My theme last week in my live trading room was simply: “Indices are hanging out, not breaking out.”

And yet, under the seemingly calm of market indices, there has been large waves of distribution selling taking place in Momo land: ROKU and NFLX in dramatic sell-off mode Friday rotated into TSLA and lots of Unicorns today. We had sharp reversals in SNAP, TWTR and FB as Trump talked down social media; continuations lower in NFLX SHOP and many more. Other stocks we caught live included roll-overs in GS, AMZN, BABA, NVDA, AMD and IWM, to name a few.

Note: Live Trading Room recordings with Closed Captioning and Saved Chat come with Membership in addition to great calls 😉

But market indices of SPY, QQQ, DIA didn’t roll-over – to play catch down to IWM – until the economic data late morning showed U.S. consumer confidence plunged in September – the largest shortfall relative to Wall Street’s expectations since 2010, the most in 9 months, and basically just far more than expected. Trump didn’t help market sentiment with his tough talk against China and Iran when he spoke to the World in his live UN address!

And although I originally dismissed the chances of Impeachment on the Trump-Biden-Ukraine intrigue, I did reconsider after retweeting this:

Whoa!

One phone call to the Ukraine President did more than two years of Russia investigations, Bob Mueller, and 10,000 CNN stories.

The betting that Trump gets impeached has its biggest day ever (volume) and soared well over 50%.@PredictIt

(1/2) pic.twitter.com/DHql4pNBFC

— Jim Bianco biancoresearch.eth (@biancoresearch) September 24, 2019

I found it more than curious with the timing of Warren’s big lead…

Market, show us you care.#Warren https://t.co/LKp9xqhfLd

— Samantha LaDuc (@SamanthaLaDuc) September 23, 2019

Add to this: Recession risks rise as consumer confidence falls so that may have also contributed to sentiment souring.

September consumer confidence from @Conferenceboard fell sharply to 125.1 from 134.2 in August (revised from 135.1); now below 2018 avg of 130.1; expectations fell to 95.8 from 106.4; present situation fell to 169 from 176; net % saying jobs plentiful fell to 33.3 from 38.3 pic.twitter.com/RdIJElbHMc

— Liz Ann Sonders (@LizAnnSonders) September 24, 2019

And just like that, sellers stepped out of the market! With the economic data of poor consumer confidence dropping precipitously, converging with Trump’s hawkish stump speech signaling no likely resolution coming soon on China or Iran, Impeachment proceedings that hit “go”, and fall-out from WeWork losing valuation, confidence and its CEO impacting all those holding overvalued Unicorns, it’s no wonder we have heavy distribution of momentum/tech stocks under the surface, a steady bid in risk-off proxies of Gold and Bonds, and now finally volatility emerging.

And it was time: basically for 7 of the prior 12 sessions, the S&P 500 closed up or down by less than 0.1%, so the Volatility that finally emerged today is what we need to watch moving forward.

And some upcoming dates of importance:

- Oct 9th: FOMC minutes released from Sept rate-cut. Will they signal they’re done cutting this yr?

- Oct 10th: REPO ends. Will there be a pause to test Fed’s liquidity claims?

- Oct 11th: Mnuchin claims they meet with China on Trade deal. Will they ever have one?

Repo Market Madness… and Flash Crashes!?!

I stand by my call that risk of Flash Crash increases with Major Momo distribution under the seemingly calm surface and major structural USD implications spur potential panic for Cash.

Perhaps the repo ruckus isn’t totally over…..the NY Fed’s $30 billion term repo operation was 2x oversubscribed. This is the first such operation; the others were overnight repos.

@lisaabramowicz1

Big Banks with “large excess reserves” chose not to make 10% (most ever) on their money in the REPO market last Monday night. Read that again: TEN PERCENT or 5 times their money begs the question: WHY? Could they have been worried about the cost and return of deploying that cash? Or was it tied up in the currency markets?

