Market Thoughts

Trade War News and Such

‘Do or die’ Brexit Boris Johnson has toughened his Brexit rhetoric with a “do or die” pledge to leave the European Union on Oct. 31. He then said he would scrap Theresa May’s withdrawal agreement and seek a completely new deal before then, as minor changes would not satisfy him. Not only has the EU said it will not reopen the withdrawal agreement, but the timetable would be extremely tight as parliament is in recess over the summer. Seeking Alpha

And I bet you thought Mueller was done too!!

Robert Mueller will appear before House lawmakers on July 17 to answer questions about his Russia report, setting up what may be one of the most dramatic hearings of the Trump presidency. He agreed to testify before the Judiciary and Intelligence panels under subpoenas. “Presidential Harassment!,” Trump tweeted.

Oh, And did you really think American Tech companies wouldn’t find a way to sell to Huawei?!

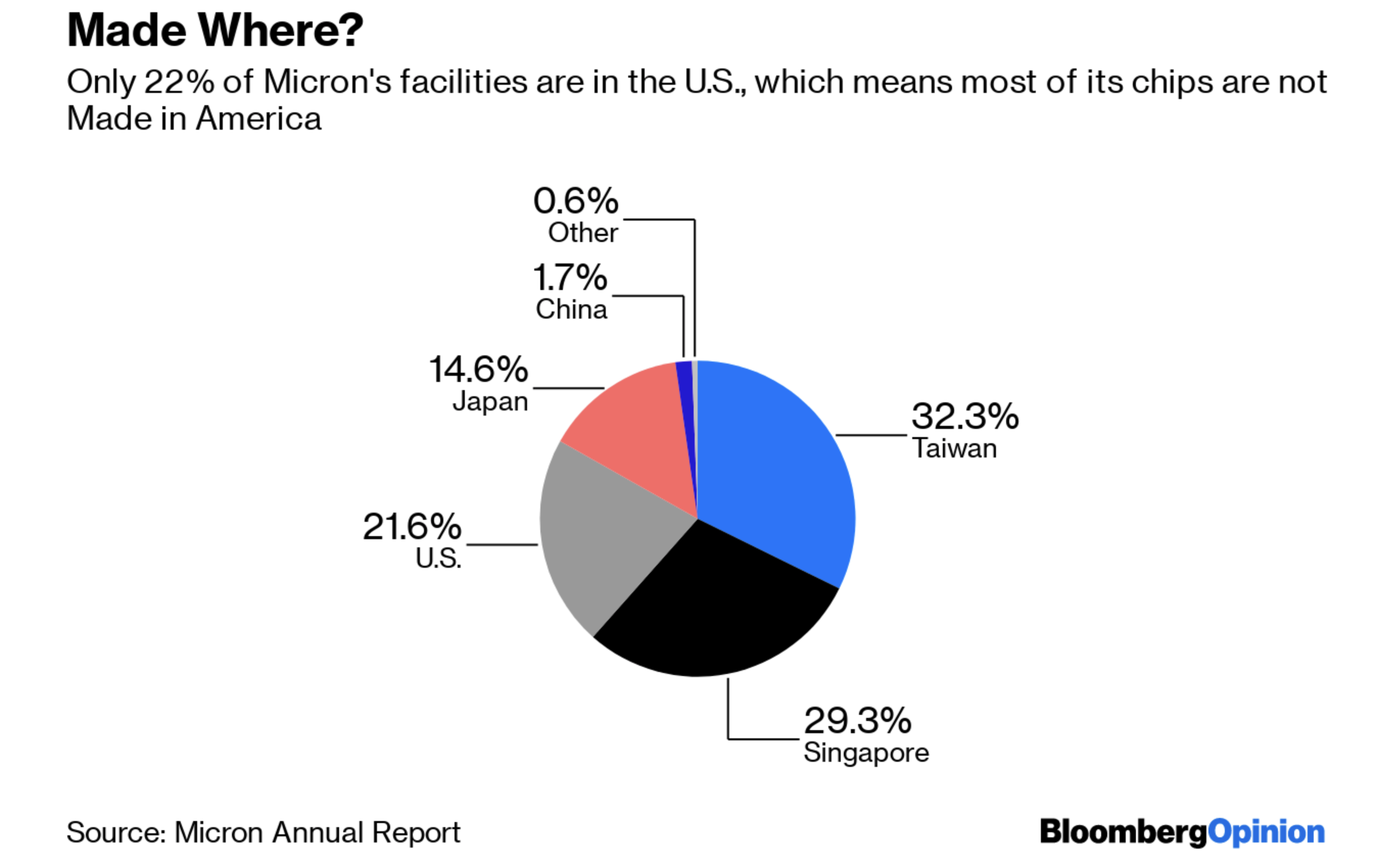

U.S. technology companies have resumed selling certain products to Huawei Technologies Co. that comes down to a loophole based on how “American” American tech companies are,

Stocks of Interest in the News

MU – reported pre-market sending shares up 10% with an additional 3.3% rise from open.Stronger-than-expected earnings from Micron Technologies (NASDAQ:MU) helped boost investing sentiment overnight as the semiconducter maker stuck to its forecast of a second half rebound in the memory chip market and resumed shipments to Huawei,

TSN – looks like a nice short on the weekly and now I understand why (note sympathy plays PPC, SAFM)Chicken producers on watch as price-fixing case gets more serious

AVGO – ‘antitrust’ fears are either delayed or investors were distracted chasing Bitcoin as stock was in the green today.EU antitrust authorities are investigating Broadcom. Competition regulators are examining whether the chipmaker uses exclusivity restrictions to block rivals

TSLA – has Yuge put buying today…$6.6M premium purchased in July $215P and another traunch of $6M for August $220P, not to mention serious size puts for this week.TSLA has forecast it will deliver 90,000 to 100,000 cars in Q2 after handing over just 63,000 vehicles to customers in the first three months of the year. Shares have slumped 34% YTD, in part due to demand concerns that Musk has repeatedly downplayed.

Macro Matters

Market Perception Meet Reality

The Fed finally gave in to the idea of rate cuts – one or two for next year anyway – that’s 2020 NOT July!

When you start out (late 2018) thinking robust economy and several rate hikes only then within weeks to shift to a Fed “pause” and then a few months later rate cuts but next year to a month further debating whether a 25 bps or 50 bps one to start with in July, things must be going sour very quickly.Rate cuts are not going to be insurance; they are the alarm bells.Jeff Snider, https://seekingalpha.com/article/4272143

