Market Thoughts

So where will dollars flow if not in equities?

Negative debt is now 26.3% of all sovereign bonds, also a new record… Think of negative rates as a “storage fee” for this excess capital that is not needed. Jim Bianco

Some will continue to take their cue from Buffet where Berkshire Hathaway’s recent earnings release shows they are increasing not deploying their cash holdings:

Due to prices being “sky-high for businesses possessing decent long-term prospects,” cash now stands at $122 billion. This increase reflects a $1 billion net reduction in holdings of financial #stocks. @elerianm

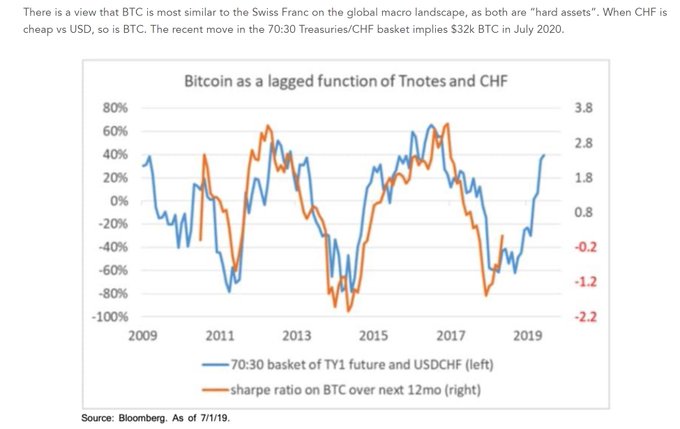

The safety trade of US Dollars would normally be a no-brainer if it were not for coordinated effort by Fed and Trump to pull it down.

There was some idea that the Fed could do it, but Powell (is accused) of mangling the message. POTUS understood the signal and ended the tariff truce within 24 hours of FOMC. That succeeded where the Fed failed: to start a $USD correction. Marc Chander

BROKERAGE-TRIGGERED TRADE ALERTS!

Performance: Since launching my new fund just 3 short weeks ago – and despite the chop – I have managed a +9.34% total account gain (MTM) in my account and all trades communicated real-time to clients from my brokerage-triggered trade alert system. Also of note that these results were based on only 30% of account value (so 70% in cash) to generate that ROI. Bonus: no trade was more than 1.5% of available equity!

Few Housekeeping Announcements:

Looking to change it up, so this Daily Market Thoughts post is announcing the following changes moving forward into the new month:

- Samantha Says – the select market commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room – will no longer be included. Interested to know what I see and how to trade it with maximum benefit and minimum risk? Then you must join me. Macro-to-Micro market analysis and brokerage-triggered trade alerts are only available on my website for clients of LaDucTrading.

- “Economic Data”, “Trade Wars and More” will no longer be supported as part of this Daily note, along with “WallStreetJane’s Journal”. Jane misses the grind of professional poker.

- LaDucTrading’s StockTwits Premium Chat Room will be closed at the end of August. WallStreetJane was doing a great job of engagement with ST members and relaying my trade ideas in a timely manner, but the ST platform is not user-friendly, the ST marketing non-existent and the resulting headcount does not justify my continued investment (direct costs and time).

I will be offering current ST members of my Premium Chat Room access to my Live Trading Room for a FREEMONTH ($500 value) as a thank you for your support of this StockTwits Premium Chat Room owned and operated by Women. Email [email protected] for your access code.

Samantha Says

Select Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Aug. 2nd, 7:35 am GM! Global equities are soft as expected and US futures are red before nonfarm payrolls at 8:30. Here are some ideas for the day: Hedge! Not only does my chart read say “not done” which was my assertion after Powell disappointed and after Trump escalated the China Trade War. Now… Piling on to the latest tariff threats against China, President Trump will make an announcement on EU trade at 1:45 p.m. ET! Trump previously threatened tariffs on EU cars, food and alcohol, and a deadline for talks was expected to come due in November. He has clearly moved that up.

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now trades full-time and actively shares her trading ideas, plan and process.