Now we’re getting to it…. New York Fed examines banks’ role in money market turmoil

@judyshel

Bottom line: here’s what the market thinks of the Fed’s temporary solution… It’s a joke.

What’s LIBOR got to do with it? Well, John Williams is worried so maybe it’s time to consider how REPO intersects with a $400 trillion market that recently moved 8+ standard deviations because of a “regularly scheduled tax date”

To say that last week’s repo debacle was precipitated by either the KSA or by the timing of corporate taxes & bills supply is a little like saying World War I was caused by Gavrilo Princip. Yes, that’s true – but the conditions had to be right & the stage appropriately set.

Mini Intermarket Chart Attack

In follow up to my newsletter – Intermarket Chart Attack: Some Things are Really Broken – I wanted to detail what I present to those in my Live Trading Room daily as my ‘roadmap’ for market action – both near term and further out. I warn you now: some of these charts are very geeky but they are also deeply valuable tools that help me make my (sometime’s famous) market timing calls!

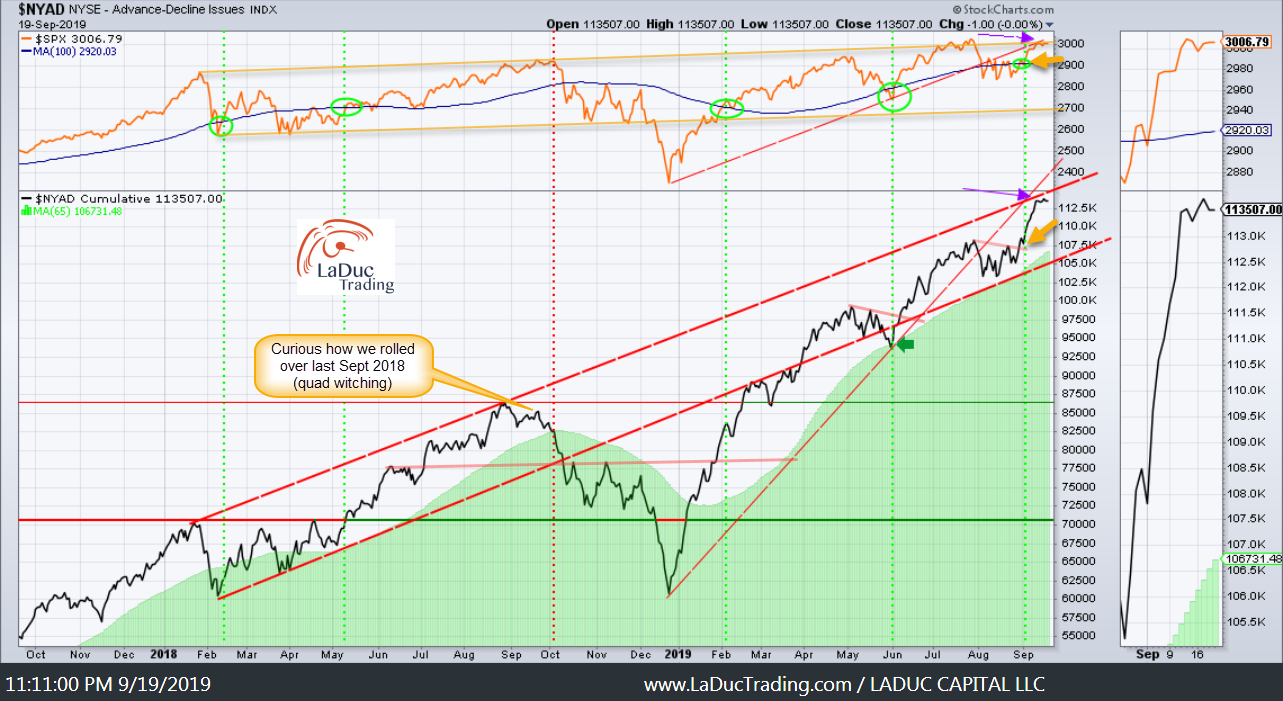

Resistance Matters: NYAD

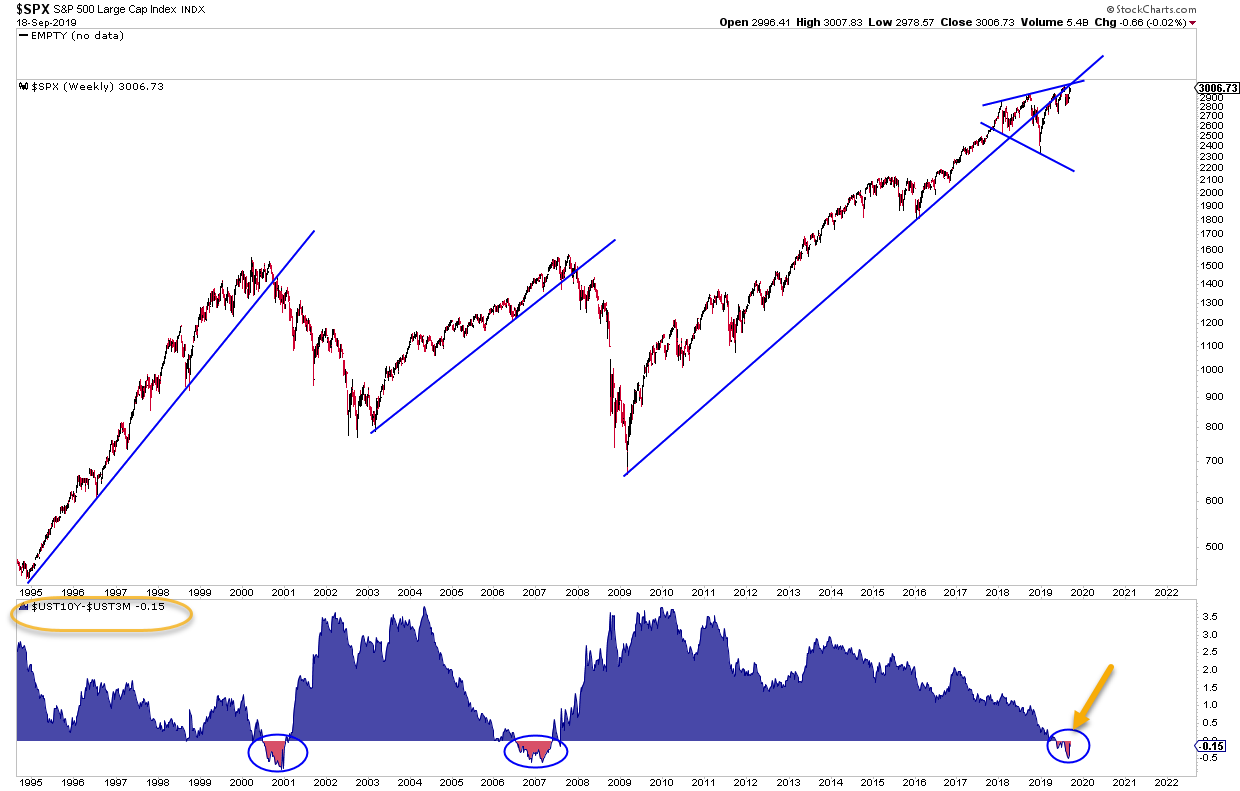

Yield Curve Inversion Matters…

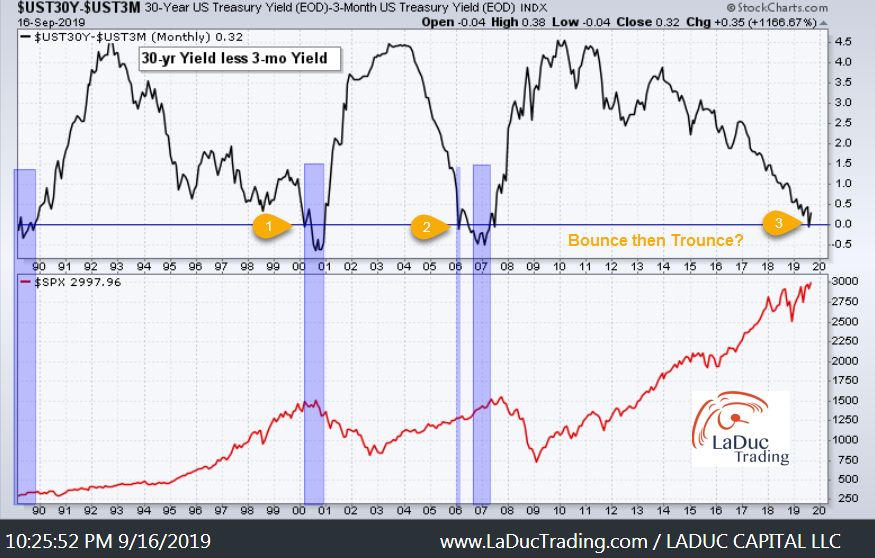

Yield Curve Bounce Then Trounce?