A dollar that perpetually depreciates would mean faster inflation with higher interest rates to follow, and it would probably only happen as a result of a serious economic slowdown. A weaker dollar is no kind of long-term solution to the worries about global growth, but for the next few months, it could make all those problems much easier to ignore and allow for one last U.S. gasp in the bull market in stocks. John Authers

Economic Data Disappoints

Orders for U.S. durable goods fell in May for the third time in four months, held down by a canceled deal for Boeing’s troubled 737 Max jet. Yet business investment perked up in a somewhat reassuring sign that companies haven’t frozen spending amid a tense trade fight with China and signs of a slower U.S. economy. Orders for long-lasting goods slid 1.3% last month, the government said Wednesday. Economists polled by MarketWatch had forecast a 1% decline. Orders in April were also weaker than initially reported. Yet if cars and planes are stripped out, orders actually rose 0.3% in April to break a string of three declines in a row. Transportation often exaggerates the ups and downs in orders because of lumpy demand from one month to the next.

Orders for commercial aircraft sank 28% in May. Boeing canceled a large order of Max planes destined for India after a struggling carrier ceased operations. The company has received barely any orders since Max flights were suspended globally after a pair of deadly crashes earlier this year. Orders for autos rose 0.6% in May. Orders also increased for heavy machinery, primary metals, computers and networking gear.

Core Capex Orders came in better than expected, a potentially good sign about business investment. However, the pace of investment is still quite weak overall:

The Advanced Trade in Goods report showed a wider than expected trade deficit for May. That higher deficit could be a drag on growth in the second half of the year.

Marketwatch notes: An early look at U.S. trade patterns in May points to a wider-than-expected trade deficit. The advance trade deficit in goods widened 5.1% to $74.5 billion, according to the Commerce Department. The government’s advance report on wholesale inventories showed a 0.4% rise in May. And advanced retail inventories increased 0.5%. Nonauto retail inventories were up 0.3%. The advance report includes trade in goods but not services. The full report will be released on July 3. The U.S. historically runs a surplus in services surplus that does not fluctuate widely from month-to-month.

