2018 for The Record Books

Last year was an anomaly (BAML data):

- US dollar finished +4.4%, Cash 1.9%, bonds -1.2%, equities -8.7%, commodities -13.1%…1st year since 2000 cash outperformed bonds & stocks.

- Since the Jan 2018 Top, global equity market cap losses = $19.9tn peak-to-trough (close to US GDP $20.6tn)…

- 2055 of 2767 US & global companies in bear market…

- Global banks price relative back to ‘08 lows…

- Big flow capitulation: record outflows in past 6 weeks in equities ($84bn) & IG bonds ($34bn); compare with record government bond inflows ($24bn)

December alone dropped nearly 10%, making it the worst December since the Great Depression almost 90 years.

Equities fell 20% from their September high into Christmas Eve. Since then, they have rallied almost 10%. But the fear is that when SPX drops 15-20% or more, it has a strong tendency to retest those lows in the weeks/months ahead.

True, but that is recency bias, and fear of a violent pullback – both of which the market uses against us to fuel a rally into higher levels. Speaking of Fuel… Cash is just rotating into equities AFTER a 10% bounce…

Here comes the reversal of last year's flight to cash. Investors pulled $745 million yesterday from Vanguard's $27.2 billion short-term bond ETF, the fund's biggest one-day withdrawal in its history. $BSV pic.twitter.com/tx8ewqFXDk

— Lisa Abramowicz (@lisaabramowicz1) January 9, 2019

And this AFTER, I posted January 4th:

Central Banks – China and Powell – plus Jobs and Crude – are tailwinds for the Bulls. @SamanthaLaDuc

