Table of Contents

Top Risks I See Right Now

1. China retaliation over US support for Hong Kong. US sanctions and trade war escalation with China/Hong Kong

US Senate passed Hong Kong Human Rights and Democracy Act by unanimous consent. House passed it by unanimous consent earlier, so there is a veto-proof majority. Now Trump decides whether to sign it. US might start sanctioning China & HK officials & reviewing trade status w/ HK.

— Edward Wong (@ewong) November 19, 2019

2. VIX Likely To Spike

VIX expiration ends Wednesday November 20th and here’s why it matters. New VIX futures become part of VXX computation and they have longer time horizon so they don’t go down as fast. So with the last day for VX November expiration, the VIX curve gets flatter. A flatter VX curve means VIX short sellers have a harder time relying on decay as market continues to grind higher or chops. The result is a flat VIX, unlikely to move down further so not worth the risk/reward of shorting in case markets break-down. The higher probability is for a VIX spike post expiration: chart h/t @VolatilityWiz

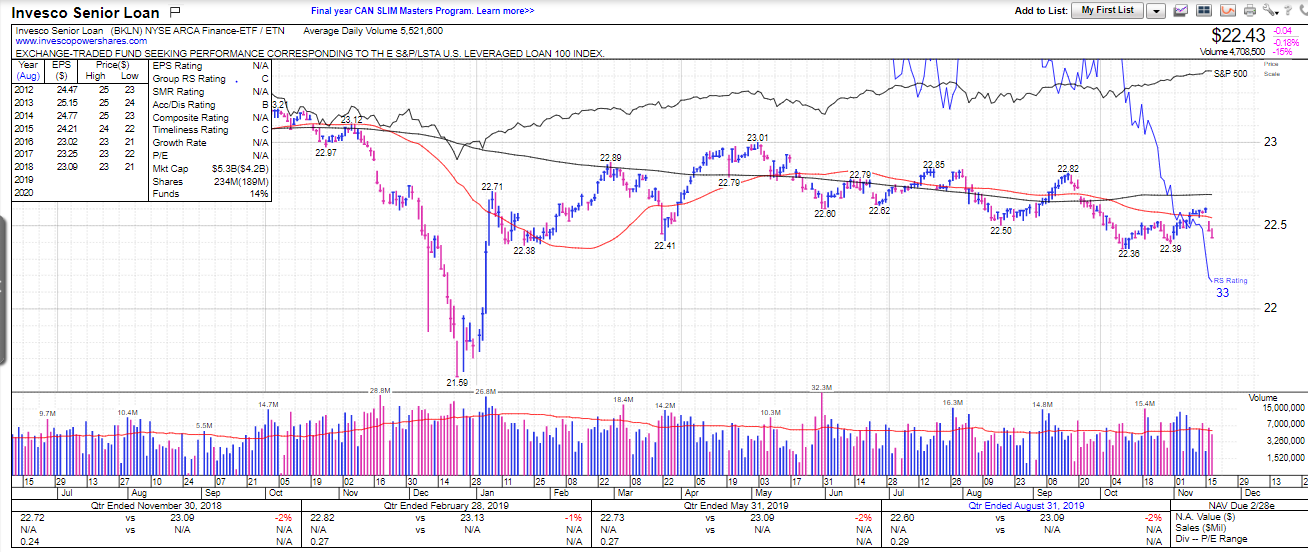

3. Credit is at Risk

Despite three rate cuts, the corp high-yield ETF’s like HYG, and JNK aren’t rallying. The SHYG is below its 200-day and that should be the biggest beneficiary of add’l liquidity. HYG and JNK at key trendlines now. Bears watching (no pun intended). @TrinityAssetMan

And my favorite: Should LQD reverse strongly (which I suspect it will at the yellow arrow), that infers a widening of IG spreads. And That would be very bearish equities

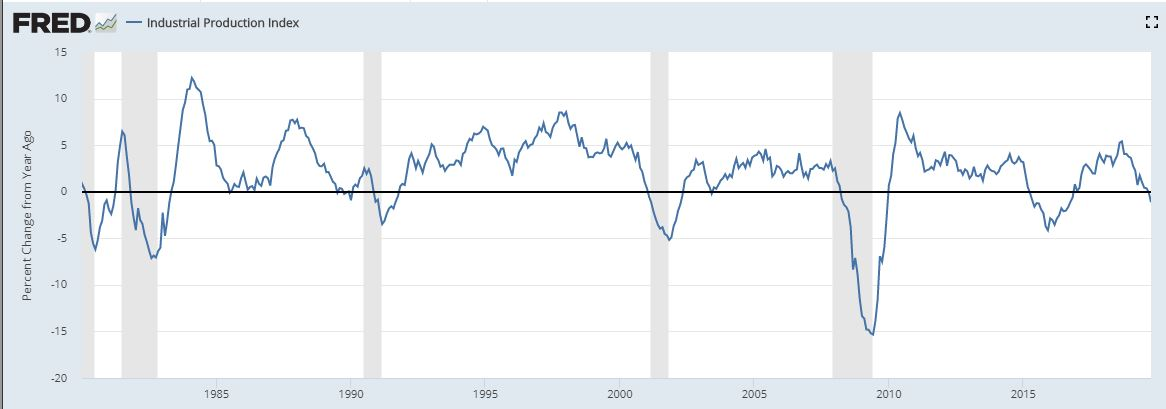

4. Economy may have entered a recession in August

The Fed’s own Industrial Production Index has signaled 5 out of the past 6 recessions:

So Temp Help demand is tanking & retail traffic is tanking; employment & personal consumption were the only coincident indicators that were suggesting we could avoid a recession. Assuming these numbers are accurate, my recession warning flag is now at full mast! @GaricMoran

Temp staffing (leading indicator) declining at fastest pace in a decade @DeutscheBank @SoberLook pic.twitter.com/OLqsIAqytP

— Liz Ann Sonders (@LizAnnSonders) November 18, 2019

US retail traffic, via @CowenResearch pic.twitter.com/CFgJipf2G6

— Carl Quintanilla 🔥 (@carlquintanilla) November 19, 2019

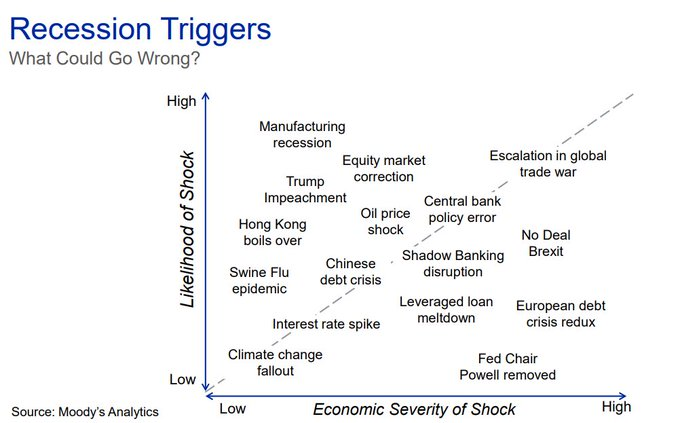

Major Macro Risks don’t help:

- Corporate profits have fallen which can hurt ability to pay corporate debt (and fund stock buybacks).

- Treasury finances are focused on paying US obligations as rates rise in the overnight lending market (repo)

- Endless quantity of USDs are at risk of being printed to fund it all (inflationary).

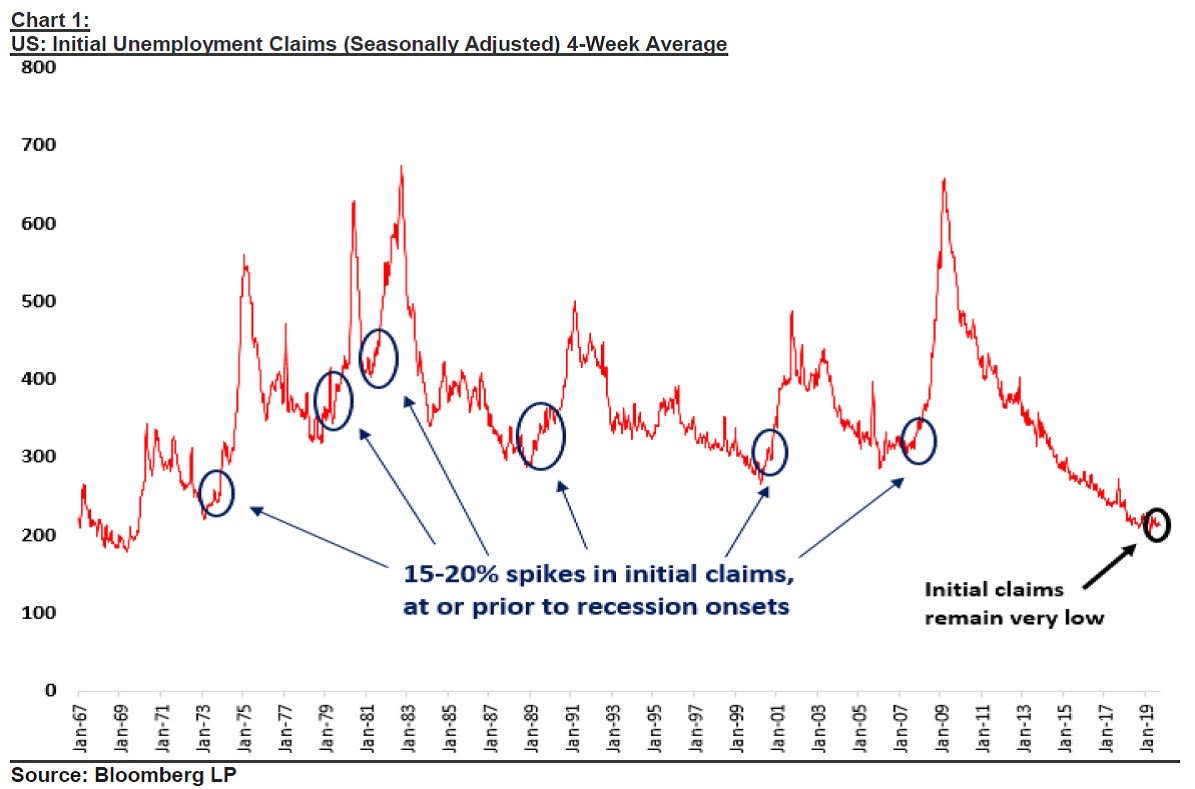

Employment the last domino to fall:

Initial claims on Thursday will be telling… And you know what I expect from PCE Thursday (one word: hot)

5. Momentum – Value Divergence

“The extreme divergence between Value stocks on one side and Low Volatility and Momentum stocks on the other side reached levels never observed in history, even including the tech bubble”, Marko Kolanovic wrote in September, even calling it a potential XIV event (volmaggeden on February 5th extinguished that product).

Here’s my intermarket analysis chart which is another way of showing the divergence between the large cap-driven indices and equal-weight proxy RSP full of oversold ‘value’ plays that were heavily shorted during the market’s advance. The extreme positioning is represented here and needs to be watched very closely for a large reversion.