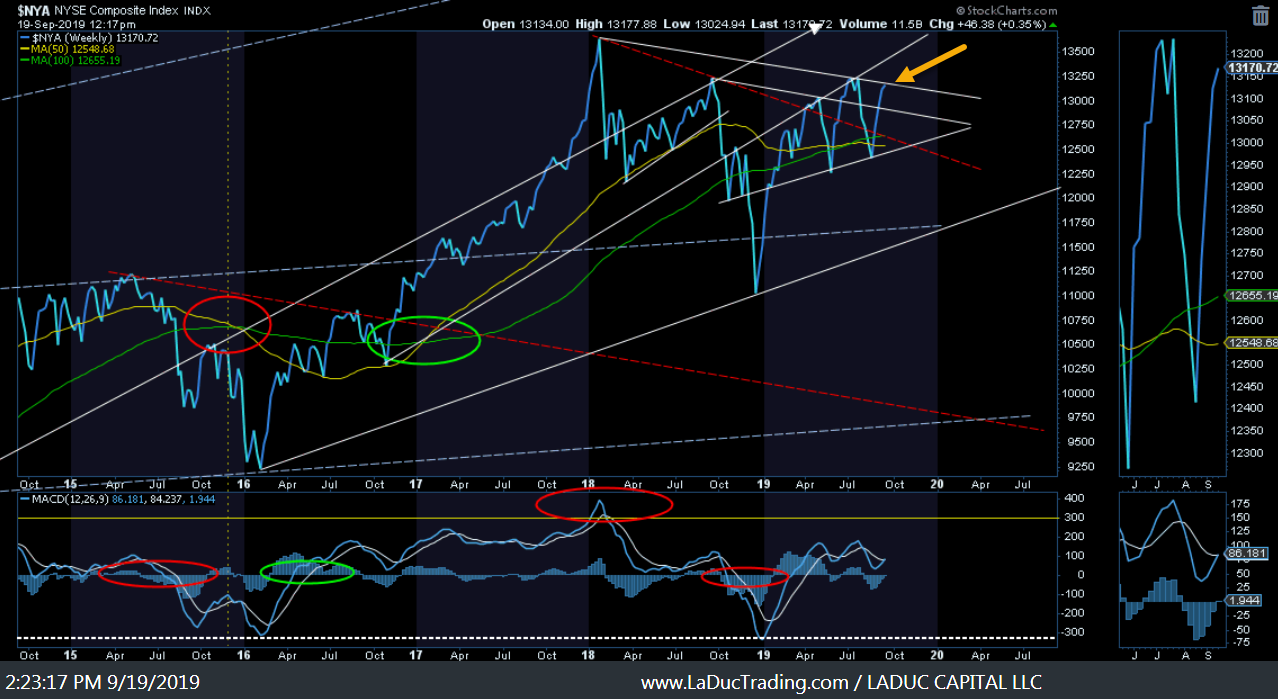

Staying Within The Lines – NYSE Roadmap

Small Cap Surprise – or Why I shorted Last Monday

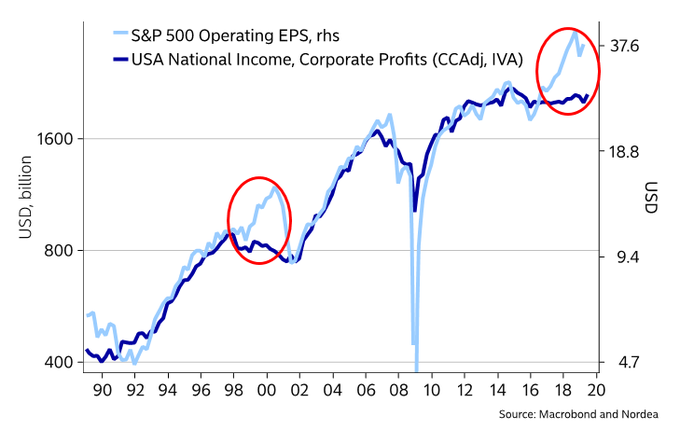

Earnings Matters

As we approach end of month and end of third quarter, stock buyback desks will be winding down next few weeks as we approach Q3 Earnings kick-off. That removes one of the large buyers of stocks and makes them more susceptible to headline macro and geopolitical risks. The biggest market-moving headline for over a year has been the market’s anticipation of a Trade Deal or escalation of a Trade War. But we’ve seen these headlines so many times, we’ve grown numb to them, so much so that portfolio managers have “given up” on worrying about the Trade War.

But with Q3 Earnings approaching, we should get a better feel for how US companies are faring in this global market of uncertainly, tariffs and de-globalization. Fedex (FDX), Corning (GLW) and Steel companies (X, NUE) have already warned about future earnings, signalling that customers have already reduced spending due to trade uncertainty. What about Micron (MU) with it’s leadership in not only Semi stocks but also China trade? We will see soon and the bar is pretty darn low to jump over:

Micron Technology, Inc. is expected* to report earnings on 09/26/2019 after market close. The report will be for the fiscal Quarter ending Aug 2019. According to Zacks Investment Research, based on 9 analysts’ forecasts, the consensus EPS forecast for the quarter is $0.43. The reported EPS for the same quarter last year was $3.5.

One reason Indices may be hanging out not breaking out is for more proof that company profits are heading down which would weaken the consumer, employment and the market’s advance.

Speaking of Earnings… Q3 EPS Reports are queuing up! Comparison with Q3 2018 will be tough, so estimates have been lowered (lower bar to jump over), but even with that, we are kicking off the first quarter of negative earnings growth in three years (h/t @EddyElfenbein).

Financial Conditions Matter

Indeed almost 12 years to the day Bernanke also cut rates in September 2007 and told Congress in November (after the market had topped in October at a further new high) that while the US economy was indeed facing some risks, it did not appear headed for a recession. A month after that, the US economy fell into the Great Recession. The price action isn’t that different either. Curiously the very top in 2007 was triggered by minutes from the September rate cut meeting that encouraged traders’ hopes for a further rate cut that year? Sound topical? And if we want to take the analogy too far, the minutes for last week’s meeting will be on October 9th. Ed Matts

Things never turn out well in global finance when bond managers are worrying more about the RETURN ON their capital not the RETURN OF their capital.

