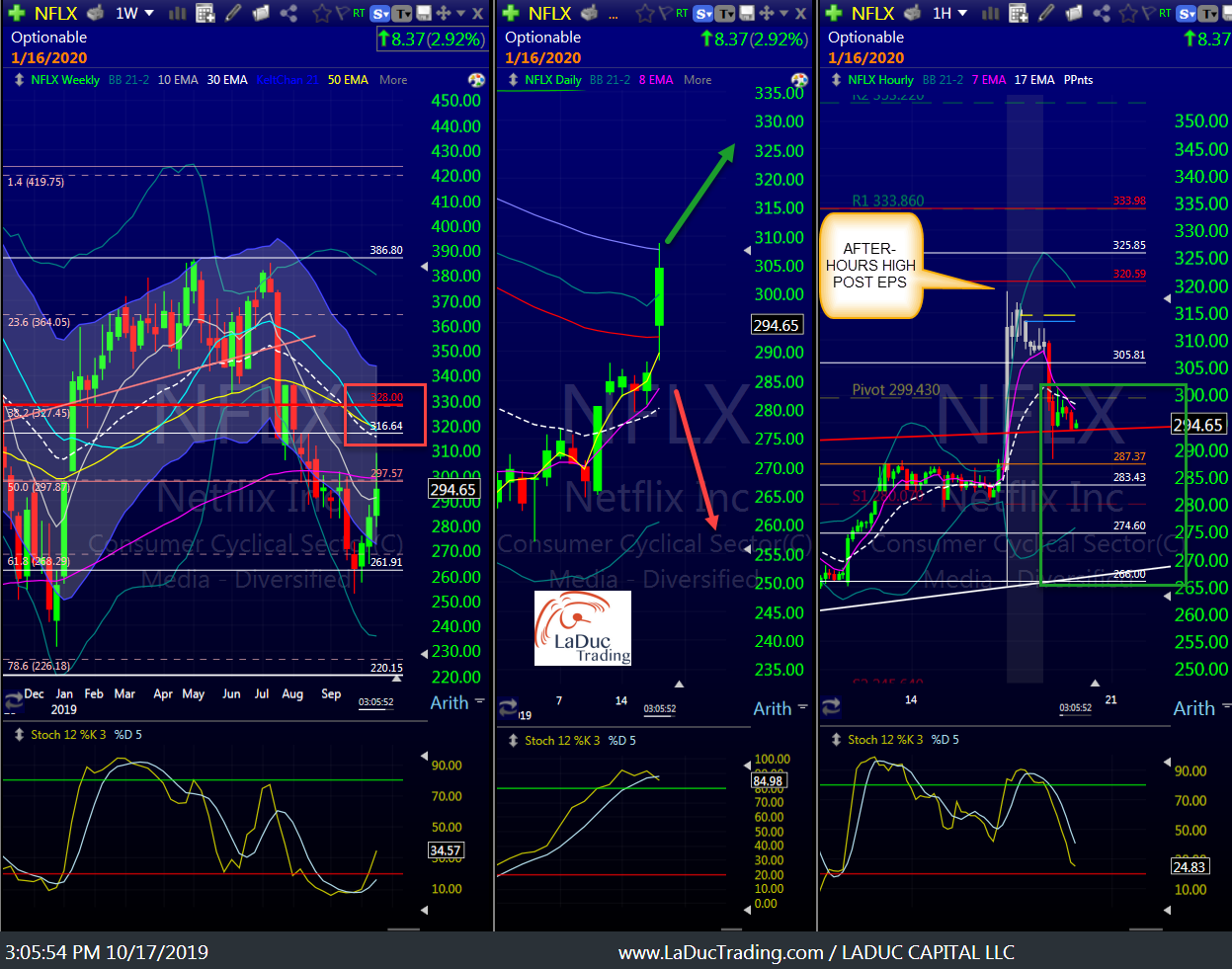

Here’s how we faded the Pop in NFLX in my Live Trading Room this morning:

Netflix was up 10% after hours Wednesday to $318.79, which excited the Bulls. My immediate reaction was to short the pop ~$315, as I expected the many (45K contracts in Open Interest) who bought the $300 OCT18 Calls would/should do so to lock in their gains. With that I expected those who shorted the pop using stock may cover around $295 today. That’s when some large NOV $300C (9K contracts) also hit the tape and price hit my 1st price target (red trendline on 1H chart).

