Market Thoughts

Tuesday the S&P 500 put in a big technical reversal signal — a bearish outside day. The last signal like this we had was on May 1, which resulted in a 7.6% correction. However, I don’t think it will be that easy given the bullish engulfing weekly candle on many indices and stocks Friday. Parent (week) has more ‘leverage’ over the child (day), so I’m watching right now to see how well the kid behaves (or not). Today, kid was surprisingly quiet. But we know that won’t last long.

My Thinking – Then:

We had a trifecta of bullish catalysts from last Monday that triggered the Bull. 1st, Not only did we have very oversold technical levels (that was just bonus/convenient timing), Goldman said there was intense BuyBack activity (yeah, that!). 2nd, Goldman also said there was a 2.5 standard deviation move Friday in short covering! 3rd, We had sentiment-driven buying all week after Powell spoke the prior Monday night reaffirming the Fed is ready to support markets if needed.

My Thinking – Now:

There is a Key Tussle I will be watching: Will these ubiquitous Buybacks keep pace into June 26 Q2 black-out period (exp 35% flow reduction after that by the way)? Or will this buyback buying be more than offset by selling into the June 19th FOMC meeting (expected to be a “no-cut neutral” announcement, which may in and of itself disappoint markets)? Can’t help but look at the timing of the G20 Trump Threat wherein Trump challenges (like Bieber challenged Cruise kind of thing?) to show up for a meeting on June 29th “OR ELSE” – ‘else’ being immediate tariffs on the remaining $300B of Chinese imports (more like Shootout at O.K. Corral). Market has been fooled too many times by Trump’s mercurial ways and tweets to really not consider a potential Chairman Xi “no show” risk . I mean, Trump didn’t mince words and he did it going into a meeting IN JAPAN, so talk about calculated or careless provocation to cause Xi to lose face. Color me skeptical. I think stocks have a higher risk of falling then going up.

Main Theme: Embrace The CHOP. I suspect there are BUYERS ABOVE $2950 and SELLERS BELOW $2700. Translation: Everything in between is CHOP for SPX.

My Thinking – Moving Forward:

I doubt Earnings will help launch SPY higher as market is expecting flat earnings growth for Q2 ’19 against tough comps from tax-cut impact of Q1 ’18. And I doubt the US-China Trade War will be settled any time soon. And I doubt Fed has enough credibility to support let alone spur growth from rate cuts or QE. But I also don’t believe we fall apart right away – later yes, but not right away. Because… When the market goes up, we will worry about new tariffs and rate hikes. And when the market goes down, we will expect trade war de-escalation talk and rate cut Trial balloons to go off and cushion the fall.

SIDEWAYS TO LOWER INTO 2020 remains my mantra since my Dec-May NYSE $1300 price target was hit.

Stocks of Interest in the News

- BA reported no new commercial aircraft orders in May, marking the second straight month that the planemaker’s orders were at a standstill in the face of its 737 Max crisis.

- QCOM – The FTC has asked District Judge Lucy Koh to deny Qualcomm’s request to delay enforcement of an antitrust ruling handed down in May

- MAT rejects another merger bid from MGA Entertainment

- TSLA Investor Meeting has ended and Musk promised profitability – again.

Macro Matters

Here is what Morgan Stanley’s chief investment officer Lisa Shalett had to say about the rate policy “about face” in the last 6 months.

”In less than six months, investors have gone from discounting three Fed rate hikes to three cuts; many factors support the shift, but we question whether easing alone can change the outcome. While looser policy may support market liquidity and valuations in the short run, we are not confident that rate cuts can cure what ails the economy. All-time high consumer confidence, 50-year low unemployment and mortgage rates near 4% have not lifted consumption and residential investment; rather, policy uncertainty from Washington and geopolitical instability is weighing on the aging business cycle; trade uncertainty appears to be distorting supply chains, quashing capital spending and contributing to a manufacturing slowdown. If the Fed is ultimately pressured into “prophylactic rate cuts,” then it may find itself with too few bullets left when it really needs them, she added.

