Macro Backdrop

Every morning I like to approach the markets from a Macro backdrop – any new policies, geopolitics, economic news, currency/rate moves from which I can pick my spots in assets for the trading day. Another words, I scan and synthesize Market Moving News for my Market Timing Calls. Then I look for sector strength/weakness (basket trading ideas) as well as rotational strength (shows risk on/off). Then I can drill down to what individual stocks are moving, why and how best to trade them: Chase, Swing, Trend time-frames.

This is a mid-week review for Members as a reminder of how some of those market timing calls are doing:

My Rate Spike call in TNX from 2.80% was well-timed as we are now at 2.96%. And with that TLT has fallen from $122 to $118.60. My Price Target (PT) is still lower…

But not today. Although the USD has been rising, today rates and dollar pulled back – which I also predicted Tuesday as China had run down 10+ straight days and was due a rest (commodity bounce) which put pressure on USD strength. Today, the USD dumped on the PPI report, but I believe it will be short-lived, judging from the dump in USDCNH which will likely reverse. Basically, I am still betting on higher rates with USD range-bound into the FOMC meeting – unless ECB surprises in a big way tomorrow with QE exit talk, which isn’t expected.

What I didn’t expect was the large bounce in EEM as it hasn’t reached my PT of $40.23 from a month ago – it tagged $40.63 instead and bounced sharply. Basically my PT is my target and I’m sticking with it, even if today’s low was the 61.8% retrace of the entire Nov 2016 election move pullback. (stubborn any?) In addition, the top two (!) option strikes in EEM accumulated over 200K contracts in Sept $42 + Oct $42.50 calls. Whoa. They are seriously banking on a sustained bounce. So if there is follow through, well obviously I will change my mind! But I have been right to stay short TLT, EEM, GLD looking for a sign of change, so this reversal is welcome but may be a tad early.

Basically, I’m betting USD and TNX churn a bit while Emerging Markets and Gold/Miners/Metals stake out a nice bottom fishing pattern into FOMC September 26. One day does not a trend reversal make! Further, I can see the indices basically going sideways into mid-terms (Nov 6th election) as Trade Talks + Tariffs get kicked down the road by Trump in support of the GOP against the Democrats.

With that, it is still a stock pickers market and we are picking some very good ones in my Live Trading Room – for newsletter and trade alert members, I invite you to jump in!

