Market Moving News

Mario Draghi said the European Central Bank won’t shy away from action to support the euro-area economy during a period of weakening growth.

The U.S. trade deficit narrowed in April as both exports and imports tumbled, highlighting the impact of President Donald Trump’s tariffs even before negotiations with China unraveled and he threatened levies on Mexican goods.

The productivity of U.S. workers increased at a 3.4% annual pace in the first quarter, a few ticks below the government’s initial estimate. Previously productivity was estimated to have risen 3.6%. The revised gain is still the biggest since 2014.

Macro Matters

People buying a new vehicle are borrowing more and paying more each month for their auto loan. Experian, which tracks millions of auto loans each month, said the average amount borrowed to buy a new vehicle hit a record $32,187 in the first quarter. The average used-vehicle loan also hit a record, $20,137.

Mortgage rates hit 2-year low, but will consumers bite? Freddie Chief Economist Sam Khater calculates that most mortgages taken out in 2018 are now eligible to be refinanced. But the favorable climate for rates may be of little help to Americans in the housing market.

China is the top foreign holder of U.S. Treasury debt. One fear constantly dogging the bond market is that China will sell its Treasuries, ruining the U.S. financially. But China has too many foreign currency reserves and too few options to do that soon.

The Fed will likely step in to bail us out, but possibly not until September – too late to help housing or autos.

Trade Wars and More

China’s travel warnings earlier in the week will likely cause airlines and casinos to take a hit.

Trump continues to threaten that Mexico tariffs will go into effect and will ramp up each month unless Mexico complies with the administrations demands. GOP leaders, however, feel that Trump should face them before the tariffs go into effect. Moreover, the House Ways & Means Chairman Richard Neal said Thursday he will introduce a resolution of disapproval if President Donald Trump goes ahead with tariffs on Mexican imports.

Risks Are Not Priced In. “Markets are gradually coming alive to the risk that the conflict of China will stretch far beyond tariffs, and will be harder to resolve than a trade dispute.”

Interesting Reading

The next trade war casualty may be the M&A market.

Coca-Cola (Japan) Co. has said it will start selling a beverage product next week packaged in bottles made entirely from recycled plastics.

African swine fever is causing growing devastation to the pig farmers of Vietnam and Cambodia and putting Thailand, Asia’s second-biggest pork producer, on “red alert”

Samantha Says –

Market Commentary from Samantha’s Live Trading Room/StockTwits Chat Room

Forgot to post the recap last night – For June 5th : Market Thoughts: Day 2, Follow-Through https://laductrading.com/2019/market-thoughts-day-2-follow-through/ So you know, every recap will be posted in one place moving forward-landing page also in pinned tweet: https://laductrading.com/free-fishing-lessons/ Sign up to be alerted via email!

Yes, we broke above the trend-line so bulls are in control, for now, and bears could get excited as we retest that breakout of the trend-line … but given the 2 day follow-through, it does appear we are on our way to fill that gap above. However, I contend the market is likely to remain volatile through ECB this morning, NFP tomorrow morning could really surprise – but mostly likely we chop leading up into FOMC at which point we will hear “go or no go“ on those rate cuts and a direction will be found. Mind the gap!

I’m doing an extended podcast with DailyFX-London time-so I am away from my trading desk this morning. From afar what I see is that AMD break out above $29.50 on way to $31.80 (talked about Monday), ROKU digesting its break out (also Monday) and TSLA continuing its break out from $185 to almost $205! Small caps very weak…

Macro economics Policies lead price action and sentiment. If you go to the landing page I created for members here, you will see a sampling of big picture macro economic indicators that I use as a backdrop for predicting inflection points in trend changes. The micro analysis comes down to the actionable trade ideas in underlying stocks and indices. In this case I use primarily technical analysis.

My Thoughts On ECB: The Bloomberg Euro Index is soaring even though Draghi says some officials discussed rate cuts and QE… That is helping soften the US dollar which is a tailwind for equities and metals. Draghi is on his way out and just sticks to the script which is overly optimistic despite the threats of Brexit and synchronized global growth slows down. In short, no one believes him anymore-currency traders the least.