Client Side Note: My intention was to short AT THE OPEN with a put spread and directional puts – which you saw in trade alerts but NOT at the open. My trade alert program was not functioning correctly so my fills were gawd-awful when they did fill at 9:48, but I did eventually get filled and NFLX stock dropped to ALMOST fill the hourly gap of $287.37 coming close at $288.30. If you were tracking closely you probably wondered why I didn’t cover a 3x position for 100% using next week’s options. Well, what most people saw was the daily gap get filled. I decided to hold to see if the $295 would be again broken on way to $283, maybe even $275 where it broke out last Thursday.

If it holds this gap ~$293, however, the path of least resistance is up (green arrow on daily), but given the rejection at highs and the EPS report received with trepidation (see below), I decided to stay short until the first part of next week. We shall see. The easy money was made. This is now a pseudo-swing.

Analysts Aren’t As Bullish

Price-target cuts started the day for $NFLX:

- Cowen $415 from $435

- Guggenheim $400 from $420

- Piper $400 from $440

- RBC $420 from $450

- Macquarie $388 from $430, downgrading to “neutral”

- Needham (hold-rated) thinks if NFLX’s subscriptions and/or revenue growth slow in 2020, they see -50% downside valuation risk. Needham projects NFLX will lose 10mm US subscribers during 2020 unless it offers a service priced below $9-16/month.

- Barclays believes that overall, concerns around the impact of new services such as Disney+ on NFLX are likely to be impossible to disprove until early 2020.

- RBC is still bullish on L-T but would caution around a Q4 trading headwind regarding Disney+ and Apple TV+ launch.

- RBC’s Mark Mahaney says that, at the margin, they come away less bullish on global subscriptions. He adds that they are slightly more confident on the margin outlook, and slightly less positive on NFLX’s pricing power.

But as Jonathan Tepper points out ,

“Netflix’s trailing 12 month free cash flow is in a league of its own at negative $2.87 billion. For each dollar of revenue generated over the last year, Netflix has 15 cents of negative free cash flow. But at least it’s growing.”

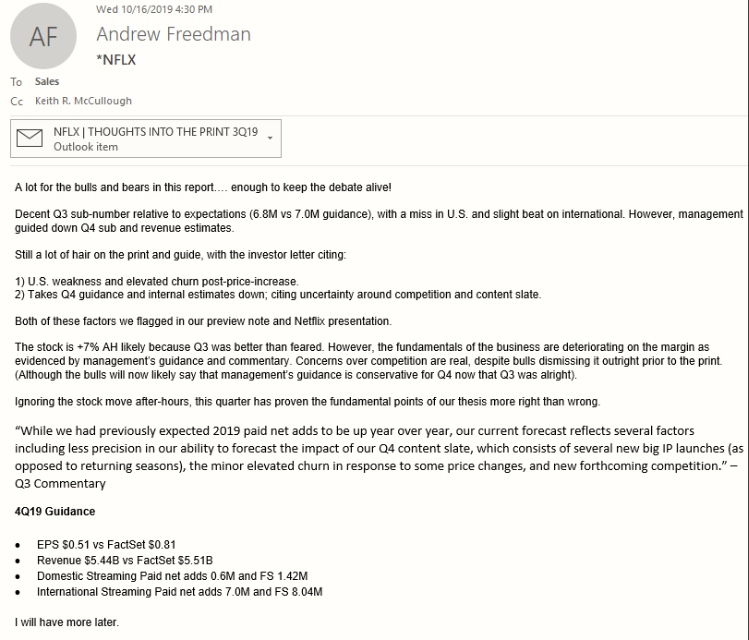

Even before the release, here was one analyst’s call for pop and drop:

“Once folks get over the initial euphoria of them reporting an in-line Q3 sub-number, they may start to look at the terrible Q4 guide and reduction in FY targets.”

Bears Still Hungry

Did Netflix prove the bears wrong by accelerating subscriber growth? By increased pricing power? Not really.

And competition is still fast approaching.

Speaking of Disney…

Curious timing!

This story was posted last night right during the Netflix management conference call.

Disney Over the Top: Bob Iger Bets the Company (and Hollywood’s Future) on Streaming

Game On!