What happened: Both imports and exports rose in May, but imports rose at a faster pace. The 3.7% gain in imports was led by autos and industrial supplies. Exports growth of 3% was led by food and consumer goods.

Big picture: The surprisingly larger May trade deficit will be a modest drag on second-quarter GDP. A larger deficit is a negative for U.S. economic growth.

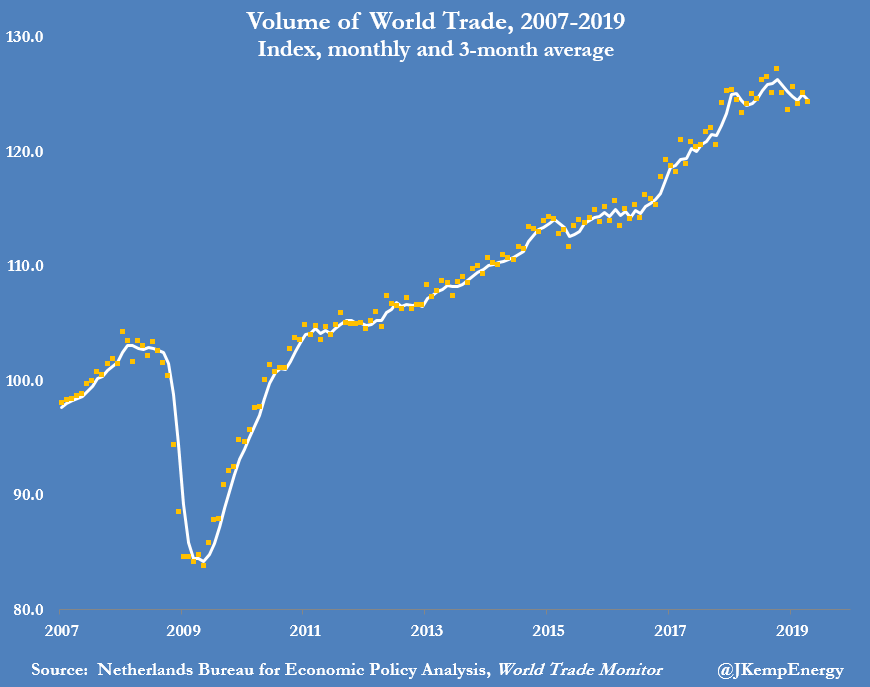

U.S./CHINA TRADE WAR has effectively brought global trade growth to a halt with biggest slide in volumes since the Great Recession: John Kemp

Samantha Says

Market Commentary from Samantha’s Live Trading Room and StockTwits Premium Chat Room

Jun. 26th, 9:21 am MU looks good if it can hold above 35.20 area (chase at open)

Wall Street Jane’s Journal

Jane is not only Samantha’s Live Trading Room moderator, she facilitates client engagement and relays Samantha’s trade ideas into the LaDucTrading StockTwits Premium Room. A former banking VP during the GFC, she now actively trades full-time and actively shares her trading ideas, plan and process.

Trade Idea Follow Up

Last night I talked about a short trade idea on $LLY. As follows: LLY had been towing the line on the 200DMA and then when some bad drug data hit, it took the leg lower. It’s now been retesting that 200DMA all the while the 50DMA is going in for the kiss from above. I’ll be watching this name for a break below 114 for short entry. I would look to trade the August 16 (monthly) 115 strike. Price target 1: 111, price target 2: 108.

This morning my $114 alert hit at 9:45am. As it was so early in the trading day I elected to wait and see if it came back in a bit before considering an entry. That didn’t happen and the stock continued to move lower throughout the session, hitting my price target 1 of $111. It finished slightly off the lows at $111.34.

Although I missed this trade, the action played out as analyzed and that’s always a positive.

Great Reads

Matt Levine at Bloomberg Opinions writes an article today titled: Everything Everywhere Is Securities Fraud – Also chicken Libor, spoofing and insider trading. Matt has crammed a lot of interesting information about securities law and how it is applied in certain cases.