Market Moving News

Antitrust scrutiny rattled Big Tech. Regulators split up oversight in apparent preparation for probes into whether the firms’ practices harm competition. The FTC will look at Facebook and Amazon as the DOJ examines Google, people familiar said. The Justice Department will also oversee Apple, Reuters reported. Bloomberg

As a result Monday, FANG was de-fanged:

- Facebook was down 7.5% – low since July 2018

- Amazon was down 4.5%.

- Alphabet was down 6% – five month low.

Despite the terrible showing for Tech, the S&P 500 ended the day only down 0.25%. Why? Plunging rates and falling USD cushioned the fall, while investors piled into the GLD ETF at the fastest pace in nearly three years.

Coming into Tuesday, the oversold markets were hungry for good news and the FED delivered when Chairman Powell indicated an openness to cut interest rates “if needed.” U.S. stocks climbed the most since January.

Samantha Says –

Market Commentary from Samantha’s Live Trading Room/StockTwits Chat Room

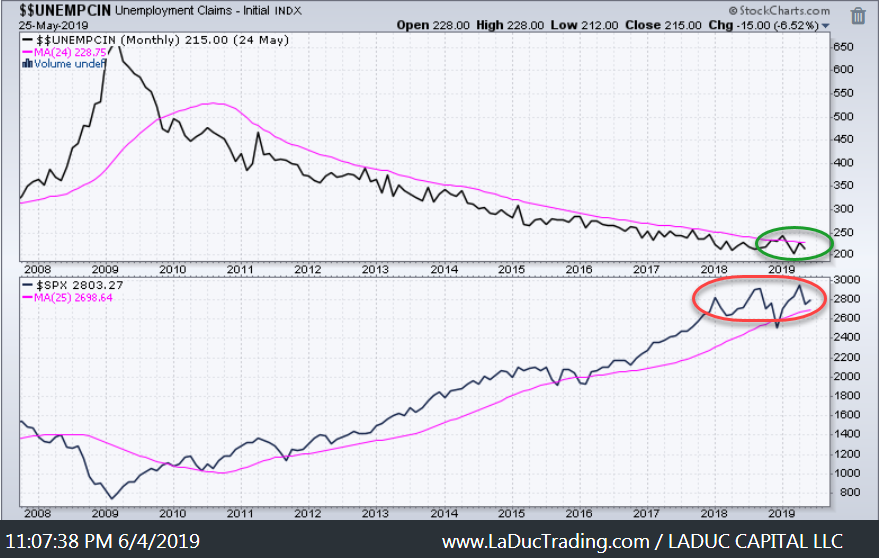

Bounce Idea Finally Working (AM I believed, PM I doubted) – but the following chart was The Tell. With that, I fully expect this is a counter-trend bounce, not the sustaining kind UNLESS Powell gives us reason at his 10am speech today – he may intonate cuts but anything definitive comes at the real one for FOMC mtg June 16-17th… anyway yday I wrote BA to $345 area and SPX to 2777 then we’ll see. Almost there on this gap up.

The short-covering rally going into today’s gap up – predicted support levels, SPX:NDX convergence AND my gap fill PT of $2742 being hit – is now being supported by Powell’s speech wherein he RECOGNIZED THE “INFLATION SHORTCOMINGS”! That is code for RATE CUT. And thus, market is rallying. Careful with longs at SPX $2794…

TLT coming down as rates pop – and SPX is strong >2777 on way to 2794 PT. Not seeing weakness yet… will let you know!!

SPX Target of $2794.81 hit intraday. When Powell recognized the “Inflation Shortcoming” – this intonated a rate cut, to the market. Doesn’t take them much. Will see if this short-covering rally off key support ($2742) along w his comments gets any follow-through >2800. I still see One More Gap Fill: $2718 to test but likely needs to tag that $2800 level 1st and get rejected, obviously. Events that might help that: ECB Rate Decision Thursday and NFP Friday.

Evening! We closed strong, yes, and not a surprise – see my comments from AM expecting $2794 and every time I checked in I said I saw no sign of weakness so that means stay long chasing intraday. As for tomorrow, that’s harder!! Remember we closed terribly weak yesterday and did a 180° gap up this AM, so we could do a 180° gap down tomorrow. I am still convinced we see $2718 in the next week. PS Our$BA did not close above $145 and neither did CMG or Oil… NFP Friday is most definitely a risk to Bulls.

