The Daily Market Catch

Top market-moving themes and insights – Delivered free to your inbox.

The One Big Thing

APPROACHING MY SPX PRICE TARGET OF $3060 from Market Thoughts: When Is It Safe To Buy?

Oct 2nd: I believe we now chop and drop into the 9th and then move higher after that into FOMC on the 31st.Samantha LaDuc

Free Treat! It’s Halloween Week after all… My Weekly Fishing Plan for Clients.

See what I spied from my Live Trading Room October 21 – 25 including $NFLX $MCD $AMZN $SLV $XNET

Clients receive my Macro Views – risks and opportunities – to my Micro trade ideas/set ups. You can too!

Top Charts

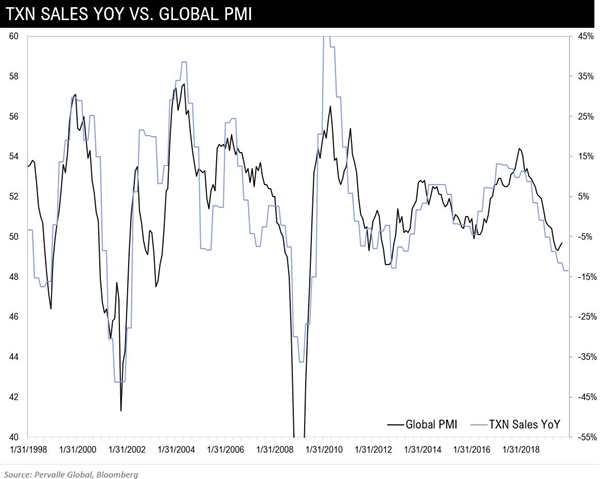

$TXN sales YoY (w/ implied guide) vs. global PMI via @TeddyVallee

Top Tweets

Assuming Republican Senator Rubio does file a bill to limit US Investing in Chinese stocks, and assuming it gets bi-partisan support and passes, then we can assume the market will price this in! The very fact that I am highlighting it (for a year now) is because the narrative is building under the surface in this Trade War with China that can reverberate in Capital Markets. It’s a risk. A potentially big one.

Top Trades

Twitter is about to really set itself apart from Facebook…

First, here is a must-read thread from their Oct 25th earnings report wherein their CFO did a full mea culpa on Twitter. If you are, like me, impressed by TWTR as a platform but dumbfounded why they haven’t monetized it to propel the stock price higher, you will want to dig in. I agree that TWTR will be a double in 2yrs.

And then just today, @Jack made a very big announcement that elevates TWTR as the antithesis of FB in its moral compass. Stock got hit afterhours, but I contend this will make for a much more rewarding and trusted experience. At the very least, those in Social Responsible Investing will be drawn in as FB has proven repeatedly to be a sewer of deep-fakes and deep distrust.

Top Reads / Videos

Jim Bianco makes a good point: Central Banks Can’t Create Negative Rates by Themselves

- Technology squashes core inflation

- Older people are buying bonds and driving yields lower

- The world savings glut is leading to massive bond buying that is resulting in yields dropping

- Global flight-to-quality will continue as the world economy slows

- Financial repression from central banks will continue as they take monetary policy rates into negative territory

For more charts and links like these check out my twitter feed.

To Great Fishing!

Samantha LaDuc

Founder LaDucTrading

CIO LaDuc Capital LLC

Thanks for reading – Curious how I help active traders and investors like you? I fuse macro analysis with market-moving news, give it context and actively trade while supporting clients who do the same.

Not a member? Here’s some more FreeBait – Fishing Stories and Trading Videos.

Want to forward this email? They can sign up for The Market Catch here.

New to trading? Learn How To Trade!

Become a Member – To get Samantha’s insights on macro inflection points and market-timing calls:

Read: Macro-to-Micro Weekly Newsletter – “Gone Fishing”

Follow: Brokerage-Triggered Trade Alerts – “Big Catch”

Participate In: Live Trade Room – “Fishing Club”

For Institutions – Gain from Custom Consulting and Allocated Trading