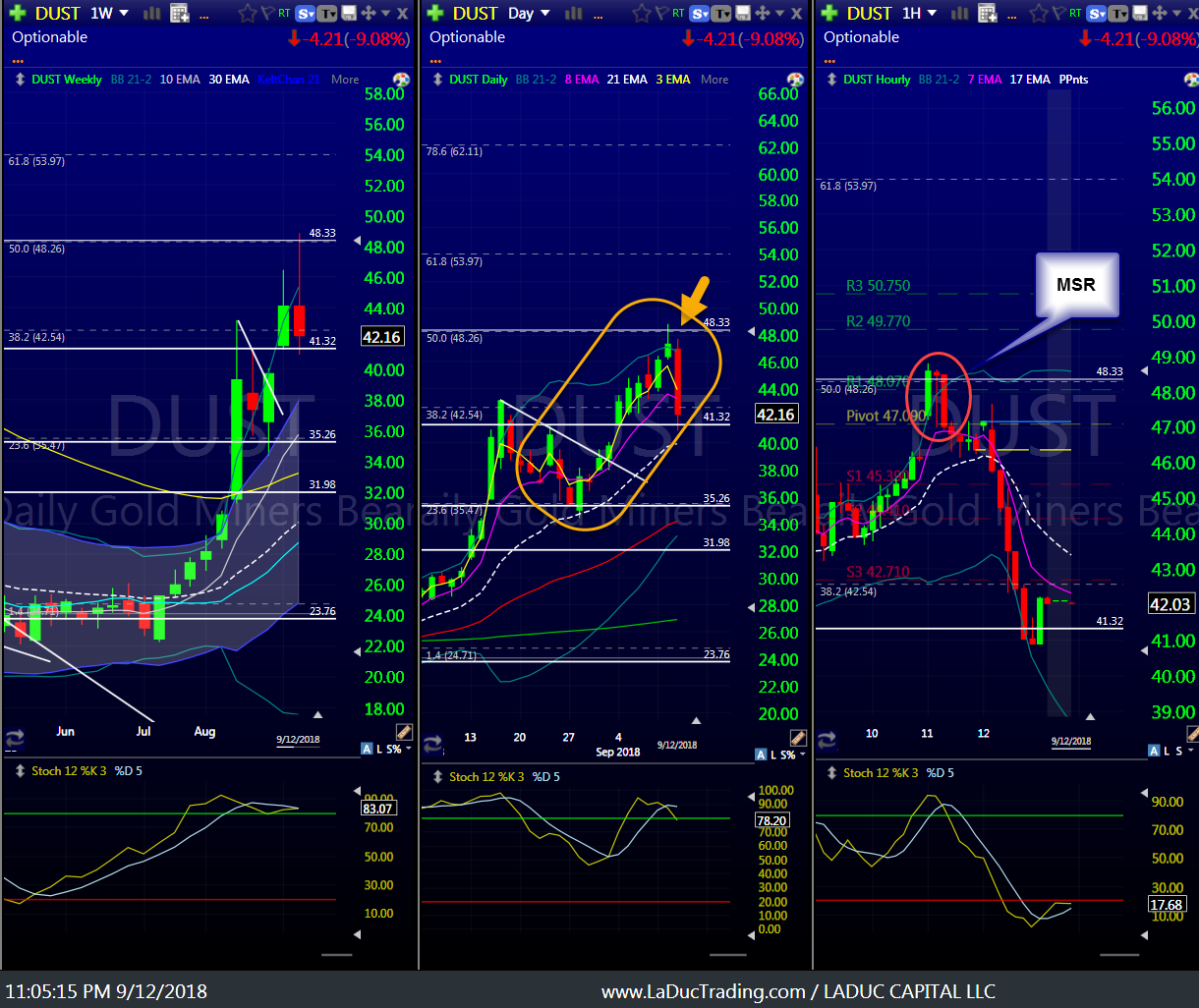

Speaking of Gold, my Trade Idea for weeks has been to be long DUST into $48. We tagged yesterday and I said time to take profit. Then today, after the PPI number came in weak and USD dropped, so too did DUST, hard – right into support after telegraphing with a Morning Star Reversal (MSR) on the Hrly – same MSR on NUGT + GDXJ but in reverse.

