The Daily Market Catch

Top market-moving themes and insights – Delivered free to your inbox.

The One Big Thing

Back on October 2nd I suggested to clients markets would run up into Oct. 31 – and target SPX $3060 and NYSE $13,333 – with lower prices starting in mid-November through the end of the year. I consider current price action around this level to be ‘cruising altitude’ before it gets a little bumpy again.

In my article for MarketWatch, I predicted higher yields:Despite the Fed’s support, this stock market is headed lower

Then, just last week we had a historic move lower in bonds for which I was positioned for clients (short bonds and gold, long value and commodities).

Top Charts

This past week we had a dramatic selloff in bonds that triggered higher yields and boosted cyclical and value stocks.

Blame it on Trade War Truce Talks and Interest Rate Traders no longer pricing in Fed rate cuts this year (although CTA unwind was part of it), but the 12 bps jump in the 10-year Thursday nearly erased the entirety of the August plunge.

Top Tweets

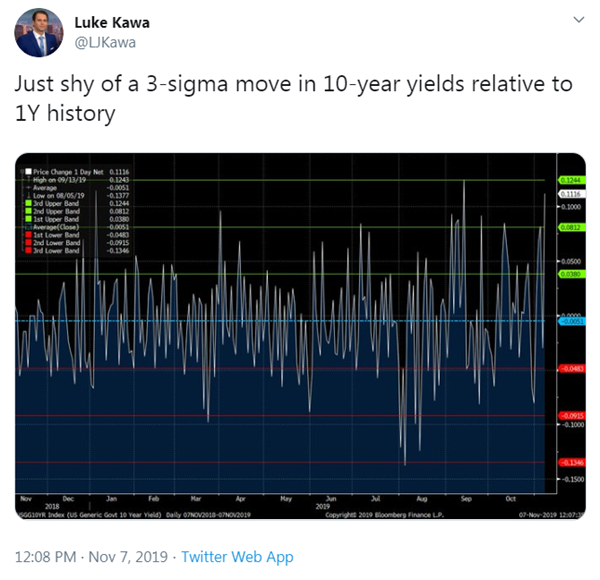

Not only was the bond move a nearly 3-sigma move in 10-year yields relative to one year [of] history, but over 2.5M Treasury options traded on Thursday – the 2nd highest all-time.

Top Trades

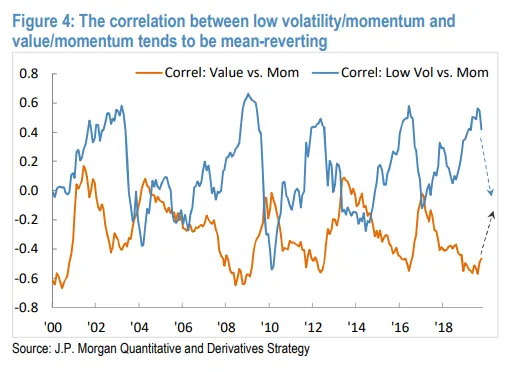

Marco Kolanovic of BAC thinks the move toward increasing exposure to value and away from duration and bond proxies (crowded defensives and momentum names), which started in September, will continue. (My mantra since my last historic bond short.)

Needless to say, any nods at fiscal stimulus or signs that aggressive easing by central banks is starting to work its way through and manifest itself in better growth outcomes, inflections in manufacturing PMIs and/or higher inflation expectations, could accelerate the rotation away from crowded consensual trades.

Top Reads / Videos

At little conspiracy theory for your weekend reading.

“to ensure that JPM’s tens of billions in buybacks and dividends continue flowing smoothly and enriching the company’s shareholders, Jamie Dimon may have held the entire US financial system hostage, forcing the Fed’s hand to restart “Not QE.”

For more charts and links like these check out my twitter feed.

To Great Fishing!

Samantha LaDuc

Founder LaDucTrading

CIO LaDuc Capital LLC

Thanks for reading – Curious how I help active traders and investors like you? I fuse macro analysis with market-moving news, give it context and actively trade while supporting clients who do the same.

Not a member? Here’s some more FreeBait – Fishing Stories and Trading Videos.

Want to forward this email? They can sign up for The Market Catch here.

New to trading? Learn How To Trade!

Become a Member – To get Samantha’s insights on macro inflection points and market-timing calls:

Read: Macro-to-Micro Weekly Newsletter – “Gone Fishing”

Follow: Brokerage-Triggered Trade Alerts – “Big Catch”

Participate In: Live Trade Room – “Fishing Club”

For Institutions – Gain from Custom Consulting and Allocated Trading