April and 4.7% below the pace set a year ago. Permits, which foreshadow future starts, were 0.3% higher for the month but 0.5% lower than May 2018.

Investors haven’t been this pessimistic since the global financial crisis of 2008. That’s according to a Bank of America Merrill Lynch survey of money managers with $528 billion between them. Equity allocations saw the second-biggest drop on record, while cash holdings jumped by the most since the 2011 debt-ceiling crisis, the June poll showed. Concerns about the trade war, a recession and “monetary policy impotence” all contributed to the bearish sentiment, Bank of America said.

Trade Wars and More

Adding to the already juiced up markets, Trump tweets “Had a very good telephone conversation with President Xi of China. We will be having an extended meeting next week at the G-20 in Japan. Our respective teams will begin talks prior to our meeting.”

Hong Kong Isn’t Just Another Chinese City. The U.S. is also an important patron. Consider the territory’s inflow of dollars, which soared after the global financial crisis.

Boris Johnson surged ahead in the race to become Britain’s next prime minister after coming first in the latest ballot of Conservative party MPs. Outsider Rory Stewart gained on his rivals, while Dominic Raab was knocked out. The remaining five candidates held a TV debate as they tried to win support to become Tory leader.

Although Johnson has softened some of his language about a no-deal Brexit, other things he said were drawn straight from the positions of his Tory colleagues who want a hard break from the EU without an agreement.

He said he would prepare the U.K. thoroughly for a no-deal exit as a way to intimidate the EU into agreeing to postpone talks over the most contentious part of the negotiations — how to avoid a hard land border with Ireland.

These talks should take place during the transition period as part of talks focusing on the future partnership between Britain and the EU, he said. EU officials have said they are unlikely to agree.

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

As Samantha was preparing to travel, there wasn’t much said today.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

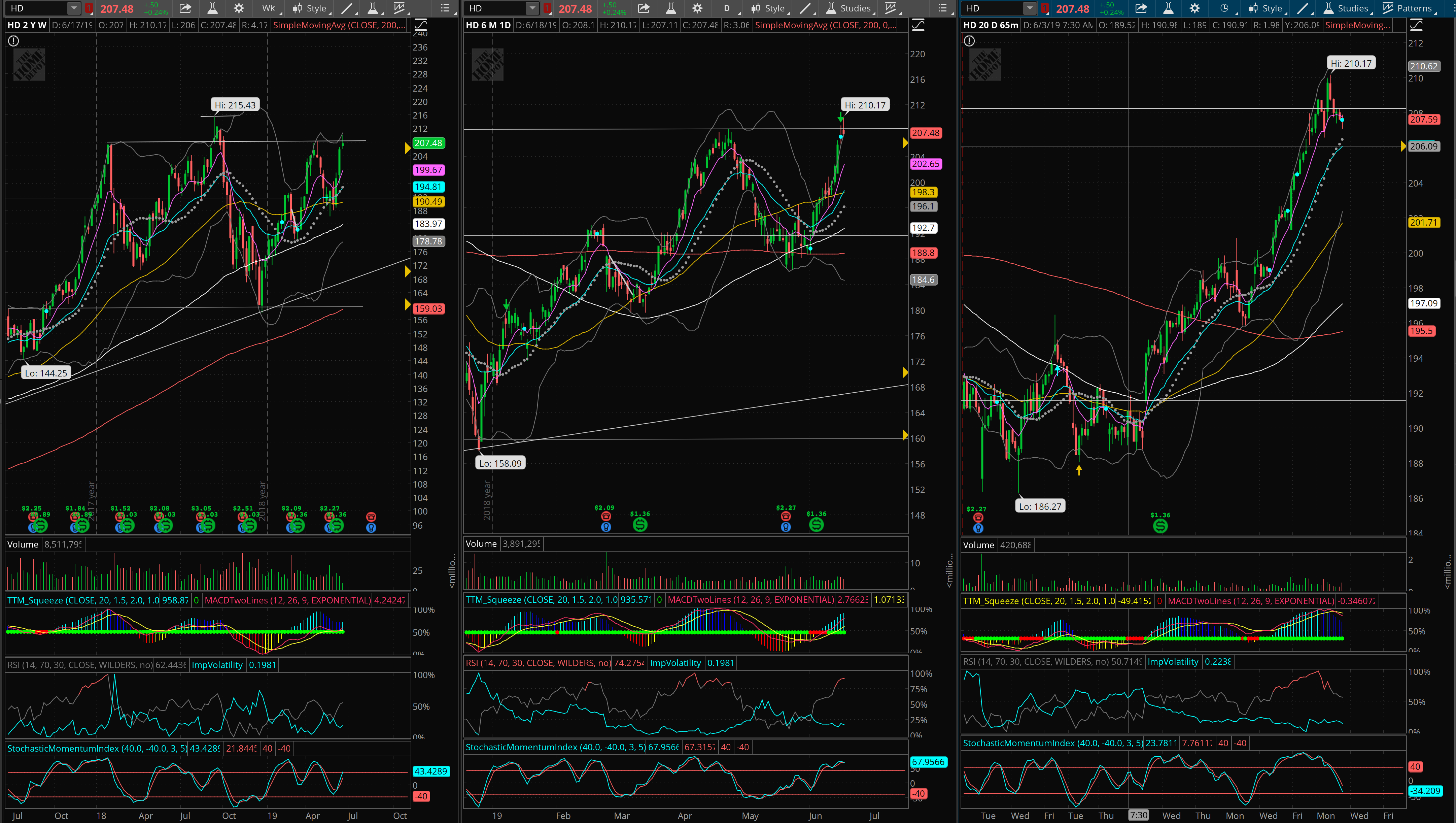

Trade Idea Review: $HD Last night I discussed this reversion to the mean play, but with the market rally this morning I was stopped out for a loss. The stock subsequently reversed most of its gains, finishing flat and below that point of resistance. I’ll continue watching and a quick play with entry just below 206 and a price target of 202, could still be in the cards. I did take some DJX calls at the end of y-day so if we want to call it a pairs trade I ended up a-ok from the long side.

After today’s strong move higher in the overall market, there are many names that look extended on a short term basis. Will they defy gravity for a bit longer or head back down and take some breaths. We’ll know more once we get this dang FED meeting behind us. I’m reserving suggesting any new trades tonight as I see nothing worthy of entry prior to the conclusion of Fed day. Honestly, I just want it to be over already. It’s not like we won’t have more drama with the G-20 at the end of the month. Just give me some direction – up or down – I don’t care.

Great Reads

The always fantastic Bloomberg Opinion columnist, John Authers, knocks it out of the park with his latest piece: Trade Wars: The Empire Strikes Back

If there were no trade conflict between the U.S. and China, would it be necessary to invent one? In other words, would it be possible to explain what is going on in markets without making reference to the deteriorating U.S.-China trade relations? I am beginning to suspect that it would. Bond markets may be behaving as though they are bracing for something terrible to happen because traders are, indeed, scared that something terrible is going to happen.