Big Short Calls

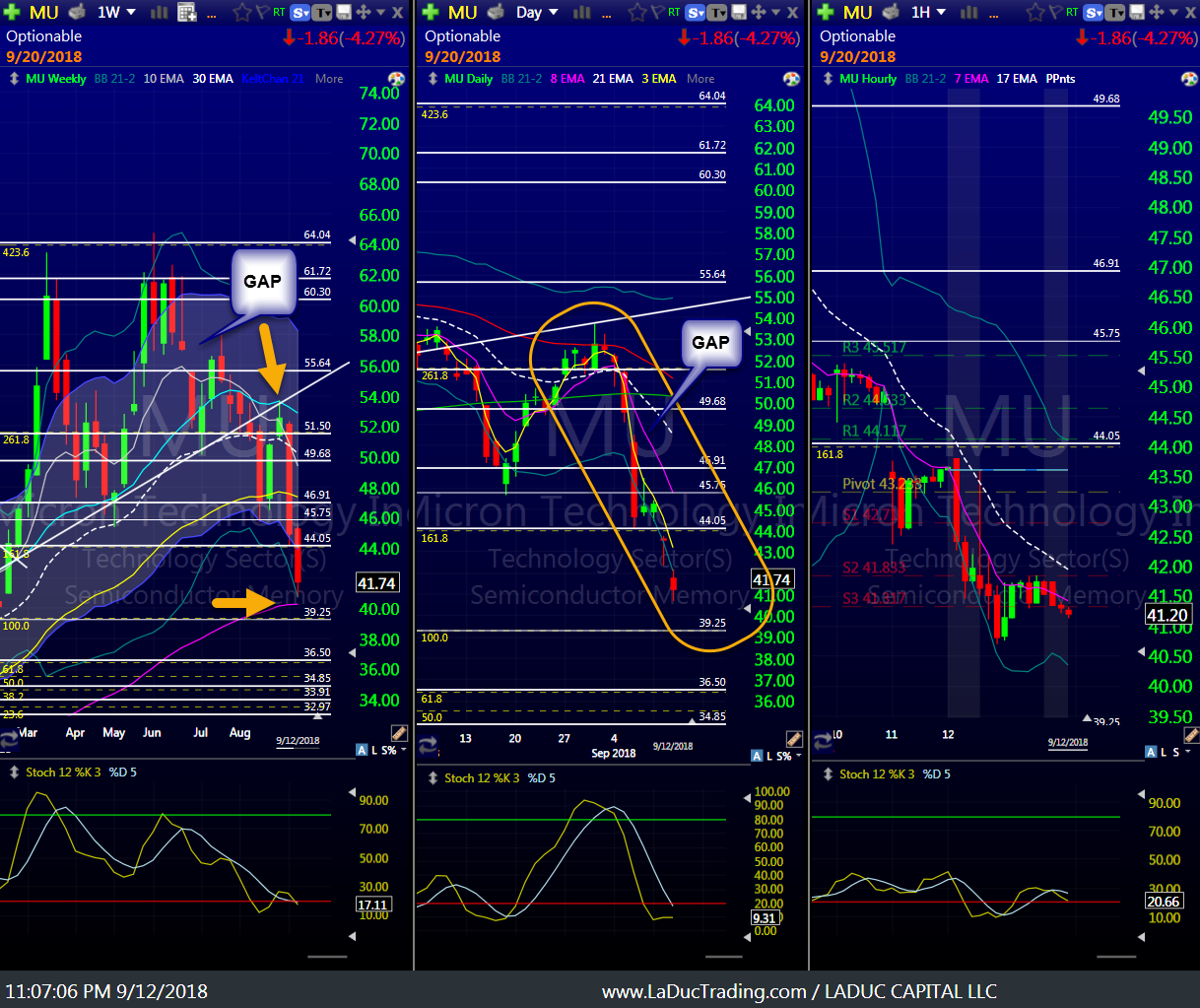

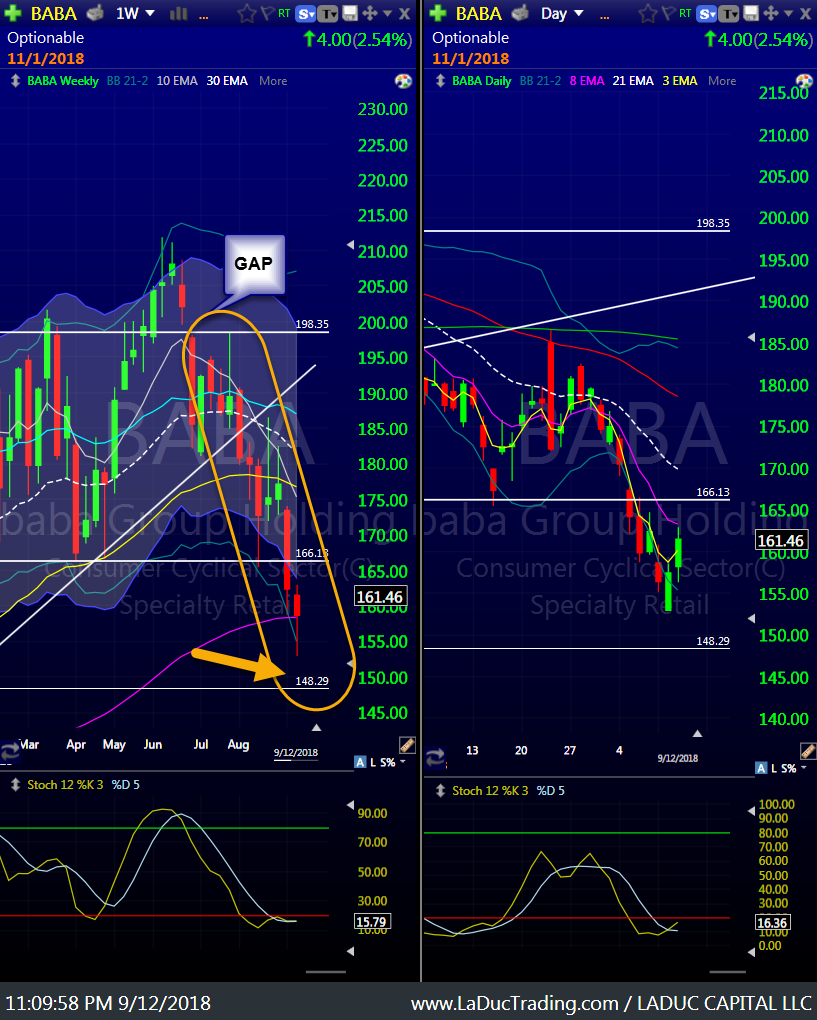

I have been a big bear on MU, TSLA, BABA for many weeks.