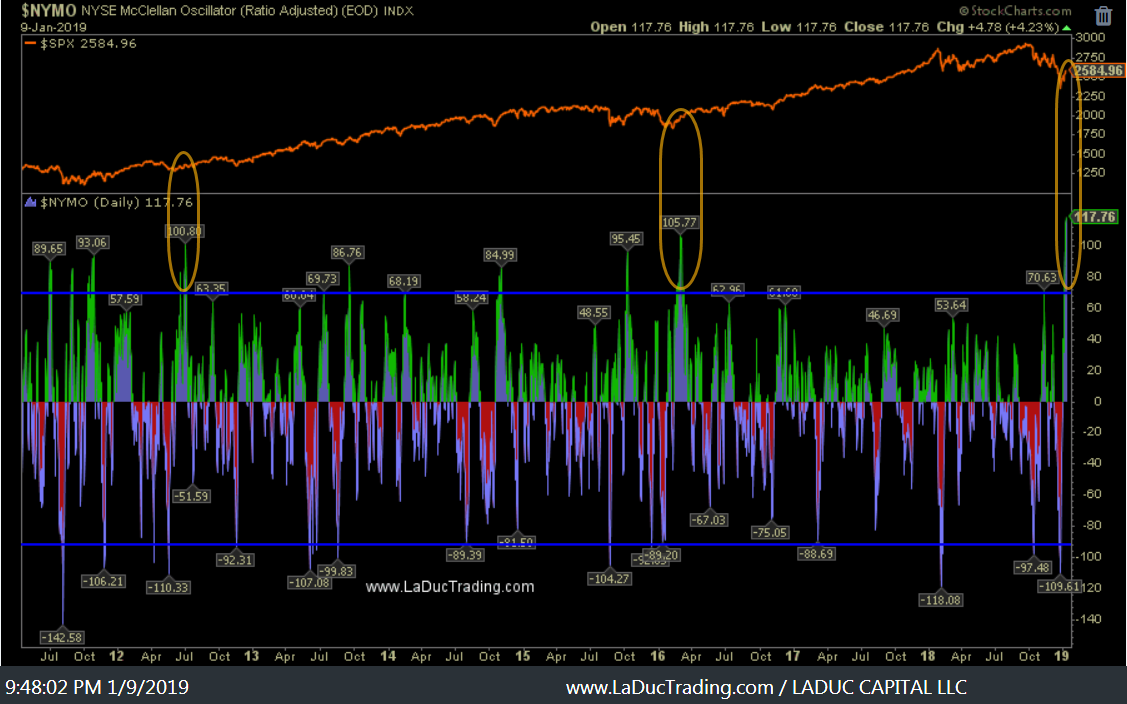

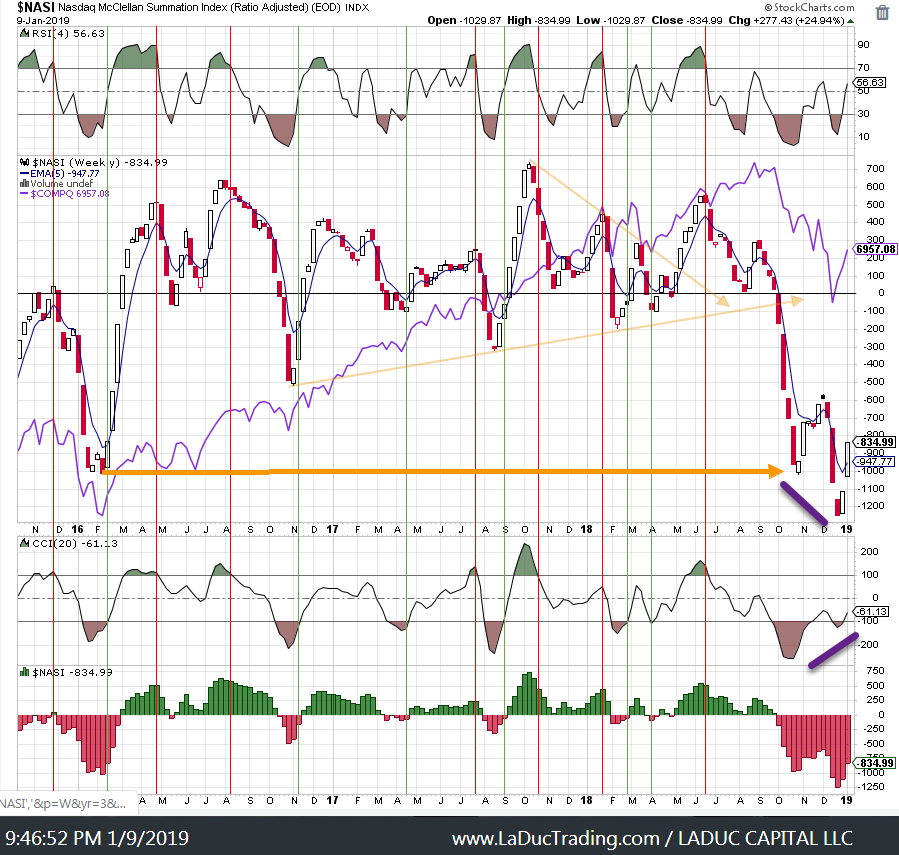

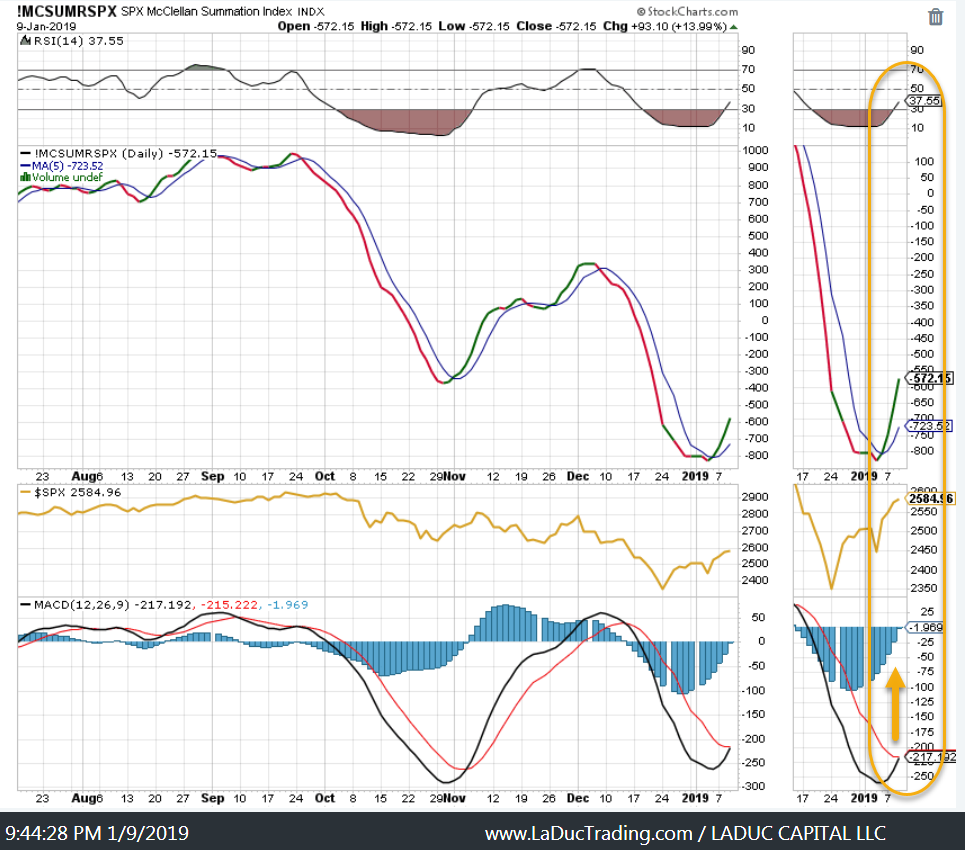

I still see $SPX $2277-2135 this year but we likely bounce to work off these wicked oversold levels. $NYSI McCllellan Summation Index hasn't been this oversold since 1998 + 2008! pic.twitter.com/pAdgltU8sf