The Relationship between oil and the SPY is not a simple relationship. As for oil, I can tell you break even is $50 for shale companies in the US which are highly indebted. Oil too strong is a headwind for companies and the consumer. Too weak and it represents deflation and deflation is extremely hard to ward against and fight. The feds tools in this area are very very few and poor. Higher dollar is very dangerous for emerging markets as their debt is denominated in our currency and higher USD is de facto tightening which restricts their economic growth. For equities to sustain and rise, we need stable dollar and stable oil. Right now, oil looks very dangerous Intermediate term. Large builds in supply with slowing global demand. A better Tell for Oil Direction than SPX is HYG. With trading oil and oil and gas companies, they most closely follow HYG as this is the credit market that holds the debt for these companies. And why this matters? Credit leads Equities.

WallStreetJane’s Journal

On Watch: $ULTA Had that big fall post earnings only to have buyers immediately step in. It is now trying to resume its uptrend and looks good for higher should the market hold up. I would say $342 area for entry with first PT of 349. PT 2 at 355. Stop 335. This can be a tough name to play as intraday moves can cause big moves in options pricing. Be aware is all.

On Watch: $HLT Another super strong name that has been unfazed by the market volatility-never even falling below its 50DMA. Entry between 90.25 and 91. PT 1 at 92.75, PT 2 at 93.50. Stop at 89.

Bit of a choppy start to the trading day withe indexes flat to red. Let’s see how the first hour closes for hints about the rest of the days action.

I took a small position in $HLT as it moved over 90.25. Stop at 89 as planned.

