Gold and Miners have done nothing wrong to warrant me selling them today. In fact, they have performed beyond expectations since I called for a Gold rally in my June 6 podcast for DailyFX and again updated Gold thesis for SeeItMarket this August.

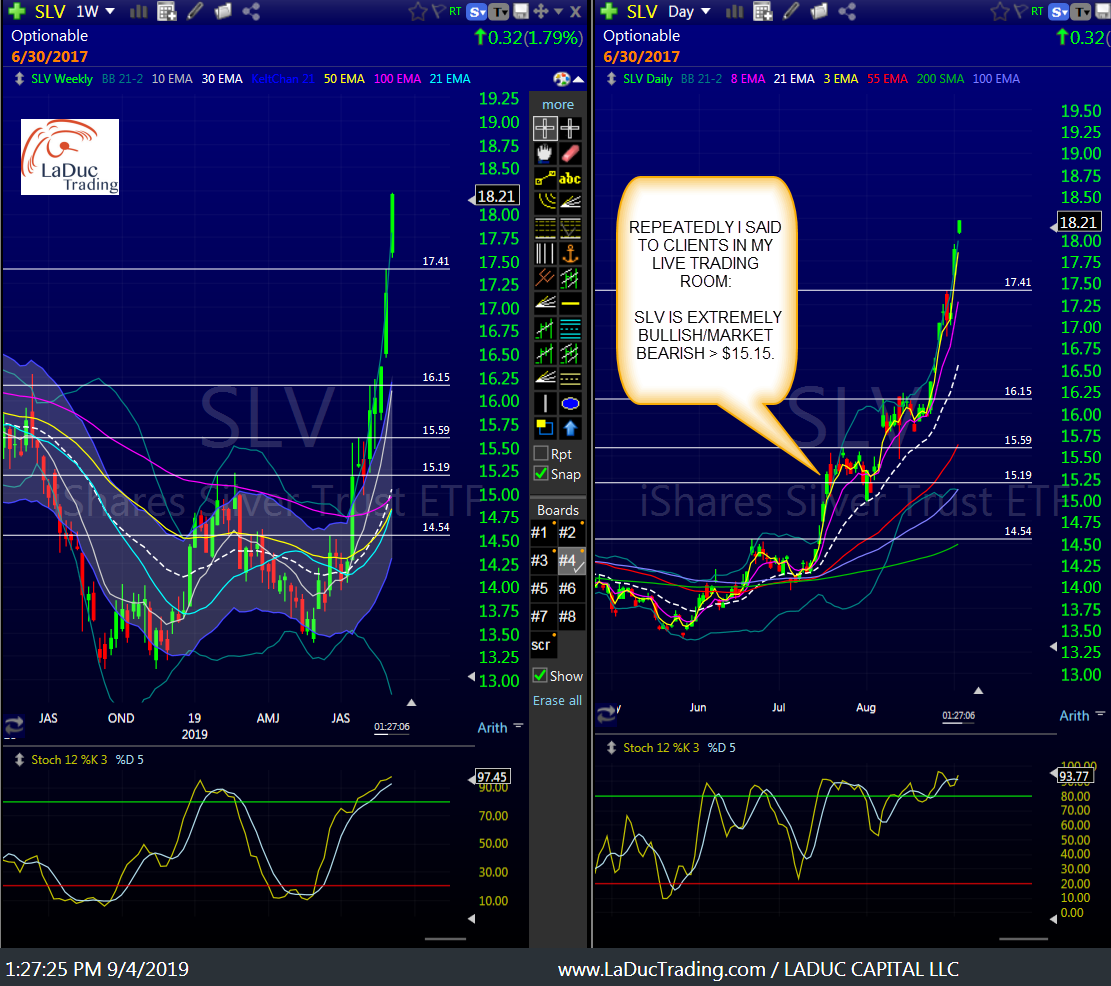

Samantha LaDuc, July 25, 2019 to clients pre-FOMC July 31st.

During the last 2 rate cut cycles, it paid to buy Gold and Silver after the first rate cut. See chart wherein the Fed cut nominal rates in late 2007 causing real interest rates (yields on 3-month Treasury bills less CPI inflation) to fall, which caused a strong run in Gold for first half of 2008 before strongly pulling back and then relaunching in 2009 for a multi-year run.

Well, they have run!

Both Bonds and Gold based (stopped going down) in October before Gold reversed trend in November, Bonds in December and Silver not until this summer with Miners – and ALL the while the US Dollar grinded ever so methodically higher. Yen has been slow to launch, but I think it’s next: Yen Nears Escape Velocity.

Brokerage-Triggered Trade Alerts!

So why did I sell today? Because I think these metals are parabolas with a case of vertigo and likely strongly pull back before they relaunch. Again, here is what I wrote to clients and later for SeeItMarket:

During the last 2 rate cut cycles, it paid to buy Gold and Silver after the first rate cut.

And here were my bullet points for my June 6th podcast with DailyFx with my case for Gold:

- Gold price divergence: price was stable/outperforming “industrial metals” like platinum and silver – this was bullish

- Both realized and implied volatility were at record lows.

- Macro backdrop distrusts Central Bank actions – or maybe more specifically their ability to act when they need to next.