— Samantha LaDuc (@SamanthaLaDuc) January 4, 2019

My Point: Outliers Revert With Velocity

Causes and Correlations of Corrections

In order to piece together tradeable themes, it helps to look back at what justified the Q4 market correction. The major selling event for this recent 20% downdraft came on October 3, when Fed Chairman Jay Powell said that we’re a “long way” from neutral. The markets took the que to lighten up on positions in light that system liquidity would continue to be tight based on Fed rebalancing and default fears were reflected in bond spreads from growth slow-down world-wide.

Earnings didn’t help sentiment as there was a change in character: earnings were being sold off into the company report and two big consumer companies – AAPL and AMZN – were guiding down in Q4.

Volatility added to the continued confusion from many big institutional money and pushed dip buyers aside in favor of safety plays like treasuries and cash. Add to that, Cash now earns a little rate of return and may continue to attract dollars as we move away from negative real interest rates.

Rotation out of equities continued and then accelerated with tax-loss selling in December.

All of this against a macro backdrop of:

- Domestic political friction, causing government shut down

- Geo-political friction, and unresolved trade tariff conflict between U.S. and China

- China;s economy, slowing quickly and gesturing toward Taiwan friction

- Brexit mess, never seeming to end

- U.S. Treasuries inverting, suggesting economy close to entering recession

- Rotation into Treasuries driving down yields with commodities, both betting economy is slowing

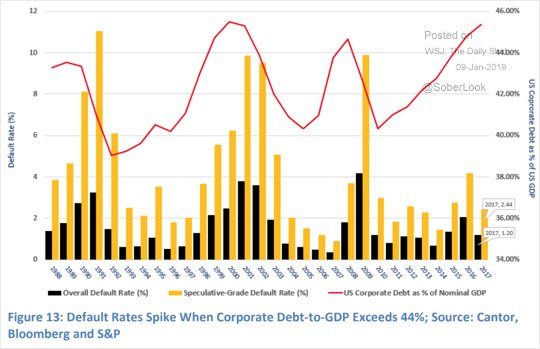

- Fed hikes and QT telegraphed, raising default fears

- Gold running higher, despite USD bid or recent 10% bounce in equities

So What Changed? Panic Buying post the Christmas Eve Massacre

Fed Chair Powell, speaking at 10:15AM January 4th said the Fed would be ‘patient’ with rate hikes. Markets soared, with SPX adding 3.2% on the day, its second best day since Feb 2016 (Dec 26 was better).

Breadth Thrusts beyond Zweig telegraphed cash was/is coming into equities but such extreme buying is rare. NYSE Oscillator

Credit has been in an panic squeeze as well (h/t @hks55)