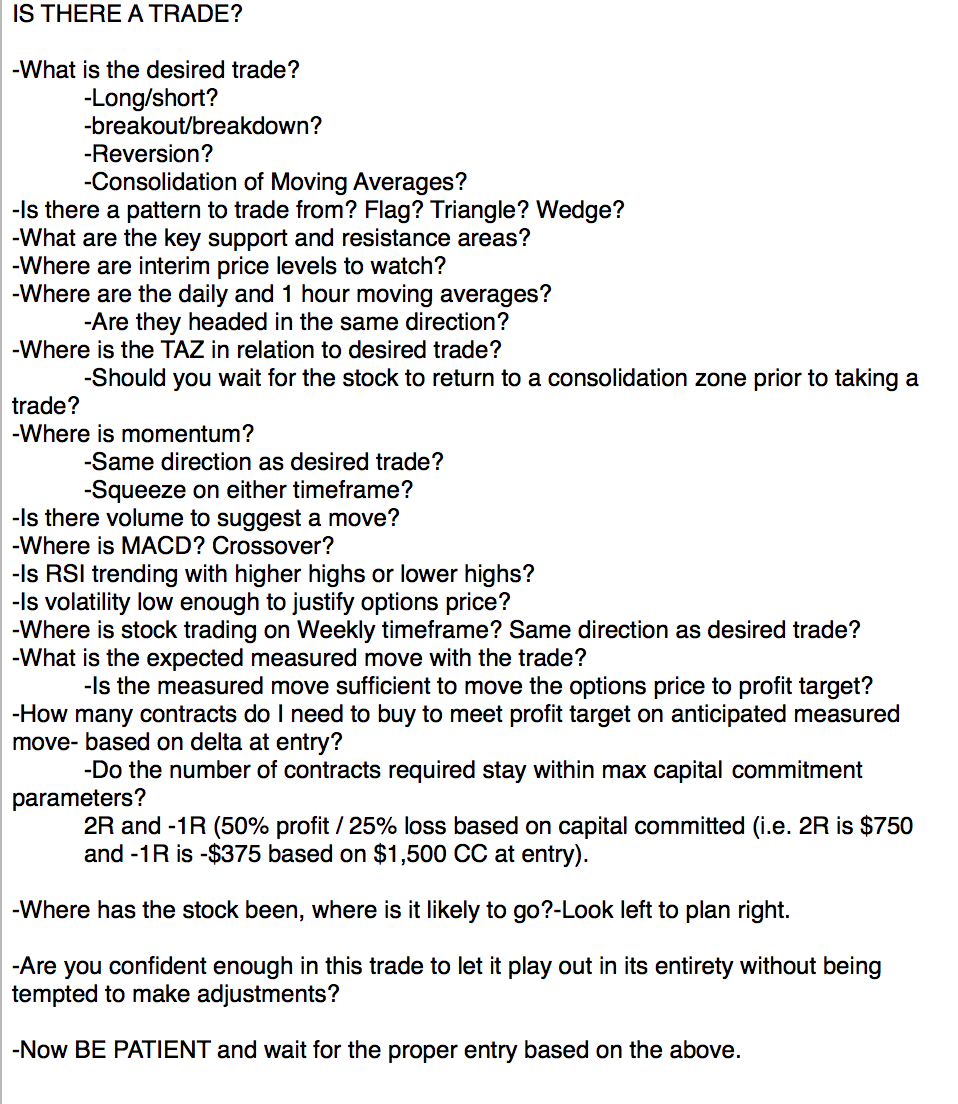

Do you have a written plan in place? One of the most vital aspects to trading successfully, and making it far less stressful, is to know exactly what you are looking for and how you will execute upon your plan criteria being met. Here is my “Is There a Trade?” checklist. This is the guide I use for every trade I enter. After you follow your checklist for a while it will start to become intuitive–a process.

$TLT Wow. Came down to touch the 8DEMA and, boom, headed back up this morning. 10-yr yield down to 2.09%

Still on Watch: $ADSK Pulling back this morning, but it held support at 158.50 area and now trying to move higher in the second hour. Could be forming an hourly inverse H & S.

Still on Watch: $JPM also pulling back a bit this morning, but look how it held support on the hourly. Bouncing nicely off that level at the moment.

$MSFT moving higher and has held that support area this morning. Hourly stochastics a bit extended so I’m going to watch for a bit, but afternoon action will lead the way.

$RUT Pretty ugly. Losing 8DEMA. Bulls hoping the hourly holds current levels, with a possible inverse H & S to form. Should it fail to hold, short entry a possibility.

You know what I always say…it could. BUT, look how extended it is from the daily and weekly moving averages. It’s also overbought (which can continue). R/R is not good at all unless you are trying a day trade to scalp a little. If you’re swing trading you always want to be patient and wait for the optimal entry to increase your odds of a successful trade. Don’t try to chase an extended move is my advice.

Follow Up: $ADSK coming back nicely this afternoon. Pushing over hourly 50DMA, 100DMA and 21WKMA. Like long.

Follow Up: $ULTA looking strong in to the close and entry at hold of 142 area still looks good. As I said last night, kind of a tough name to play.

There you have it folks. Market closed. Market held up throughout the day and the late days news that Mexico tariffs might be delayed help move price higher to end the day. Recap of ideas we discussed forthcoming. And don’t forget to follow the link in Samantha’s pinned tweet to sign up for the free nightly recap–where the stream from the room will be condensed for easy reading.

Trade Update: $WDAY I continue to hold WDAY, but didn’t really have a good opportunity to add to the position comfortably. It’s due for a breather after the nice move higher today. Holding July monthly contracts.

Trade Recap: $HLT As mentioned I took a small position this morning. It didn’t do much until the end of the day, but closed nicely and I’m up 5% on the option trade. Looking for follow through tomorrow.

Trade Recap: $JPM took a small position with the nice recovery after holding support today. Up marginally on trade heading in to tomorrow.

Recap: $RUT talked earlier about it looking pretty ugly and needing to hold that support level on the hourly. Well, it had a nice hold and reversal in the afternoon. Still an ugly D and WK chart, but positive sign that it didn’t fall apart as the day progressed.

Recap: $MSFT Hot, fire, flames all afternoon. Now definitely extended on hourly and might run in to some resistance at that gap fill overhead. Just on watch for pullback and possible entry once it cools off a bit.