- My Bullish Percent Gold Miners Index was extremely oversold.

- Gold usually trades down into an FOMC meeting, but as soon as market priced in rate cuts, Gold soared as USD pulled back and yields dropped hard.

Fast forward three months:

- Gold price divergence has closed greatly compared to silver and platinum.

- Realized and implied volatility are at record highs for Gold.

- Macro backdrop is still full of Central Bank distrust but so is the case that Negative Interest Rates are Negative.

- My Bullish Percent Gold Miners Index is extremely overbought.

- And Gold usually trades down into FOMC, which is coming up in two weeks.

Well, I got the Silver part right but the Market hasn’t fallen, yet. We shall see what FOMC has to say about that September 18th!

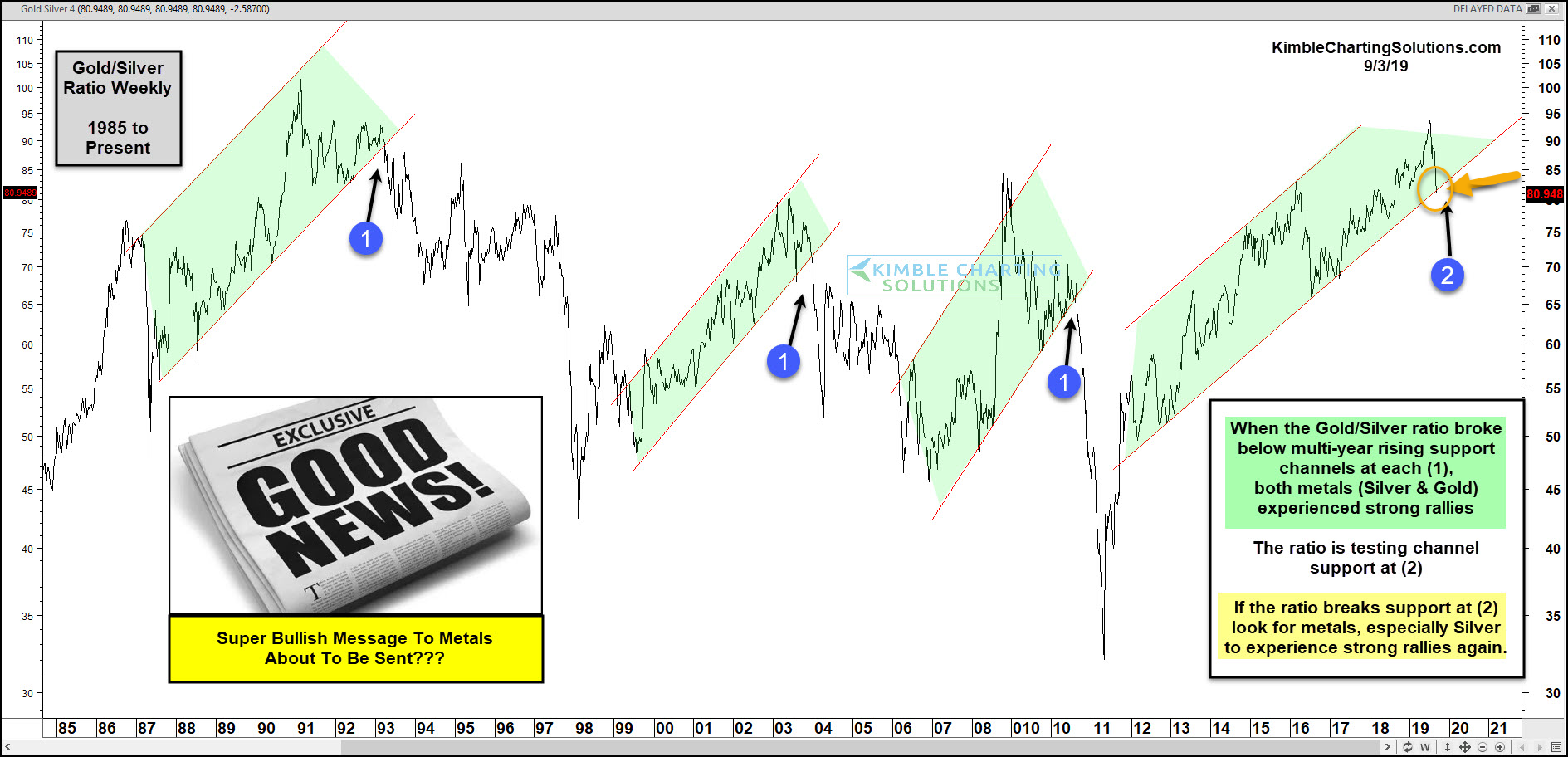

In the meantime, I will be watching this very important Gold:Silver ratio that my friend Chris Kimble put out today:

I saw this great chart after I sold my GLD and GDX positions, but it does illustrate an excellent example of when it makes sense, for me, to re-enter: WHEN this trend-line breaks but I think it will do a bit of digesting there first.

But when it does… there is a high-probability bet that there is no safety in stocks or bonds. Everyone will buy Gold and every penny-stock gold mining shop will rise 1000 fold.

Be careful what you wish for!!