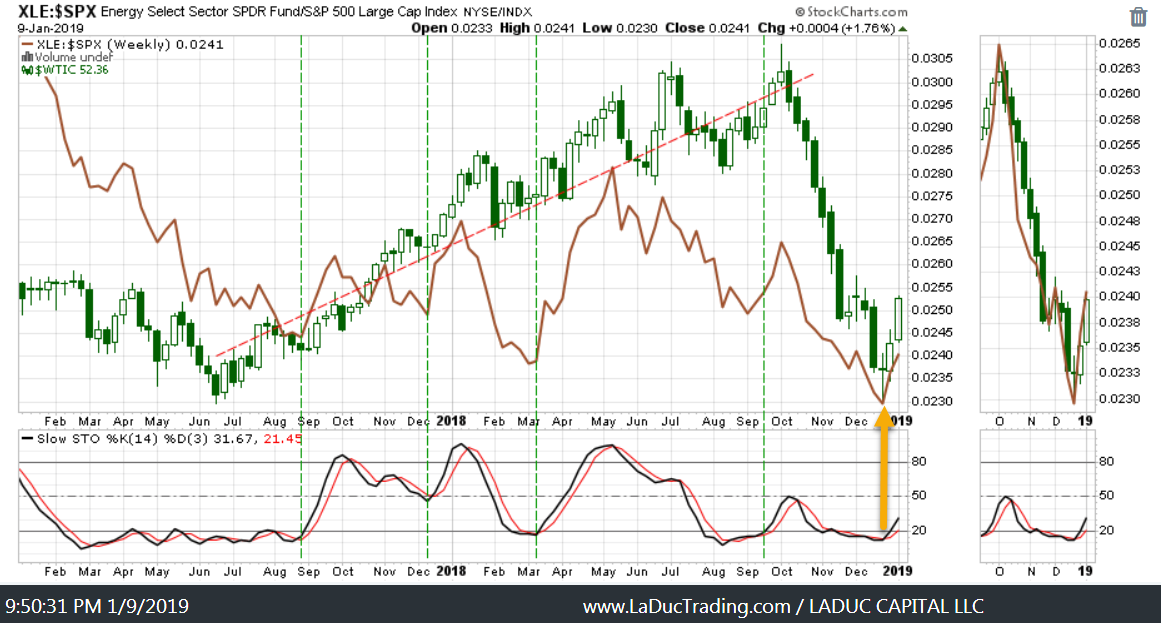

Helped by Crude up 25% off the the lows.

Divergence in Nasdaq Summation Sell-off (see purple lines) has been Bullish

SPX Summation Turned Bullish

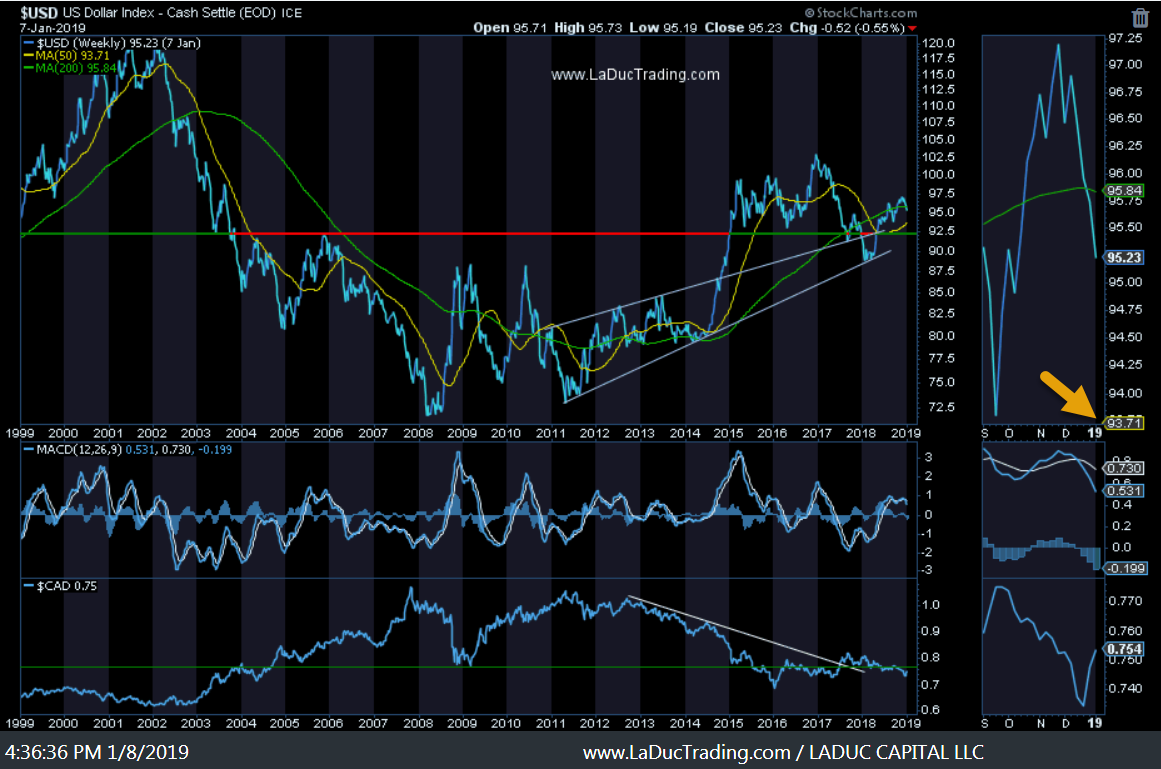

USD Falling has been a Tailwind for this Recent Rally

Transports Are Gaining Strength

Volatility has room to fall.

Put/Call Ratio Signaling This Rally is Not Ready to Short

My Point: I expect corporate default rates to increase starting in Q1, but not until AFTER we have completed this rip-your-face-off rally first 🙂

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading