The Daily Market Catch

Top market-moving themes and insights – Delivered free to your inbox.

The One Big Thing

Back on October 2nd I suggested to clients markets would run up into Oct. 31 – and target SPX $3060 and NYSE $13,333 – with lower prices starting in mid-November through the end of the year. I consider current price action around this level to be ‘cruising altitude’ before it gets a little bumpy again.

In my article for MarketWatch, I predicted higher yields: Despite the Fed’s support, this stock market is headed lower

Then, just after it went to press, we had a historic move lower in bonds for which I was positioned for clients (short bonds and gold, long value and commodities).

Top Charts

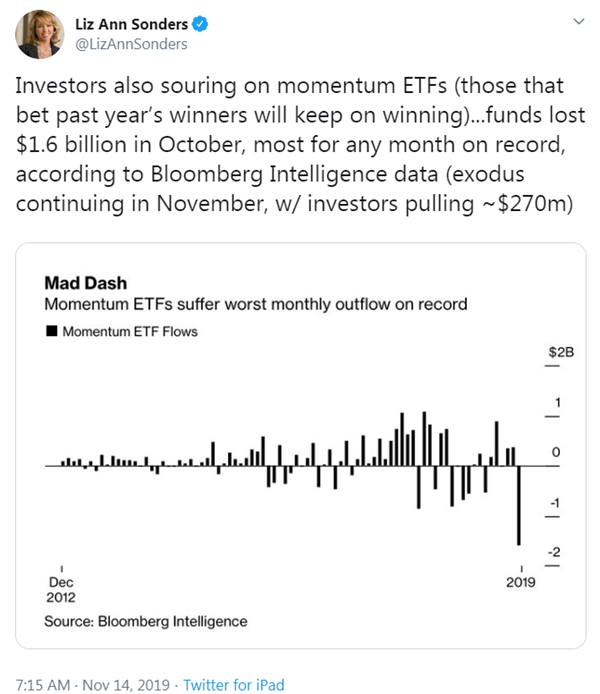

Momentum to Value rotation continues:

- September

- October

- November

- …

Top Tweets

Top Trades

My favorite mantra applies here: Outliers Revert With Velocity – $VIX

Top Reads / Videos

Why Taiwanese Life Insurers Are The Great ‘Whodunit’ Of The Financial World

They’ve built up a gigantic position in foreign, US-dollar denominated assets in order to fund domestic liabilities denominated in Taiwanese Dollars. But how do they hedge this currency mismatch? Nobody has figured it out until now.

For more charts and links like these check out my twitter feed.

To Great Fishing!

Samantha LaDuc

Founder LaDucTrading

CIO LaDuc Capital LLC

Thanks for reading – Curious how I help active traders and investors like you? I fuse macro analysis with market-moving news, give it context and actively trade while supporting clients who do the same.

Not a member? Here’s some more FreeBait – Fishing Stories and Trading Videos.

Want to forward this email? They can sign up for The Market Catch here.

New to trading? Learn How To Trade!

Become a Member – To get Samantha’s insights on macro inflection points and market-timing calls:

Read: Macro-to-Micro Weekly Newsletter – “Gone Fishing”

Follow: Brokerage-Triggered Trade Alerts – “Big Catch”

Participate In: Live Trade Room – “Fishing Club”

For Institutions – Gain from Custom Consulting and Allocated Trading