Have you heard about LaDucTrading’s LIVE Portfolio Trade Alerts?

Whether a new or existing client, Samantha’s goal in launching her trader education service last year was always to give you the advantage for more opportunities, more education and more custom analysis. We hope you feel you have already benefited from her ability to scope out, scan and synthesize market moving news and analysis — as it happens in her daily LIVE Trading Room — or through investment themes in her weekly Gone Fishing Newsletter. Now you won’t miss out on what she is catching while on those fishing expeditions! Announcing real-time Portfolio Tracking with SMS/Email Trade Alerts!

So for those who need to step away from her LIVE Trading Room during market hours, or just can’t get on the boat with her any day, now you won’t miss Samantha’s Swing/Trend/Chase/Idea trades or Steve’s Quant Trades. This real-time mobile text/SMS trade alert and email service will comprise all trades from the LIVE Trading Room, which will be centralized in the LIVE Trade Log available under the LIVE Portfolio section of the Member area. And as LIVE Trading Room members, you still get my running market commentary from Macro to Micro of what, why and how to trade any market, sector, or stock move!

How Trade Alerts Work

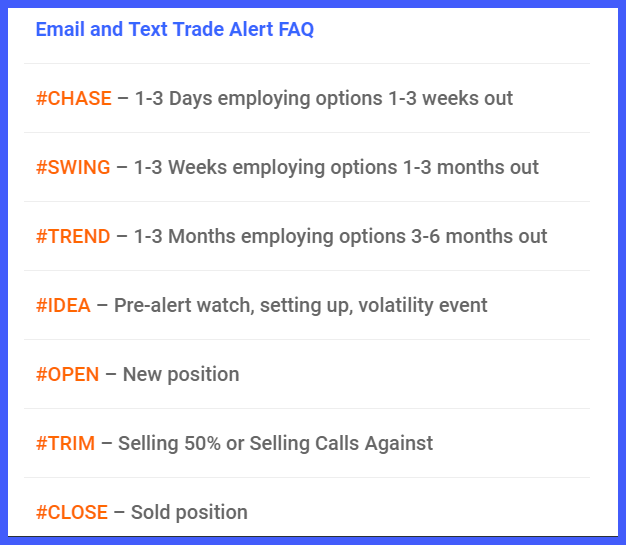

Trade Alerts include all trading time-frames: Chase, Swing, Trend and even Ideas – something for active traders, active investors and value investors. The longer term Trends are focused on Value Plays, those which meet certain macro, fundamental, technical, sentiment and intermarket criteria. There are many swings, and intraday chases, but few value play trend plays.

Sector rotation, highlighted in the weekly newsletter, is a theme of Samantha’s which can help with better positioning/active management of portfolios. The intermediate Swing trades are focused on momentum, volatility and expected moves. This is Samantha’s favorite kind of fishing. For those who want to actively Chase, it is best to be in her LIVE Trading Room; regardless, she will endeavor to text out trade alerts on time-sensitive Chase positions when feasible.

Steve’s Quantitative System has a very impressive back-tested and high win rate. Although at heart a swing trader, Steve, (who occasionally Chases, and regularly manages long-term income investments), loves combining Samantha’s Macro-to-Micro analysis (technical, intermarket, fundamental…) with his objective technical Quant signals. And now you benefit from both!

How to Use Trade Alerts

All LaDucTrading Trade Alerts, for both stock and options, include defined stops and profit targets based on the underlying stock. Basing an option buy/sell order on its underlying stock may not lend itself to your trading platform’s conditional order capabilities. Results are also not guaranteed. You must manage your trades, position size, risk and account. These alerts are not intended for members to copy each and every trade but to serve as a “fishing plan” from which you can choose which trades are appropriate for your timeframe, experience, risk profile and goals

Housekeeping

- You will find an archive of trade alerts under the Member section of www.laductrading.com/account “Trade Alerts” sub-menu item.

- An email will be sent for all trade alerts but these can be delayed with some carriers. Mobile text/SMS alerts are often closer to real-time.

- If you prefer not to receive SMS/Text on your mobile device, text back “STOP” to opt out. You will still receive email as long as your membership is active.

- To receive the trade alerts on your mobile device via text/SMS, go to the “your account” section of our website and make sure we have your mobile phone number!

- Obviously, standard phone carrier text rates apply and the number must be able to receive text/SMS messages!

- We are not responsible for missing text/SMS messages your carrier does not deliver for whatever reason!!

Trade Alert Text Messaging Terms of Service:

The goal of the text/SMS messaging trade alert service is to alert members of LaDucTrading to the specific trades that are being initiated in the Live Trading Room. Every trader must develop his or her own trading plan and not blindly follow any trader. Ensure the trade aligns with your risk tolerance and trading plan. By using the text messaging trade alert service you agree to the following:

1) I agree that any trades I take from the LaDucTrading Trade Alert service are made with the understanding I am solely responsible for each trade. 2) I confirm that I understand the mechanics of how to enter and exit the trades. 3) I agree that any trades I place incorrectly are my fault and I cannot hold LaDucTrading/LaDuc Capital LLC, their affiliates, the text messaging service provider and even my cell phone carrier responsible. 4) I understand the primary purpose of the trade alert text messaging service is to alert me of a trade for educational purposes. 5) I understand that not all trades posted or discussed in the Live Trading Room will be sent in the text messaging trade alert service. 6) I understand that if a trade is texted out there may not be any follow up to the trade and I am responsible for my own risk parameters on when and how to exit the trade. 7) I understand that I must use a physical cell phone number to receive text alerts and that text forwarding services like Google Voice do not qualify. 8) I understand that I may not receive the trade alert text message real-time and delays can occur in both text and email.

I value your feedback. Let me know how I can help! I value referrals. Let others know I am here to help! [email protected].

Thank you for your patience while we rolled out Trade Alerts and Welcome to this very exciting new service!

Happy Trading,

Samantha

Friendly Sidebar: It’s easy to subscribe to my Free Fishing Stories/Blog. You are also invited to Come Fish With Me in my LIVE Trading Room for custom analysis or receive actionable trade ideas with my real-time Trade Alerts! Thanks for reading and Happy Trading.

At LaDucTrading, I analyze price patterns and intermarket relationships across stocks, commodities, currencies and interest rates. I develop macro investment themes to identify tactical trading opportunities and employ strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, my real-time Trade Alerts via SMS/email frame my Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. I selectively use Unusual Option Activity (UOA) and Deal Flow but no proprietary indicators – just solid chart pattern recognition, volatility insight and some big-picture perspective thrown in. @SamanthaLaDuc