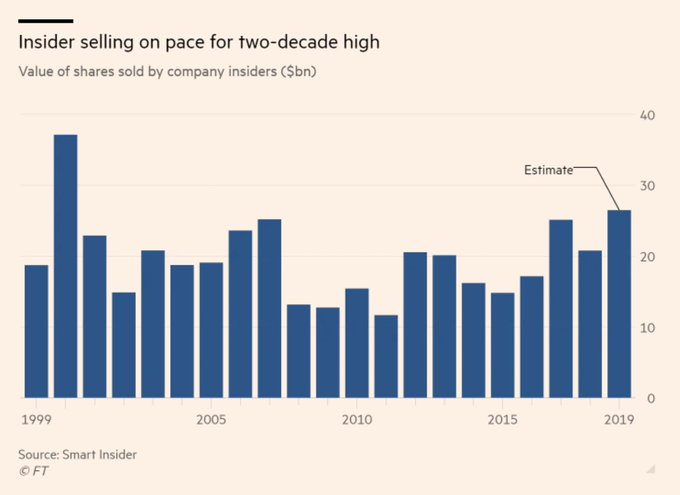

Sold-To-You Rally

When Global money supply diverged from market price, beginning of July, it became a “Sold-to-You” market in my eyes. As a result, I am still expecting SPX to take out recent lows and trade sideways-to-lower into 2020 elections.

Concerns Can Become Reality

Our pensions were only about 60% of GDP in ’84. Now they are 120% of GDP. That’s massive spectacular growth. There’s nothing on earth that’s grown that fast from such a high base. So they’re the dominant global investor, but they’re so underfunded they need to make 7.5%.…So what we’ve seen over the last 10 years, especially the last 5, is more and more pensions reducing their low yielding cash in favor of more aggressive credit investments, that helps increase the intensity of this credit boom and it exacerbates these up and down panics, because it removes shares from the stock market, which means that the money that remains can move shares with less effort.…And the result is this Daisy chain of money coming in from taxes to pensions, going into credit, which is then used to artificially push up stock prices.Brian Reynolds

- We had a 3.5 standard deviation move in Bonds

- The Gold + Silver Parabola broke down next day.

- A Historic 8.5 standard deviation move triggered from Momentum to Value plays.

- Global markets had the largest one-day surge in Oil Prices in history.

- The Funding Spreads in the REPO markets exploded higher than in Sept 2008!

The Fed is Cutting but Loathe to Cut

Just a little more than a year ago, the yield on the 10-year Treasury got to 3.2% (October 3rd – I called an audible for a Market Correction). Soon after, yields reversed hard and got to under 1.5% (September 3rd – I called an audible for a Bond Correction). Talk about a rate reversal.

Since the middle of last year, the global growth outlook has weakened, notably in Europe and China. Additionally, a number of geopolitical risks, including Brexit, remain unresolved. Trade-policy tensions have waxed and waned, and elevated uncertainty is weighing on U.S. investment and exports. Our business contacts around the country have been telling us that uncertainty about trade policy has discouraged them from investing in their businesses.

Escalating Trade War Tensions with Oil

Pentagon will deploy US forces to the Middle East on the heels of the Iranian attack on Saudi Arabian oil facilities. CNBC

But there is something else that the potential for higher oil prices can cause, should the Saudi-Iran, US-China square off: a far greater geo-economic risk to China than tariffs imposed by the US. And that is what I think Trump is doing now:

- Using the Fed’s rate cuts to empower his Trade War against China through higher tariffs.

- Using Saudi attack -whether real or orchestrated – to add pressure on China through economic pain.

Other than headline risk of Iran conflict, I saw no reason to be long before these recent drone attacks. After the 20% oil price surge Sunday, I said in my live trading room I expected it to fade. We closed the week +7% Crude, not 20%. Despite the risk premium now in the oil price from this outlier event (poor Saudi air defenses!?!), we now have deployed troops. No, I do not expect US to go to war for Saudi Arabia, let alone invade Iran, but I do expect Trump to keep a presence in the area to keep pressure on Iran so as to put economic pressure on China and in doing so lift the price of oil.

In short, companies need the expansionary affects of global economic growth and trade, and lots of US Dollar Liquidity to prime the pump of financing. We have the opposite but we have Pension Funds to serve as buyers of last resort, Yield Differentials to attract foreign money, and stock buybacks to keep domestic money parked in equities. So why worry?

That’s my job.