Follow Up: $ADSK

Last night I discussed how the head and shoulders pattern had broken, with a close below the neckline. It was already approaching oversold levels and contended it may bounce. Wrong. What a classic break with a measured move to the first target area of 146 hitting today. I was watching it just keep falling with eyes wide and mind irritated I didn’t take the trade upon first alert of neckline break. I’ll be curious to see what next week brings for this name.

Macro Matters

Economic Data

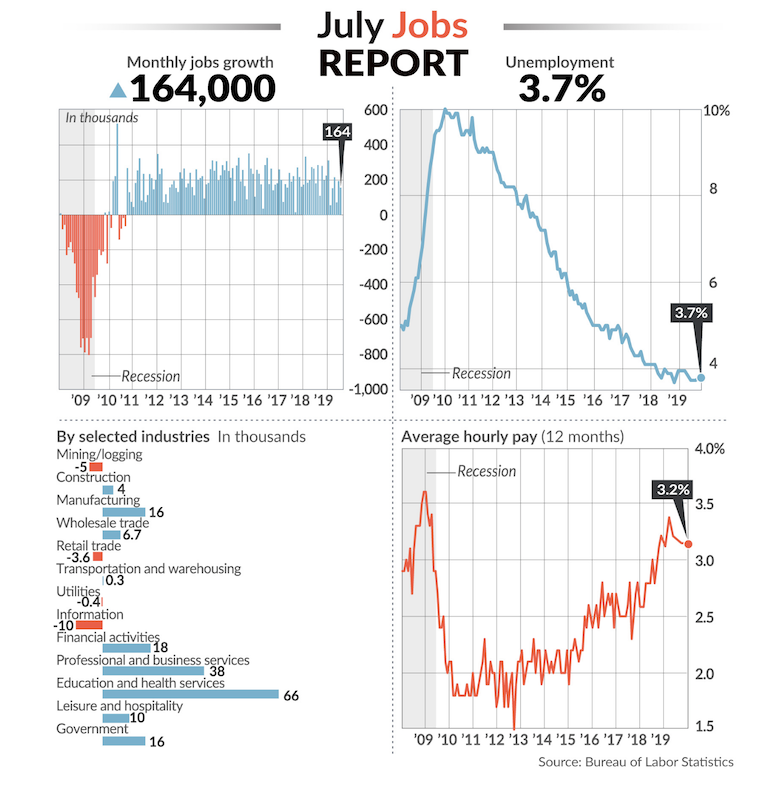

Nonfarm Payrolls: The economy created 164,000 new jobs in July, in-line with forecast of 165,000.

Unemployment Rate: The unemployment rate remained unchanged at 3.7%, remaining near a 50-year low.

Average Hourly Earnings: Wage gains remain at just slightly above 3% a year.

Trade Deficit: The deficit decreased 0.3% to $55.2 billion from a revised $55.3 billion in May

Exports declined 2.1% to $206.3 billion, marking the lowest level since December. The U.S. exported fewer autos, drugs and computer accessories.

One bright spot: Inflation-adjusted exports of U.S. oil hit an all-time high on the back of surging domestic production that’s reduced the need for foreign imports. The real trade deficit in petroleum was the lowest on record.

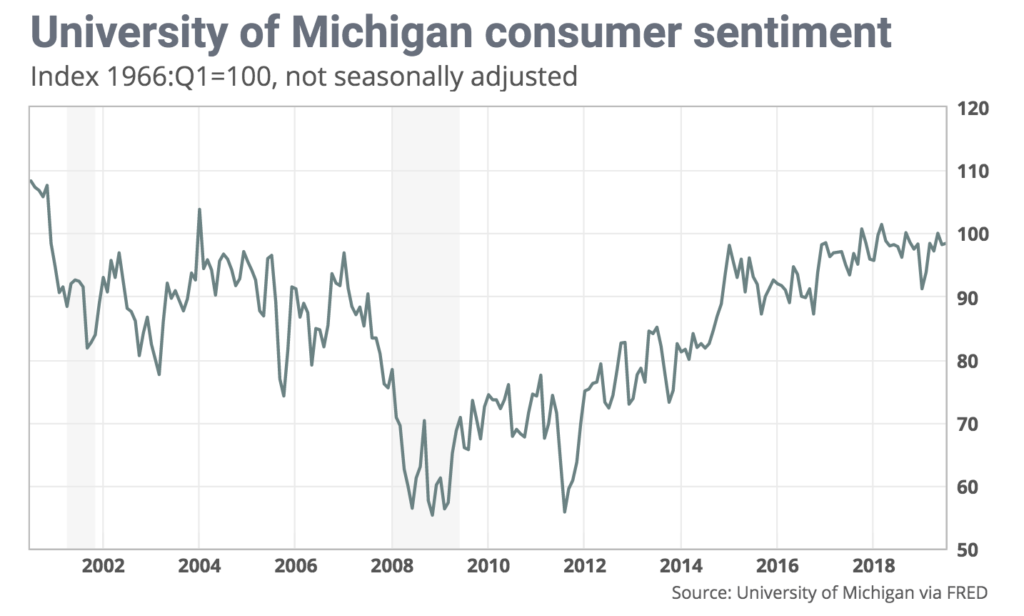

Consumer Sentiment Index: The University of Michigan said the final reading of its consumer-sentiment index for July was 98.4, up from 98.2 in June. Forecasts expected a 98.5 reading.

The index of consumer expectations rose while that for current conditions fell. Recent surveys have pointed to the most favorable personal finance expectations since May 2003, but consumers also have begun to take precautionary measures to increase savings and reduce debt, the University of Michigan said.

Attitudes toward buying homes and vehicles have significantly receded from their cyclical peaks despite declining interest rates, the University of Michigan said.

Factory Orders: U.S. factory orders rose 0.6% in June following two consecutive decline. Orders minus transportation moved up 0.3%. Core capital goods orders advanced a revised 1.5%, down from a preliminary 1.9%.

Trade Wars and More

China Vows to Counter Trump’s Tariff Threat as Trade Rift Widens

Beijing pledged to respond if the U.S. insists on adding extra tariffs to the remainder of Chinese imports, as President Donald Trump’s abrupt escalation of the trade war between the world’s largest economies sent stocks tumbling across three continents.

Trump announced Thursday that he would impose a 10% tariff on a further $300 billion in Chinese imports, a move set to hit American consumers more directly than his other tariffs so far. The new duties, which Trump said could go “much higher,” will be imposed beginning Sept. 1 on a long list of goods expected to include smart-phones, laptop computers and children’s clothing.

Trump rolls out trade agreement with the EU one day after escalating tensions with China

President Donald Trump announced Friday the European Union would open its beef market to American farmers in a bid to defuse one front in a yearlong trade trade dispute between the two sides.

“The agreement we’re about to sign keeps one more promise to the great patriots of American agriculture,” Trump said of the deal, under which the US would get guaranteed share of the EU’s 45,000 ton quota for hormone-free beef. “They’ve really been looking forward to this for many, many years.”

EU settles on World Bank’s Georgieva to lead IMF

European Union governments picked Bulgaria’s Kristalina Georgieva as the bloc’s candidate to lead the International Monetary Fund after more than 12 hours of talks on Friday that highlighted the EU’s internal divisions.

The 65-year-old chief executive of the World Bank got the backing of a majority of the 28 EU states, defeating the Dutch candidate Jeroen Dijsselbloem after two rounds of voting and prolonged negotiations among EU nations.

Georgieva is a center-right politician who grew up in Bulgaria under communism before a career that brought her to the top of the World Bank and the European Commission.

Great Reads

Jane: A few days ago an article about an invention to remove microplastics from sand was posted and now I see this: Irish Teen Wins 2019 Google Science Fair For Removing Microplastics From Water So cool.

Samantha: Implications for a Commodity Run 2020 by Brian Gilmartin has been a theme of mine for awhile so like seeing another perspective on it from a very different lens.