Here’s MU – almost at my PT. By the way, INTC looks the exact same in its pullback pattern.

You know I have had a high conviction short in BABA for months – before and after EPS. By the way, it is not down as much as BIDU and TCEHY which is another reason why I stayed conviction short. That and China still looked strongly shortable ($SSEC $FXI) as presented all summer long in my Intermarket Analysis newsletter.

You know I am a structural bear on TSLA and called it short at $345 after the beauty of that Head&Shoulders and Elon’s irresponsible $420 tweeting violations…er…”funding secure” busyness. My PT was $270 with overshoot to $260. It hit! Now I see no edge. Elon could attempt a “take-under” which puts the stock at risk for lower. The Board of Directors, or Elon, could replace Elon giving the shorts a reason to cover if even for a little bit. My levels below are now my guide – and yet I still see the stock in dangerous waters fundamentally.

Another really good call short was $AAOI – and relatedly so was closing the FNSR financed call spread for 700% prior to their EPS.

FANG fame from My Live trading room:

GOOGL – short break of $1244 to 1164. Hit.

FB – short break of $173 to $160. Hit. Since 25% of their users left in the past year, this makes the stock vulnerable. This time the stock was just a few dollars higher ~$170 (before running up to $218.62). My bet: $145 after a bounce.

TWTR – short break of $35 to $30/29. Hit. But careful that large H&S on the Wkly.

SNAP – short PT from months has been $8.66 – it closed at $9.20

AAPL, AMZN, MSFT – are just starting, short carefully.

NVDA – Tuesday I suggested a Put Spread; NVDA opened up -4% this morning before bouncing.

NFLX – Tuesday I thought market would roll and NFLX would fail but by end of day I changed my mind and said if any stock gaps up Wed AM it will likely be NFLX. It opened up with a tiny gap and then ran 4%. It was one of my top 3 Chase suggestions from the open today.

My fave stocks from Monday:

So you can look at a chart yourself and see how these are doing. Suffice it to say, they are doing awesome.

Technical oversold Bounces for TSLA, AAOI, LB

Continuation plays for AMD, ROKU, DUST, P, CGC, JNJ, BMY

Bounces at support for SPOT, FGEN

Breakout Potentials for TSN, HOG, URI, ATVI

Fave Tells for Market Direction: ZIV, VXN, TNX

Even my Spec Plays from Monday are doing well and setting up for higher if market remains strong/range-bounce: GME, BBBY, MAT, LB, HOG.

Even my Top Hurricane plays from Monday have stayed elevated: GNRC, URI, USO, HD, HTZ (being my favorite).

Wednesday Fave Stocks

Chases turned Swing: FDX on news it would be operating home deliveries 6 days/wk helped it pop and looks to continue.

GILD is basing nicely for a swing trade higher.

WDC was a well-timed long off $54 with PT of $58.50 measured move. It closed at $56.70.

CLDR is a great looking chart with $22PT in sight.

AMZN, AAPL – $1880 + $211 PTs are in progress from last Wed; put spreads can work well still.

ROKU – above $60.65 on W was suggested long, now stop can be moved up to $66; PT of $80

GIS, PEP, PG, CLX, K, THS – the XLP plays I still like long.

MO, PM – were chases in room after learning of potential effort to restrict teens from vaping.

P – has already made it to my $10PT; I think it has more in the tank so I will be rolling those Sept $8C.

Hope it Helps

Samantha

Thanks for reading and please consider joining me in the LIVE Trading Room where we work through Value and Momentum trade ideas and set ups every trading day.

At LaDucTrading, Samantha LaDuc leads the analysis, education and trading services. She analyzes price patterns and inter-market relationships across stocks, commodities, currencies and interest rates; develops macro investment themes to identify tactical trading opportunities; and employs strategic technical analysis to deliver high conviction stock, sector and market calls. Through LIVE portfolio-tracking, across multiple time-frames, we offer real-time Trade Alerts via SMS/email that frame the Thesis, Triggers, Time Frames, Trade Set-ups and Option Tactics. Samantha excels in chart pattern recognition, volatility insight with some big-picture macro perspective thrown in.

More Macro: @SamanthaLaDuc Macro-to-Micro: @LaDucTrading