And Sid from Bloomberg Opinion

Central bankers keep reminding us implicitly that they will cap real rates to keep the debt-driven supercycle going. For all the talk of currency wars, relatively muted equity price swings and synchronized dovish monetary policy are killing FX volatility. And as Jefferies points out, rate cuts are happening all over the place, from New Zealand to the Philippines, without central bankers having to worry that weaker currencies will boost imported inflation. Meanwhile, the fall in Treasury yields is rekindling carry trades around the world. Against this risk-taking backdrop feeding growth, the outlook for the second half of the year feels more binary than usual. Bonds seem to be flashing recession signals, as per the New York Fed’s implied recession-probability model. It’s at 29% right now, the highest since 2008. Yet other lead indicators from the OECD may suggest a tentative pick-up in the coming months.

Trade Wars and More

President Donald Trump said he had no deadline for China to return to trade talks, other than the one in his head. “I have no deadline,” Trump told reporters at a news conference Wednesday at the White House. “My deadline is what’s up here,” he added, pointing to his head.

Samantha Says –

Select Market Commentary from Samantha’s Live Trading Room and StockTwits Chat Room

Jun. 12th, 9:19 am $MSFT Chase trade- if falls below 131.35 could be a quick short options trade to 128.

Jun. 12th, 9:22 am ONE TO WATCH for IGV sector rollover! One to CHASE short if you do that kinda thing: (TTD) Was $255 yday, PreM $237, Downgrade PT $144…TTD (-5.0% pre) Nomura/Instinet Downgrades The Trade Desk (TTD) to Reduce, Says TAM is not $1 Trillion, More Like $41 Billion, $144 P

Jun. 12th, 9:36 am $BA continuation short. Could head down to major support ($336) she discussed last night

Jun. 12th, 9:37 am XLE couldn’t hold that 61.85 I’ve talked about. Oil inventories report at 10:30am. (Thesis: Short)

Jun. 12th, 10:20 am Market just not doing a lot. Some names still on their own planet like $ROKU $SHOP and $CMG while others fade quietly

Jun. 12th, 10:23 am $TSLA (rejected at PT $225 as suggested)

Jun. 12th, 10:57 am $DBX percolating. Calls been trickling in..on watch.

Jun. 12th, 11:10 am Just nothing much going on out there. No big news, no big movement for the most part.

Jun. 12th, 11:21 am $NFLX Chase short ($348 break with) swing short down to 200DMA $338 and then to 333 area.

Jun. 12th, 11:44 am $FB news just out about internal e-mails and concern about Zuck interference. Was 160 last week. Below 173 and could be a nice short

Jun. 12th, 4:54 pm Dull, Dull, Dull Day. Every. Single. Index. On. 3D. Support. MSFT short idea didn’t trigger – will see at open tomorrow. BA cont short – working. NFLX cont short – working. CMG broke>$730 on way to ATH $758.61. SPOT, SFIX, GRUB cont long… maybe MAT GE (not yet) TSLA HIT PT of $225 PreM and promptly sold off 5% down to 21D, engulfing not one but two days of gains. :-)) (I have a good feel for where suppply wants out – at resistance and this is the 10Wk.) WDC noted in last night’s post got big hit -5.6% on supply chain disruption due to Huawei. Now on $36 support of sorts.

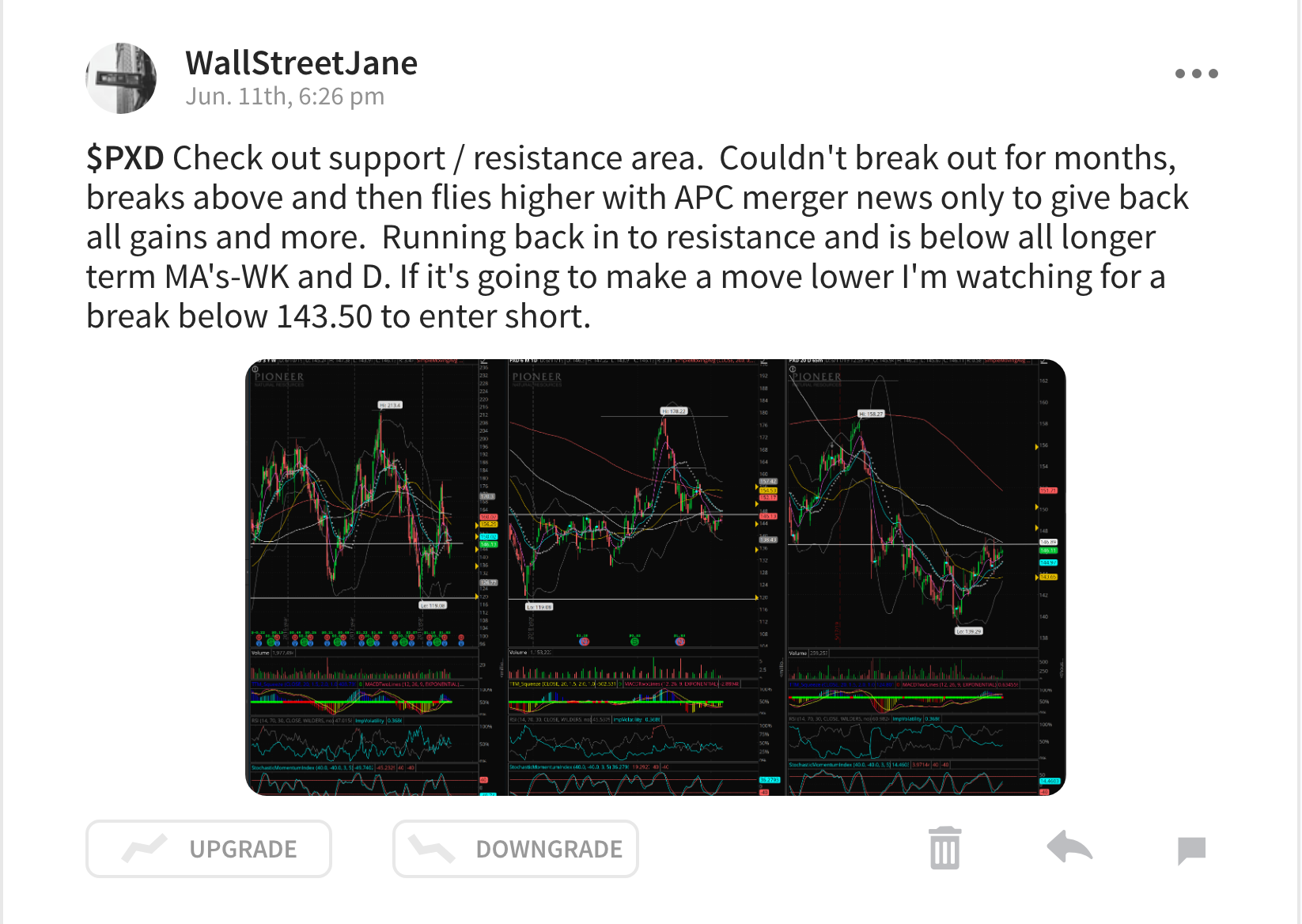

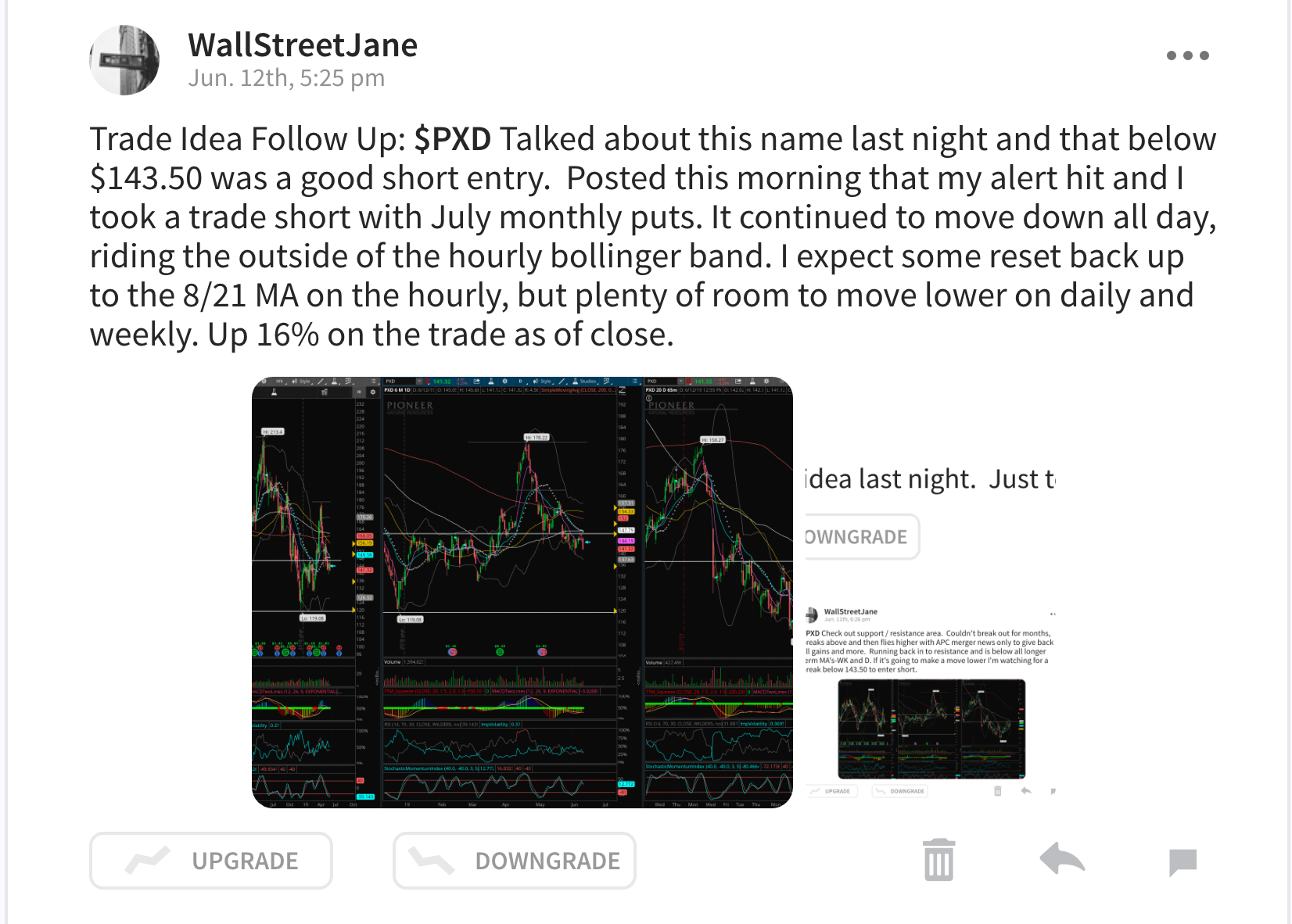

Wall Street Jane’s Journal

Denise Shull provides the most excellent first hand advice for “Modeling Out Your Emotions” Best 5 minutes you’ll spend this evening:

Excellent synopsis/read: #Oil $WTIC $USO

Global economy on leading edge of recession: @JKempEnergy

Astounding gender income discrimination

These Pro Women Soccer players make $.40 on the dollar to their male counterparts, are world champions and brought in more revenue!