WallStreetJane’s Journal

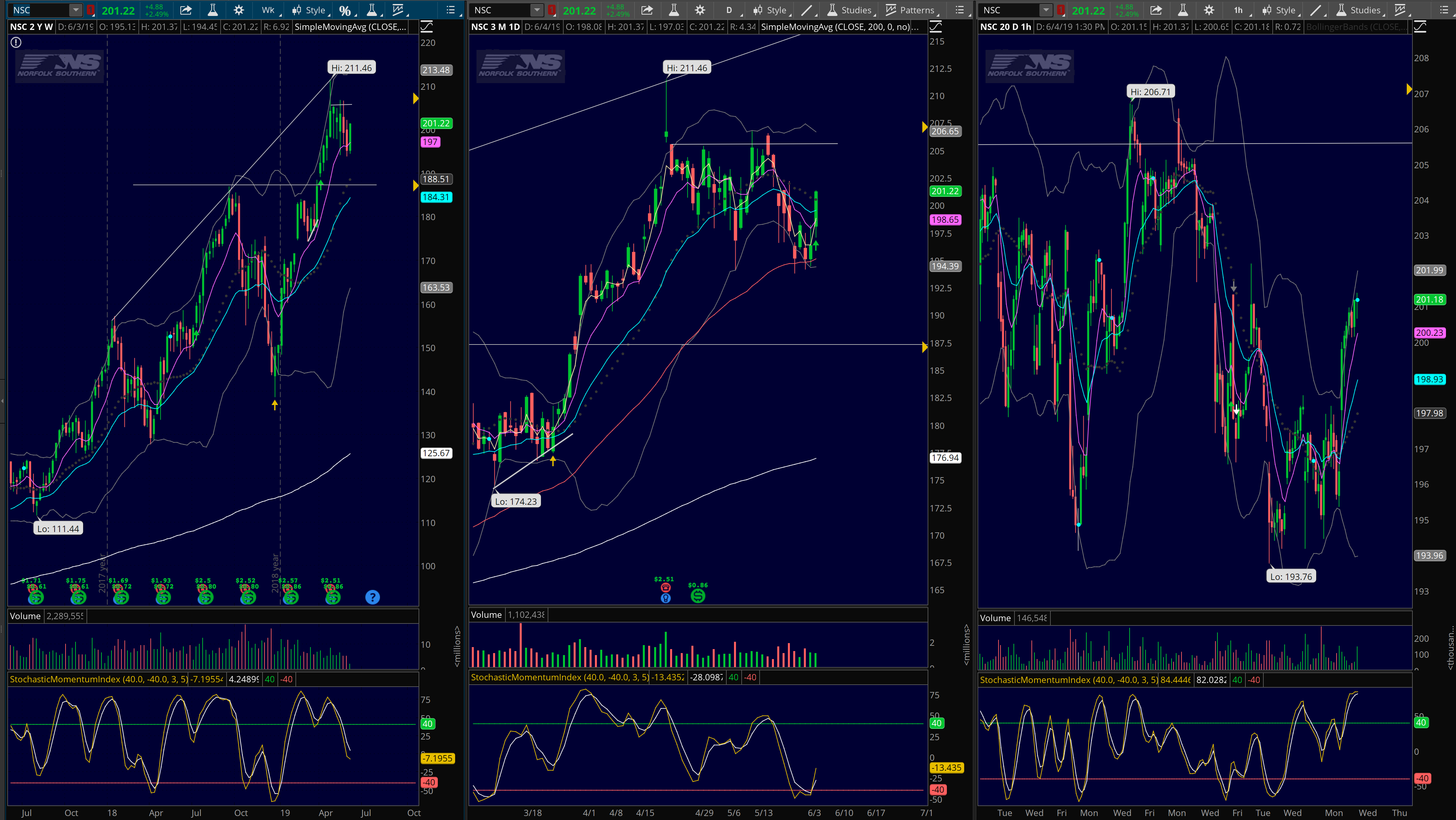

Despite some questionable data regarding rail traffic, transports such as $NSC, $UNP and $KSU have remained relatively strong despite the market turbulence. $NSC is of particular interest for a swing trade given its close above all moving averages (WK, D, HR) and close above mid bollinger band. I would like to see a small reset on the hourly so the averages can do some catch up and stochastics move down to a more neutral level. First price target would be $205.65.

Macro Matters

- Here is the economic news from Monday, and it’s not good… 1) ISM imports point to 0% GDP growth 2) ISM is set to weaken for next six months.

- Meanwhile, factory orders sank again last month. Orders dropped 0.8% in the month. Demand was even weaker for durable goods — products such as autos, appliances and machines meant to last at least three years. These orders sank an unrevised 2.1%.

- The yearly pace of business investment slowed in April to 1.2% from 3.8%, marking the smallest 12-month increase since the final month of Barack Obama’s presidency in January 2017.

Trade Wars and More

- As China warns citizens against U.S. travel, citing “frequent” shootings – keep in mind Chinese tourists to US number ~3mm/yr and ~$36bln of domestic spend. Short Ideas in Tourism/Air/Hospitality as theme, especially as market/economy weakens down the road.

- Calling the US economic terrorists, threatening to restrict rare earth exports, generally allowing state media to dial up the rhetoric, and the release of the weekend White Paper laying the blame of the collapse of recent talks on the US

- Mexican tariffs announced this week for June 10.

Stocks of Interest This Week

- Beijing is investigating FedEx.

- Trump wants Americans to boycott AT&T

- GOOGL Will be investigated for anti-trust

- Macau casinos return to growth in May despite trade war – WYNN LVS

- BA has “wing trouble”. As presented Friday, it must hold $336 or the June $300P at $4 could run to $40 in an airpocket drop.

- Bounce candidate AAPL had its Development Conference kick off Monday and improved sentiment from survey regarding higher-priced iPhone rollout next year with 5G

Interesting Reads

- The battle for China’s coffee culture is heating up—and the warring factions are attacking the market in very different ways. Take-Out Vs. Sit-In: The $5.8 Billion War for China’s Coffee Drinkers

- This Bloomberg Opinion piece by Hal Brands provides an interesting take on how China Is Winning the Battle of Brains With the U.S.

- Fraud in the Solar Space: The Couple Who Feds Say Scammed Berkshire Hathaway for Millions